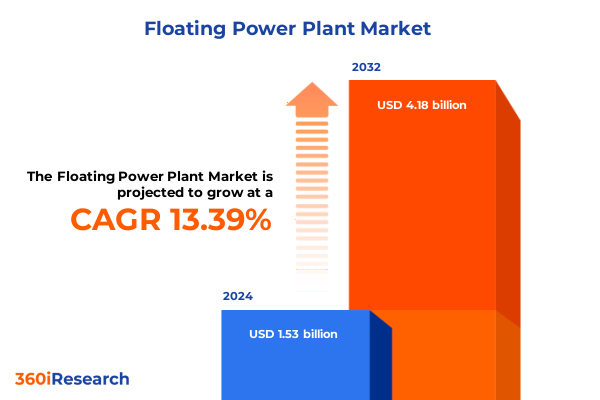

The Floating Power Plant Market size was estimated at USD 1.72 billion in 2025 and expected to reach USD 1.94 billion in 2026, at a CAGR of 13.50% to reach USD 4.18 billion by 2032.

Unveiling the Strategic Imperative of Floating Power Plants in Modern Energy Systems to Meet Global Demands and Environmental Goals

Floating power plants represent a paradigm shift in the energy sector by offering modular, scalable, and rapidly deployable solutions capable of addressing the twin imperatives of energy security and environmental stewardship. Traditionally anchored power stations have demanded extensive land use, long lead times, and complex permitting processes. In contrast, floating platforms-whether barge-mounted, semi-submersible, or ship-based-can be mobilized to optimize grid support in coastal or remote regions, bringing essential capacity online without the typical terrestrial constraints. This capability is especially critical as global demand for electricity intensifies amid the rapid electrification of transportation, expanding data center footprints, and industrial decarbonization initiatives.

Moreover, floating installations align with broader sustainability goals by enabling seamless integration of renewable energy sources. Floating solar photovoltaics, wind turbines, and ocean thermal energy conversion systems tap into underutilized maritime spaces, reducing land-use conflicts and preserving coastal ecosystems. As governments and corporations pledge net-zero targets, floating platforms have emerged as a versatile complement to onshore renewables, smoothing intermittency and increasing resiliency. Consequently, industry stakeholders are investing heavily in technological advancement to enhance mooring stability, grid connectivity, and lifecycle performance, setting the stage for floating power plants to become a cornerstone of the future energy mix.

Exploring How Technological Innovation, Policy Evolution, and Environmental Pressures Are Redefining the Floating Power Plant Sector

The floating power plant sector is undergoing a transformative evolution driven by converging trends in digitalization, materials science, and policy reform. Advanced composite materials and modular construction techniques have accelerated platform fabrication timelines while reducing capital expenditures. Concurrently, digital twin technologies and real-time performance monitoring enable predictive maintenance and operational optimization, ensuring platforms deliver peak efficiency across diverse marine environments. These technological leaps are further reinforced by progressive marine regulations favoring low-emission power generation, as well as regional incentives designed to bolster energy resilience in island and coastal grids.

In parallel, environmental pressures-including climate change adaptation and post-storm recovery imperatives-have elevated the appeal of floating power plants as rapid-response assets. Governments facing the aftermath of extreme weather events can deploy floating generators to restore critical infrastructure without waiting months for onshore repairs. Additionally, the shift toward circular economy principles has prompted OEMs and asset owners to prioritize design-for-disassembly and component recyclability, ensuring that floating platforms adhere to stringent sustainability benchmarks. Together, these dynamics are redefining the competitive landscape, encouraging collaboration among technology providers, marine contractors, and energy utilities to deliver integrated, resilient solutions.

Analyzing the Ripple Effects of 2025 United States Tariff Policies on International Supply Chains, Investment Flows, and Project Viability

The imposition of updated tariffs by the United States in 2025 has reverberated throughout global supply chains, compelling floating power plant developers and equipment suppliers to reassess procurement strategies. Imports of specialized marine-grade steel, high-capacity transformers, and precision instrumentation now face elevated duties, increasing project development costs and elongating negotiation cycles with international vendors. As a result, many stakeholders have pivoted toward nearshoring critical components or forming strategic alliances with domestic manufacturers to offset tariff-related surcharge impacts. This reorientation not only influences CapEx considerations but also drives renewed investment in local supply chain resilience.

Furthermore, the cumulative effect of tariffs has prompted financiers and insurers to adopt more conservative underwriting criteria, reflecting heightened risk profiles for cross-border deliveries. Projects reliant on imported floating LNG or nuclear modules have encountered delayed timelines as cost escalations erode contingency reserves. In contrast, initiatives centered on technologies that leverage indigenous resources-such as floating solar photovoltaics and wind turbines-have gained comparative advantage, attracting both public and private funding. Ultimately, the 2025 tariff landscape has catalyzed a strategic realignment within the industry, reinforcing the importance of supply chain diversification, contractual flexibility, and proactive stakeholder engagement.

Breaking Down Market Dynamics Across Power Sources, Output Capacities, Mooring Solutions, Installations, Ownership Structures, and End Use Profiles

An examination of floating power plant market segmentation reveals nuanced variations in technology uptake, investment dynamics, and operational priorities. The division by power source splits the landscape into non-renewable and renewable domains, with the former encompassing floating LNG platforms prized for high-density energy output, alongside emerging floating nuclear units that promise baseload reliability with strict safety protocols. On the renewable side, floating solar photovoltaics deliver modular scalability to sun-rich coastlines, while floating wind turbines harness offshore wind corridors. Ocean thermal energy conversion, though still nascent, offers a promising route to continuous clean power where temperature gradients are favorable.

Additionally, power output segmentation distinguishes projects by capacity band: below 50 MW initiatives excel at localized grid support or industrial off‐grid supply, whereas mid-range platforms (50–150 MW) strike a balance between flexibility and scale. Above 150 MW installations focus on utility‐scale deployments, often involving hybrid configurations combining multiple energy vectors. Mooring system choices-catenary versus taut mooring-reflect site-specific bathymetry, tidal patterns, and platform mass, influencing stability and maintenance cycles. Installation typologies further diversify the landscape, with barge‐mounted solutions offering cost-effective retrofits of existing hulls, semi-submersible designs enhancing deepwater adaptability, and ship-based units providing exceptional mobility.

Ownership models alternate between private venture capital and public partnerships, each bringing distinct risk appetites and governance structures. Meanwhile, end users span commercial entities-ranging from hospitality resorts seeking clean backup power to retail complexes aiming for sustainability credentials-government and defense applications prioritizing energy security, industrial consumers in manufacturing, mining, and oil & gas sectors requiring reliable remote operations, and utilities integrating floating assets to balance generation portfolios. This multifaceted segmentation underscores that no single approach will dominate; rather, platform configurations and financing models will evolve in concert with project-specific objectives and regulatory frameworks.

This comprehensive research report categorizes the Floating Power Plant market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Power Source

- Power Output

- Mooring System

- Installation

- Ownership Model

- End User

Evaluating Regional Forces Shaping Floating Power Plant Adoption and Infrastructure Development Across the Americas, EMEA, and Asia-Pacific

Regional analysis uncovers divergent adoption patterns for floating power plants across the Americas, where utility stakeholders in North and South America leverage coastal infrastructure to address peak demand fluctuations and remote community electrification. The United States, in particular, is advancing pilot projects that integrate floating solar into existing hydroelectric reservoirs, whereas Latin American nations explore hybrid floating LNG arrays to support off‐grid mining operations. These initiatives benefit from stable regulatory environments and evolving tax incentives aimed at decarbonization.

In Europe, Middle East and Africa, marine jurisdictions span from the North Sea’s strong wind corridors-catalyzing floating offshore wind demonstrations-to the Eastern Mediterranean’s exploration of floating solar and gas hybrid solutions. Regulatory harmonization under the European Green Deal and GCC nations’ energy diversification programs are driving capital allocation toward modular, rapid‐deployment power assets. Meanwhile, North African and sub‐Saharan coastal states are assessing floating platforms to bridge critical infrastructure gaps without incurring large‐scale land development.

Asia-Pacific markets exhibit robust momentum, where dense coastal populations and aggressive renewable mandates converge to create fertile ground for floating installations. Japan’s resource constraints have propelled innovation in floating wind turbines, while Southeast Asian archipelagos rely on floating LNG and solar systems to ensure energy access. In Australasia, advanced mooring research and localized manufacturing partnerships augment project feasibility. Consequently, the Asia-Pacific region is poised to lead in both technology commercialization and capacity additions, drawing significant interest from multinational developers and sovereign wealth funds.

This comprehensive research report examines key regions that drive the evolution of the Floating Power Plant market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Driving Technological Advances and Competitive Positioning in the Floating Power Plant Arena

Leading companies in the floating power plant sector are distinguished by their technology portfolios, collaborative ecosystems, and project execution track records. Global energy majors have partnered with naval architects to design semi‐submersible nuclear modules that adhere to the highest safety and non-proliferation standards, while floating LNG pioneers leverage decades of offshore engineering to optimize regasification and storage integration. In the renewable domain, solar specialists are adapting floatovoltaic arrays with low-weight polymers, and wind turbine OEMs are engineering pivoting nacelle interfaces for dynamic sea states.

Strategic alliances between platform fabricators and digital solution providers are yielding next-generation operational platforms equipped with AI-driven performance analytics and remote diagnostics. Meanwhile, conglomerates with shipbuilding heritage are repurposing tanker hulls into barge‐mounted power stations, showcasing cost-effective retrofit pathways. Cross-sector consortia, involving utilities, defense contractors, and marine insurers, are co-developing lifecycle frameworks to de-risk financing and streamline regulatory approvals. As competition intensifies, companies that can offer turnkey, integrated solutions-combining hardware, software, and financing-will secure competitive positioning and attract long-term offtake agreements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Floating Power Plant market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bharat Heavy Electricals Limited

- Caterpillar Inc.

- CHN ENERGY Investment Group Co. LTD

- Ciel et Terre International, SAS

- DNV AS

- Doosan Heavy Industries & Construction Co., Ltd.

- Equinor ASA

- Floating Power Plant A/S

- GE Vernova Inc.

- Hyosung Heavy Industries Corporation

- Hyundai Heavy Industries Co., Ltd.

- JERA Co., Inc.

- Karadeniz Holding

- Kawasaki Heavy Industries, Ltd.

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Ocean Power Technologies, Inc.

- Ocean Sun AS

- Shanghai Electric Group Co., Ltd.

- Siemens Energy AG

- Swimsol GmbH

- Vikram Solar Limited

- Wärtsilä Oyj Abp

Delivering Strategic Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Navigate Regulatory and Technological Challenges

Industry leaders should prioritize investment in modular design platforms that accommodate rapid technology swaps, enabling flexible responses to evolving regulatory requirements and environmental conditions. By adopting digital twins and advanced analytics, operators can predict equipment degradation, optimize maintenance schedules, and extend asset service life, thereby reducing total cost of ownership. Furthermore, cultivating partnerships with local fabrication yards and supply chain actors will mitigate tariff exposure and enhance project resilience, particularly in the wake of shifting trade policies.

Additionally, proactive engagement with policy makers is essential to secure long‐term incentives, streamline permitting processes, and establish clear marine zoning for deployments. In parallel, companies must enhance workforce capabilities by developing specialized training programs focused on marine engineering, renewable energy integration, and offshore safety protocols. Finally, embracing a circular economy mindset-prioritizing component recyclability and end‐of‐life decommissioning plans-will not only meet emerging environmental standards but also bolster corporate reputations. Through these strategic moves, industry participants can capture emerging growth opportunities, de‐risk investment portfolios, and deliver sustainable, high‐performance floating power solutions.

Detailing Rigorous Research Approaches, Data Triangulation Techniques, and Validation Frameworks Underpinning Insights into the Floating Power Plant Market

The research underpinning this executive summary combined comprehensive secondary analysis with primary data collection to ensure robust, evidence-based insights. The process began with a systematic review of technical publications, patent filings, industry white papers, and policy documents to identify current technology trajectories and regulatory frameworks. This was complemented by interviews with marine engineers, offshore operations managers, and grid integration specialists to capture frontline perspectives on deployment challenges and performance benchmarks.

Data triangulation was achieved by cross-referencing findings with project reports, environmental impact assessments, and supply chain audits. Quantitative inputs were validated through a database of known floating power plant installations, segmented by geography, power source, and capacity band. Qualitative validation workshops with subject matter experts provided additional context on strategic alliances, investment trends, and policy initiatives. Finally, scenario modeling exercises were conducted to test the resilience of identified strategies under varying tariff regimes, environmental conditions, and technology adoption curves, ensuring that recommendations remain actionable across diverse market environments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Floating Power Plant market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Floating Power Plant Market, by Power Source

- Floating Power Plant Market, by Power Output

- Floating Power Plant Market, by Mooring System

- Floating Power Plant Market, by Installation

- Floating Power Plant Market, by Ownership Model

- Floating Power Plant Market, by End User

- Floating Power Plant Market, by Region

- Floating Power Plant Market, by Group

- Floating Power Plant Market, by Country

- United States Floating Power Plant Market

- China Floating Power Plant Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Summarizing Critical Takeaways and Forward-Looking Perspectives for Stakeholders Engaging with the Evolving Floating Power Plant Landscape

In conclusion, floating power plants represent a dynamic convergence of maritime engineering, renewable energy innovation, and strategic policy support, poised to address critical gaps in global energy systems. By leveraging modular platforms, advanced mooring solutions, and digital performance management, this market offers versatile pathways for rapid capacity deployment, decarbonization, and grid resilience. The interplay of evolving technology, shifting trade policies, and region-specific drivers underscores the need for adaptable business models and diversified supply chains.

As tariffs reshape procurement strategies and regional initiatives accelerate adoption, organizations that proactively align their R&D, partnerships, and regulatory engagement will secure leadership positions. Ultimately, the floating power plant sector’s growth will be determined by the ability of stakeholders to integrate cross‐disciplinary expertise, anticipate policy shifts, and deliver sustainable, cost-efficient solutions that meet the world’s growing energy demands.

Contact Ketan Rohom to Secure the Comprehensive Floating Power Plant Market Report and Empower Your Organization with In-Depth Strategic Insights

Building on a deep understanding of the floating power plant ecosystem, engaging directly with Ketan Rohom will unlock access to the full breadth of analysis, data, and strategic foresight contained within the comprehensive market research report. As Associate Director of Sales & Marketing, Ketan Rohom can guide you through tailored subscription options, bespoke data extracts, and specialized consulting packages designed to elevate your decision-making and investment strategies. By partnering with Ketan, your organization will benefit from a customized roadmap to harness the potential of floating power solutions, align with evolving regulatory landscapes, and secure partnerships with innovators across the supply chain. Reach out today to discuss how this report can be integrated into your strategic planning, enhance stakeholder communications, and drive sustainable growth in an increasingly competitive energy market.

- How big is the Floating Power Plant Market?

- What is the Floating Power Plant Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?