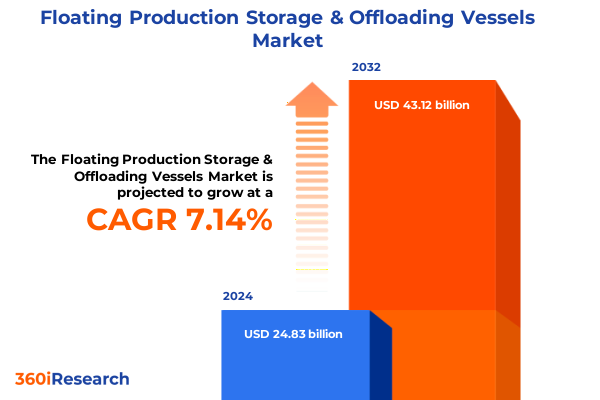

The Floating Production Storage & Offloading Vessels Market size was estimated at USD 26.51 billion in 2025 and expected to reach USD 28.31 billion in 2026, at a CAGR of 7.19% to reach USD 43.12 billion by 2032.

Unveiling the Strategic Foundations and Critical Drivers Shaping the Global Floating Production and Storage Vessel Industry Dynamics

The global offshore energy landscape is undergoing profound transformation as industry leaders turn to floating production storage and offloading vessels to bridge the gap between remote hydrocarbons and onshore processing facilities. Floating production infrastructure offers unparalleled flexibility, enabling operators to tap into deepwater reserves, marginal fields, and stranded assets that would otherwise remain inaccessible. As exploration ventures extend into more challenging environments, the strategic value of FPSO and FSO units becomes increasingly clear, serving as both production hubs and storage terminals in a single asset configuration.

In this context, decision-makers must consider the multifaceted drivers shaping vessel deployment, from rising energy demand and shifting supply patterns to the drive for cost containment and operational resilience. Technological advancements in hull design, mooring systems, and topside processing capacity have reduced project lead times while enhancing safety and uptime performance. Crucially, floating production solutions also support lower carbon footprints by optimizing gas flaring practices and facilitating carbon capture integration. Together, these developments underscore why industry stakeholders are prioritizing FPSO and FSO assets as central pillars of their offshore strategies, ensuring continued energy security and competitive differentiation in a rapidly evolving market.

Revolutionary Technological, Regulatory, and Environmental Forces Redefining the Trajectory of Offshore Floating Production and Storage Solutions Worldwide

Over the past decade, the floating production landscape has witnessed revolutionary technological, regulatory, and environmental shifts that are redefining how operators conceive and manage offshore assets. Digital twin and advanced analytics platforms now enable real-time monitoring of hull integrity, turret operations, and subsea wells, unlocking predictive maintenance regimes that minimize downtime and extend asset lifecycles. Meanwhile, modularization trends have streamlined topside fabrication, allowing for parallel construction processes that compress delivery schedules without compromising quality.

At the same time, evolving environmental regulations and stakeholder expectations have spurred adoption of low-emission fuel systems, energy-efficient power generation, and waste-heat recovery on board. Carbon intensity metrics have become as important as daily production rates, driving investment in integrated carbon capture systems and electrification of auxiliary units. Regulatory bodies in key offshore basins are also tightening vessel certification and inspection protocols, ushering in a new era of compliance governance. Consequently, industry players must continuously adapt to these transformative forces, aligning capital allocation with innovation imperatives and policy frameworks that shape future floating production and storage deployments.

Assessing the Far-Reaching Consequences of Recent United States Tariff Measures on the Economics and Supply Chains of Floating Production Vessels

The cumulative impact of United States tariff measures introduced through Section 232 and Section 301 provisions has reverberated across the supply chains underpinning floating production storage and offloading vessel projects. Initially enacted to bolster domestic steel and aluminum sectors, the 2018 Section 232 steel tariffs triggered immediate cost escalations for hull materials sourced from international fabrication yards. Subsequent extensions and tariff adjustments in 2025 have sustained upward pressure on material procurement budgets, prompting operators and fabricators to reassess their sourcing strategies and regional partnerships.

Furthermore, the application of Section 301 tariffs on select offshore equipment imports from Asia has compounded logistical complexities, as vessel integrators navigate higher duty liabilities and extended customs clearance timelines. These measures have inadvertently encouraged greater reliance on U.S.-based shipyards and engineering firms, yet have also exposed capacity constraints and incremental labor rate challenges. As a result, project sponsors are increasingly incorporating tariff expense allowances into contracting negotiations and exploring alternative mooring systems or local sourcing arrangements to mitigate cost volatility and schedule impacts.

Revealing In-Depth Segmentation Perspectives to Illuminate the Multifaceted Market Dimensions and Growth Pathways of Floating Production and Storage Vessels

Insight into market segmentation reveals the intricate layers that define floating production storage and offloading vessel demand and asset design preferences. Based on vessel type, the industry evaluates the comparative merits of FPSO and FSO units, with each segment further differentiated by conversion projects that retrofit existing hulls versus new builds crafted for bespoke field requirements. In parallel, storage capacity segmentation highlights distinct operational needs, spanning units designed to hold less than five hundred thousand cubic meters to those structured for capacities between five hundred thousand and 1.2 million cubic meters, as well as ultra-large vessels exceeding this threshold.

Water depth considerations introduce another dimension, categorizing deployments into shallow, deep, and ultra deepwater contexts, each presenting unique mooring and riser challenges. Mooring type segmentation underscores the strategic trade-offs between spread mooring systems and turret configurations, the latter offering either internal turret integration for improved rotational dynamics or external turret solutions for streamlined topside layouts. Application-based insights contrast gas production versus oil production vessels, illustrating how processing topology and flare management differ according to hydrocarbon phase. Finally, contract type serves as a financial lens, capturing the nuances between bareboat charters, build-own-operate structures, and time charter agreements, each influencing risk allocation and cash flow profiles throughout the vessel lifecycle.

This comprehensive research report categorizes the Floating Production Storage & Offloading Vessels market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vessel Type

- Storage Capacity

- Water Depth

- Mooring Type

- Contract Type

- Application

Exploring Critical Regional Dynamics Across Americas, Europe Middle East Africa, and Asia Pacific Impacting Floating Production Storage Vessel Deployment Trends

Regional analysis exposes a mosaic of opportunity and regulatory diversity across the Americas, Europe Middle East Africa, and Asia Pacific, each shaping floating production storage and offloading vessel utilization in distinct ways. The Americas region has emerged as a hotbed for deepwater FPSO deployments, leveraging robust project financing frameworks in the Gulf of Mexico and an expanding production portfolio along Brazil’s pre-salt province. Local content rules and US Jones Act considerations have further propelled joint venture models and incentivized domestic fabrication capacity.

In the Europe, Middle East & Africa cluster, mature North Sea operations coexist with frontier prospects in West Africa and the Eastern Mediterranean, demanding vessels that can navigate stricter environmental controls and more complex stakeholder ecosystems. Meanwhile, Asia Pacific nations from Australia to Malaysia continue to push ultra deepwater boundaries, driven by national oil company partnerships and a strategic pivot toward gas production. Regulatory incentives for local talent development and harsh weather design considerations underscore the region’s tailored technical requirements. Ultimately, each geography presents a unique regulatory, economic, and environmental profile that informs project planning and asset design choices.

This comprehensive research report examines key regions that drive the evolution of the Floating Production Storage & Offloading Vessels market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Positioning and Innovation Portfolios of Leading Global Players in the Floating Production and Storage Vessel Domain

A review of leading industry players reveals how strategic positioning, technological investment, and alliance strategies are shaping competitive dynamics in the floating production and storage domain. Several major integrators have oriented their R&D focus toward enhanced digital oversight systems, integrating sensors and predictive analytics to optimize turret operations and mooring integrity. Meanwhile, yards with strong conversion expertise have capitalized on retrofitting brownfield vessels, offering cost-effective alternatives to greenfield new build campaigns.

Collaborative ventures between engineering firms and design institutes are accelerating the development of next-generation hull forms that improve motion response and reduce fatigue loading in ultra deepwater. Additionally, a migration toward standardized topside modules is enabling manufacturers to achieve volume efficiencies, compress delivery timelines, and support rapid redeployment between fields. Strategic acquisitions and joint ventures in target markets are also enabling top-tier companies to secure long-term service contracts, lock in feedstock supply chains, and diversify their revenue streams across both oil and gas production applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Floating Production Storage & Offloading Vessels market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aker Solutions ASA

- Altera Infrastructure L.L.C.

- Bluewater Energy Services B.V.

- Bumi Armada Berhad

- BW Offshore Limited

- Chevron Corporation

- CNOOC Limited

- Equinor ASA

- ExxonMobil Corporation

- Hyundai Heavy Industries Co., Ltd.

- INPEX Corporation

- Keppel Offshore & Marine Ltd

- MISC Berhad

- MODEC, Inc.

- Petróleo Brasileiro S.A.

- Saipem S.p.A.

- Samsung Heavy Industries Co., Ltd.

- SBM Offshore N.V.

- Sembcorp Marine Ltd.

- Shell plc

- TechnipFMC plc

- Teekay Corporation

- TotalEnergies SE

- Woodside Energy Group Ltd.

- Yinson Holdings Berhad

Actionable Strategic Recommendations to Empower Industry Leaders in Optimizing Floating Production and Storage Vessel Operations and Competitive Positioning

Industry leaders should prioritize forging cross-sector partnerships to co-develop digital twin frameworks and advanced materials that enhance asset reliability while enabling seamless integration of carbon management systems. Embracing nearshore fabrication hubs presents an opportunity to circumvent tariff exposure and shorten supply chains, particularly when aligned with regional content regulations and circular economy principles. To strengthen project resilience, stakeholders ought to adopt flexible contracting models that balance owner and contractor risk, leveraging milestone-based payments and performance incentives tied to uptime metrics.

Furthermore, aligning R&D investment with emerging power generation technologies-such as hydrogen fuel cells or dual-fuel gas turbines-will position operators to meet tightening emissions targets without compromising throughput. Leaders must also establish data governance protocols that support interoperable platforms across vessel fleets, encouraging predictive maintenance regimes and real-time decision support tools. By cultivating a culture of innovation and agile project execution, organizations can not only mitigate the complexities introduced by tariff fluctuations and regulatory shifts but also cultivate a sustainable competitive advantage.

Outlining a Rigorous Research Methodology Underpinning the Comprehensive Analysis of Floating Production and Storage Vessel Market Dynamics

The research methodology underpinning this analysis integrates both primary and secondary data sources to ensure a holistic view of the floating production storage and offloading landscape. Primary insights were gathered through confidential interviews with vessel operators, engineering procurement and construction contractors, and maritime authorities, complemented by site visits to fabrication yards renowned for FPSO conversion projects. Secondary research encompassed a review of regulatory filings, industry white papers, technical journals, and publicly available environmental impact assessments.

Data triangulation techniques were deployed to reconcile differing perspectives, cross-validating project timelines and equipment specifications across multiple stakeholders. Expert panel workshops facilitated scenario stress-testing of tariff impact assumptions and technological adoption rates. Finally, thematic analysis distilled recurring trends in contract structuring, regional policy evolution, and stakeholder collaboration models, ensuring the final report reflects both granular project realities and macroeconomic influences that shape floating production and storage vessel deployment worldwide.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Floating Production Storage & Offloading Vessels market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Floating Production Storage & Offloading Vessels Market, by Vessel Type

- Floating Production Storage & Offloading Vessels Market, by Storage Capacity

- Floating Production Storage & Offloading Vessels Market, by Water Depth

- Floating Production Storage & Offloading Vessels Market, by Mooring Type

- Floating Production Storage & Offloading Vessels Market, by Contract Type

- Floating Production Storage & Offloading Vessels Market, by Application

- Floating Production Storage & Offloading Vessels Market, by Region

- Floating Production Storage & Offloading Vessels Market, by Group

- Floating Production Storage & Offloading Vessels Market, by Country

- United States Floating Production Storage & Offloading Vessels Market

- China Floating Production Storage & Offloading Vessels Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Key Insights and Emerging Imperatives Driving the Evolution of the Floating Production and Storage Vessel Landscape

The insights presented throughout this report coalesce into a coherent narrative that underscores the pivotal role of floating production storage and offloading vessels in meeting global energy demand while navigating evolving cost, regulatory, and environmental landscapes. Technological breakthroughs in digitalization and modularization are unlocking new efficiencies, whereas regional diversities in regulatory frameworks and project financing models continue to dictate asset design and deployment strategies.

At the same time, cumulative tariff measures have reshaped supply chain alignments and cost structures, prompting industry stakeholders to innovate in sourcing, contracting, and fabrication approaches. By synthesizing segmentation perspectives and regional profiles, stakeholders can make more informed decisions about where to deploy specific vessel configurations, how to optimize contract terms, and which technology partnerships will yield the greatest performance gains. Ultimately, the convergence of these forces points to a dynamic future for FPSO and FSO assets, one defined by resilience, adaptability, and strategic foresight.

Engage with Ketan Rohom to Unlock Exclusive Insights and Secure Your Advanced Floating Production and Storage Vessel Market Research Report Today

We invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to discover tailored insights that align with your strategic goals in offshore production. Ketan brings a deep understanding of market dynamics and vessel specifications, enabling him to guide your team toward optimal decision-making and competitive advantage. Engaging with Ketan ensures you gain early access to proprietary analysis, regulatory assessments, and scenario planning essential for mitigating risks and capitalizing on emerging opportunities within the FPSO and FSO domain.

Seize this opportunity to leverage our comprehensive research report, which encapsulates the latest industry developments, segmentation deep dives, and regional perspectives. Reach out to Ketan Rohom to explore customized data packages, subscription options, or enterprise licensing models that fit your budget and operational needs. Don’t miss the chance to equip your organization with the actionable intelligence necessary to navigate evolving supply chains, tariff environments, and technological innovations. Contact Ketan today to secure your copy of the definitive floating production storage and offloading vessel market report and transform insights into impact.

- How big is the Floating Production Storage & Offloading Vessels Market?

- What is the Floating Production Storage & Offloading Vessels Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?