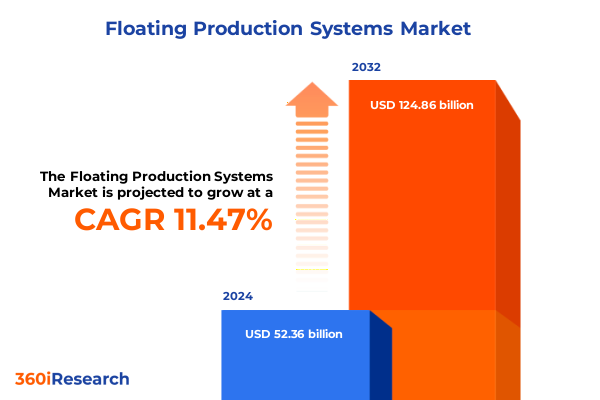

The Floating Production Systems Market size was estimated at USD 57.88 billion in 2025 and expected to reach USD 63.98 billion in 2026, at a CAGR of 11.60% to reach USD 124.86 billion by 2032.

Setting the Stage for an In-depth Exploration of Floating Production Platforms Transforming Offshore Oil and Gas Operations and Investment Strategies

Floating production systems represent a cornerstone of modern offshore oil and gas development, enabling energy companies to harness reserves located far beyond the reach of traditional platforms. These sophisticated installations integrate production, processing and storage functions into a single mobile or fixed structure, providing unparalleled flexibility in water depths ranging from shallow continental shelves to ultra-deep offshore basins. As global energy demand evolves, operators increasingly rely on floating solutions to optimize capital deployment, accelerate project timelines and enhance operational resilience.

In recent years, the convergence of advanced engineering, digitalization and sustainability imperatives has transformed the floating production landscape. Operators are moving beyond conventional FPSO and semi-submersible designs to embrace innovative hull materials, dynamic positioning systems and hybrid power configurations that reduce environmental footprint. At the same time, the drive for cost efficiency has spurred modular construction approaches and strategic partnerships across the supply chain, enabling quicker commissioning and smoother life-of-field adaptations.

Against this backdrop, this executive summary offers decision-makers a comprehensive overview of the critical factors shaping floating production systems. We examine the latest technological breakthroughs, regulatory and tariff pressures, market segmentation dynamics and regional deployment patterns. By distilling key findings and strategic takeaways, this report equips senior executives and engineering leads with the insights needed to navigate a rapidly evolving offshore production ecosystem.

Examining Revolutionary Technological and Operational Shifts Redefining the Floating Production Systems Landscape and Industry Dynamics in 2025

The floating production systems landscape is undergoing a period of profound transformation as shifting energy priorities and technological advancements converge. Emerging digital tools such as predictive analytics, digital twins and remote monitoring now provide real-time visibility into asset performance, enabling operators to execute proactive maintenance and optimize production throughput. Meanwhile, the integration of automation and robotics into subsea operations is unlocking safer, more efficient interventions, reducing reliance on costly offshore personnel deployments.

Beyond digitalization, next-generation power solutions are redefining offshore energy management. Hybrid power systems that couple gas turbines with battery storage and renewable sources like offshore wind or solar rides are starting to gain traction. This shift not only mitigates carbon emissions but also enhances operational resilience by reducing fuel consumption and diversifying energy inputs.

Moreover, the increased focus on life extension and asset redeployment is prompting operators to explore modular FPSO conversions and tow-and-install strategies. These approaches minimize dry-dock time and enable rapid market entry in emerging resource plays. Decommissioning expertise is likewise influencing design philosophies, with an emphasis on adaptable configurations that can be repurposed for subsea storage or renewable integration at end of field life.

Collectively, these transformations are setting the stage for a new era of offshore production, where agility, sustainability and digital enablement drive competitive advantage across the value chain.

Unpacking the Cumulative Impact of United States Steel Aluminum and Related Tariffs on Floating Production Infrastructure and Supply Chains by 2025

United States tariffs imposed on steel and aluminum imports have cumulatively reshaped the cost structure and supply chain architecture for floating production infrastructure. Originally introduced under national security provisions, the 25% steel tariff and 10% aluminum tariff continue to elevate raw material costs for hull and topside fabricators. These import levies, compounded by Section 301 duties on components sourced from select countries, have prompted operators to revisit their procurement strategies and accelerate localization of fabrication yards.

Consequently, global players have pursued strategic partnerships with domestic steel mills and shipyards to secure preferential pricing and mitigate delivery delays. In many cases, this shift has resulted in increased capital allocation toward onshore manufacturing capacity, while also sparking investment in alternative hull materials and composite solutions designed to reduce reliance on tariff-impacted imports.

Furthermore, the ripple effects of tariff-driven cost pressures extend beyond the fabrication phase. Mooring systems, riser assemblies and subsea structures, traditionally manufactured in low-cost regions, now face extended lead times and higher landed costs due to cross-border duties. In response, supply chain managers are expanding their vendor networks to include mid-capital cost geographies that offer more favorable trade terms.

Ultimately, the cumulative impact of U.S. tariffs in 2025 underscores a broader trend toward supply chain diversification and regional self-reliance. By adopting a proactive sourcing approach, operators can better control production schedules, enhance margin predictability and maintain project timelines despite ongoing trade uncertainties.

Illuminating Essential Insights across System Type Depth Application End Use Hull Material and Mooring System Segmentation to Navigate the Floating Production Market

Analysis of system types reveals a pronounced shift toward floating LNG solutions as global gas markets tighten and national policies favor energy security. Floating production storage and offloading units continue to dominate legacy oilfield developments, yet semi-submersibles and spar platforms are experiencing renewed interest for ultra-deepwater applications in frontier basins. Tension leg platforms remain a niche solution, prized for their superior stability in select conditions but constrained by higher mooring complexity and capital intensity.

When considering water depth, deepwater installations in the 300 to 1,500-meter range have become the workhorse for established offshore plays, leveraging a balance of engineering maturity and cost efficiency. Shallow water projects persist in mature basins where brownfield tie-backs and incremental field development provide steady returns. Meanwhile, ultra-deepwater deployments beyond 1,500 meters are carving out new frontiers in both oil and gas production, driven by advancements in hull design and dynamic positioning technologies.

Differentiation by application underscores a bifurcation between brownfield expansions and greenfield developments. Brownfield brownfield projects increasingly utilize refurbished vessels and modular topsides to optimize redeployment, whereas greenfield schemes prioritize bespoke hull designs and integrated processing trains to maximize recovery factors and accommodate complex reservoir fluids.

Evaluating end-use segments highlights a growing prevalence of combined oil and gas production systems, reflecting operators’ desire for flexible processing capacity to respond to volatile commodity price dynamics. Dedicated gas production FPSOs are also on the rise, particularly as governments impose stricter emissions regulations and incentivize cleaner fuel sources. Pure oil-only platforms remain significant in regions where gas reinjection or export infrastructure is limited.

Hull material insights point to a long-standing preference for high-strength steel, valued for its structural reliability and weldability. However, concrete hulls are gaining traction in ultra-deep and corrosive environments, offering advantages in fatigue resistance and lower maintenance over multi-decade field lives.

Finally, mooring system analysis reveals dynamic positioning as the go-to solution for redeployable floater assets, especially in regions with limited local infrastructure. Spread mooring endures as a cost-effective approach for long-term fixed facilities, while turret mooring finds favor in circumstances demanding continuous production turndown and weathervaning capabilities.

This comprehensive research report categorizes the Floating Production Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- System Type

- Water Depth

- Hull Material

- Mooring System

- Application

- End Use

Decoding Regional Dynamics Shaping Adoption Investment and Deployment Patterns for Floating Production Systems across Americas Europe Middle East Africa and Asia-Pacific

In the Americas, the Gulf of Mexico remains a hotbed for floating production innovation, with a blend of greenfield deepwater discoveries and brownfield conversions in mature reservoirs. Brazil’s pre-salt hinterland continues to attract robust FPSO investments, while emerging Guyana fields are rapidly shaping regional supply chain hubs. North American operators are likewise exploring floating LNG facilities along the U.S. Gulf Coast to capitalize on export opportunities and diversify energy portfolios.

Within Europe, the Middle East and Africa, North Sea operators focus on life-extension projects, often converting older VLCC hulls into second-life FPSOs to tie back satellite reservoirs. West Africa’s prolific offshore basins leverage a mix of floating production storage solutions and floating gas units, driven by growing energy demand in regional markets. The Middle East is exploring hybrid offshore platforms that integrate decarbonization technologies, including carbon capture readiness and partial electrification from shore power where grid connectivity permits.

In Asia-Pacific, Australia leads with large floating LNG installations tied to gas-rich fields, complemented by growing interest in small-scale floating units to serve remote archipelagic markets. Southeast Asia’s brownfield patchwork is ripe for modular FPSO expansions, while China and India are investing in local fabrication yards to support domestic offshore ambitions. As regional governments push for energy transition agendas, floating platforms with integrated renewable power modules and lower carbon footprints are poised to gain traction.

This comprehensive research report examines key regions that drive the evolution of the Floating Production Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Global Companies Strategic Collaborations and Innovative Deployments Driving Competitive Advantage in the Floating Production Sector

Leading operators and engineering firms are forging strategic alliances to address the complexity of floating production projects. Global energy majors maintain joint ventures with specialized offshore contractors to share technical risk and leverage complementary capabilities in hull design and subsea integration. Meanwhile, independent production companies partner with engineering procurement and construction specialists to accelerate field development timelines and reduce capex exposure.

Notable technology providers are investing in digital platforms to enhance remote asset management, offering cloud-based solutions that integrate live telemetry, safety management systems and predictive maintenance algorithms. Several forward-thinking shipyards have secured position tracking and mooring analytics tools to offer value-added packages that go beyond traditional fabrication contracts.

Additionally, marine classification societies are collaborating with certification bodies and research institutions to develop standardized guidelines for next-generation floating concepts, encompassing hydrogen-ready hull modifications and carbon capture integration. These collaborative efforts underscore the importance of a holistic approach that balances regulatory compliance, technical innovation and commercial viability.

Finally, a wave of mergers and acquisitions is reshaping the vendor landscape, as established players seek to fill portfolio gaps in digital services and greenfield execution expertise. This consolidation, while intensifying competition, also creates opportunities for new entrants to differentiate through niche offerings in areas such as composite hulls or advanced mooring subsystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Floating Production Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bumi Armada Berhad

- BW Offshore Limited

- China Oilfield Services Limited

- Exmar NV

- Golar LNG Limited

- MODEC, Inc.

- Moog Inc.

- Nippon Yusen Kabushiki Kaisha

- NOV Inc.

- Petróleo Brasileiro S.A.

- Reliance Naval and Engineering Limited

- Samsung Heavy Industries Co., Ltd.

- SBM Offshore N.V.

- TechnipFMC plc

- Teekay Corporation

- Worley Group

- Yinson Holdings Berhad

Actionable Recommendations for Industry Leaders to Capitalize on Emerging Opportunities Mitigate Risks and Accelerate Growth in Offshore Floating Production Operations

Industry leaders should prioritize the adoption of digital twins and advanced analytics platforms that enable real-time optimization of floating production operations. By integrating sensor networks with cloud-based modeling tools, operators can reduce downtime, extend maintenance intervals and enhance safety performance through predictive insights. Moreover, early investment in automation and robotics for subsea interventions will yield long-term cost savings and accelerate decision cycles during critical well intervention campaigns.

To mitigate supply chain risk, executives must diversify vendor portfolios by establishing regional fabrication partnerships that leverage favorable trade terms and local incentives. Incorporating flexible contracting frameworks, such as risk-share limited reimbursement models, can align supplier incentives with project outcomes while safeguarding against tariff-driven cost escalations.

Embracing sustainability imperatives is crucial for future competitiveness. Leaders should evaluate hybrid power solutions, from battery storage to shore-power electrification, and develop decarbonization roadmaps that align with evolving regulatory requirements. Integrating carbon capture readiness and hydrogen blending capabilities into new hull designs will position operators to meet ambitious net-zero targets and unlock green financing options.

Finally, fostering cross-disciplinary talent is essential. Organizations should invest in training programs that bridge subsea engineering, data science and environmental compliance. By cultivating a workforce equipped to manage digital ecosystems and sustainability challenges, industry leaders can ensure resilient operational performance and maintain a strategic edge as the floating production landscape continues to evolve.

Rigorous Research Methodology Outlining Comprehensive Data Collection Analytical Frameworks and Validation Processes Ensuring Credible Floating Production Insights

This research employs a multi-tiered methodology to ensure robust and reliable insights. Primary data were gathered through in-depth interviews with senior executives, offshore operations managers and engineering specialists across major oil and gas operators and service providers. These conversations provided contextual understanding of project execution challenges, technology adoption drivers and regional policy impacts.

Secondary research involved comprehensive analysis of industry publications, technical papers and regulatory filings, supplemented by proprietary databases tracking vessel conversions, hull fabrication contracts and mooring system deployments. Publicly available environmental legislation records and trade policy documentation were systematically reviewed to assess the cumulative impact of U.S. tariffs and regional content requirements.

Data triangulation was achieved by cross-referencing qualitative feedback with quantitative indicators such as equipment delivery schedules, fabrication yard throughput and apprenticeship program metrics. A validation workshop with industry experts refined preliminary findings and ensured that strategic recommendations reflect operational realities. Throughout the study, adherence to quality standards and ethical research practices has been maintained, guaranteeing that the insights presented herein carry high confidence and applicability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Floating Production Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Floating Production Systems Market, by System Type

- Floating Production Systems Market, by Water Depth

- Floating Production Systems Market, by Hull Material

- Floating Production Systems Market, by Mooring System

- Floating Production Systems Market, by Application

- Floating Production Systems Market, by End Use

- Floating Production Systems Market, by Region

- Floating Production Systems Market, by Group

- Floating Production Systems Market, by Country

- United States Floating Production Systems Market

- China Floating Production Systems Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Concluding Reflections Emphasizing Strategic Takeaways Foundational Insights and Critical Considerations for Stakeholders in the Evolving Floating Production Landscape

In summary, the floating production systems sector stands at the nexus of technological innovation, regulatory complexity and evolving energy priorities. Digitalization and hybrid power integration are unlocking new levels of operational efficiency, while tariff pressures are driving supply chain realignment and material innovation. Detailed segmentation analysis underscores the importance of tailoring solutions across diverse system types, water depths and application profiles. Regionally, the Americas, EMEA and Asia-Pacific each offer distinct growth vectors tied to local policy incentives and resource endowments.

As leading companies form strategic alliances and invest in advanced capabilities, the competitive landscape will continue to shift, favoring those who can balance agility with sustainability. Industry stakeholders must embrace data-driven decision-making, expand regional partnerships and cultivate the talent needed to navigate complex floating production projects. By internalizing these takeaways, decision-makers will be well positioned to capitalize on the next wave of offshore development opportunities and deliver long-term value.

Take Advantage of Expert Market Intelligence to Secure a Competitive Edge in Floating Production Systems by Engaging with Associate Director Ketan Rohom Today

To gain an in-depth understanding of the strategic opportunities and risks shaping the floating production systems landscape, reach out directly to Associate Director Ketan Rohom. His expertise in tailoring market intelligence to executive needs ensures you receive actionable insights aligned with your organization’s growth objectives. Connect today to secure your comprehensive market research report and position your team to capitalize on emerging offshore production trends and innovations.

- How big is the Floating Production Systems Market?

- What is the Floating Production Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?