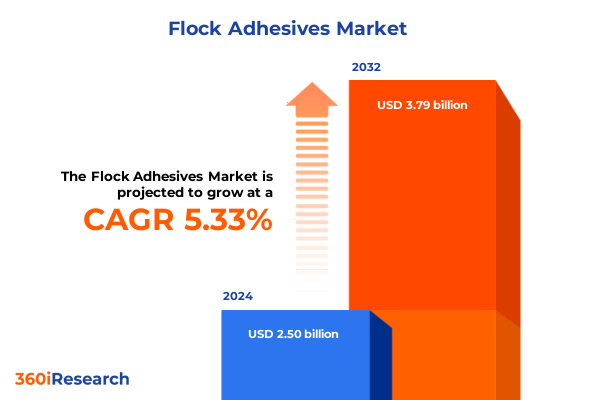

The Flock Adhesives Market size was estimated at USD 2.60 billion in 2025 and expected to reach USD 2.72 billion in 2026, at a CAGR of 5.48% to reach USD 3.79 billion by 2032.

Unveiling the dynamic evolution of the global flock adhesives industry amidst innovation, sustainability priorities, and changing application demands

The global flock adhesives industry is experiencing a period of rapid transformation, driven by heightened demand for customized surface textures and functional enhancements across multiple end use sectors. As manufacturers and formulators alike pursue innovative materials and application techniques, the market is witnessing a shift toward performance-driven solutions that balance tensile strength, environmental compliance, and cost efficiency. This convergence of requirements has encouraged cross-industry collaboration, pushing suppliers to adopt a more holistic approach to product development that addresses the complex needs of automotive exteriors, medical devices, and consumer electronics.

In parallel, sustainability has emerged as a critical catalyst for change, guiding formulators toward bio-based polymers and waterborne systems that minimize volatile organic compound emissions while maintaining superior adhesive properties. Advances in ultraviolet-curable formulations are also challenging conventional solvent-based approaches by offering rapid cure times and reduced energy consumption. Underpinning these material innovations is a growing emphasis on digitalization, as real-time monitoring and predictive maintenance tools enable manufacturers to optimize production efficiency and quality control across both jetting and coating processes.

Navigating the transformative forces reshaping flock adhesive technologies from material breakthroughs to digital integration and regulatory evolution

The flock adhesives landscape is being redefined by a wave of transformative forces that extend from novel chemistries to evolving regulatory frameworks. Material science breakthroughs in hot melt and UV-curable adhesives are unlocking new performance thresholds, enabling enhanced adhesion to advanced substrates like engineered plastics and composite panels. Concurrently, digital integration of production lines has elevated precision and repeatability, facilitating injection and spray flocking processes that were previously constrained by manual variability.

Meanwhile, global regulatory initiatives aimed at reducing hazardous air pollutants and encouraging circular economy principles are setting new benchmarks for formulation transparency and end-of-life recyclability. These policy shifts are prompting industry stakeholders to reassess their raw material sourcing strategies and invest in greener alternatives. As a result, adhesives developers are forging partnerships with specialty chemical producers to co-develop low-VOC and bio-derived solutions, thereby aligning with both compliance mandates and consumer expectations for environmentally responsible products.

Analyzing the cascading effects of 2025 United States tariff revisions on supply chains, pricing mechanisms, and competitive positioning

The introduction of revised United States tariffs in early 2025 has generated ripple effects throughout the flock adhesives supply chain, influencing raw material availability and cost structures. Increased duties on key chemical precursors have forced formulators to re-evaluate their procurement strategies, seeking alternative feedstocks and negotiating longer-term contracts to mitigate price volatility. These adjustments have, in turn, triggered a reassessment of pricing mechanisms, with some suppliers passing on incremental cost burdens while others strategically absorbing fees to maintain customer loyalty.

In addition, the tariff realignment has prompted a geographic rebalancing of production footprints. Several manufacturers have accelerated investments in domestic manufacturing capabilities to circumvent import levies, while others have diversified their supplier networks across Asia-Pacific and Europe to preserve continuity. These shifts have not only impacted lead times and logistics expenses but have also reshaped competitive positioning, as companies with flexible manufacturing platforms and integrated supply chains gain a strategic advantage in a more protectionist trade environment.

Extracting nuanced segmentation perspectives spanning product types, end use industries, application processes, and form factors

The flock adhesives market exhibits a rich tapestry of product types that cater to diverse performance and processing requirements. Hot melt formulations deliver rapid setting and high bond strength for applications ranging from textile embellishments to automotive trim, while solvent-based systems continue to serve specialty coatings where nuanced adhesion and surface wetting are essential. Ultraviolet-curable adhesives are gaining traction for their swift cure rates and minimal energy consumption, and water-based alternatives are responding to regulatory demand for low-emission materials.

End use industries further segment the landscape, with the automotive sector spanning exteriors, interiors, and powertrain components that each impose unique temperature, durability, and chemical resistance standards. In construction, flooring materials such as carpet, tile, and wood demand adhesives that balance elasticity and shear strength, whereas insulation, roofing, and wall coverings prioritize long-term weatherability and ease of application. Consumer goods applications include electronics, footwear, and furniture, with each category seeking flock adhesives that enhance aesthetics, tactile feel, and structural integrity. Medical markets encompass consumables, devices, and equipment requiring biocompatibility and sterilization resilience, while packaging segments-flexible film and paper, labels, and rigid substrates like glass, metal, and PET-call for tailored bonding and sealing solutions. Across all use cases, core application modes of bonding, coating, laminating, and sealing define performance benchmarks, and form factors such as aerosol, film, liquid, paste, and solid dictate processing workflows and equipment configurations.

This comprehensive research report categorizes the Flock Adhesives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- End Use Industry

- Application

Deciphering regional dynamics across Americas, EMEA, and Asia-Pacific to uncover varying demand drivers and market maturation patterns

Regional dynamics in the flock adhesives market reveal contrasting growth trajectories and innovation priorities that reflect broader economic and regulatory landscapes. In the Americas, a mature industrial base has driven demand for high-performance adhesives tailored to automotive exteriors and packaging applications, with North American manufacturers increasingly focusing on flexible production lines to respond swiftly to shifting customer requirements. Latin American markets, while still emerging, are demonstrating growing adoption of water-based and UV-curable systems, particularly in construction and consumer goods sectors.

The Europe, Middle East & Africa region presents a complex mosaic in which regulatory rigor and sustainability mandates have catalyzed the uptake of low-VOC and bio-derived adhesives, especially across Western Europe’s automotive and medical device clusters. Eastern European nations are investing in capacity expansion to support broader industrial modernization, while Middle Eastern markets seek adhesives optimized for high-temperature and sand-laden environments. In Asia-Pacific, rapid infrastructure development and electronics manufacturing have fueled robust demand for bonding and laminating solutions, with key hubs in China, Japan, South Korea, and India prioritizing both cost-effective solvent-based systems and next-generation UV-curable technologies.

This comprehensive research report examines key regions that drive the evolution of the Flock Adhesives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading flock adhesive manufacturers and innovators based on strategic initiatives, technological investments, and collaborative ventures

Leading companies in the flock adhesives space are distinguishing themselves through strategic investments in research and development, collaborative partnerships, and targeted acquisitions. Firms with robust innovation pipelines are exploring advanced polymer chemistries and functional additives designed to enhance adhesion to challenging substrates, while simultaneously reducing environmental footprints. In tandem, several market participants have established joint ventures with specialty chemical providers to co-create customized solutions for high-growth verticals such as electric vehicles and medical consumables.

Beyond product innovation, top-tier organizations are reinforcing their market positions by optimizing global manufacturing footprints and reinforcing supply chain resilience. Investments in digital manufacturing platforms-encompassing predictive maintenance, real-time quality monitoring, and automated process control-are enabling these companies to achieve greater operational efficiency and consistent product performance. Meanwhile, strategic acquisitions of regional formulators and equipment suppliers are expanding their distribution channels and end user access, solidifying their status as comprehensive solutions providers in the adhesives ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Flock Adhesives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Bostik SA

- CHT Gruppe

- Dow Inc.

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- International Coatings Company

- Jowat SE

- Kissel + Wolf GmbH

- Parker Hannifin Corporation

- Permabond Engineering Adhesives Ltd.

- Pidilite Industries Limited

- Sika AG

- Stahl Holdings B.V.

- SwissFlock AG

Strategic imperatives for flock adhesive stakeholders to capitalize on emerging trends, fortify supply resilience, and accelerate value creation

Industry leaders should prioritize the establishment of flexible supply chains that can swiftly adapt to tariff fluctuations and raw material constraints, thereby safeguarding their operational continuity. By diversifying supplier networks and investing in dual sourcing of critical feedstocks, companies can mitigate cost exposure and reinforce negotiating leverage. Furthermore, adopting sustainable adhesive technologies will not only satisfy tightening regulatory requirements but also differentiate product portfolios in a market where environmental credentials increasingly influence purchasing decisions.

In addition, executives are advised to integrate digital twins and advanced analytics across production lines to unlock predictive maintenance capabilities and in-line quality assurance. This digital transformation can significantly enhance throughput while reducing waste and energy consumption. Collaborative innovation should also be at the forefront of corporate agendas; forging alliances with material science institutions and end use OEMs will accelerate the development of tailored adhesives that meet evolving performance benchmarks. Collectively, these strategies will enable organizations to capture emerging opportunities and maintain competitive advantage in a dynamic industry.

Methodological framework integrating primary engagements, secondary intelligence, and analytical rigor to deliver robust market insights

The research methodology underpinning this report combines primary and secondary data collection with rigorous analytical validation. Primary engagements included in-depth interviews with senior executives at adhesive formulators, raw material suppliers, and end use manufacturers, complemented by site visits to leading coating and flocking facilities. These interactions provided qualitative insights into technological adoption rates, cost pressures, and long-term strategic priorities.

Secondary research encompassed comprehensive reviews of industry publications, patent databases, and regulatory filings to trace material innovation trajectories and policy developments. Market intelligence was further enriched through an analysis of financial reports, trade association data, and academic research. Quantitative data points were triangulated with qualitative findings to ensure robustness and reliability. Throughout the study, methodological integrity was maintained via cross-validation of sources and continuous calibration of analytical models.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Flock Adhesives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Flock Adhesives Market, by Product Type

- Flock Adhesives Market, by Form

- Flock Adhesives Market, by End Use Industry

- Flock Adhesives Market, by Application

- Flock Adhesives Market, by Region

- Flock Adhesives Market, by Group

- Flock Adhesives Market, by Country

- United States Flock Adhesives Market

- China Flock Adhesives Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing key revelations and strategic implications to guide informed decision making in the expanding flock adhesives landscape

This executive summary has highlighted the pivotal developments shaping the flock adhesives market, from material innovations and sustainability mandates to regional dynamics and tariff impacts. The synthesis of segmentation insights reveals the nuanced requirements across product types, end use industries, application processes, and form factors. Alongside, strategic profiling of leading companies underscores the importance of R&D investment, digital transformation, and collaborative partnerships in driving competitive differentiation.

As the industry moves forward, stakeholders equipped with a deep understanding of these trends will be better positioned to navigate uncertainties and capitalize on high-growth opportunities. By aligning procurement strategies with tariff contingencies, embracing environmentally responsible formulations, and leveraging advanced analytics for operational excellence, market participants can unlock value across the entire flock adhesives value chain. These insights provide a strategic compass for driving innovation, mitigating risks, and sustaining long-term growth in a dynamic global landscape.

Connect directly with Ketan Rohom to unlock comprehensive flock adhesives research insights and empower strategic growth initiatives

To access the full-depth analysis and actionable intelligence on the global flock adhesives industry, you are invited to reach out directly to Associate Director, Sales & Marketing, Ketan Rohom. His expertise and personalized guidance will ensure that you secure the most relevant data, strategic recommendations, and tailored insights necessary to drive decisive growth and innovation within your organization. Engage with Ketan today to unlock the definitive market research report and catalyze your success in the evolving adhesives landscape.

- How big is the Flock Adhesives Market?

- What is the Flock Adhesives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?