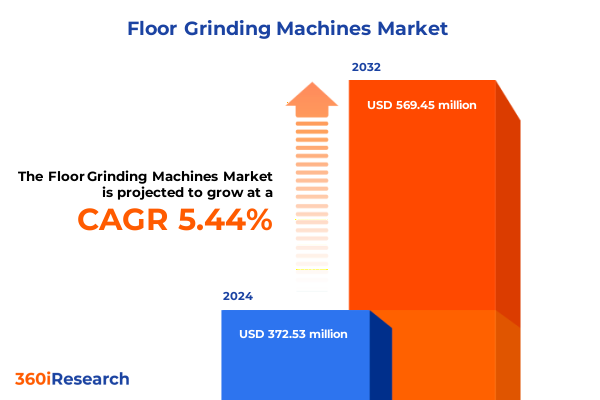

The Floor Grinding Machines Market size was estimated at USD 391.47 million in 2025 and expected to reach USD 412.92 million in 2026, at a CAGR of 5.49% to reach USD 569.45 million by 2032.

Setting the Stage for Floor Grinding Machine Market Growth: Drivers, Emerging Technologies, and Regulatory Milestones Shaping Industry Trends

The floor grinding machine market has evolved far beyond its roots in basic concrete surface preparation to become a dynamic sector influenced by sustainability, regulatory standards, and cutting-edge technology. Recent years have witnessed a notable shift toward polished concrete floors for their low maintenance, aesthetic appeal, and lifecycle cost advantages. This trend is particularly pronounced in North America, where specifiers and contractors increasingly favor polished concrete in commercial spaces, driving demand for versatile, high-performance grinders that deliver both grinding and finishing capabilities. Concurrently, the emphasis on green building practices is reshaping product development as manufacturers introduce energy-efficient models designed to minimize dust emissions and water consumption, aligning with corporate sustainability goals and emerging environmental regulations.

Technological advancements are another critical driver fueling market expansion. Innovations such as hermetically sealed grinding heads, EZChange tooling systems, and integrated dust extraction modules demonstrate the industry’s commitment to enhancing operator safety and productivity. For instance, leading equipment producers have consolidated features from multiple platforms into optimized grinder lines that offer improved ergonomics, reduced maintenance, and consistent performance across diverse applications. These enhancements support faster setup, tool changes, and easier maintenance, enabling crews to complete complex projects on compressed timelines.

Regulatory imperatives further catalyze market growth by compelling end users to upgrade aging fleets and prioritize compliance. The Mine Safety and Health Administration’s latest silica dust rule lowers permissible exposure limits to 50 micrograms per cubic meter, requiring more effective dust control systems and medical surveillance for at-risk workers. At the same time, NIOSH-endorsed local exhaust ventilation systems and HEPA filtration standards guide buyers toward grinders equipped with advanced shrouds and vacuum solutions proven to reduce silica exposure by over 90% during grinding operations. Together, these market forces establish a robust foundation for continued innovation, investment, and strategic growth within the floor grinding machine industry.

Exploring the Transformational Shift to Automation, IoT Integration, and Sustainable Machine Designs Revolutionizing Floor Grinding Operations Globally

The floor grinding machine industry is undergoing a profound transformation driven by automation, digital connectivity, and eco-conscious design. One of the most visible shifts involves the integration of IoT-capable dust removal systems that allow remote monitoring of filter performance, airflow, and system diagnostics in real time. Such systems enhance worker safety and operational efficiency by alerting maintenance teams to impending filter replacements and performance variances before they lead to unplanned downtime. Simultaneously, contractors and rental houses are increasingly adopting remote-controlled grinder variants that minimize operator exposure to hazardous dust and volatile worksite environments.

Pioneering equipment manufacturers are now introducing self-navigating grinders that leverage advanced positioning technologies and machine vision to automate floor surface treatments. For example, Husqvarna’s Autogrinder 8 D represents a quantum leap with its proprietary navigation system and safety settings that enable unattended grinding while operators focus on complementary finishing tasks. Field tests report significant gains in project throughput and resource optimization as these autonomous units maintain consistent grinding paths and adapt to surface irregularities without direct human intervention.

Looking ahead, artificial intelligence and robotics will further accelerate machine autonomy and precision. Emerging platforms embed AI-driven algorithms that analyze floor conditions and dynamically adjust grinding parameters-such as head pressure, rotation speed, and tool selection-to optimize finish quality and maximize abrasive life. As these technologies mature, they promise to elevate productivity, reduce labor costs, and address skilled-labor shortages by enabling operators to supervise multiple machines concurrently rather than manually drive each one. This confluence of automation, IoT connectivity, and sustainable design marks the dawn of a new era in floor grinding operations worldwide.

Assessing the Cumulative Impact of Section 301 and Other U.S. Tariff Measures on Floor Grinding Machine Supply Chains and Cost Structures

Recent U.S. trade policy actions have introduced added complexity to the floor grinding machine supply chain through the imposition of Section 301 tariffs on Chinese-origin machinery. These measures include a 25% duty on covered imports, affecting a broad swath of equipment under HTS chapters 84 and 85, which encompass many floor grinding machine classifications. The tariffs aim to counteract unfair Chinese trade practices but have had the unintended consequence of elevating landed costs for importers and end-users alike, compressing margin structures across the channel.

Recognizing the cost pressures on American manufacturers and contractors, the Office of the United States Trade Representative opened a targeted exclusion process on October 15, 2024, enabling companies to petition for temporary relief on specific machinery subheadings. Stakeholders can submit detailed requests through March 31, 2025, and, if approved, secure tariff exclusions through May 31, 2025. The process requires precise HTS classifications, justifications for exclusion, documentation of domestic sourcing attempts, and evaluations of investment program alignments such as the Inflation Reduction Act and Build America Buy America provisions.

From a strategic standpoint, these tariff dynamics underscore the importance of diversified sourcing and domestic manufacturing capabilities. While exclusions can mitigate short-term cost spikes, relying on them is not a sustainable long-term solution. Consequently, many industry players are evaluating reshoring opportunities and third-country procurement strategies to reduce exposure to U.S.-China trade tensions. In parallel, suppliers are reinforcing after-sales networks and value-added service offerings to differentiate on total cost of ownership rather than purchase price alone, thus cushioning the broader cost implications of tariff volatility.

Gaining Key Market Insights Through Product, Application, End-User, Power Source, and Tool Type Segmentation in Floor Grinding Machines

Integrating multiple dimensions of market segmentation reveals nuanced opportunities and challenges for stakeholders across the floor grinding machine landscape. When viewing the market through the product type lens, hand-held grinders-encompassing angle and die grinders-offer unmatched precision for edge work and small-scale refinishing, while ride-on models, including drum grinders and planetary grinders, deliver high-output performance on expansive surfaces. Walk-behind machines, available in both multi-disc and single-disc configurations, strike a balance of maneuverability and productivity, making them indispensable on mid-sized commercial projects.

Turning to application segmentation highlights how specialized tasks influence equipment requirements. Coating removal operations, subdivided into epoxy and paint removal, frequently leverage multi-disc walk-behind grinders fitted with aggressive tooling to strip finishes efficiently. Concrete grinding workflows bifurcate into pre-grinding and fine grinding phases, each demanding distinct head pressures and abrasive grit profiles. Polishing processes, whether diamond or resin based, rely on variable speed settings and water-feed systems to achieve the desired gloss levels. Surface preparation modalities such as scarifying and shot blasting introduce additional considerations around dust control, cutting speeds, and operator ergonomics.

End-user categories-commercial, industrial, and residential-further refine targeting strategies by dictating fleet composition and service models. Commercial environments often prioritize aesthetics and foot traffic performance, driving up demand for high-powered ride-on and remote-controlled grinders with integrated dust extraction. Industrial settings, governed by stringent flatness and safety requirements, favor heavy-duty planetary drive systems and automated guidance features. Residential buyers, though smaller in volume, represent a steady niche for compact walk-behind and hand-held solutions, particularly in premium renovation segments. Overlaying power source trends-electric, hydraulic, pneumatic-and tool type preferences, including abrasive pads, diamond cup wheels, and polishing pads, completes a multidimensional view that informs product development, distribution, and service strategies.

This comprehensive research report categorizes the Floor Grinding Machines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Power Source

- Tool Type

- Application

- End User

Uncovering Critical Regional Dynamics Across Americas, EMEA, and Asia-Pacific Influencing the Floor Grinding Machine Market’s Growth and Adoption

Examining regional trends across the Americas, Europe, Middle East & Africa (EMEA), and Asia-Pacific reveals distinct growth trajectories and strategic imperatives. In the Americas, a robust renovation wave across commercial real estate and a mature rental equipment ecosystem combine to sustain steady demand for both walk-behind and ride-on grinders. Contractors leverage rental services to access the latest dust-controlled and variable-speed models without the capital commitment of ownership, while North American silica regulations accelerate the replacement of outdated units with HEPA-equipped machines.

In EMEA, stringent environmental directives and circular economy initiatives are shaping equipment specifications. European building codes increasingly mandate low-emission power sources, prompting manufacturers to introduce electric and battery-assisted grinders that meet carbon reduction targets. Meanwhile, the Middle East’s infrastructure expansion, particularly in hospitality and logistics hubs, drives interest in heavy-duty ride-on grinders for large-scale polishing and pre-treatment tasks, often paired with water recycling systems to adhere to local water-use regulations.

Asia-Pacific emerges as the fastest-growing region, fueled by rapid urbanization, smart city programs, and significant public infrastructure investments. China’s high-speed rail projects and India’s Smart Cities Mission call for ultra-flat, polished concrete floors in transit hubs and civic buildings, while Southeast Asia’s expanding manufacturing belt underpins strong uptake of automated and GPS-guided ride-on grinders. The region’s construction market growth projections of over 3.4% year-on-year in 2025 underlie its status as the primary driver of global equipment demand in the coming decade.

This comprehensive research report examines key regions that drive the evolution of the Floor Grinding Machines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Players and Competitive Strategies Driving Innovation and Market Leadership in the Floor Grinding Machine Sector

Market leadership in the floor grinding machine sector is anchored by a mix of global conglomerates and specialized innovators, each leveraging unique strengths to capture share and drive technological advancement. Husqvarna Construction continues to reinforce its position through product line consolidation and R&D investment. In late 2024, the company launched a consolidated large grinder platform featuring hermetically sealed heads, EZChange tooling, and hermetic electrical cabinets designed to prevent dust and water ingress-streamlining maintenance and boosting uptime across its PG 8 series.

Blastrac, now operating under the Husqvarna umbrella for surface preparation, remains a critical innovator in remote-controlled ride-on grinders. Its BMG 2200RC model combines joystick-driven ergonomics with a tri-head planetary design and integrated HEPA filtration, addressing both operator comfort and silica compliance requirements in high-volume applications. Meanwhile, HTC Group’s 2023 introduction of the DURATIQ 5 offers compact precision for fine grinding in confined spaces, appealing to contractors serving the retail and residential remodeling markets.

National Flooring Equipment’s strategic acquisition of Syntec Diamond Tools in early 2025 represents a consolidation of tooling and equipment portfolios under one roof. By combining Syntec’s diamond tooling expertise with National’s global distribution network, the partnership aims to deliver end-to-end surface preparation solutions-reinforcing National’s standing in mid- and large-size markets while expanding Syntec’s reach into European and Asia-Pacific territories. Complementing these leaders, regional specialists such as Achilli, SASE Company, Klindex, Levetec, and Scanmaskin continue to innovate niche offerings, ranging from custom abrasive solutions to localized service models that address unique market requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Floor Grinding Machines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Achilli S.r.l.

- Aztec Products, Inc.

- Bartell Global, LLC

- Blastrac BV

- Diamatic USA, Inc.

- EDCO, Inc.

- HTC Sweden AB

- Husqvarna AB (publ)

- Klindex S.r.l.

- Levetec Concrete Equipment, Inc.

- LINAX Co., Ltd.

- National Flooring Equipment, Inc.

- Onyx Environmental Solutions, LLC

- Roll GmbH

- Samich, Inc.

- SASE Company LLC

- Scanmaskin Sverige AB

- StoneKor, LLC

- Substrate Technology, Inc.

- Superabrasive, Inc.

- Terrco, Inc.

- Terrco, LLC

- WerkMaster, Inc.

- Xingyi Intelligent Equipment Co., Ltd.

- Xtreme Polishing Systems, Inc.

Actionable Recommendations to Empower Industry Leaders to Optimize Operations, Embrace Innovation, and Navigate Market Complexities Effectively

To capitalize on evolving market dynamics, industry leaders should prioritize strategic investments in automation and digital enablement. Deploying IoT-enabled monitoring systems across equipment fleets enables predictive maintenance, extending machine life and reducing unplanned downtime. Companies can pilot connected solutions on flagship models before scaling across entire product lines.

Diversifying supply chains to include domestic assembly or sourcing from lower-tariff jurisdictions strengthens resilience against future trade policy shifts. Simultaneously, building robust exclusion request capabilities under current tariff frameworks can mitigate short-term cost impacts while long-term reshoring initiatives mature.

Manufacturers and distributors should expand service portfolios with value-added offerings, including operator training on silica compliance, digital fleet management platforms, and tool subscription models. Such services deepen customer relationships, differentiate brands beyond hardware, and unlock new recurring revenue streams.

On the product side, advancing battery-electric and low-emission grinder variants will address sustainability mandates and urban jobsite restrictions. Prioritizing modular designs that accommodate evolving dust control and automation modules allows for future-proofing equipment investments. Through these actions, industry stakeholders can sharpen competitive positioning and drive profitable growth.

Behind the Scenes: Methodologies, Data Sources, and Analytical Frameworks Ensuring the Rigor and Integrity of Floor Grinding Machine Market Research

This research integrates primary and secondary methodologies to ensure comprehensive, unbiased analysis. Primary insights were gathered through in-depth interviews with construction contractors, equipment rental managers, and safety compliance experts across North America, Europe, and Asia-Pacific. These conversations provided frontline perspectives on usage patterns, emerging requirements, and technology adoption barriers.

Secondary research encompassed a thorough review of regulatory publications, industry press releases, technical white papers, and academic studies. Sources included USTR Federal Register notices, OSHA and NIOSH technical reports, manufacturer product datasheets, and recognized market intelligence portals. Data triangulation techniques were applied to reconcile disparate estimates and validate key trends.

Quantitative modeling leveraged historical shipment data, equipment rental metrics, and macro-economic indicators such as construction output and infrastructure spending forecasts. Scenarios were stress-tested against tariff assumptions, regulatory timelines, and potential technology adoption rates. The resulting framework offers a solid empirical basis for strategic decision-making by manufacturers, investors, and end users alike.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Floor Grinding Machines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Floor Grinding Machines Market, by Product Type

- Floor Grinding Machines Market, by Power Source

- Floor Grinding Machines Market, by Tool Type

- Floor Grinding Machines Market, by Application

- Floor Grinding Machines Market, by End User

- Floor Grinding Machines Market, by Region

- Floor Grinding Machines Market, by Group

- Floor Grinding Machines Market, by Country

- United States Floor Grinding Machines Market

- China Floor Grinding Machines Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing Insights and Charting the Path Forward for Stakeholders in the Evolving Floor Grinding Machine Market Landscape

The floor grinding machine industry stands at the convergence of technology innovation, regulatory evolution, and shifting customer priorities. Robust demand driven by refurbishment trends and infrastructure investment is matched by unprecedented advancements in automation, IoT connectivity, and sustainable design. At the same time, complex trade policy landscapes and stringent safety standards compel stakeholders to refine sourcing strategies and fleet compositions.

Segment-level analysis highlights the need for configurable equipment solutions that meet specialized application requirements-ranging from high-precision concrete polishing to aggressive coating removal. Regional patterns underscore the imperative of tailored market approaches, with North America focusing on rental flexibility and compliance, EMEA emphasizing electrification and circular economy, and Asia-Pacific leading growth through mega-projects and smart city initiatives.

As leading companies continue to coordinate product innovation with service diversification, the competitive battleground will shift toward digital-enabled value propositions and lifecycle cost leadership. By synthesizing these insights, decision-makers can chart a path that balances profit objectives with operational resilience and regulatory compliance, ensuring sustained success in a rapidly evolving market.

Connect with Ketan Rohom for Expert Guidance and Secure Your Comprehensive Floor Grinding Machine Market Research Report Today

Ready to leverage unparalleled insights and make informed decisions with your floor grinding machine market research report? Connect directly with Ketan Rohom, Associate Director, Sales & Marketing, who will guide you through the report’s comprehensive findings and customization options. Whether you are seeking deep-dive analysis on emerging technologies, tailored segmentation intelligence, or detailed competitive strategies, Ketan has the expertise to ensure the research aligns with your strategic objectives. Don’t miss the opportunity to gain a competitive edge-reach out today to secure your definitive market intelligence and propel your business forward

- How big is the Floor Grinding Machines Market?

- What is the Floor Grinding Machines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?