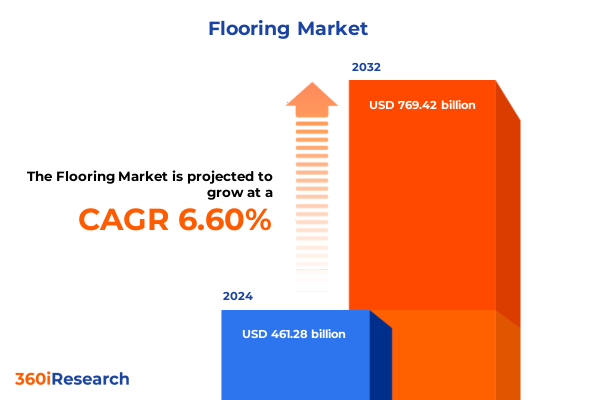

The Flooring Market size was estimated at USD 491.23 billion in 2025 and expected to reach USD 520.79 billion in 2026, at a CAGR of 6.62% to reach USD 769.42 billion by 2032.

A concise framing of the modern flooring industry landscape highlighting trade, sourcing, sustainability, and distribution changes that demand strategic action

The flooring sector is navigating a period of concurrent disruption and opportunity driven by rapid shifts in trade policy, supply chain reorientation, materials innovation, and evolving buyer behavior across residential, commercial, and industrial applications. This executive summary synthesizes qualitative and cross‑channel research to frame the near‑term landscape for manufacturers, distributors, installers, and institutional buyers. It foregrounds how external shocks-most notably recent U.S. tariff actions-intersect with long‑running structural trends such as sustainability requirements, labor dynamics in skilled installation, and the accelerating pivot to omnichannel distribution.

Taken together, these forces are reshaping how product portfolios are prioritized, where capital is invested for domestic capacity or nearshore sourcing, and how commercial contracts and procurement strategies are constructed. Readers should expect evidence‑based, actionable perspectives that preserve operational detail without drifting into proprietary market-sizing claims. This introduction sets the context for subsequent sections by outlining the levers that matter most to decision‑makers: tariff and trade developments; product, installation and distribution segmentation; regional supply and demand differentials; and competitive responses by major suppliers and channel partners. From this foundation, the report provides targeted insights and pragmatic recommendations intended to support pricing strategy, sourcing diversification, and capability investment discussions at board and operational levels.

How sourcing, sustainability, digital channels, and regulatory shifts are reconfiguring product strategies, installation models, and competitive advantage in flooring

The industry is undergoing transformative shifts that are structural rather than temporary, with multiple vectors of change converging to redefine competitive advantage. One primary shift is the rebalancing of global sourcing footprints: firms are accelerating moves away from single‑country concentration toward a broader supplier mix that includes domestic manufacturing, nearshore suppliers, and diversified Asia‑Pacific partners. This reorientation is tightly coupled with capital allocation decisions to expand local capacity where economically feasible and to invest in supplier development programs that transfer manufacturing know‑how closer to end markets.

Another substantive change is the rise of materials and sustainability imperatives. Demand growth for low‑emission, circular and renewable materials is prompting manufacturers to redesign product compositions, extend warranties tied to lifecycle performance, and certify supply chains to meet institutional purchasing standards. Concurrently, finishing and coating technologies are evolving to deliver improved durability and reduced maintenance, which shifts value conversations from first‑cost to total cost of ownership in both commercial and residential procurement.

Digital transformation and channel evolution are also reshaping customer journeys. E‑commerce and virtual specification tools have become integral to early‑stage decision making, while digital inventory visibility and integrated logistics platforms are required to manage increasingly fragmented sourcing. At the same time, the installation ecosystem is bifurcating: a larger DIY-adopter segment is emerging in certain resilient and snap‑together products, while complex commercial projects continue to demand skilled professional installation and certified installers. This duality forces manufacturers and distributors to maintain differentiated product families and service models that serve both self‑install consumers and large commercial contractors.

Finally, policy and regulatory changes, most visibly recent tariff actions, have introduced a new layer of commercial risk that affects contract cadence, landed cost calculations, and supplier selection. These policy shocks accelerate strategic shifts already under way, compelling firms to embed trade‑scenario planning into procurement processes and to engage more proactively with government exclusion mechanisms and industry associations to protect critical product lines. Collectively, these transformational shifts create higher‑velocity decision cycles and raise the value of flexible sourcing, modular product design, and repeatable installation systems.

A detailed appraisal of how recent U.S. tariff measures have altered landed costs, triggered price adjustments by manufacturers, and accelerated sourcing realignment across the supply chain

The United States’ tariff actions announced in 2025 have had immediate and material effects on the cost structures, supply networks, and commercial behavior of flooring sector participants. The executive order imposing an across‑the‑board baseline tariff and higher reciprocal rates created a new cost premium on many imported finished goods and components, prompting manufacturers and distributors to reprice inventories, accelerate sourcing changes, and, in some cases, implement permanent list price adjustments to preserve margin integrity. These policy changes compelled the federal government to provide implementing guidance and to adjust tariff codes and classifications that directly affect flooring categories, creating both near‑term administrative complexity for customs compliance and medium‑term implications for procurement strategies.

Industry participants reacted rapidly: a cohort of major floorcovering manufacturers and brands announced price increases on internationally sourced products and signaled that domestically produced ranges would remain insulated for the short term. Those publicized price adjustments reflect an effort to pass through higher landed costs borne out of the tariff environment while maintaining competitiveness on locally manufactured assortments. This commercial reflex has had downstream consequences for distributors, contractors, and end customers as order timing, supplier substitution, and project budgeting practices were rebalanced to mitigate immediate cost pressures.

At the operational level, the tariffs have accelerated supply‑chain realignment in predictable ways. Buyers have intensified qualification of alternative manufacturers in Mexico, Vietnam, South Korea, and other Asia‑Pacific jurisdictions that offer production capacity and logistical advantages, but this shift is constrained by technical specifications and the time required to scale capacity for product families such as luxury vinyl tile and engineered composites. Where near‑term capacity gaps exist, firms leaned on existing domestic inventories and selectively applied tariff‑exclusion processes or product reclassification where legally viable. This dynamic underscores the importance of multi‑tier risk mapping that identifies single‑source exposures by SKU, raw material, and component.

Policy complexity has also opened a pragmatic channel for firms to seek relief through documented exclusion requests and engagement with trade authorities. A number of product classes historically used in flooring manufacture were carved out from prior tariff actions based on narrowly defined physical characteristics, demonstrating that well‑structured exclusion petitions and technical documentation can preserve commercial access for specific panels, engineered products, and vinyl formulations. Firms that invest the effort to pursue exclusions and to document supply chain uniqueness reduce margin erosion and protect critical SKUs during periods of elevated trade tension.

Finally, the tariff environment has generated a tangible legal and political overlay that adds uncertainty to planning horizons. Legal challenges and judicial review timelines can affect whether duties remain in force or are suspended, creating potential for retroactive refunds or further adjustments. Strategic planning must therefore accommodate multiple scenarios-ranging from sustained tariffs to phased reductions or legal remedies-so that capital allocation, contract terms, and inventory posture are resilient across outcomes. Recent reporting on litigation and judicial responses underscores that the policy picture can evolve rapidly, reinforcing the need for scenario‑based procurement playbooks.

Segmented intelligence that maps product families, installation systems, material choices, and channel dynamics into practical commercial and operational priorities

Effective segmentation is essential for operationalizing strategy because each product and channel cluster exhibits distinct cost drivers, demand elasticities, and distribution requirements. Within product type, the market differentiates among carpets and rugs, non‑resilient flooring, and resilient flooring, with non‑resilient further subdivided into bamboo, ceramic tile, laminate, stone, and wood, and resilient further subdivided into cork, linoleum, resin, rubber, and vinyl. This layered taxonomy matters because sourcing and installation practices diverge sharply across those families: ceramic and stone products are capital‑intensive to produce and favor regional tile clusters and specialty installers, whereas resilient vinyl and cork benefit from modular, lower‑skill installation systems and can be optimized for DIY channels. The interaction of product form and installer capability drives assortment decisions, warranty structures, and channel mix.

Installation type introduces another axis of differentiation that affects margins and service models. The choice among floating installation, glue‑down installation, and nail‑down installation changes labor content, project scheduling, and post‑installation liability. Products engineered for floating installation typically accelerate project timelines and lower professional labor intensity, which in turn expands addressable markets in owner‑occupied residential projects and fast‑turn commercial retrofits. Conversely, glue‑down and nail‑down systems remain prevalent in high‑traffic commercial and industrial applications where long‑term performance and resilience to heavy loads are primary considerations.

Material composition is equally consequential. The split between natural materials and synthetic materials influences procurement risk, specification language, and sustainability narratives. Natural materials such as stone and wood are subject to commodity and regulatory dynamics-softwood and hardwood sourcing, phytosanitary controls, and conservation standards-while synthetic materials present opportunities for recycled content claims, engineered performance, and manufacturing consistency. Each material pathway interacts with regional supply strengths and regulatory expectations, shaping playbooks for product innovation and supplier selection.

Application segmentation-commercial, industrial, and residential-further refines go‑to‑market tactics. Commercial end users, including corporate offices, healthcare facilities, hospitality and leisure, and retail spaces, prioritize lifecycle performance, acoustic and hygiene characteristics, and brand conformity with sustainability mandates, driving demand for certified products and integrated service contracts. Industrial applications such as manufacturing facilities and warehouses emphasize durability, chemical resistance, and easy maintenance, directing specification processes toward heavy‑duty resilient systems and specialty coatings. Residential demand, while diverse, shows bifurcation between DIY‑friendly resilient formats and higher‑finish wood and stone solutions that require professional installation.

Installation method and distribution channel complete the segmentation map. The distinction between DIY installation and professional installation influences packaging, instructions, and the extent of pre‑finished modularity required. Distribution paths between offline and online channels determine inventory strategies; bricks‑and‑mortar showrooms continue to matter for high‑touch specification sales and large commercial deals, while online channels are critical for volume, rapid quote cycles, and reaching smaller renovation projects. Integrating these segmentation lenses into commercial processes allows firms to prioritize SKUs, tailor inventory holdings, and align marketing investments with the segments that deliver strategic margin advantage.

This comprehensive research report categorizes the Flooring market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Installation Type

- Flooring Material

- Application

- Installation Method

- Distribution Channel

Regional demand and supply differentials across the Americas, Europe Middle East & Africa, and Asia‑Pacific that determine sourcing resilience and specification requirements

Regional dynamics are shaping both supply and demand in ways that materially affect sourcing and go‑to‑market strategy. In the Americas, end‑market demand is influenced by renovation cycles, construction starts, and a rising emphasis on domestic content in procurement decisions. North American producers and distributors are finding opportunities to expand regional capacity and to market shorter lead times, while cross‑border trade rules and agreements continue to support integrated North American supply chains for many product families. This regional proximity remains an advantage for heavy or high‑service products where logistics and on‑site support are cost drivers.

Europe, Middle East and Africa presents a heterogeneous landscape where premium tile and engineered wood segments often command higher margins, and regulatory expectations on sustainability and chemical disclosure are comparatively advanced. Buyers in these markets increasingly require transparency in material sourcing and expect compliance with regional regulations that govern emissions, recycled content, and end‑of‑life handling. Manufacturers targeting commercial projects in these markets must therefore align product specifications and certifications with local procurement norms to remain competitive.

Asia‑Pacific continues to be the primary production hub for many flooring components and finished goods, with suppliers in several countries supporting global distribution. That production leadership creates both opportunity and risk: exposure to geopolitical shifts and tariffs can rapidly change cost competitiveness, while proximity to raw materials and industrial scale offers price and lead‑time advantages that are hard to replicate quickly. Consequently, buyers seeking supply resilience are balancing Asia‑Pacific sourcing with investments in alternative capacity and strategic inventory buffering. The interplay among these regions is critical; policy changes or capacity shocks in one region ripple through global sourcing networks and emphasize the importance of cross‑regional contingency planning.

This comprehensive research report examines key regions that drive the evolution of the Flooring market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How industry participants are adjusting pricing, accelerating nearshore capacity, and using trade engagement to protect critical product assortments

Companies across the value chain are responding with a mix of near‑term commercial measures and longer‑term strategic repositioning. Several major flooring manufacturers have publicly announced price increases on internationally sourced products while maintaining stable pricing for domestically produced assortments. These moves demonstrate a prioritized effort to protect margins where tariffs and freight cost inflation bite hardest, and to use domestic production as a commercial buffer to retain competitive listings with large contractors and national distributors. At the same time, some suppliers are accelerating investments in Mexico and other nearshore facilities to retain proximity to the U.S. market and to mitigate potential tariff exposure.

Beyond pricing, firms are redeploying commercial and technical resources to support customers through specification changes, product substitutions, and expedited logistics. Distribution partners and retail chains are adapting inventory policies and financing terms to accommodate extended lead times and to manage cash flow sensitivity created by rapid price adjustments. Likewise, installers and training organizations are scaling certification programs for newer, lower‑skill resilient systems to capture the higher DIY and self‑managed installation segments while preserving specialty crews for premium installations.

Importantly, proactive engagement with trade authorities and well‑documented exclusion requests have emerged as a differentiator. Companies that systematically document product uniqueness, demonstrate lack of viable domestic substitutes, and follow exclusion processes have reduced exposure for select SKUs. Those operational capabilities-technical documentation, legal‑trade expertise, and rapid customs classification-have become as important as traditional manufacturing excellence in protecting margins and preserving market access during policy turbulence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Flooring market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abet Laminati S.p.A.

- Adore Floors Inc.

- AHF, LLC

- Al Maha Ceramics Co. SAOG

- Al-Anwar Ceramic Tiles Co. SAOG

- American Biltrite Inc.

- Barlinek S.A.

- Bauwerk Group AG

- Beaulieu International Group

- Congoleum Corporation

- Daejin Co., Ltd.

- Daiken Corporation

- Forbo Holding AG

- Gerflor Group

- Goodfellow Inc.

- Greenlam Industries Ltd.

- Impermo-Stultjens NV

- Interface, Inc.

- Jiangsu Taide Decoration Materials Co., Ltd.

- Kronospan Limited

- Kährs Holding AB

- LX Hausys, Ltd.

- Mannington Mills, Inc.

- Mercier Wood Flooring

- Milliken & Company

- Mohawk Industries, Inc.

- RAK Ceramics PJSC

- Raskin Industries LLC

- Responsive Industries Limited

- Riyadh Ceramics

- Shaw Industries Group, Inc.

- Swiss Krono Group

- Tarkett S.A.

- Toli Corporation

- Trelleborg AB

- Victoria PLC

- Wellmade Floor Coverings International, Inc.

- Zhejiang Hailide New Material Co., Ltd.

Practical, high‑impact recommendations for executives to diversify sourcing, defend margins through tariff playbooks, and capture value from product and channel innovation

Industry leaders can convert disruption into advantage by pursuing a set of pragmatic, high‑impact actions that align commercial, sourcing, and operational levers. First, diversify supply footprints by qualifying multi‑country manufacturing partners and creating tiered sourcing strategies that reduce single‑country concentration risk. This requires investment in supplier development, quality auditing, and logistics orchestration so that product consistency and lead times remain market‑competitive. Second, build tariff scenario playbooks that integrate procurement, legal, and finance teams; those playbooks should include SKU‑level vulnerability mapping, contract clauses to allocate duty exposure, and a defined escalation pathway for exclusion petitions and governmental engagement.

Third, accelerate the development of domestic and nearshore capacity for product families where technical replication is feasible and where logistics or tariff exposure are material cost drivers. Investments should prioritize modular production methods, platform engineering, and product families that can scale with lower capital intensity. Fourth, reframe product value propositions toward total cost of ownership and sustainability performance to justify premium pricing where appropriate; purchasers increasingly trade on lifecycle metrics, and credible, certified sustainability claims create differentiation in competitive bids.

Fifth, align channel strategies to reflect the segmentation tradeoffs between DIY and professional installation. That means packaging, instructional design, and online content tailored to the self‑installer while maintaining certification programs and service bundles for professional installers on commercial projects. Sixth, strengthen commercial communications to end customers and channel partners by providing transparent landed cost calculators and advance guidance on lead times and substitutions to reduce project friction and protect reputations. Finally, embed scenario governance into capital planning so that investment decisions remain robust across potential tariff reversals or legal outcomes. By sequencing these actions-short‑term tariff mitigation, medium‑term capacity and supplier diversification, and longer‑term product and channel innovation-industry leaders can protect margins while positioning for the market opportunities created by structural change.

A transparent mixed‑method research approach combining primary interviews, supply‑chain trace analysis, regulatory review, and scenario testing to ensure actionable validity

This research synthesis draws on a mixed‑method approach integrating primary interviews, supply‑chain trace analysis, and targeted policy review. Primary inputs included structured conversations with procurement and strategy leaders at manufacturers, distributors, and installation service providers, supplemented by interviews with independent specifiers and large institutional buyers to understand procurement drivers and specification sensitivities. The supply‑chain trace analysis mapped tier‑one and tier‑two supplier footprints across production nodes, logistics corridors, and inventory nodes to identify concentration risk and alternative capacity options.

Secondary research encompassed regulatory and policy documents, customs classification guidance, published industry reporting, and company disclosures that illuminate tariff actions, price adjustments, and strategic responses. Trade policy and executive orders were reviewed to capture legal mechanisms and implementation timelines, while industry press and trade publications were used to track public commercial responses such as announced price increases and capacity investments. Scenario analysis was applied to test operational responses under alternative policy paths, and findings were stress‑tested in conversations with practitioners to validate feasibility and likely timeframes.

Finally, the methodology intentionally avoided presenting proprietary market sizing or forecasted values in this executive summary; rather, it prioritized diagnostic and action‑oriented insight designed to be interoperable with client financial models and procurement systems. Where specific trade rulings, exclusion decisions, or company announcements are material to the narrative, primary source references and documented press reports were used so that readers can audit the evidence base and request the supporting appendix as needed.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Flooring market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Flooring Market, by Product Type

- Flooring Market, by Installation Type

- Flooring Market, by Flooring Material

- Flooring Market, by Application

- Flooring Market, by Installation Method

- Flooring Market, by Distribution Channel

- Flooring Market, by Region

- Flooring Market, by Group

- Flooring Market, by Country

- United States Flooring Market

- China Flooring Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

A strategic synthesis emphasizing resilient sourcing, capability building, and value‑based specification as the path to sustainable competitive advantage in flooring

In an environment of elevated policy uncertainty and fast‑moving supply responses, flooring industry leaders must move from reactive fixes to durable strategic repositioning. The combined pressures of tariff actions, evolving material preferences, and channel transformation require organizations to invest in supply‑chain agility, tariff governance, and differentiated product lines that meet both performance and sustainability expectations. Short‑term tactical measures-such as seeking exclusions, adjusting prices for impacted import assortments, and prioritizing domestic inventories-are necessary to stabilize margins, but they must be complemented by medium‑term capacity investments and a concerted focus on specification‑driven sales in commercial channels.

The firms that will outperform are those that treat trade shock as a catalyst for portfolio rationalization and capability building: diversifying sourcing while preserving high‑service domestic offerings, monetizing durability and total cost of ownership in specification conversations, and investing in digital tools that reduce friction across the buyer journey. Adopting scenario governance for tariff outcomes and embedding trade expertise into commercial operations will reduce uncertainty and enable faster, more confident decisions. The conclusion is straightforward: the current period of disruption rewards decisive action that combines immediate mitigation with strategic capacity and product choices that capture the next wave of demand.

Contact the Associate Director of Sales and Marketing to secure the full proprietary flooring market report, tailored briefings, and tariff scenario toolkits

To acquire the full, proprietary market research report and an executive briefing tailored to your strategic priorities, please reach out to Ketan Rohom, Associate Director, Sales & Marketing. Ketan will coordinate delivery options, scope a customized briefing that aligns with your commercial objectives, and arrange access to the dataset, appendices, and primary interview transcripts that underpin this analysis. Engaging directly will ensure you receive the version of the report that best supports procurement, sourcing, and go-to-market decisions, along with optional add-ons such as supplier-risk modeling, tariff-scenario toolkits, and on‑demand expert consultations. Contacting Ketan is the fastest way to secure privileged insights, schedule a walkthrough of the evidence base, and obtain tailored recommendations that your leadership and procurement teams can operationalize immediately.

- How big is the Flooring Market?

- What is the Flooring Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?