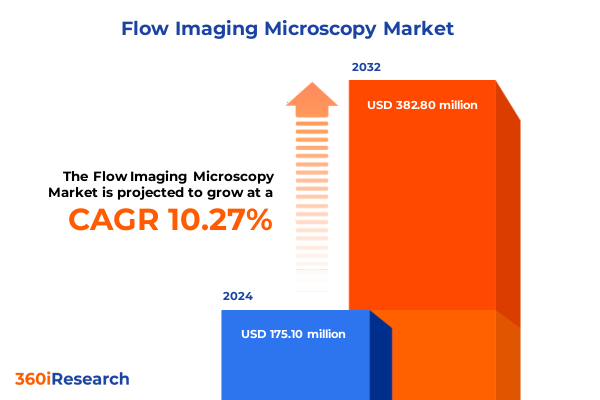

The Flow Imaging Microscopy Market size was estimated at USD 192.43 million in 2025 and expected to reach USD 214.01 million in 2026, at a CAGR of 10.32% to reach USD 382.79 million by 2032.

Unveiling the Strategic Importance of Flow Imaging Microscopy in Modern Analytical Sciences Driving Unprecedented Precision and Innovation in Particle Analysis

Flow imaging microscopy has emerged as a cornerstone of modern analytical sciences, offering unparalleled precision in characterizing particle size, morphology, and concentration within complex samples. By merging the principles of optical microscopy with high-throughput flow cytometry, this technology enables users to visualize and quantify particulate matter in suspension with exceptional resolution and statistical rigor. As laboratories seek to streamline quality control, bioprocess monitoring, and contamination detection workflows, flow imaging microscopy has quickly gained traction as a versatile tool that bridges traditional imaging methods and next-generation particle analysis platforms.

This executive summary provides a structured overview of the flow imaging microscopy domain, detailing the technological innovations, regulatory influences, and market dynamics that are reshaping how researchers and manufacturers approach particle characterization. The analysis spans a comprehensive range of imaging modalities, from bright field and fluorescence to phase contrast, and explores static versus dynamic technology implementations. Additionally, it examines how sample attributes-be it large molecules, liquid formulations, synthetic nanofibers, or small molecule suspensions-drive methodological choices. Drawing on expert interviews, peer-reviewed literature, and insights from end-user industries, this introduction sets the stage for a deeper exploration of transformative shifts, tariff impacts, segmentation nuances, regional variations, competitive landscapes, strategic recommendations, and the rigorous research framework underpinning these findings.

How Emerging Technological Breakthroughs and Digital Integration Are Catalyzing a Paradigm Shift in Flow Imaging Microscopy Applications and Workflows

In recent years, flow imaging microscopy has undergone a paradigm shift fueled by advances in sensor technology, real-time data processing, and artificial intelligence. High-resolution cameras with increased frame rates now enable researchers to capture detailed morphological features at speeds once thought unattainable in flow-based platforms. Parallel to these hardware innovations, machine learning algorithms have been integrated into analysis pipelines, automating image classification, anomaly detection, and trend recognition. This convergence of digital imaging and predictive analytics is empowering laboratories to derive deeper insights from particulate samples while reducing time-to-result and minimizing operator variability.

Alongside technological breakthroughs, the workflow surrounding flow imaging microscopy has transformed through heightened demands for regulatory compliance and data integrity. Pharmaceutical and biotechnology sectors are increasingly adopting inline monitoring strategies to satisfy stringent quality standards, prompting vendors to embed cloud-enabled data management and audit-ready reporting within their offerings. Furthermore, the expansion of decentralized testing paradigms in environmental monitoring and food safety has driven modular instrument designs that integrate seamlessly with portable sampling systems. As a result, stakeholders are no longer evaluating standalone imaging platforms but comprehensive solutions that address end-to-end analytical challenges.

Assessing the Comprehensive Impact of 2025 United States Tariffs on Flow Imaging Microscopy Supply Chains and Pricing Structures across Multiple Industries

The imposition of new United States tariffs in 2025 on imported optical components, electronic modules, and precision instruments has reshaped the supply chain for flow imaging microscopy systems. Manufacturers reliant on overseas component sourcing have confronted increased import duties that have translated into elevated production costs. In response, many suppliers have restructured procurement strategies by diversifying their vendor base, accelerating domestic partnerships, and exploring near-shoring opportunities. While some cost pressures have been passed through to end users, strategic pricing adjustments and bundled service offerings have emerged as mitigating measures to preserve market competitiveness without compromising access.

Beyond direct cost implications, the tariff adjustments have prompted a revaluation of inventory management practices. Facilities have extended lead times for critical components and ramped up safety stock levels to buffer against future trade policy shifts. Simultaneously, service providers have recalibrated maintenance contracts, offering flexible spare parts subscriptions to offset upfront tariff-induced pricing spikes. Although short-term disruption and volatility characterized the first half of 2025, the market has begun to stabilize as stakeholders adapt to the new trade landscape, optimize cross-border logistics, and integrate tariff considerations into strategic procurement and capital investment roadmaps.

Revealing Key Segmentation Insights on How Imaging Modalities, Technology Variants, Sample Types, Dispersion Methods, and Applications Drive Market Dynamics

Analyzing the market through multiple segmentation dimensions reveals nuanced insights into current and future opportunities within flow imaging microscopy. When evaluating the market based on imaging type, it becomes evident that bright field imaging remains the foundational modality for general particle visualization, whereas fluorescence imaging is rapidly gaining ground for applications requiring specificity through tagged markers. Meanwhile, phase contrast imaging continues to serve research environments that demand label-free analysis of transparent samples.

From a technology standpoint, static imaging configurations offer robust performance for high-volume batch testing, but dynamic imaging systems are on the rise due to their enhanced throughput and capacity to capture transient particle events. Examining sample types, large molecule suspensions and liquid samples dominate biopharmaceutical quality control workflows, whereas microfibers and nanofibers are increasingly scrutinized in environmental and industrial sectors. Small molecule formulations, while less prevalent, are critical in specialized research contexts. Sample dispersion techniques further refine analytical precision, with dry dispersion gaining favor for particulate solids and wet dispersion remaining indispensable for liquid matrices.

Considering end-user industries underscores the breadth of flow imaging microscopy adoption. Biotechnology organizations leverage these systems for biologics characterization, chemical manufacturers use them for formulation testing, and cosmetics and personal care companies rely on high-resolution imaging to ensure product safety. Environmental and industrial sectors employ particle analysis for air and water quality, food and beverage firms adopt the technology to safeguard against contamination, and pharmaceutical companies integrate flow imaging microscopy into drug development and release testing workflows.

Delineation by application stands out as another key axis, with bio-imaging applications exploiting fluorescence capabilities, contamination detection workflows demanding rapid real-time alerts, particle characterization protocols requiring detailed morphological data, and research and development teams favoring customizable configurations. These segmentation insights collectively inform strategic decisions, from R&D investment prioritization to regional product portfolio design.

This comprehensive research report categorizes the Flow Imaging Microscopy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- Sample Type

- Sample Dispersion

- Application

- End-User Industry

Examining Regional Dynamics and Growth Drivers in the Americas, Europe Middle East & Africa, and Asia-Pacific to Identify Opportunities in Flow Imaging Microscopy

Regional analysis of flow imaging microscopy adoption highlights distinctive market drivers and growth trajectories across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, strong demand from biopharmaceutical hubs in the United States and Canada underpins investment in high-throughput screening platforms. With a well-established distribution network and extensive academic-industry collaborations, North American stakeholders benefit from rapid technology transfer and a mature aftermarket service ecosystem. Additionally, Latin American markets are experiencing gradual uptake as local research institutions modernize analytical infrastructure and regulatory agencies strengthen particulate testing guidelines.

Moving across the Atlantic, Europe Middle East & Africa presents a mosaic of opportunity influenced by regional regulatory harmonization efforts and sustainability mandates. Western European nations lead in integrating flow imaging microscopy into quality control labs for advanced therapy medicinal products, while emerging markets in Eastern Europe and the Middle East prioritize environmental monitoring and industrial applications. Africa remains in the early stages of adoption, with growth prospects tied to infrastructure development and international partnerships. Collaborative initiatives aimed at bolstering research capacity in universities and contract testing facilities are generating interest but face challenges related to funding and technical expertise.

In the Asia-Pacific region, rapid expansion is driven by pharmaceutical manufacturing in India, China’s burgeoning life sciences sector, and accelerating R&D investment in countries such as Japan and South Korea. Localized manufacturing of optical components and sensor modules is reducing lead times and enabling cost-competitive instrument offerings. Moreover, government-backed innovation programs and public-private partnerships are fueling product development and encouraging the deployment of advanced analytical platforms in academic laboratories. As a result, Asia-Pacific is positioned to become a critical growth engine for flow imaging microscopy adoption worldwide.

This comprehensive research report examines key regions that drive the evolution of the Flow Imaging Microscopy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators in Flow Imaging Microscopy Driving Competitive Advantage and Technological Advancements Globally

The competitive landscape for flow imaging microscopy encompasses a spectrum of organizations ranging from established instrument manufacturers to emerging software innovators and specialized service providers. Leading analytical instrument companies continue to invest heavily in R&D, refining optical designs, sensor integration, and automation features to maintain their market positioning. Meanwhile, software vendors are developing AI-enabled image analysis solutions that seamlessly integrate with proprietary hardware, offering users turnkey platforms for particle classification and real-time reporting.

Concurrent with product innovation, contract research organizations and independent analytical service laboratories have expanded their offerings to include flow imaging microscopy as part of broader particle characterization portfolios. These entities leverage deep domain expertise to support clients in method development, regulatory validation, and technology transfer. In parallel, academic collaborations are contributing to the evolution of novel imaging approaches, such as multimodal platforms that combine flow imaging with spectroscopy or microfluidic sorting. Through these partnerships, research institutions are not only validating new applications but also generating the next generation of industry talent skilled in advanced microscopy techniques.

Strategic alliances between component suppliers and end-user firms are further enhancing the ecosystem. By co-developing custom optical modules, microfluidic cartridges, and cloud-based management tools, these collaborations are driving incremental improvements in throughput, sensitivity, and ease of use. As a result, the market is characterized by a dynamic interplay of hardware incumbents, software disruptors, service specialists, and research consortia all striving to deliver comprehensive solutions that meet evolving analytical demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Flow Imaging Microscopy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3P Instruments GmbH & Co. KG

- Aiforia Technologies Oyj

- Anton Paar GmbH

- Bio-Rad Laboratories, Inc

- Bio-Techne Corporation

- Carl Zeiss AG

- Coriolis Pharma Research GmbH

- Danaher Corporation

- Fluid Imaging Technologies, Inc.

- Horiba, Ltd.

- Kenelec Scientific Pty Ltd.

- Meritics Ltd.

- NanoFCM Co., Ltd

- PerkinElmer, Inc.

- Sartorius AG

- Shimadzu Corporation

- Sympatec GmbH

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

- Yokogawa Fluid Imaging Technologies, Inc

Actionable Recommendations for Industry Leaders to Harness Flow Imaging Microscopy Innovations and Strengthen Competitive Positioning in Analytical Workflows

To remain at the forefront of flow imaging microscopy innovation, industry leaders should prioritize investments in end-to-end digital integration that bridges instrument data with laboratory information management systems. By establishing standardized protocols for data capture, annotation, and sharing, organizations can accelerate method development cycles and enhance reproducibility. Moreover, aligning analytics platforms with cloud-native architectures will enable secure remote monitoring, collaborative decision-making, and scalable processing capacity to handle ever-growing image datasets.

Simultaneously, diversifying supply chains is essential to mitigate the impact of trade policy fluctuations. Companies should explore partnerships with alternative component manufacturers, expand regional distribution agreements, and adopt just-in-time inventory strategies that balance cost efficiency with supply resilience. Engaging in collaborative procurement networks or consortia may further unlock volume discounts and strengthen negotiating platforms with major suppliers.

Leaders should also expand service models by incorporating predictive maintenance and outcome-based agreements to differentiate offerings in a competitive environment. By leveraging sensor telemetry and usage analytics, service providers can proactively address instrument performance issues, optimize uptime, and build client loyalty through performance guarantees. Finally, fostering cross-industry alliances with environmental agencies, academic consortia, and regulatory bodies will accelerate standardization, open new application pathways, and inform future innovation roadmaps. Such collaborations will ensure that technology enhancements are aligned with real-world requirements and evolving compliance landscapes.

Research Methodology Outlining Data Collection, Analytical Frameworks, and Validation Techniques Underpinning the Flow Imaging Microscopy Market Analysis

The research methodology underpinning this analysis combines rigorous secondary data compilation with targeted primary research to ensure comprehensive and validated insights. Initially, a detailed literature review was conducted across peer-reviewed journals, patent databases, and publicly available regulatory filings to map the technological landscape and identify emerging trends. Concurrently, trade association reports and conference proceedings were examined to capture real-time developments and community consensus on best practices.

To supplement desk research, in-depth interviews were carried out with subject matter experts spanning instrument manufacturers, end-user laboratories, contract research organizations, and independent consultants. These conversations provided qualitative context on adoption barriers, performance benchmarks, and procurement strategies. Responses were systematically coded and triangulated with quantitative data to reveal convergence points and disparities across regions and application sectors.

Data validation was performed through expert panel workshops, where preliminary findings were reviewed and refined based on participant feedback. This iterative process bolstered the robustness of the conclusions and ensured that the analysis reflected practical insights grounded in operational realities. Finally, a multi-layered quality control protocol encompassing peer review, editorial oversight, and consistency checks was applied to guarantee accuracy, coherence, and methodological transparency.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Flow Imaging Microscopy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Flow Imaging Microscopy Market, by Type

- Flow Imaging Microscopy Market, by Technology

- Flow Imaging Microscopy Market, by Sample Type

- Flow Imaging Microscopy Market, by Sample Dispersion

- Flow Imaging Microscopy Market, by Application

- Flow Imaging Microscopy Market, by End-User Industry

- Flow Imaging Microscopy Market, by Region

- Flow Imaging Microscopy Market, by Group

- Flow Imaging Microscopy Market, by Country

- United States Flow Imaging Microscopy Market

- China Flow Imaging Microscopy Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Conclusive Insights Highlighting the Strategic Significance and Future Trajectory of Flow Imaging Microscopy Across Diverse Industries and Research Domains

This comprehensive review of flow imaging microscopy demonstrates how the convergence of optical innovation, digital analytics, and regulatory imperatives is reshaping the landscape of particle characterization. From the advent of high-speed, AI-driven imaging to the adaptation of sampling workflows in response to trade policy changes, the technology has matured into a critical asset across biotechnology, pharmaceuticals, environmental monitoring, and beyond. The segmentation insights underscore the diverse yet interconnected dimensions that define market opportunities, revealing pathways for product differentiation and application-specific value creation.

Regional dynamics further highlight the importance of contextual strategies, whether it be leveraging established distribution networks in the Americas, navigating regulatory harmonization in Europe Middle East & Africa, or capitalizing on rapid R&D investment and localized manufacturing in Asia-Pacific. Competitive analysis illustrates the multifaceted ecosystem of hardware innovators, software developers, service providers, and academic partners, all converging to advance the state of the art.

By adopting the strategic recommendations presented-ranging from digital integration and supply chain diversification to collaborative procurement and outcome-based service models-industry leaders can mitigate risk, accelerate innovation, and maintain a competitive edge. The methodologies applied in this study ensure that the conclusions are rooted in empirical evidence and validated expertise, providing a reliable foundation for decision-making. Looking ahead, flow imaging microscopy is poised to unlock new frontiers in particle analysis, powering breakthroughs in research and quality assurance across global markets.

Connect with Ketan Rohom to Unlock Comprehensive Flow Imaging Microscopy Market Insights and Drive Strategic Decisions with Customized Research Solutions

I invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to gain direct access to an in-depth analysis of the flow imaging microscopy market. Engage in a personalized consultation where your specific analytical objectives and operational challenges will guide a tailored discussion of the research framework, methodologies, and key insights relevant to your organization’s needs. By leveraging this conversation, you can clarify any questions about technology adoption, segmentation strategies, regional dynamics, or competitive positioning.

Purchasing the comprehensive market research report will equip your team with actionable intelligence to make informed decisions, mitigate supply chain risks, and identify high-value opportunities across imaging modalities, sample types, end-user industries, and geographical markets. Reach out to Ketan Rohom to explore volume licensing options, corporate subscription plans, and bespoke analysis packages designed to support strategic planning and drive innovation in your analytical workflows. Your next breakthrough in particle characterization and quality control begins with this critical resource-secure your copy today and stay at the forefront of flow imaging microscopy advancements

- How big is the Flow Imaging Microscopy Market?

- What is the Flow Imaging Microscopy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?