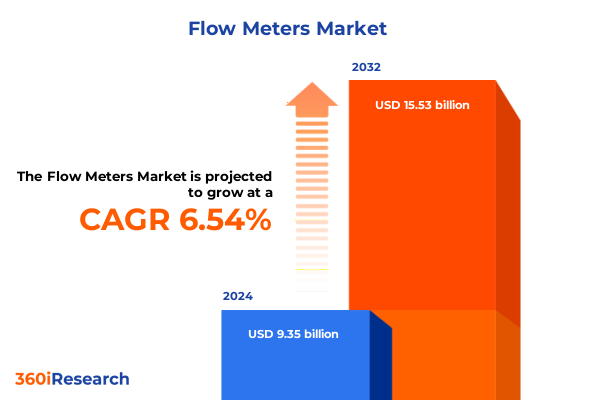

The Flow Meters Market size was estimated at USD 9.92 billion in 2025 and expected to reach USD 10.54 billion in 2026, at a CAGR of 6.60% to reach USD 15.53 billion by 2032.

Setting the Stage for Precision and Digital Transformation in Flow Measurement Through Emerging Technologies and Operational Imperatives

The landscape of flow measurement is undergoing a profound transformation driven by the converging forces of digitalization, sustainability imperatives, and evolving operational requirements. As organizations worldwide demand greater precision, reliability, and real-time visibility into fluid processes, the adoption of intelligent flow meter solutions has surged. This trend reflects a broader shift toward data-centric operations, where instrumentation not only measures but also communicates, analyzes, and predicts performance anomalies. The growing integration of Industrial Internet of Things (IIoT) platforms has enabled seamless connectivity between field devices and enterprise systems, facilitating advanced analytics and predictive maintenance strategies that reduce unplanned downtime and optimize asset utilization.

Moreover, regulatory mandates aimed at improving energy efficiency and reducing environmental impacts have heightened the focus on flow meters as critical enablers of resource conservation. In industries ranging from water and wastewater management to oil and gas, accurate flow measurement underpins efforts to minimize waste and ensure compliance with stringent emission and discharge standards. Transitioning from traditional mechanical meters to smart ultrasonic, Coriolis, and magnetic technologies, organizations are embracing solutions that deliver superior accuracy across diverse fluid types and challenging process conditions. As we embark on an era defined by digital innovation and operational resilience, understanding the drivers and dynamics of this shift is essential for stakeholders seeking to harness these opportunities and mitigate emerging risks.

Navigating the Pivotal Shifts Shaping the Future of Flow Meter Solutions in an Industry Embracing Digitalization and Sustainability Imperatives

In recent years, the flow meter industry has witnessed a series of pivotal shifts that are redefining market expectations and competitive dynamics. The rise of wireless connectivity protocols such as Bluetooth Low Energy, LoRaWAN, NB-IoT, and WirelessHART has liberated flow meter deployment from traditional wiring constraints, enabling rapid installation and flexible network architectures that support distributed monitoring across expansive facilities and remote sites. Concurrently, the integration of artificial intelligence and machine learning within flow measurement platforms has advanced predictive maintenance capabilities, allowing operators to detect anomalies and forecast maintenance needs based on real-time data patterns, thereby extending equipment lifespan and minimizing downtime.

Alongside these technological innovations, stringent environmental regulations and corporate sustainability goals are compelling industries to optimize water and energy usage, catalyzing the adoption of high-accuracy ultrasonic and Coriolis meters in municipal utilities and process industries alike. Smart metering systems that offer self-diagnostics, adaptive algorithms, and autonomous calibration are becoming standard expectations, driving differentiation among vendors and reshaping procurement criteria. Meanwhile, the convergence of digital twin technology and cloud-based analytics is providing stakeholders with unprecedented visibility into fluid processes, enabling scenario modeling, anomaly detection, and continuous performance optimization across entire asset portfolios.

Unpacking the Cumulative Effects of United States Tariff Actions on Flow Meter Supply Chains and Market Dynamics in 2025

The cumulative impact of United States tariff actions in 2025 has reverberated through the flow meter supply chain, altering cost structures, sourcing strategies, and market competitiveness. In June 2025, the U.S. Trade Representative announced an additional 20% levy on Chinese imports under Section 301, supplementing existing duties that range from 7.5% to 100% on various product categories. Although flow meters were not explicitly singled out in the tariff lists, many of the electronic components, semiconductor chips, and specialized materials essential for advanced flow measurement devices fall within the broader scope of these duties. Consequently, manufacturers have confronted upward pressure on input costs, prompting strategic responses to maintain margin integrity and price competitiveness.

To mitigate tariff-related disruptions, leading suppliers have accelerated efforts to diversify sourcing, shifting production of critical components to alternative regions in Southeast Asia, Eastern Europe, and North America. Some are collaborating with domestic OEMs to localize assembly lines, while others have renegotiated supplier contracts and frontloaded inventory to insulate against further duty escalations. These adjustments, while effective in preserving supply continuity, have introduced complexities in supply chain management, necessitating enhanced logistics planning and dynamic inventory optimization tools. Additionally, the prospect of future tariff reviews continues to underscore the importance of supply chain resilience and agility as foundational elements of strategic risk management.

Delving into Product, Fluid, Installation, Communication, Signal, Application and Channel Segmentation to Reveal Actionable Market Dynamics

Analyzing the market through multiple segmentation lenses reveals nuanced insights that can guide product development, go-to-market strategies, and customer engagement. Within the product dimension, Coriolis meters are gaining traction for their high accuracy and suitability for multi-parameter measurement, especially in the oil and gas, chemical, and pharmaceutical sectors, whereas differential pressure units remain prevalent in HVAC systems due to their cost-effectiveness. Magnetic flow meters continue to dominate water and wastewater applications with their robustness and low maintenance requirements, while positive displacement and turbine meters retain niches in custody transfer and mechanical applications. Ultrasonic and vortex technologies are also expanding within utility and industrial automation, offering non-intrusive installation and low-pressure drop benefits.

Fluid type segmentation highlights distinct growth drivers: gas measurement demands high sensitivity and temperature compensation, liquid flows emphasize chemical compatibility and hygienic design in food and beverage, and steam applications require high-temperature resilience and accurate density compensation. Installation considerations-such as clamp-on solutions for retrofit scenarios, inline units for new installations, and insertion probes for larger pipe diameters-shape value propositions based on ease of deployment and process interruption minimization. Communication protocols are bifurcated into wired interfaces, which integrate seamlessly with existing control systems, and wireless networks that cater to remote monitoring and IIoT architectures. Signal types, whether analog or digital, influence integration complexity and data fidelity, which in turn affect maintenance cycles and calibration requirements.

On the application front, aerospace and defense, metals and mining, and semiconductors prioritize ultra-high accuracy under demanding environmental conditions, while HVAC, marine, and water management focus on scalability and cost efficiency. Within power generation, segmenting into hydro, nuclear, renewable, and thermal sheds light on unique regulatory environments and safety requirements. Distribution channels span traditional offline networks that service legacy installations and rapidly growing online channels that enhance accessibility for emerging players and smaller end-users. By synthesizing these segmentation insights, stakeholders can identify white spaces, optimize product portfolios, and tailor messaging to resonate with target segments.

This comprehensive research report categorizes the Flow Meters market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Fluid Type

- Installation

- Communication

- Signal Type

- Application

- Distribution Channel

Exploring Regional Trends and Opportunities Across the Americas, EMEA and Asia-Pacific for Flow Meter Solutions and Services

Regional dynamics exert a profound influence on market evolution, shaped by local regulatory frameworks, industrial priorities, and infrastructure investments. In the Americas, momentum is driven by upstream oil and gas operations in the United States and Canada, along with the modernization of water infrastructure and the expansion of renewable energy projects in Brazil and Mexico. Utility providers in North America are integrating smart metering technology to meet clean water mandates, while Latin American governments are prioritizing efficiency gains to mitigate water scarcity and pipeline losses. Across Europe, Middle East and Africa, stringent environmental directives, such as the EU’s Water Framework Directive and the Middle East’s growing desalination capacity, are driving demand for advanced flow measurement solutions that ensure compliance and operational reliability. The region’s established industrial base, encompassing chemicals, pharmaceuticals, and power generation, underpins steady investments in instrumentation upgrades and digital transformation initiatives.

In Asia-Pacific, rapid industrialization coupled with ambitious smart city and Industrial 4.0 programs in China, India, and Southeast Asian economies is fueling adoption of connected flow meters across manufacturing, energy, and water management sectors. Chinese manufacturers, despite facing tariff headwinds, continue to expand production capabilities and innovate around positive displacement and electromagnetic technologies. Japan and South Korea are leading in high-precision solutions for semiconductor and petrochemical applications, while Australia invests heavily in mining and resource processing, driving consumption of rugged, high-accuracy meters. Overall, regional trends underscore the need for differentiated channel strategies, local support models, and strategic partnerships to navigate regulatory complexities and address diverse end-user requirements.

This comprehensive research report examines key regions that drive the evolution of the Flow Meters market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Flow Meter Manufacturers and Their Strategies for Innovation, Digitalization and Competitive Differentiation

The competitive landscape is anchored by established industrial technology leaders who leverage deep domain expertise, expansive product portfolios, and global service networks to drive market leadership. Emerson has positioned its Plantweb digital ecosystem, combining edge devices, analytics software, and model-based diagnostics to deliver comprehensive IIoT-enabled process optimization, earning recognition for its pervasive sensing and IIoT innovations. Siemens has emphasized industrial AI and digital twin capabilities, integrating its Insights Hub platform and SIWA Leak Finder and Blockage Predictor applications to empower utilities with AI-driven leak detection and network optimization across water and wastewater networks.

ABB, a leader in electromagnetic flow measurement, has introduced its AquaMaster4 Mobile Comms solution, offering 4G LTE and NB-IoT connectivity for real-time water loss management, along with modular ProcessMaster and AquaMaster lines designed for IoT environments to reduce total cost of ownership and facilitate predictive maintenance. Endress+Hauser’s Proline Prosonic Flow P 500 clamp-on ultrasonic meter has won industry accolades for its high-temperature, non-intrusive measurement capabilities and integrated diagnostic functions, enhancing versatility in aggressive process conditions. Yokogawa’s expanded AXG magnetic flowmeter deployment in India underscores its commitment to local manufacturing and service excellence, while Honeywell’s NXU Residential Smart Gas Meter and Q.Sonicmax ultrasonic devices demonstrate its leadership in smart gas and custody transfer applications. Collectively, these key players are differentiating through digital innovation, strategic partnerships, and targeted regional investments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Flow Meters market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Azbil Corporation

- Badger Meter, Inc.

- Baker Hughes Company

- BR Instrumentation & Controls

- Bronkhorst High-Tech B.V.

- Brooks Instrument, LLC

- Emerson Electric Co.

- Endress+Hauser AG

- Fuji Electric Co., Ltd.

- General Electric Company

- Hitachi, Ltd.

- Honeywell International Inc.

- Katronic Technologies Ltd.

- KEM Küppers Elektromechanik GmbH

- KROHNE Messtechnik GmbH

- Manas Microsystems Private Limited

- Max Machinery, Inc.

- Omega Engineering, Inc.

- ONICON Incorporated

- Parker Hannifin Corporation

- Peltek India

- PSG by Dover Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- Sick AG

- Siemens AG

- SmartMeasurement

- Yokogawa Electric Corporation

Guiding Industry Leaders to Capitalize on Digital Innovation, Supply Chain Resilience and Sustainability in Flow Meter Markets

To thrive in the rapidly evolving flow meter market, industry leaders should prioritize a portfolio of actionable strategies. First, investing in IIoT-enabled, wireless communication capabilities will position offerings to meet the growing demand for remote monitoring and real-time data analytics. By expanding support for protocols such as LoRaWAN, NB-IoT, and WirelessHART, companies can enhance asset visibility and enable predictive maintenance use cases. Second, diversifying supply chains through strategic partnerships and regional manufacturing footprints will reduce exposure to tariff risks and ensure continuity of critical component supply. Establishing local assembly hubs and collaborating with trusted suppliers in Southeast Asia, Europe, and North America can mitigate duty impacts and improve responsiveness to market fluctuations.

Third, advancing digital services and software-as-a-service (SaaS) platforms that integrate seamlessly with existing enterprise systems will drive recurring revenue streams and deepen customer engagement. Offering predictive analytics, digital twin simulations, and condition-based maintenance subscriptions can differentiate value propositions and lock in long-term contracts. Fourth, aligning product development with sustainability objectives-such as low-power operation, remote calibration, and leak detection-will resonate with end-users facing regulatory pressures and corporate ESG mandates. Finally, cultivating specialized application expertise in key verticals, including water and wastewater, power generation, and life sciences, will enable tailored solutions that address the unique measurement challenges of each sector. By implementing these recommendations, organizations can strengthen market positioning, drive customer loyalty, and capitalize on emerging growth opportunities.

Elucidating the Research Framework and Methodological Rigor Underpinning the Comprehensive Flow Meter Market Analysis

The research underpinning this comprehensive market analysis employed a rigorous, multi-faceted methodology to ensure accuracy, objectivity, and actionable insights. Primary research was conducted through structured interviews with senior executives, product managers, and technical experts across leading manufacturers, distributors, and end-user organizations. These dialogues provided firsthand perspectives on technology adoption trends, procurement criteria, and emerging challenges. Secondary research involved the review of corporate filings, white papers, patent databases, and industry publications to validate market developments and technological innovations. To bolster the depth of analysis, proprietary databases were leveraged to track shipment volumes, installed base analytics, and revenue performance across product segments and regions.

Quantitative modeling was undertaken to map the complex interplay of segmentation factors-product type, fluid, installation, communication, signal, application, and distribution channel-while scenario analysis assessed the impact of external factors such as tariff changes, regulatory shifts, and macroeconomic indicators. Expert validation sessions were convened with external advisors, including consultants and academic researchers, to test assumptions and refine projections. Throughout the research process, quality control measures, such as data triangulation, peer review, and consistency checks, were applied to uphold methodological rigor and credibility. This structured approach ensured that the findings delivered are robust, comprehensive, and directly applicable to strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Flow Meters market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Flow Meters Market, by Product

- Flow Meters Market, by Fluid Type

- Flow Meters Market, by Installation

- Flow Meters Market, by Communication

- Flow Meters Market, by Signal Type

- Flow Meters Market, by Application

- Flow Meters Market, by Distribution Channel

- Flow Meters Market, by Region

- Flow Meters Market, by Group

- Flow Meters Market, by Country

- United States Flow Meters Market

- China Flow Meters Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Synthesizing Critical Insights to Chart a Forward-Looking Course for Flow Meter Technologies and Stakeholder Decision-Making

In summary, the flow meter market stands at the cusp of a transformational phase shaped by digital innovation, regulatory imperatives, and supply chain realignments. The integration of IIoT technologies and AI-driven analytics is enhancing the functionality of measurement solutions, enabling proactive maintenance, process optimization, and data-driven decision-making. Meanwhile, U.S. tariff adjustments have underscored the importance of flexible sourcing strategies and regional manufacturing capabilities to mitigate cost pressures and maintain market access. Segmentation analysis highlights diverse value propositions across product types, fluid categories, installation methods, communication protocols, signal interfaces, application areas, and distribution channels, providing a roadmap for targeted product and market strategies.

Regionally, the Americas, EMEA, and Asia-Pacific each present unique growth drivers, from water infrastructure modernization and renewable energy expansion to smart city initiatives and industrial digitalization programs. The competitive landscape is dominated by major technology providers-Emerson, Siemens, ABB, Endress+Hauser, Yokogawa, and Honeywell-each differentiating through digital ecosystems, advanced sensing capabilities, and strategic partnerships. By adopting the recommended strategic imperatives, industry leaders can fortify their market positions, drive sustainable growth, and anticipate evolving customer needs. As the market continues to evolve, stakeholders who balance technological innovation, operational resilience, and sustainability will be best positioned to lead the next wave of transformation in fluid measurement.

Empowering Decision-Makers to Secure In-Depth Insights and Drive Competitive Advantage with Expert Market Research Support

To unlock the full breadth of market intelligence, tailored competitive strategies, and in-depth technical analyses on flow meter technologies, connect with Ketan Rohom, Associate Director, Sales & Marketing, for personalized guidance and a complimentary discussion on how the full market research report can address your specific business challenges and growth objectives. Engage directly with Ketan to explore custom research options, gain a sneak peek at report highlights, and establish a roadmap for leveraging these insights to outpace competitors. Act now to secure your competitive edge by initiating a conversation that will transform your decision-making with robust data and strategic foresight, ensuring your organization remains at the forefront of innovation and operational excellence in fluid measurement solutions.

- How big is the Flow Meters Market?

- What is the Flow Meters Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?