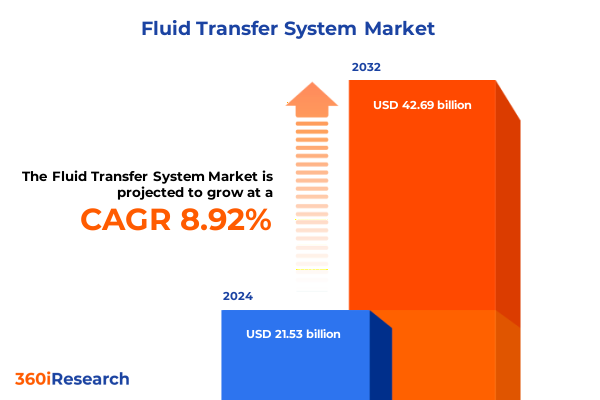

The Fluid Transfer System Market size was estimated at USD 23.44 billion in 2025 and expected to reach USD 25.53 billion in 2026, at a CAGR of 8.93% to reach USD 42.69 billion by 2032.

Understanding the Critical Role of Fluid Transfer Systems in Modern Industrial Operations Amid Accelerating Digitalization, Sustainability, and Market Demands

Fluid transfer systems serve as the backbone of countless industrial processes, facilitating the controlled movement of liquids and gases across sectors including oil and gas, chemical processing, pharmaceuticals, and wastewater management. In agriculture, precision irrigation and autonomous fluid delivery solutions are gaining traction, underscoring the sector’s growing reliance on resilient and intelligent pumping, tubing, and valve technologies. These systems not only enable operational continuity but also bolster safety and regulatory compliance, making them indispensable assets for modern enterprises seeking to optimize performance while adhering to stringent environmental standards.

Simultaneously, the convergence of automation and digitalization is redefining expectations for fluid handling equipment. Sensors embedded within hoses and fittings provide real-time condition monitoring, enabling predictive maintenance and minimizing unplanned downtime. Edge computing and 5G connectivity are unlocking new levels of responsiveness, allowing operators to oversee distributed networks from remote control centers or mobile devices. Adoption of these technologies is accelerating, driven by a desire to reduce lifecycle costs and increase asset utilization across complex, globally dispersed operations.

Moreover, escalating ESG mandates and a heightened focus on sustainability are influencing material choices and design philosophy. Biocompatible tubing materials in pharmaceutical manufacturing, corrosion-resistant alloys in petrochemical environments, and recyclable components aligned with circular economy principles are becoming strategic differentiators. Companies that integrate sustainable practices from product development through end-of-life refurbishment not only mitigate regulatory risk but also enhance brand reputation and long-term asset value.

Exploring Technological Innovations and Environmental Imperatives Reshaping the Fluid Transfer Landscape for Operational Excellence

Technological innovation is catalyzing a new era for fluid transfer solutions. Smart pumps equipped with embedded sensors now capture flow characteristics, pressure fluctuations, and temperature variations, feeding data into machine learning algorithms that forecast maintenance needs and optimize performance parameters. Concurrently, additive manufacturing techniques are enabling complex geometries in fittings and valves, reducing turbulence, lowering energy consumption, and allowing for rapid prototyping of customized components. This digital-physical synergy is fostering a continuous improvement cycle, whereby field data drives iterative enhancements in design and service offerings.

The integration of cloud platforms with edge analytics is further enhancing system resilience and scalability. Operators can aggregate performance metrics from multiple sites into unified dashboards, enabling real-time diagnostics and streamlined decision-making. This capability is particularly valuable in distributed industries such as water treatment and pharmaceuticals, where compliance and uptime are paramount. As these connected frameworks mature, they lay the groundwork for autonomous fluid networks capable of self-optimizing based on predictive insights.

Environmental imperatives and stringent emissions regulations are redefining product lifecycles across the value chain. Low-leakage valves, recyclable polymer hoses, and biocompatible tubing materials exemplify how manufacturers are aligning product portfolios with circular economy goals. Service models that emphasize refurbishment, remanufacturing, and component recycling are gaining momentum, extending asset longevity while minimizing resource extraction. These sustainability-driven shifts are not only reducing operational footprints but also unlocking cost efficiencies over the long term.

Evaluating the Cumulative Impact of 2025 United States Tariff Policies on Fluid Transfer Equipment Supply Chains and Cost Structures

In early 2025, the United States implemented a baseline 10% import tariff on all incoming goods, followed by an additional 34% duty on products originating from countries with significant trade imbalances, including China. These measures, combined with the elimination of duty-free treatment for low-value parcels under $800, have substantially raised the cost of hydraulic fittings, hoses, and related fluid transfer components. Companies relying on global supply chains have encountered steep increases in procurement costs, compelling many to reevaluate sourcing strategies in response to heightened tariff pressures.

To mitigate the cumulative effect of overlapping tariff authorities, a Presidential Executive Order issued in April 2025 established protocols to prevent stacking multiple duties on the same article. By designating the most relevant tariff under overlapping statutory provisions, this directive has provided targeted relief for select imported components, though its scope remains limited. Stakeholders continue to monitor its implementation closely for potential adjustments in classification and duty application.

Survey data from industry associations reveal that approximately three-quarters of fluid power manufacturers anticipate negative impacts on business conditions, citing increased production costs and price volatility. Many companies have opted to pass a portion of these additional duties to end customers, while others absorb the cost in exchange for maintaining market competitiveness. The resulting fluctuation in pricing has complicated long-term contract negotiations and inventory planning, introducing uncertainty into capital expenditure forecasts.

In response, firms have pursued strategies such as front-loading inventory ahead of tariff deadlines and diversifying supply bases to include regional and domestic producers. While these approaches offer temporary respite, capacity constraints and qualification timelines for alternative suppliers limit the pace of transition. As a result, industry participants are focusing on process optimization and lean inventory management to cushion the financial impact and preserve operational continuity.

Unveiling Key Product Type, End User Industry, Material, and Flow Rate Segments Driving Differentiated Opportunities in Fluid Transfer Systems

Insights based on product type reveal that fittings, hoses, pumps, tubing, and valves each play a distinct role in fluid transfer architectures, yet pumps are commanding particular attention due to their complex performance requirements and customization potential. Within pump technologies, centrifugal pumps remain prevalent for high-volume applications, but positive displacement variants are increasingly favored for precision dosing and controlled flow. Among positive displacement pumps, diaphragm models deliver chemical compatibility for aggressive fluids, gear pumps excel in viscosity management, and peristaltic designs ensure sanitary handling in pharmaceutical and food-grade processes. This granular segmentation underscores the need for tailored solution sets aligned with application-specific demands.

When viewed through the lens of end-user industries, the chemical and petrochemical sector continues to drive demand for robust, corrosion-resistant components, subdivided between petrochemical and specialty chemical processes that impose divergent material and sealing requirements. The food and beverage industry, with its exacting hygiene standards, relies on sanitary fittings and biocompatible tubing, while oil and gas operations prioritize high-pressure performance and fugitive emissions reduction. Pharmaceutical applications bifurcate into biotechnology and generic manufacturing, each imposing unique sterility and validation protocols, and water and wastewater management distinguishes between municipal systems requiring large-scale distribution networks and industrial facilities focused on treatment process control.

Material segmentation highlights the strategic trade-offs between plastic, PTFE, rubber, and stainless steel constructions. Within plastics, polyethylene offers cost-effective chemical resistance, while polypropylene extends performance at elevated temperatures. Rubber hoses leverage both natural and synthetic compounds to balance flexibility and chemical compatibility, and stainless steel tubing and fittings deliver unparalleled mechanical strength and longevity in harsh environments. These material choices not only influence component durability but also affect lifecycle emissions and recyclability.

Flow rate segmentation-categorized into high, medium, and low flow tiers-dictates system architecture, driver selection, and control strategies. High-flow systems emphasize energy efficiency and pressure modulation, medium-flow solutions balance throughput with precision, and low-flow configurations prioritize accuracy for dosing or analytical sampling. By understanding the interplay of these segments, stakeholders can pinpoint opportunities for product innovation and market differentiation.

This comprehensive research report categorizes the Fluid Transfer System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Flow Rate

- End User Industry

Analyzing Regional Dynamics Across Americas, EMEA, and Asia-Pacific Highlighting Opportunities and Challenges in Fluid Transfer Markets

The Americas region remains a focal point for fluid transfer innovation, with established oil and gas hubs in the Gulf Coast and growing water infrastructure projects in the western United States. Tariff adjustments and supply chain realignments have spurred domestic manufacturing expansions and supplier partnerships, while end-user investments in digital pumping stations and remote monitoring systems are on the rise. Regulatory emphasis on water conservation and emissions reduction is further encouraging the deployment of leak-resistant valves and sustainable tubing materials across both industrial and municipal applications.

In Europe, Middle East & Africa (EMEA), fluid transfer adoption is propelled by stringent environmental standards and circular economy initiatives. The European Union’s focus on decarbonization has accelerated demand for energy-efficient pumps and IoT-enabled condition monitoring, with Siemens and Festo collaborating to offer cross-vendor industrial edge solutions that integrate real-time analytics on the shop floor. In the Middle East, petrochemical expansions are driving high-performance alloy fittings and valves, while South African water resilience projects emphasize scalable control systems and local fabrication partnerships.

Asia-Pacific is experiencing robust growth fueled by rapid industrialization, urban water stress, and agri-tech innovations. Precision agriculture platforms in Australia are adopting autonomous irrigation modules with built-in edge sensors to optimize water usage, and China’s pharmaceutical manufacturing sector is intensifying its focus on sanitary fluid transfer components to support biopharma production. Southeast Asian markets are increasingly prioritizing compact, modular pump-and-valve packages for small-and-medium enterprise applications, while regional OEMs collaborate with global suppliers to localize material sourcing and assembly.

This comprehensive research report examines key regions that drive the evolution of the Fluid Transfer System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players Leveraging Strategic Acquisitions, Digitalization, and Sustainable Solutions to Shape the Fluid Transfer Industry

Leading companies are differentiating through strategic acquisitions, digital innovation, and sustainability commitments. Parker Hannifin’s $1 billion acquisition of Curtis Instruments expands its electrification portfolio, enhancing motion control and hydraulic system integration, and positioning the company to address growing demand for electric and hybrid solutions in material handling and off-highway equipment.

Siemens and Festo’s partnership within the Industrial Edge ecosystem exemplifies cross-vendor collaboration, enabling customers to deploy AI-driven applications for pump control and valve diagnostics on a unified platform. This open-architecture approach accelerates time-to-value for smart fluid transfer solutions and fosters a vibrant marketplace for third-party developers.

Swagelok continues to support oil, gas, and chemical operators with low-leakage fittings and fugitive emissions reduction services, emphasizing ESG compliance through end-to-end engineering validation and flare recovery solutions. Their consultative model underscores the importance of supplier partnerships in navigating complex regulatory landscapes.

Eaton’s LifeSense intelligent hose monitoring system leverages IoT-enabled sensors to detect impending failures in hydraulic hoses, providing predictive maintenance alerts that prevent costly downtime. By integrating variable-speed drives and cloud-based analytics, Eaton also offers holistic energy-optimization packages for electro-hydraulic power units, reducing energy consumption by up to 70% in select applications.

Danfoss Power Solutions is driving digital displacement pump technology that delivers up to 15% fuel savings and enhanced control via electronic actuation. Their focus on electrification and regenerative hydraulic valves highlights the convergence of fluid power and energy recovery capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fluid Transfer System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfa Laval AB

- Danfoss A/S

- Eaton Corporation

- Eaton Corporation plc

- Flowserve Corporation

- Grundfos Holding A/S

- IDEX Corporation

- Parker-Hannifin Corporation

- SPX Flow, Inc.

- Sulzer Ltd

- Xylem Inc.

Actionable Strategies for Industry Leaders to Enhance Resilience, Drive Innovation, and Capitalize on Emerging Fluid Transfer Trends

Industry leaders should prioritize the integration of digital condition monitoring across critical fluid transfer assets to transition from reactive repairs to predictive maintenance. Investing in edge analytics platforms and machine learning models enables early detection of performance anomalies and reduces unplanned downtime, ultimately lowering total cost of ownership and enhancing reliability across applications. Partnerships with IIoT service providers can accelerate deployment and unlock incremental data-driven value.

Supply chain resilience demands diversification of sourcing networks beyond traditional low-cost geographies. Organizations should identify and qualify regional and domestic suppliers while maintaining strategic safety stocks to buffer against tariff fluctuations and transport disruptions. Collaborative forecasting and vendor-managed inventory arrangements can further stabilize material availability and support just-in-time operations.

Sustainability objectives must be embedded within product roadmaps, with a focus on recyclable materials, circular service models, and energy-efficient equipment design. Manufacturers should collaborate with end users to quantify lifecycle emissions, validate ESG performance through independent certifications, and communicate environmental benefits as a competitive differentiator. Circular remanufacturing or refurbishment programs can extend asset lifecycles while minimizing waste.

Finally, leaders should cultivate cross-functional teams combining engineering, procurement, and sustainability expertise to accelerate innovation. Customer co-creation workshops and pilot programs can validate new fluid transfer configurations under real-world conditions, ensuring rapid feedback loops and market-ready solutions. Clear governance structures and investment roadmaps will sustain momentum and align organizational priorities with emerging fluid transfer trends.

Detailing the Comprehensive Methodology Underpinning the Fluid Transfer Market Analysis for Robust Insights and Data Integrity

This analysis is grounded in a structured research methodology combining comprehensive secondary sources and expert primary engagements. Secondary research involved systematic review of industry publications, regulatory filings, company financial disclosures, and scholarly articles to capture technological advances, tariff developments, and competitive activities.

Primary research included in-depth interviews with fluid transfer system manufacturers, end users across key industries, and technology providers to validate market dynamics and uncover emerging challenges. Insights from conference proceedings and trade association webinars supplemented these dialogues, ensuring alignment with real-world operational experiences.

Data triangulation was employed to reconcile divergent perspectives, while qualitative insights were cross-referenced against objective metrics. The segmentation framework-encompassing product type, end user industry, material, and flow rate-provided a consistent lens for comparative analysis. Regional assessments reflected local regulatory regimes and supply chain considerations.

Company profiles were developed through direct analysis of corporate announcements, M&A transactions, and product launches, with a focus on strategic imperatives influencing portfolio evolution. This rigorous process ensures that the findings presented are both robust and actionable, supporting well-informed decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fluid Transfer System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fluid Transfer System Market, by Product Type

- Fluid Transfer System Market, by Material

- Fluid Transfer System Market, by Flow Rate

- Fluid Transfer System Market, by End User Industry

- Fluid Transfer System Market, by Region

- Fluid Transfer System Market, by Group

- Fluid Transfer System Market, by Country

- United States Fluid Transfer System Market

- China Fluid Transfer System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Synthesizing Critical Insights on Technology Trends, Tariff Impacts, and Strategic Segments to Guide Fluid Transfer System Decision-Making

The fluid transfer landscape is undergoing profound transformation driven by digitalization, sustainability imperatives, and evolving trade policies. Technological advancements are equipping pumps, valves, and hoses with data intelligence that enhances operational visibility, while circular economy principles are reshaping material and service strategies. Concurrently, the introduction of targeted tariff measures has prompted supply chain realignments and cost optimization initiatives.

Segmentation insights underscore the importance of precision engineering across product types, end-user industries, materials, and flow rates, highlighting tailored opportunities for innovation and differentiation. Regional trends in the Americas, EMEA, and Asia-Pacific reveal diverse market drivers ranging from regulatory compliance to agri-tech automation, necessitating localized approaches to market entry and growth.

Leading companies are responding with strategic acquisitions, cross-vendor digital platforms, and sustainable solution portfolios that address both performance and environmental objectives. Actionable recommendations emphasize the integration of predictive analytics, supply chain diversification, and sustainability commitments as cornerstones for long-term resilience.

By synthesizing these critical insights, decision-makers are equipped to navigate the complexities of the modern fluid transfer market, align investments with emerging trends, and drive operational excellence in an increasingly dynamic environment.

Connect with Ketan Rohom to Drive Strategic Growth with a Tailored Fluid Transfer System Market Research Report

Are you ready to elevate your strategic initiatives with unparalleled market insights? Reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, and secure access to the comprehensive Fluid Transfer System Market Research Report. With his expertise and support, you can gain customized analysis, in-depth data, and actionable guidance tailored to your organization’s unique needs. Connect with Ketan today and take the first step toward informed decision-making and accelerated growth.

- How big is the Fluid Transfer System Market?

- What is the Fluid Transfer System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?