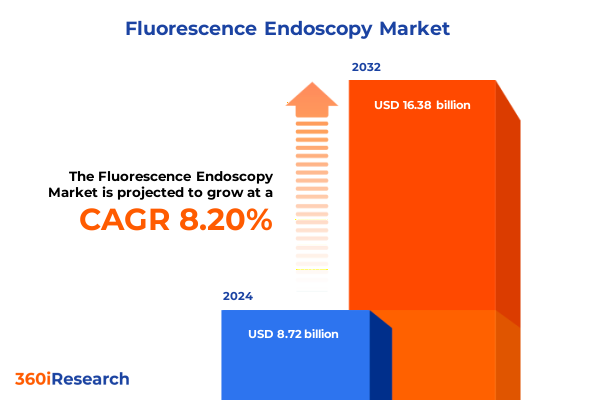

The Fluorescence Endoscopy Market size was estimated at USD 9.45 billion in 2025 and expected to reach USD 10.12 billion in 2026, at a CAGR of 8.17% to reach USD 16.38 billion by 2032.

Unveiling the Power of Fluorescence Endoscopy as a Cutting Edge Technique for Enhanced Real-Time Visualization of Lesions

Fluorescence endoscopy represents a paradigm shift in endoscopic diagnostics by augmenting traditional white light visualization with molecular-specific imaging capabilities. This technique introduces exogenous fluorescent probes that bind selectively to targeted biomarkers or anatomical structures, thereby illuminating lesions that might evade detection under conventional imaging. Unlike standard endoscopes, fluorescence systems incorporate near-infrared or visible-light filters and specialized cameras to capture emitted fluorescence in real time. As a result, clinicians can differentiate between healthy and diseased tissue based on signal intensity, enabling more accurate margin delineation and targeted biopsy guidance.

Over the past decade, the clinical value of fluorescence molecular endoscopy has transitioned from preclinical proof-of-concept studies into early human trials, demonstrating its potential for enhanced detection of subtle and flat lesions in high-risk populations. Fluorescence molecular endoscopy has been particularly promising in identifying dysplastic areas in Barrett’s esophagus and in stratifying patients for targeted therapies, moving endoscopy beyond morphology-based assessments toward a more precise, biomarker-driven approach. As the technology matures, hybrid platforms combining fluorescence imaging with artificial intelligence are emerging, poised to further reduce miss rates and support real-time clinical decision-making.

Revolutionary Innovations and Emerging Technologies Redefining the Fluorescence Endoscopy Landscape in Clinical Practice

Recent years have witnessed groundbreaking advancements that are redefining the fluorescence endoscopy landscape. Imaging platforms now leverage extended depth-of-field optics and multimodal overlays to deliver sharper and more information-rich visualizations. For instance, the integration of Extended Depth of Field (EDOF) technology into next-generation endoscopes allows continuous sharp focus across variable working distances, minimizing the need for manual adjustments and improving detection rates of subtle lesions. At the same time, multispectral camera systems compatible with multiple fluorophores enable simultaneous visualization of several molecular targets, expanding clinical applications beyond perfusion assessment to include targeted tumor margin identification and lymphatic mapping.

Assessing the Comprehensive Effects of Recent United States Tariff Policies on Fluorescence Endoscopy Supply Chains and Adoption

The United States’ reintroduction and expansion of import tariffs in early 2025 have exerted significant pressure on the fluorescence endoscopy supply chain. Section 301 tariffs reinstated a 25 percent duty on Class I and II medical devices sourced from China, affecting key components such as optical sensors and laser diodes critical to imaging systems. Parallel levies on imports from Mexico and Canada initially set at 25 percent and 10 percent respectively were delayed, yet manufacturers remain wary of sudden policy shifts that could disrupt equipment availability. These measures have collectively accelerated supply chain diversification, with OEMs establishing secondary manufacturing hubs in Southeast Asia and Europe to mitigate potential cost spikes and inventory shortages.

Illuminating Critical Segmentation Dimensions That Shape the Fluorescence Endoscopy Market Dynamics and Growth Trajectories

Analyzing the market through a product-type lens reveals that consumables-comprising bioprobes and fluorescent dyes-serve as the cornerstone for clinical procedure customization, with clinicians relying on specific probe chemistries to target biomarkers associated with various disease states. Equipment offerings range from advanced capsule endoscopy systems designed for autonomous intraluminal fluorescence screening, to ergonomic flexible endoscopes equipped with integrated near-infrared imaging modules, and to portable handheld devices ideal for point-of-care applications and rapid intraoperative assessments. Complementing these hardware innovations, software and services encompass sophisticated imaging platforms that process multispectral data, routine maintenance programs ensuring system uptime, and specialized training services that accelerate procedural proficiency among endoscopists.

In terms of clinical applications, the gastrointestinal endoscopy segment dominates investigation into colorectal and upper GI pathologies, with colonoscopy, enteroscopy, and esophagoscopy procedures enhanced by fluorophore-conjugated probes for polyp and dysplasia detection. Gynecological endoscopy leverages hysteroscopic fluorescence imaging to delineate endometrial malignancies, while pulmonary bronchoscopy applies targeted dyes to identify early lung lesions. Meanwhile, urological cystoscopy utilizes fluorescent markers to map bladder tumor boundaries, optimizing resection strategies.

Adoption among end-user categories highlights the crucial roles of ambulatory surgical centers and specialized clinics that offer minimally invasive diagnostic workflows, alongside secondary and tertiary care hospitals equipped to support complex fluorescence-guided interventions. This diversified segmentation framework underscores how each market dimension-from consumable chemistry and procedural focus to service support-interacts to shape the broader fluorescence endoscopy ecosystem.

This comprehensive research report categorizes the Fluorescence Endoscopy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End User

Revealing How Regional Market Drivers and Challenges in the Americas, EMEA, and Asia-Pacific Influence Fluorescence Endoscopy Adoption

The Americas continue to lead in fluorescence endoscopy adoption, driven by robust reimbursement pathways and a culture of early technology uptake within advanced healthcare facilities. The United States, in particular, benefits from strong academic-industry collaborations that accelerate translational research and facilitate rapid FDA clearances for novel imaging systems. Across Latin America, growing investments in private and public health infrastructure are gradually broadening access to fluorescence-guided procedures, albeit tempered by budget constraints and variable regulatory environments.

In Europe, the Middle East, and Africa region, regulatory harmonization through programs such as the EU Medical Device Regulation has streamlined cross-border product approvals, supporting a competitive landscape where major imaging vendors vie for clinical partnerships. Funding mechanisms under the Horizon Europe framework further promote multicenter trials, fostering evidence generation that underpins clinical guidelines. At the same time, diverse economic conditions across EMEA manifest in a heterogeneous adoption pace, with leading Western European centers integrating cutting-edge fluorescence platforms, while select Middle Eastern markets invest heavily in bespoke endoscopy suites.

The Asia-Pacific arena exhibits dynamic growth as nations prioritize healthcare modernization. Government incentives for domestic manufacturing have spurred the entry of local players offering cost-competitive fluorescence imaging solutions, effectively addressing price sensitivity in markets such as India and Southeast Asia. In developed APAC economies like Japan and Australia, established optical engineering expertise and favorable reimbursement schemes encourage the integration of fluorescence modules into routine endoscopic practice. This regional interplay of innovation, regulation, and financing underscores the multifaceted nature of global fluorescence endoscopy adoption.

This comprehensive research report examines key regions that drive the evolution of the Fluorescence Endoscopy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Leading Innovators and Strategic Collaborators Propelling Advances in Fluorescence Endoscopy Technologies Worldwide

Industry leadership in fluorescence endoscopy is characterized by strategic partnerships and targeted acquisitions that consolidate technological capabilities. Medtronic, for instance, pioneered AI-driven computer-aided detection with its GI Genius Intelligent Endoscopy Module, enhancing polyp detection rates during colonoscopy and setting the stage for fluorescence integration. Wision AI’s collaboration with Micro-Tech Endoscopy yielded the EndoScreener platform, reflecting a convergence of molecular imaging and machine learning to elevate early lesion detection.

Olympus reinforced its market position through the acquisition of Odin Vision, bringing cloud-enabled AI solutions to its flagship endoscopy systems and laying the groundwork for fluorescence-AI hybrid platforms. Fujifilm’s CAD EYE suite integrates dual computer-aided detection and diagnosis, tailoring fluorescence overlays to guide both lesion identification and real-time histology prediction. Pentax Medical’s Discovery AI-Assisted Polyp Detector further exemplifies the drive toward seamless AI-fluorescence workflows by providing regulatory-cleared assistance during colorectal examinations. Meanwhile, NEC Corporation’s WISE VISION Endoscopy software leverages extensive lesion image libraries to facilitate accurate fluorescence-based diagnostics, positioning NEC for broader international expansion. Together, these innovators are shaping the clinical and commercial trajectories of fluorescence endoscopy through technology convergence and ecosystem partnerships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fluorescence Endoscopy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aesculap, Inc.

- Arthrex, Inc.

- B. Braun Melsungen AG

- Boston Scientific Corporation

- Carl Zeiss Meditec AG

- Conmed Corporation

- Cook Group Incorporated

- Dantec Dynamics A/S

- Fujifilm Holdings Corporation

- Hamamatsu Photonics K.K.

- Intuitive Surgical, Inc.

- Leica Microsystems GmbH

- Medtronic plc

- Olympus Corporation

- PerkinElmer, Inc.

- Quest Medical Imaging B.V.

- Richard Wolf GmbH

- Shimadzu Corporation

- Smith & Nephew plc

- Stryker Corporation

- Synergy Vision Ltd.

Targeted Strategic Imperatives for Industry Leaders to Capitalize on Opportunities and Navigate Challenges in Fluorescence Endoscopy

To capitalize on fluorescence endoscopy’s transformative potential, industry leaders should prioritize investment in next-generation probe chemistries, focusing on multifunctional near-infrared agents that combine deep tissue penetration with high specificity. Secondly, forging partnerships with academic centers and clinical consortia will expedite the generation of robust clinical evidence, underscoring diagnostic accuracy and therapeutic value to payers and guideline committees. Simultaneously, companies must reinforce supply chain resilience by diversifying manufacturing footprints across multiple geographic hubs, thereby insulating operations from sudden policy shifts or logistical disruptions.

Building comprehensive service ecosystems that include remote monitoring for device performance and on-demand training modules will enhance customer satisfaction and promote higher technology utilization rates. In parallel, advocating for the establishment of reimbursement codes specific to fluorescence-guided procedures will be essential to unlocking widespread clinical adoption. Finally, embracing cloud-based data analytics and AI platforms will enable real-time image processing, predictive maintenance, and personalized learning pathways for clinicians, collectively driving better patient outcomes and reinforcing vendor differentiation in a competitive market.

Detailing a Rigorous Research Methodology Combining Primary Insights and Secondary Data to Ensure Robust Market Analysis

This research combines a multilayered methodology to ensure comprehensive analysis and credible insights. Secondary research included an extensive review of peer-reviewed literature, regulatory filings, and clinical trial registries to map technological advancements and product approvals. Proprietary databases provided granular information on device launches, patent trends, and collaborations within the fluorescence endoscopy space.

Primary research incorporated in-depth interviews with key opinion leaders across gastroenterology, pulmonary medicine, and surgical oncology, capturing firsthand perspectives on clinical needs, procedural workflows, and adoption barriers. Additional discussions with procurement managers at hospital systems and ambulatory centers provided quantitative assessments of procurement cycles, training requirements, and maintenance considerations. A structured framework guided the triangulation of these inputs, harmonizing qualitative narratives with secondary data points to validate thematic conclusions. This hybrid approach ensured that the resulting insights reflect both the evolving technological landscape and real-world clinical practice dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fluorescence Endoscopy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fluorescence Endoscopy Market, by Product Type

- Fluorescence Endoscopy Market, by Application

- Fluorescence Endoscopy Market, by End User

- Fluorescence Endoscopy Market, by Region

- Fluorescence Endoscopy Market, by Group

- Fluorescence Endoscopy Market, by Country

- United States Fluorescence Endoscopy Market

- China Fluorescence Endoscopy Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1431 ]

Synthesizing Key Insights and Emerging Trends to Highlight the Transformative Potential of Fluorescence Endoscopy Innovations

Across multiple dimensions, fluorescence endoscopy is poised to redefine procedural precision and diagnostic confidence. Technological breakthroughs in multispectral imaging, AI integration, and depth-of-field enhancements have collectively expanded the technique’s clinical applicability, from early cancer detection to intraoperative navigation. Meanwhile, evolving tariff structures and policy measures have underscored the importance of supply chain diversification, prompting strategic realignment among device manufacturers and consumable suppliers.

Segment-specific dynamics reveal that consumable and equipment innovations must remain closely aligned with clinical application requirements, whether in gastrointestinal, gynecological, pulmonary, or urological endoscopies. Regional disparities in reimbursement guidelines, regulatory approvals, and infrastructure capacities necessitate tailored go-to-market strategies that respect local healthcare ecosystems. Leading companies are already leveraging collaborations, M&A, and licensing agreements to accelerate product development and market access. Guided by these trends, stakeholders across the value chain have the opportunity to deploy fluorescence endoscopy solutions that not only improve patient outcomes but also establish new standards for precision medicine in endoscopic practice.

Engage with Ketan Rohom to Secure Comprehensive Fluorescence Endoscopy Market Intelligence and Elevate Strategic Decision-Making

To explore how a tailored report can empower your organization with deep insights into fluorescence endoscopy trends, methodologies, and strategic opportunities, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings a wealth of industry expertise and will guide you through the report’s detailed chapters, helping you identify the sections most relevant to your priorities. By engaging directly with Ketan, you can discuss custom research add-ons, data visualizations, or executive briefings designed to accelerate your decision-making. Secure your access today to gain a competitive advantage through comprehensive market intelligence that will inform product development, commercial strategies, and partnership initiatives aimed at the rapidly evolving fluorescence endoscopy sector.

- How big is the Fluorescence Endoscopy Market?

- What is the Fluorescence Endoscopy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?