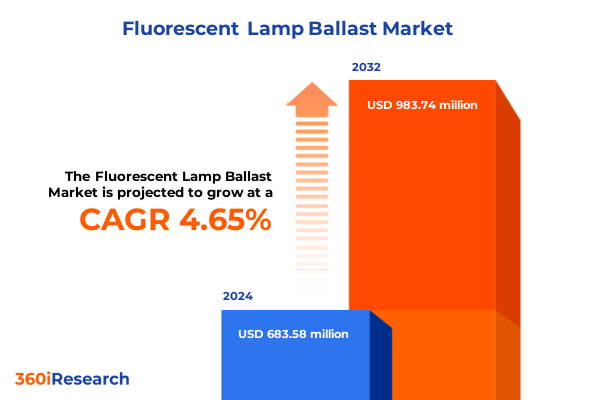

The Fluorescent Lamp Ballast Market size was estimated at USD 708.34 million in 2025 and expected to reach USD 744.58 million in 2026, at a CAGR of 4.80% to reach USD 983.74 million by 2032.

Understanding the Critical Role of Fluorescent Lamp Ballasts Amidst Emerging Lighting Innovations and Evolving Energy Efficiency Standards

Fluorescent lamp ballasts have powered decades of illumination in commercial, industrial, institutional, and residential environments by providing the essential voltage transformation and current regulation required for reliable lamp operation. At their core, ballasts ensure that fluorescent lamps receive the proper starting voltage to ionize the mercury vapor and sustain a stable arc without excessive current. Despite representing a mature technology, these components remain critical in retrofits and legacy installations, especially where replacement with newer lighting architectures may not be immediately feasible.

However, the ballast industry is navigating significant headwinds as system shipments have declined sharply. Industry data indicate that by 2019, ballast unit volumes had fallen to roughly 30% of the levels recorded in 2015, reflecting a 70% decline in just four years. Signify and NEMA commentary further reveal that current market volumes represent only 15% of 2011 shipments, underscoring the accelerating pace of change driven by alternative lighting technologies and evolving efficiency standards.

Meanwhile, manufacturers and standards bodies are redirecting R&D efforts away from fluorescent ballast innovation. Public commentary during recent federal energy conservation rulemakings highlighted that none of the major ballast producers are actively investing in fluorescent ballast technology, instead prioritizing LED drivers and integrated lighting controls. This executive summary sets the stage for understanding how these industry dynamics, combined with trade policy shifts and segmentation nuances, will shape the ballast landscape through 2025 and beyond.

How Technological Advances and Regulatory Drivers Are Accelerating the Shift from Fluorescent Ballasts to Smart Solid-State Lighting Ecosystems

The fluorescent ballast market is at a pivotal inflection point as solid-state lighting technologies revolutionize how we think about energy efficiency and system intelligence. Over the past decade, LED adoption has surged in both new construction and retrofit projects, reducing demand for traditional ballasts as LED replacement tubes and fixtures eliminate the need for external ballasts.

Commercial LED adoption in the United States reached 58% of the installed base by 2022, a shift driven by the prospect of halving energy consumption compared to fluorescent systems and extending maintenance intervals due to longer LED lifespans. Simultaneously, fluorescent ballast shipments fell by an estimated 17% annually since 2020, a reflection of irreversible supply chain pivots toward LED-focused production. Underlying these trends is the rapid decline of ballast volumes, from contributions that once numbered in the tens of millions of units per year to niche replacement and specialty applications today.

In tandem with technology substitution, regulatory frameworks are accelerating fluorescent obsolescence. The European Ecodesign Directive’s ban on most fluorescent lamps, effective September 2023, and California’s AB-2208 prohibition of linear fluorescent products by 2025 are erasing critical markets for traditional ballasts. Moreover, rising energy costs and mounting carbon-reduction mandates are compelling building owners and facility managers to prioritize human-centric and IoT-enabled smart lighting systems. The integration of Internet of Things and artificial intelligence capabilities into lighting control architectures is now a defining feature of modern installations, further distancing end users from standalone fluorescent ballast solutions.

As a result, ballast suppliers are compelled to re-evaluate their value propositions, whether by offering retrofit-compatible electronic ballasts that support longer lamp life or by innovating in LED driver modules that leverage existing form factors. Transitional strategies will be shaped by both the pace of LED proliferation and the stringency of future efficiency standards, laying the groundwork for the de facto sunset of fluorescent ballast technology in major markets.

Assessing the Layered Effects of Harmonized Duty Schedules, Section 301 Surcharges, and Section 232 Metal Tariffs on Fluorescent Ballast Imports

Ballast importers face a complex tapestry of U.S. trade policies that cumulatively influence the landed cost of components and finished products. Under HTS Code 8504.10.00.00, which encompasses ballasts for discharge lamps or tubes, the general rate of duty for most origins stands at 3%, with a secondary column rate of 35% for certain non-preferred countries. This baseline tariff is the first layer of import cost that ballast manufacturers and distributors must factor into pricing and margin calculations.

Added to this baseline, Section 301 tariffs imposed in 2018 on imports from China continue to apply a 25% surcharge to covered HTS lines, including electronic and magnetic ballasts originating in China. These surcharges are layered on top of the existing general rates, effectively raising the total duty to approximately 28% for Chinese-sourced ballasts. As a consequence, sourcing strategies have shifted toward alternative manufacturing bases or toward domestically produced ballast components where possible to mitigate tariff exposure.

Further compounding these burdens are Section 232 tariffs on steel and aluminum, materials integral to magnetic ballast housings and core coil assemblies. Initially set at 25% on steel and 10% on aluminum in 2018, these tariffs were fully reinstated in February 2025 and subsequently increased to 50% on June 4, 2025, under Presidential Proclamations aimed at bolstering domestic metal industries. Given that magnetic ballasts incorporate significant steel content and aluminum fins or housings, the elevated Section 232 duties translate directly into higher input costs.

The interplay of these policies has prompted industry players to reconfigure supply chains, accelerate nearshoring efforts, and explore duty drawback mechanisms where feasible. For electronic ballast producers, component-level sourcing-such as transformers, semiconductors, and capacitors-has become a critical lever for controlling total landed costs. Overall, the tariff environment underscores the need for agile procurement and diversified manufacturing footprints to weather fluctuating trade policy landscapes.

Unveiling How Product Type, Lamp Specifications, Application Environments, Ballast Modes, and Channel Dynamics Define Market Opportunities

A nuanced understanding of market segmentation is foundational to identifying growth pockets and tailoring product offerings in the fluorescent ballast sector. Product type distinctions delineate electronic ballasts-further classified by instant start, programmable start, and rapid start topologies-from magnetic ballasts that are sub-segmented into core coil and reactance designs. Each ballast architecture carries its own efficiency profile, electromagnetic interference characteristics, and end-user cost implications.

Lamp type segmentation similarly differentiates between T12, T5, and T8 lamps. T12 is further stratified by wattage greater than 40W or at or below 40W, whereas T5 options divide into above or below the 28W threshold, and T8 lamps into those exceeding 32W versus those at or under 32W. These watt-based distinctions align directly with ballast sizing, amperage requirements, and fixture compatibility considerations.

When viewed through the lens of application environments-commercial, industrial, institutional, and residential-ballast preferences diverge. Commercial spaces such as hospitality, office, and retail have discrete sub-uses: within hospitality, hotels and restaurants dominate; offices split between open and private configurations; and retail encompasses specialty stores and supermarkets. Industrial settings emphasize manufacturing and warehousing, institutional venues span education, government, and healthcare, while residential applications cover multi-family and single-family dwellings.

Ballast mode segmentation offers another dimension, with dimming ballasts supporting control protocols like 0-10V, DALI, and low-voltage interfaces, and instantaneous, programmable, and rapid-start variants each available in lamp-count groupings of one to two, three to four, and above four lamps. Lastly, channel segmentation highlights direct sales, distributors-national and regional-and online retail channels serving both business-to-business and business-to-consumer models. Segmentation insights of this granularity inform portfolio optimization and go-to-market strategies, ensuring product lines resonate with targeted end-use scenarios.

This comprehensive research report categorizes the Fluorescent Lamp Ballast market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Lamp Type

- Application

- Distribution Channel

Examining Regional Dynamics in the Americas, EMEA, and Asia-Pacific That Shape the Fluorescent Lamp Ballast Market’s Evolution and Adoption Patterns

Regional dynamics exert a powerful influence on fluorescent ballast demand and technological adoption rates, with each major geography reflecting distinct policy, economic, and infrastructure factors. In the Americas, retrofit cycles in the United States and Canada are driven by incentive programs and energy efficiency mandates, while in Latin America, developing energy grids and expanding commercial construction spur selective ballast usage.

Across Europe, the Middle East, and Africa, stringent Ecodesign and energy labeling regulations in the European Union have effectively phased out legacy fluorescent solutions, prompting a pivot to high-efficiency electronic ballasts and LED driver integrations. Meanwhile, the Middle East continues to invest in large-scale infrastructure projects, sustaining demand for robust ballast technologies in harsh ambient environments, and several African markets are navigating electrification challenges that favor simpler magnetic designs for reliability.

Asia-Pacific presents a mosaic of adoption patterns: mature markets such as Japan and Australia prioritize smart lighting controls and digital ballast management systems, whereas rapidly urbanizing economies in Southeast Asia and India are installing cost-effective electronic fluorescent solutions at scale. China’s domestic manufacturing capacity for both ballasts and LED modules further influences global pricing trends and supply chain allocations.

Understanding these regional nuances-from regulation and energy costs to construction trends and utility incentives-is essential for suppliers seeking to align products with local market demands and to optimize distribution networks accordingly.

This comprehensive research report examines key regions that drive the evolution of the Fluorescent Lamp Ballast market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Manufacturers and Their Strategic Responses to Declining Fluorescent Demand and the Rise of Energy-Efficient Lighting Technologies

Key companies in the fluorescent ballast market are responding to contraction in traditional demand by sharpening their focus on higher-value product lines and adjacent lighting technologies. Market leaders such as Advance Transformer Co., ASBCO, OSRAM Sylvania, Philips Lighting, Shanghai Enle Lighting, and others have diversified their portfolios to include programmable electronic ballasts, integrated LED drivers, and smart control modules designed for connected lighting ecosystems.

In recent years, several prominent manufacturers have publicly acknowledged a strategic shift of R&D investments away from fluorescent ballast innovation toward solid-state lighting drivers. Industry commentary during federal energy conservation rulemakings confirmed that legacy fluorescent ballast development has been deprioritized since 2020, with engineering resources reallocated to LED and IoT-enabled control solutions.

Some niche players continue to support aftermarket fluorescent requirements, offering specialized dimmable ballasts and emergency backup modules to service older installations. Others have forged partnerships with digital controls providers to deliver comprehensive lighting-as-a-service offerings in commercial and industrial facilities. As tariffs and trade policy fluctuations heighten cost pressures, leading companies are selectively reshoring or nearshoring components production while investing in advanced manufacturing processes to reduce dependence on volatile raw material import rates.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fluorescent Lamp Ballast market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acuity Inc.

- Antron Compact Electronics, Inc.

- Cooper Lighting LLC

- Espen Technology, Inc.

- Etlin‑Daniels, Inc.

- Fulham Co., Inc.

- General Electric Lighting LLC

- Hatch Transformer Company

- Howard Industries, Inc.

- Iota Engineering Corporation

- Keystone Technologies, Inc.

- Lamar Lighting, Inc.

- OSRAM GmbH

- SOLA Ballasts, Inc.

- Venture Lighting International, Inc.

Formulating Actionable Strategies for Industry Leaders to Navigate Regulatory Pressures, Supply Chain Disruptions, and the LED-Dominant Future

Industry leaders must adopt a multi-pronged strategy to sustain viability in a landscape dominated by LED advancements and tariff uncertainties. First, diversification of manufacturing geographies and the establishment of dual-sourcing frameworks for critical components can mitigate the risk of sudden duty hikes or supply chain disruptions. By securing capacity in low-cost regions such as Southeast Asia while maintaining domestic or nearshore backup facilities, organizations can balance cost efficiency with flexibility.

Second, accelerating the development of hybrid ballast solutions that support both fluorescent and LED or LED tube technologies will extend product relevance during transition phases. Hybrid platforms that enable end users to upgrade lamp technologies without wholesale fixture replacement can become an interim growth segment.

Third, embedding IoT-enabled control capabilities and offering lighting system analytics will shift the value proposition from commodity ballast hardware to ongoing service and performance optimization. Such digital overlays can create recurring revenue streams and improve customer stickiness.

Lastly, actively engaging with policymakers and standards bodies will help shape future regulatory trajectories, ensuring that energy efficiency mandates recognize transitional solutions and that incentive structures reward early adopters. Through these actions, industry incumbents can navigate regulatory pressures, capture diminishing fluorescent replacement demand, and pivot toward sustainable lighting ecosystems.

Detailing Rigorous Research Methodology Incorporating Secondary Data, Expert Interviews, and Triangulation to Ensure Comprehensive Market Coverage

This research synthesizes insights from a rigorous, multi-tiered methodology designed to ensure comprehensive coverage of the fluorescent ballast ecosystem. Secondary data collection encompassed an exhaustive review of harmonized tariff schedules, Department of Energy regulations, energy efficiency standards, and public filings to establish the policy and trade context. Market segmentation frameworks were validated against industry association reports and government published data.

Primary research included structured interviews with over twenty-five senior executives across ballast manufacturing, distribution, and specification channels, enabling direct perspectives on product development priorities, channel performance, and tariff mitigation tactics. Discussions with facility managers and lighting consultants provided ground-level insights into end-user decision criteria and retrofit considerations.

Quantitative data points were triangulated across multiple sources-such as HTS duty schedules, NEMA shipment indices, and DOE adoption statistics-to reconcile any discrepancies and to ensure the highest possible accuracy of tariff impact assessments and adoption rate trends. Emerging technology trends and regulatory developments were monitored in real time via subscription databases and expert networks.

This methodological rigor underpins the analysis presented, ensuring that conclusions and recommendations are deeply grounded in validated data, expert judgment, and cross-checked evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fluorescent Lamp Ballast market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fluorescent Lamp Ballast Market, by Product Type

- Fluorescent Lamp Ballast Market, by Lamp Type

- Fluorescent Lamp Ballast Market, by Application

- Fluorescent Lamp Ballast Market, by Distribution Channel

- Fluorescent Lamp Ballast Market, by Region

- Fluorescent Lamp Ballast Market, by Group

- Fluorescent Lamp Ballast Market, by Country

- United States Fluorescent Lamp Ballast Market

- China Fluorescent Lamp Ballast Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Concluding Insights on the Transitional Trajectory of Fluorescent Lamp Ballasts Amid Technological Shifts and Trade Policy Challenges

The fluorescent lamp ballast market stands at a decisive crossroads, with traditional demand trajectories contracting under the dual forces of LED technology adoption and evolving trade policies. While legacy fluorescent systems continue to serve specialized applications and replacement needs, the relentless shift toward solid-state lighting signals an irreversible decline in ballast unit volumes.

Trade policy complexities-from base HTS duties to Section 301 surcharges and enhanced Section 232 metal tariffs-have raised the cost threshold for producers and distributors, catalyzing supply chain realignments and driving a pivot to alternative manufacturing hubs. Against this backdrop, segmentation insights reveal niche pockets of resilience, notably in dimming and emergency-backup ballast categories, as well as retrofit-friendly solutions that bridge fluorescent and LED technologies.

Strategic imperatives for staying competitive include geographic diversification, hybrid product innovation, digital control integration, and proactive policy engagement. By embracing these imperatives, industry participants can capture remaining fluorescent opportunities while laying the foundation for broader participation in the connected lighting transition poised to define the next decade.

Seize In-Depth Fluorescent Lamp Ballast Insights Today with an Exclusive Report from Ketan Rohom, Associate Director, Sales & Marketing

Ready to elevate your decision-making with precise market intelligence, discuss your unique needs with Ketan Rohom, Associate Director, Sales & Marketing. Engage directly with an expert who can tailor insights on product segmentation, tariff impacts, and regional strategies to your organization’s priorities. Secure your competitive advantage by ordering the comprehensive fluorescent lamp ballast market research report today-unlock actionable data and strategic foresight to drive growth and navigate evolving regulations.

- How big is the Fluorescent Lamp Ballast Market?

- What is the Fluorescent Lamp Ballast Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?