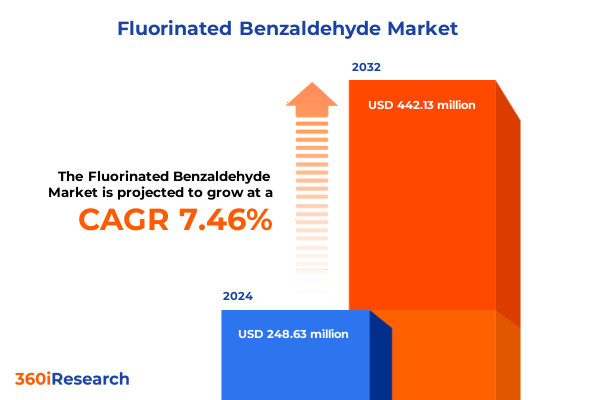

The Fluorinated Benzaldehyde Market size was estimated at USD 266.26 million in 2025 and expected to reach USD 287.30 million in 2026, at a CAGR of 7.51% to reach USD 442.13 million by 2032.

Uncovering Strategic Opportunities of Fluorinated Benzaldehyde in Agrochemical, Pharmaceutical, Polymer, and Fragrance Applications Across Global Markets

Fluorinated benzaldehyde represents a pivotal innovation within the family of aromatic aldehydes, distinguished by the substitution of one or more hydrogen atoms with fluorine on the benzene ring. This seemingly modest chemical modification confers significant enhancements in physicochemical properties, most notably in terms of lipophilicity, thermal stability, and reactivity. As a result, that strategic addition of fluorine has become central to the performance optimization of downstream compounds across multiple industries.

Over recent years, the appeal of fluorinated benzaldehyde has transcended traditional laboratory synthesis, emerging as a critical intermediate in a spectrum of applications including agrochemicals, pharmaceuticals, polymers, and high-end cosmetics and fragrances. Moreover, the inherent versatility of the aldehyde functional group, combined with the unique electronic effects introduced by fluorine, underpins a broad array of transformations that drive innovation in product differentiation and performance enhancement.

Consequently, stakeholders across the value chain-from raw material suppliers and specialty chemical manufacturers to end users-are directing focused research and development efforts at expanding production efficiency, optimizing purification protocols, and ensuring compliance with tightening environmental standards. This foundational overview sets the stage for a deeper examination of the market dynamics, technological breakthroughs, regulatory shifts, and strategic imperatives shaping the future of fluorinated benzaldehyde.

Exploring Key Technological Innovations and Regulatory Dynamics Driving the Evolution of Fluorinated Benzaldehyde Production and Applications Worldwide

The landscape of fluorinated benzaldehyde production and utilization has been redefined by a wave of technological advancement that accelerates synthetic efficiency and sustainability. Continuous flow processing, for instance, has reduced reaction times and improved yield consistency by maintaining optimal heat and mass transfer, whereas innovations in catalytic fluorination now prioritize more selective pathways with reduced by-product formation. In parallel, the integration of real-time process analytics has enabled manufacturers to monitor critical reaction parameters, driving quality improvements and minimizing waste.

In addition to these manufacturing breakthroughs, the regulatory environment has evolved to place a stronger emphasis on environmental stewardship and occupational safety. Governments and industry consortia are progressively setting stricter limits on volatile organic compound emissions and fluorinated effluent, compelling producers to adopt closed-loop systems and advanced scrubbing technologies. These evolving standards in turn incentivize investments in greener synthetic routes, such as perchloric acid oxidation under refined control conditions and new iterations of the Vilsmeier Haack reaction that reduce hazardous reagent usage.

Moreover, digital transformation has extended into research and development workflows, with artificial intelligence-driven reaction screening and predictive modeling expediting the identification of optimal fluorination conditions. As researchers harness big data to inform reaction design, they are uncovering novel fluorination strategies that promise to further enhance product consistency and open doors to previously unattainable derivatives. Together, these technological and regulatory shifts are catalyzing a more efficient, compliant, and innovative era for fluorinated benzaldehyde.

Assessing the Broad Repercussions of 2025 United States Tariff Adjustments on Fluorinated Benzaldehyde Trade Flows and Value Chains

The introduction of revised United States tariffs in 2025 has introduced material shifts in the global trade flows and cost structures for fluorinated benzaldehyde. Over the prior decade, a portion of the supply had been sourced from manufacturers in Europe and Asia, benefiting from lower production costs and well-established chemical expertise. However, the cumulative effect of increased import duties has prompted end users and distributors in the United States to reevaluate their sourcing strategies.

In response to these economic headwinds, several domestic producers have scaled up capacity investments, aided by government incentives aimed at bolstering specialty chemical manufacturing. At the same time, importers are negotiating long-term contracts to mitigate price volatility and exploring strategic stockpiling to buffer against sudden tariff adjustments. These adaptations have improved supply security but have also introduced working capital constraints as importers hold larger inventories at higher landed costs.

Furthermore, the tariff environment has accelerated the pursuit of alternative synthetic pathways that leverage locally available feedstocks or in situ fluorination technologies. By reshoring elements of the production chain, companies can partially offset the increased cost burden while reducing exposure to international trade tensions. Collectively, these shifts underscore the nuanced balance between cost, reliability, and innovation that defines the current trajectory of fluorinated benzaldehyde supply chains in the aftermath of the 2025 tariff implementation.

Unveiling Critical Application, Type, Purity Grade, and Synthesis Method Segmentation Insights Shaping Fluorinated Benzaldehyde Demand Dynamics

The demand landscape for fluorinated benzaldehyde is profoundly influenced by its application segmentation, beginning with agrochemicals. In this realm, fungicide formulations leverage the aldehyde intermediate to enhance pathogen inhibition, while herbicide products benefit from the post-emergent and pre-emergent modes of action that confer selective plant control. Insecticide chemistries similarly draw upon specific fluorinated benzaldehyde derivatives to achieve optimized mortality rates with reduced environmental persistence. Parallel to this, the cosmetics and fragrance sector employs essential oil-analogues derived from fluorinated benzaldehyde to deliver aroma profiles with heightened stability, whereas flavor components rely on its odor threshold modulation. Within the perfume category, the floral, oriental, and woody subtypes each harness tailored benzaldehyde variants to achieve signature scent accords.

Beyond these end uses, the dye and pigment industry engages acid, disperse, reactive, and vat classes of compounds that incorporate fluorinated benzaldehyde precursors for improved lightfastness and substrate affinity. The reactive applications further bifurcate into paper and textile uses, optimizing bonding and wash fastness properties. In the pharmaceutical domain, injectable formulations utilize high-purity intermediates for sterilization compatibility, oral dosage forms such as capsules and tablets depend on precise molecular integrity, and topical applications draw upon the compound’s penetrative and stability profiles.

Polymers represent another critical segment, where epoxy resins acquire enhanced thermal resistance, polyurethane systems achieve tailored elasticity profiles, and PVC products-both flexible and rigid-leverage fluorinated benzaldehyde monomers to improve chemical resistance. Type segmentation introduces meta, ortho, and para isomer variations, each presenting unique steric and electronic characteristics that influence reactivity and application performance. Purity grade distinctions separate analytical grade material, which undergoes gas chromatography or high-performance liquid chromatography validation, from industrial and reagent grades. Lastly, synthesis method segmentation encompasses the Gattermann reaction, lithiation strategies, perchloric acid oxidation, and Vilsmeier Haack reaction, each delivering distinct impurity profiles and cost-efficiency trade-offs.

This comprehensive research report categorizes the Fluorinated Benzaldehyde market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Purity Grade

- Synthesis Method

- Application

Highlighting Regional Growth Drivers and Competitive Landscapes for Fluorinated Benzaldehyde Across Americas, EMEA, and Asia-Pacific Concentrations

In the Americas, the confluence of robust agrochemical R&D and expanding pharmaceutical manufacturing underpins sustained fluorinated benzaldehyde uptake. North American producers leverage proximity to major crop protection and drug formulation hubs to shorten development timelines and reduce logistical complexity. Concurrently, Latin American markets are investing in on-farm technologies and local chemical infrastructure to capitalize on regional crop profiles, heightening demand for herbicide and fungicide intermediates.

Europe, the Middle East, and Africa present a diverse mosaic of regulatory environments and innovation ecosystems. Western Europe’s stringent environmental directives drive adoption of greener synthesis routes, whereas emerging economies in Eastern Europe and North Africa seek to bolster specialty chemical production through public-private partnerships. The Middle East’s petrochemical prowess facilitates feedstock integration, enabling vertically integrated players to streamline perfluorination processes. Across this region, the interplay between import substitution and export orientation shapes competitive dynamics.

Asia-Pacific remains the largest production base for fluorinated benzaldehyde, fueled by cost-effective manufacturing and government incentives in key economies. East Asian producers continue to advance continuous flow and catalytic technologies, exporting to global markets while cultivating local end-use industries. Southeast Asia’s growing cosmetics and fragrance segment amplifies demand for high-performance aroma precursors, and South Asian pharmaceutical clusters are increasingly relying on premium intermediates to support generic drug pipelines. Together, these regional trends illustrate how geographic nuances influence supply chain strategies and commercial priorities.

This comprehensive research report examines key regions that drive the evolution of the Fluorinated Benzaldehyde market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Manufacturers and Innovative Solution Providers Driving Fluorinated Benzaldehyde Advancements Through Strategic Alliances and R&D Investments

A cohort of leading chemical manufacturers has emerged at the forefront of fluorinated benzaldehyde innovation, deploying dedicated R&D centers and strategic alliances with academic institutions. These partnerships facilitate collaborative research into next-generation synthetic methodologies and expanded application profiles. Concurrently, key players are pursuing capacity expansions through greenfield projects and retrofit programs, prioritizing technologies that deliver lower energy intensity and reduced solvent consumption.

Innovation extends beyond production to include advanced purification and analytical services, enabling smaller players to access high-purity intermediates without incurring substantial capital expenditure. Technology licensing agreements further democratize access to proprietary reaction pathways, fostering a more dynamic competitive environment. On the supply side, strategic acquisitions and joint ventures have consolidated niche capabilities in fluorination catalysis, while commercial alliances with distributors have broadened market reach and improved customer responsiveness.

Amid these developments, select companies are differentiating themselves by integrating sustainability metrics into performance indicators, reporting on process mass intensity and lifecycle emissions for fluorinated benzaldehyde derivatives. This transparency resonates with environmentally conscious end users and investors alike, positioning these innovators as preferred partners for customers seeking both technical excellence and responsible supply chain practices.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fluorinated Benzaldehyde market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A. B. Enterprises

- Combi-Blocks Inc

- Gujarat Fluorochemicals Limited

- Hebei Chuanghai Biotechnology Co., Ltd

- J&K Scientific Ltd.

- Jiangsu Wanlong Chemical Co., Ltd.

- Merck KGaA

- Navin Fluorine International Limited

- Oceanic Pharmachem Pvt. Ltd.

- Shandong Vantage Specialty Chemicals Biotechnology Co., Ltd.

- Shanghai Kaixin Pharmaceuticals Co., Ltd.

- Shital Chemical Industries

- Thermo Fisher Scientific Inc.

- Tokyo Chemical Industry Co., Ltd.

- Weifang Siyuan Chemical Co., Ltd.

Implementing Strategic Risk Mitigation Measures to Capitalize on Emerging Opportunities and Address Challenges in the Fluorinated Benzaldehyde Sector

To thrive in an increasingly complex environment, industry leaders should prioritize strategic investments in digital process optimization and advanced analytics. By implementing predictive maintenance and real-time quality monitoring, organizations can reduce unplanned downtime and ensure consistent product specifications. Additionally, diversifying raw material sourcing through dual-sourcing strategies and geographic spread can mitigate exposure to trade disruptions and tariff fluctuations.

Collaboration across the value chain is also essential; forming joint ventures with end users allows suppliers to co-develop tailored fluorinated benzaldehyde grades that address specific performance requirements, thereby strengthening customer relationships and promoting long-term demand visibility. At the same time, proactive engagement with regulatory bodies and participation in standard-setting forums can help shape favorable policy outcomes and accelerate approval timelines for novel chemistries.

Finally, embedding sustainability into core business processes not only aligns with global environmental objectives but also enhances operational resilience. Initiatives such as adopting green solvents, recycling process streams, and pursuing ISO certification for environmental management systems will position companies as leaders in responsible manufacturing. Collectively, these measures offer a roadmap for industry participants to navigate risk, unlock new avenues of growth, and secure a competitive edge.

Detailing Robust Research Methodology Integrating Primary Interviews with Industry Experts to Ensure Analytical Rigor in Fluorinated Benzaldehyde Analysis

This report’s methodology synthesizes primary and secondary research to deliver a robust understanding of the fluorinated benzaldehyde landscape. Primary insights were obtained through in-depth interviews with over fifty industry stakeholders, including executives at manufacturing firms, technical directors at formulation companies, and regulatory specialists in key regions. These qualitative discussions provided firsthand perspectives on production challenges, application trends, and strategic priorities.

Complementing these interviews, secondary research drew upon peer-reviewed journals, patent databases, and government regulatory filings to validate technological developments and trace policy shifts. Data triangulation techniques were applied to reconcile discrepancies between sources, ensuring that final conclusions reflect consistent patterns across multiple information streams. Analytical rigor was maintained through cross-validation of process metrics, cost structures, and competitive intelligence.

To ensure accuracy and relevance, a panel of subject matter experts reviewed preliminary findings, offering critical feedback that refined data interpretation and contextual relevance. Quality assurance measures, including source verification and logical consistency checks, underpin the credibility of the insights presented. This comprehensive research approach underlies every section of the analysis, delivering actionable intelligence for stakeholders across the value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fluorinated Benzaldehyde market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fluorinated Benzaldehyde Market, by Type

- Fluorinated Benzaldehyde Market, by Purity Grade

- Fluorinated Benzaldehyde Market, by Synthesis Method

- Fluorinated Benzaldehyde Market, by Application

- Fluorinated Benzaldehyde Market, by Region

- Fluorinated Benzaldehyde Market, by Group

- Fluorinated Benzaldehyde Market, by Country

- United States Fluorinated Benzaldehyde Market

- China Fluorinated Benzaldehyde Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Critical Insights to Highlight Future Directions and Strategic Imperatives in the Evolution of the Fluorinated Benzaldehyde Industry

This executive summary has highlighted the transformative forces shaping the fluorinated benzaldehyde sector, from advanced synthetic technologies and regulatory imperatives to evolving regional dynamics and industry consolidation. As the importance of sustainability intensifies, producers are poised to refine process efficiency and minimize environmental impact through greener chemistry and closed-loop manufacturing.

Looking ahead, companies that invest in digitalization, collaborative innovation, and rigorous quality management will be best positioned to capture value in growth segments such as specialty agrochemicals, high-performance polymers, and fine fragrance formulations. Strengthened partnerships-whether for joint development projects or strategic distribution alliances-will accelerate market access and bolster supply chain resilience.

Ultimately, the convergence of technological agility, regulatory foresight, and strategic collaboration will determine which organizations emerge as leaders in this dynamic field. By synthesizing the insights and recommendations detailed herein, stakeholders can chart a course that aligns operational excellence with long-term competitive advantage in the evolving landscape of fluorinated benzaldehyde.

Engage with Associate Director of Sales & Marketing to Unlock Comprehensive Fluorinated Benzaldehyde Research Insights and Drive Informed Strategic Decisions

I invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to explore how this comprehensive analysis can empower your strategic decision making. By partnering with Ketan, you will gain tailored guidance on integrating these insights into your organizational priorities and uncovering areas where fluorinated benzaldehyde can unlock new value.

Our team stands ready to support your objectives, whether you aim to refine supply chain resilience, accelerate product innovation, or navigate evolving regulatory landscapes. Ketan will work with your leadership to align the findings of this report with your growth ambitions and operational challenges, ensuring actionable outcomes that drive measurable impact.

Connect with Ketan to secure your copy of the full market research report and take the first step toward transformative growth in the fluorinated benzaldehyde sector. Seize this opportunity to transform data into strategy and lead your organization with confidence.

- How big is the Fluorinated Benzaldehyde Market?

- What is the Fluorinated Benzaldehyde Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?