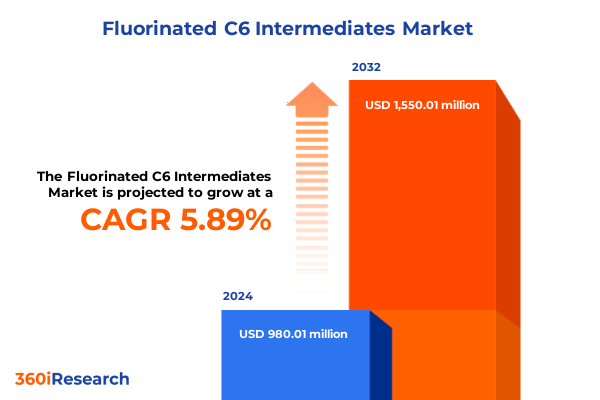

The Fluorinated C6 Intermediates Market size was estimated at USD 1.00 billion in 2025 and expected to reach USD 1.07 billion in 2026, at a CAGR of 6.31% to reach USD 1.55 billion by 2032.

Fluorinated C6 Intermediates Shaping High-Performance Materials with Exceptional Stability and Versatile Industrial Applications

Fluorinated C6 intermediates stand as pivotal building blocks in modern material science, delivering unique performance characteristics that elevate product functionality across a wide range of end markets. These compounds, characterized by their carbon-fluorine bonds, exhibit exceptional chemical stability, thermal resilience, and low surface energy. Such properties enable breakthrough innovations across industries, from enhancing crop protection efficacy to advancing next-generation electronic components. As global demand intensifies for materials that meet stringent performance and sustainability standards, fluorinated C6 intermediates emerge at the forefront of high-value chemical portfolios.

In recent years, the convergence of environmental regulations and customer expectations has accelerated the shift toward fluorinated solutions that minimize ecological footprints without compromising on performance. This momentum has been further fueled by rapid technological advancements in synthesis pathways, which have reduced production complexities and improved cost efficiencies. Consequently, stakeholders across agriculture, coatings, electronics, and pharmaceuticals are reevaluating their product development pipelines to integrate these specialized intermediates, seeking a balance between regulatory compliance, operational efficiency, and competitive differentiation.

As markets continue to evolve, understanding the nuances of fluorinated C6 intermediates-including their production processes, application versatility, and regulatory considerations-will be instrumental for companies aiming to harness their full potential. This introductory overview sets the stage for a deeper exploration of the transformative shifts, tariff implications, and strategic segmentation that define the current landscape and inform future growth trajectories in this dynamic sector.

Dynamic Evolution of Global Supply Chains and Regulatory Landscapes Reshaping Fluorinated C6 Intermediate Production and Demand Dynamics

The landscape of fluorinated C6 intermediates has undergone several transformative shifts in recent years, driven by evolving regulatory frameworks, supply chain reconfiguration, and the relentless pursuit of greener chemistries. Regulatory agencies worldwide have tightened restrictions on per- and polyfluoroalkyl substances, compelling manufacturers to innovate safer, more environmentally benign production pathways. This regulatory tilt, in turn, has spurred strategic collaborations between specialty chemical producers and research institutions, accelerating the development of next-generation fluorinated intermediates with reduced persistence and enhanced recyclability.

Simultaneously, supply chain dynamics have been reshaped by geopolitical developments and a growing emphasis on regional self-sufficiency. Traditional reliance on a handful of global producers has given way to diversified sourcing strategies, ensuring business continuity and mitigating the risks associated with transportation bottlenecks. Parallel to these shifts, digitalization initiatives-such as process intensification and real-time analytics-have permeated production facilities, enabling more precise control over reaction parameters and improving overall yield and purity.

Innovation in catalyst design and process engineering has further reduced energy consumption and waste generation, aligning with broader sustainability targets. As industry participants adopt circular economy principles, interest in closed-loop recovery of fluorinated byproducts is rising, reflecting a holistic approach to minimizing environmental impact. Taken together, these transformative shifts illustrate a market in motion, defined by regulatory pressures, technological breakthroughs, and strategic realignments that are collectively shaping the future trajectory of fluorinated C6 intermediate production and application.

Assessing the Far-Reaching Effects of the 2025 United States Tariffs on Fluorinated C6 Intermediates Supply Chains and Cost Structures

In 2025, the United States implemented a series of tariffs on imported fluorinated intermediates that have significantly altered cost structures and supply chain strategies within the sector. Tariffs levied on key imports from major fluorochemical producing regions led to an immediate uptick in landed costs for companies reliant on global sourcing. As a result, domestic producers have gained a temporary advantage, prompting several buyers to renegotiate supplier contracts and explore local production partnerships to hedge against elevated import duties.

These tariff measures have also influenced inventory management practices, forcing many organizations to reassess buffer stock levels and logistics networks. The heightened cost of imports encouraged firms to consolidate shipments and optimize transportation routes, while others accelerated investments in production capacity expansion at regional hubs. Despite these adaptive strategies, small and mid-size enterprises have faced greater financial pressure due to thinner margins, compelling some to explore alternative intermediate chemistries or enter co-manufacturing agreements to maintain competitiveness.

Moreover, the tariffs have precipitated a deeper examination of total cost of ownership, encompassing raw material sourcing, logistics, storage, and regulatory compliance expenses. Buyers increasingly demand greater transparency from suppliers, analyzing landed costs and tariff exposure as part of their procurement decisions. While the long-term impact of these measures will depend on subsequent policy adjustments and trade negotiations, the current environment underscores the criticality of agile supply chain design and proactive tariff mitigation strategies in safeguarding operational resilience.

Unveiling Critical Market Segmentation Insights to Drive Strategic Decisions in the Fluorinated C6 Intermediates Industry

A nuanced understanding of market segmentation is essential to recognize where fluorinated C6 intermediates create maximum value and how targeted strategies can unlock new growth avenues. Across applications, initiatives in crop protection leverage fungicide, herbicide, and insecticide formulations that rely on these intermediates to enhance active ingredient stability and efficacy under diverse environmental conditions. In the realm of protective and decorative surfaces, specialty coatings and surface coatings have integrated fluorinated intermediates to deliver superior scratch resistance, chemical corrosion protection, and hydrophobic performance that differentiate premium products.

Within electronics manufacturing, dielectrics and etchants formulated from these intermediates support the miniaturization of circuits and improve yield rates in semiconductor fabrication. Meanwhile, pharmaceutical innovators deploy active pharmaceutical ingredient intermediates and drug delivery intermediates to achieve precise molecular modifications, facilitating controlled release profiles and improved bioavailability. Product type segmentation further reveals distinct pathways for value creation: monocentric fluorinated acids, fluorinated alcohols like HFPO and perfluorohexanol, fluorinated alkanes exemplified by perfluorohexane, specialized fluorinated ethers derived from HFPO dimer acid fluoride, and multiple fluorinated ketones differentiated by subtle structural isomers.

Purity grade considerations-from high purity to standard grades-intersect with formulation requirements, influencing downstream performance and cost. Likewise, form factors as neat liquids or solutions, granules or powders, determine processing methods, handling procedures, and end-product integration. This comprehensive segmentation framework illuminates where targeted investments and tailored product offerings can provide competitive advantages, enabling stakeholders to refine portfolio strategies and accelerate market penetration.

This comprehensive research report categorizes the Fluorinated C6 Intermediates market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Purity Grade

- Form

- Application

Analyzing Regional Market Dynamics and Growth Drivers across the Americas, EMEA, and Asia-Pacific for Fluorinated C6 Intermediates

Regional dynamics play a pivotal role in shaping the supply and demand equilibrium for fluorinated C6 intermediates, as each geographic market exhibits unique drivers and constraints. In the Americas, robust end-use demand from agrochemical manufacturers and electronics fabricators has spurred investments in domestic production capabilities to reduce reliance on imports and bolster supply chain resilience. Producers in this region have also capitalized on proximity to major agricultural heartlands and semiconductor clusters, leveraging logistical advantages to secure competitive positioning.

The Europe, Middle East & Africa region presents a complex regulatory mosaic, with stringent environmental standards driving adoption of sustainable production technologies and closed-loop recovery systems. The push for circularity and strict chemical registration requirements has led local stakeholders to partner with technology providers to ensure compliance while enhancing process efficiencies. Meanwhile, diverse market maturity levels across EMEA have fostered a range of collaborative ventures, from joint research into green chemistries to co-investment in shared manufacturing infrastructures.

Asia-Pacific continues to dominate global fluorinated intermediate output, supported by large-scale production facilities and a strong manufacturing ecosystem spanning China, Japan, and Korea. This region’s cost advantages and integrated supply chains have positioned it as a critical export hub, though evolving environmental regulations and rising labor costs are driving selective reshoring initiatives. Across all regions, geographic proximity to end-use markets, policy environments, and infrastructure capabilities remain key determinants of market access and competitiveness.

This comprehensive research report examines key regions that drive the evolution of the Fluorinated C6 Intermediates market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Competitive Strategies Shaping the Fluorinated C6 Intermediates Market Landscape

The competitive landscape for fluorinated C6 intermediates is defined by a mix of established specialty chemical producers and agile niche players, each leveraging distinct capabilities to secure market share. Established multinationals benefit from extensive research and development resources, integrated production networks, and global distribution channels that facilitate end-to-end solutions. These industry behemoths often invest heavily in process optimization and scale economies, enabling them to offer a broad portfolio spanning high-purity grades and tailored form factors.

Conversely, smaller innovators focus on disruptive chemistries and modular manufacturing approaches, bringing agility to respond swiftly to emergent regulatory requirements and application trends. Their strengths lie in rapid scale-up of novel processes, strategic alliances with research institutions, and targeted product development for high-growth segments such as specialized electronics applications and pharmaceutical intermediates. Some players have also formed collaborative partnerships to co-develop next-generation intermediates with reduced environmental footprints, balancing joint risk with shared innovation gains.

Increasingly, companies are distinguishing themselves through digitalization initiatives that integrate predictive analytics, real-time process monitoring, and advanced metrology. By deploying these technologies, leading producers can achieve higher yields, lower energy consumption, and consistent quality, reinforcing their competitive edge. As market dynamics continue to evolve, the ability to blend scale, innovation, and sustainability will be decisive in determining which organizations lead the sector’s next phase of growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fluorinated C6 Intermediates market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- AGC Inc.

- Arkema S.A.

- Clariant AG

- Daikin Industries, Ltd.

- Dongyue Group Co., Ltd.

- Gujarat Fluorochemicals Limited

- Navin Fluorine International Limited

- Shandong Dongyue Group Co., Ltd.

- Solvay S.A.

- SRF Limited

- The Chemours Company

- Zhejiang Juhua Co., Ltd.

Strategic Imperatives and Actionable Recommendations for Industry Leaders Navigating the Complex Fluorinated C6 Intermediates Ecosystem

To thrive in the complex fluorinated C6 intermediates ecosystem, industry leaders must adopt a multifaceted approach that balances innovation, operational excellence, and risk management. First, accelerating investments in research partnerships will facilitate the rapid development of greener synthesis routes and next-generation intermediates, aligning product portfolios with evolving regulatory demands and customer sustainability goals. Cultivating strong relationships with academic and government research centers can unlock access to novel catalyst designs and process intensification techniques.

Second, companies should diversify supply chain footprints by establishing regional manufacturing nodes and securing flexible sourcing agreements. This dual focus on redundancy and agile capacity allocation reduces exposure to trade policy fluctuations and logistical disruptions. Simultaneously, embracing advanced digital solutions for real-time supply chain visibility enables proactive inventory optimization and scenario planning, reinforcing resilience against unforeseen shocks.

Third, refining commercialization strategies through segmentation-driven product differentiation will sharpen market positioning. By leveraging granular insights into application-specific performance requirements, firms can tailor product grades and form factors to capture premium opportunities in agrochemicals, coatings, electronics, and pharmaceuticals. Finally, fostering a culture of continuous improvement-supported by key performance metrics across sustainability, cost efficiency, and quality-will embed the operational discipline needed to sustain competitive advantage in a dynamic industry environment.

Robust Research Methodology and Analytical Framework Underpinning the Fluorinated C6 Intermediates Market Analysis

This research employs a rigorous, multi-layered methodology designed to deliver comprehensive insights into the fluorinated C6 intermediates market. Primary data collection involved in-depth interviews with key executives, technical experts, and procurement managers across leading end-use industries. These conversations provided granular perspectives on application requirements, supply chain constraints, and emerging innovation priorities. Complementing these qualitative insights, secondary research incorporated peer-reviewed journals, patent analysis, and regulatory filings to validate developmental trends and process advancements.

A triangulation approach was applied to integrate multiple data streams, ensuring robustness in analytical outcomes. Market segmentation analyses were conducted by categorizing applications, product types, purity grades, and form factors, then mapping these segments against regional dynamics and supply chain considerations. This enabled the identification of high-potential growth pockets and critical risk factors. Supply chain assessments combined customs data analysis with logistics partner interviews, quantifying the impact of tariffs, transport bottlenecks, and capacity constraints.

Scenario modeling was employed to evaluate the long-term implications of trade policy shifts and technological breakthroughs, utilizing sensitivity analyses to stress-test assumptions. Quality control measures included peer reviews by independent industry specialists and iterative validation cycles to refine data integrity. This comprehensive framework ensures that stakeholders receive actionable, evidence-based insights to support strategic planning and investment decisions in the fluorinated C6 intermediates domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fluorinated C6 Intermediates market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fluorinated C6 Intermediates Market, by Product Type

- Fluorinated C6 Intermediates Market, by Purity Grade

- Fluorinated C6 Intermediates Market, by Form

- Fluorinated C6 Intermediates Market, by Application

- Fluorinated C6 Intermediates Market, by Region

- Fluorinated C6 Intermediates Market, by Group

- Fluorinated C6 Intermediates Market, by Country

- United States Fluorinated C6 Intermediates Market

- China Fluorinated C6 Intermediates Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing Key Findings to Inform Decision-Making in the Evolving Fluorinated C6 Intermediates Industry Landscape

The insights presented throughout this report converge to paint a clear picture of a market at the intersection of technological innovation, regulatory evolution, and strategic realignment. Fluorinated C6 intermediates continue to gain traction across high-value applications in agriculture, coatings, electronics, and pharmaceuticals, driven by their unmatched performance characteristics and advancing production capabilities. However, the 2025 tariff measures underscore the importance of a resilient supply chain, proactive policy monitoring, and cost management strategies.

Segmentation analysis reveals opportunities for differentiation through tailored product offerings that address specific application needs and purity requirements. Regional insights highlight the strategic significance of localized manufacturing and collaborative partnerships to navigate diverse regulatory landscapes. Meanwhile, competitive profiling emphasizes the growing role of digitalization and sustainability investments in securing long-term leadership positions.

Together, these findings offer a cohesive roadmap for stakeholders aiming to capitalize on market growth, mitigate operational risks, and foster innovation-driven value creation. By integrating the key takeaways and strategic imperatives outlined herein, decision-makers can chart a course toward sustainable, high-performance product portfolios and robust supply chain architectures that will define success in the evolving fluorinated C6 intermediates industry.

Secure Your Comprehensive Fluorinated C6 Intermediates Market Insights Report through a Personalized Consultation with Associate Director Ketan Rohom

The path to unlocking comprehensive insights into the fluorinated C6 intermediates market begins with a personalized consultation run by Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). By connecting with Ketan, stakeholders can explore how this report addresses their specific challenges, whether navigating shifting tariffs, refining supply chain strategies, or identifying emerging application opportunities. Engaging with his expertise ensures a tailored approach that aligns with unique business priorities and accelerates time-to-value.

During the consultation, clients gain a preview of actionable data, gain clarity on segmentation nuances, and refine their research focus to support critical strategic initiatives. This interactive process elevates decision-making by delivering bespoke recommendations, illuminating market entry considerations, and pinpointing high-potential growth segments. With Ketan’s guidance, organizations can secure the competitive intelligence they need to stay ahead in a rapidly evolving ecosystem.

Don’t miss the opportunity to transform market intelligence into strategic advantage. Schedule your session today to delve into comprehensive analyses on tariffs, regional dynamics, and technology-driven trends that will define the future of fluorinated C6 intermediates. Reach out to Ketan Rohom to finalize your investment in a research report designed to empower proactive, data-driven leadership.

- How big is the Fluorinated C6 Intermediates Market?

- What is the Fluorinated C6 Intermediates Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?