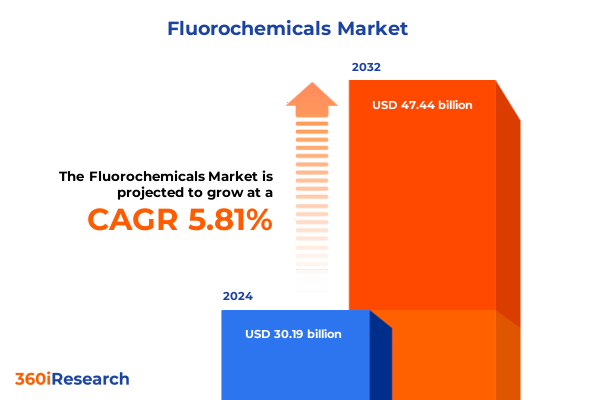

The Fluorochemicals Market size was estimated at USD 31.83 billion in 2025 and expected to reach USD 33.56 billion in 2026, at a CAGR of 5.86% to reach USD 47.44 billion by 2032.

Comprehensive Exploration of Fluorochemicals Unveiling Their Pivotal Roles in Industrial Applications, Innovation Trends, and Strategic Implications

The fluorochemical sector underpins a vast array of modern industries by delivering unique chemical properties that enable advanced performance characteristics. From providing exceptional thermal stability and chemical resistance in engineering plastics to facilitating precision etching in semiconductor fabrication, these specialized compounds have become indispensable across multiple end-use environments. In recent years, rapid advancements in fluoropolymer technologies and growing demand for low global warming potential refrigerants have highlighted the strategic significance of these materials for businesses seeking to enhance product performance and meet evolving regulatory standards.

Further amplifying the importance of fluorochemicals is the convergence of stringent environmental regulations and sustainability initiatives. Policymakers worldwide are phasing out high-global-warming-potential hydrofluorocarbon blends while incentivizing research into next-generation alternatives. In parallel, industries such as electronics and aerospace are escalating their quality requirements, driving the development of novel fluorosurfactants and fluoroelastomers that can withstand extreme operating conditions. As a result, companies are forging partnerships across the chemical value chain to accelerate innovation and optimize production processes. This introduction establishes the foundation for understanding key drivers that are reshaping the market and underscores the strategic implications for stakeholders evaluating growth and investment opportunities in this dynamic field.

Identifying the Paradigm Shifts Reshaping the Fluorochemical Landscape Through Regulatory Evolution, Technological Breakthroughs, and Sustainability Imperatives

The fluorochemical landscape is experiencing a series of paradigm shifts propelled by evolving regulatory frameworks, groundbreaking technological advancements, and an unwavering focus on environmental stewardship. Notably, new global mandates aimed at reducing the carbon footprint of refrigerants and industrial gases have compelled manufacturers to explore low-global-warming-potential hydrofluoroolefin formulations and perfluorocarbon alternatives. Concurrently, rapid progress in deposition and etching technologies-particularly chemical vapor deposition and plasma etching-has expanded the applicability of fluoropolymers within next-generation microelectronics and coating solutions.

Meanwhile, digital transformation initiatives are optimizing supply chain visibility and process efficiency, enabling producers to anticipate raw material shortages and adjust production schedules in real time. Add to this the increasing adoption of circular economy principles, which drive the recycling of fluoropolymer waste streams and recovery of high-value fluorinated gases, and a holistic picture emerges of a market in transition. As these converging forces redefine value creation across the chemical value chain, companies that proactively align their R&D portfolios and operational frameworks with these shifts are best positioned to capture emerging opportunities and mitigate the risks associated with rapid market change.

Analyzing the Cumulative Economic and Operational Consequences of United States Tariff Measures on Fluorochemical Imports and Supply Chains in 2025

The introduction of new tariff measures by the United States in 2025 has had a pronounced effect on the import and procurement strategies of fluorochemical end-users and producers. While the intent of these tariffs centers on safeguarding domestic manufacturing capabilities, the resulting increase in landed costs for key fluoropolymer and fluorosurfactant intermediates has prompted buyers to reevaluate their sourcing networks. Several multinational producers have responded by redirecting volumes to local affiliates and investing in domestic capacity expansions to restore cost competitiveness and ensure uninterrupted supply.

In addition to cost pressures, these tariff measures have accelerated the consolidation of supply chains by compelling companies to strengthen relationships with compliant raw material suppliers. Forward-thinking organizations are leveraging this disruption to negotiate value-added partnerships that combine toll-manufacturing services with technology transfer agreements. As a result, the cumulative impact of the 2025 tariffs extends beyond immediate price adjustments to encompass broader strategic realignments. These developments highlight the critical need for industry stakeholders to continuously monitor trade policy shifts and adapt procurement models to sustain operational resilience and maintain product quality.

Delivering Deep Insights into Fluorochemical Market Segmentation by Compound Type, Technology, Product Form, End-Use Industry, and Application

A nuanced understanding of fluorochemical market segmentation reveals distinct drivers and application requirements across compound classes, production technologies, product forms, end-use industries, and application areas. When organized by compound type, the market encompasses fluorinated gases, which include hydrofluorocarbons, hydrofluoroolefins, nitrogen trifluoride, perfluorocarbons, and sulfur hexafluoride, alongside fluoroelastomers, fluoropolymers such as ethylene tetrafluoroethylene, fluoroethylene propylene, perfluoroalkoxy, polytetrafluoroethylene, and polyvinylidene fluoride, as well as fluorosurfactants. Each compound class serves unique functions, ranging from high-performance insulating mediums in electrical equipment to ultra-durable coatings in chemical processing installations.

Meanwhile, technology-based segmentation highlights the prominence of chemical vapor deposition in semiconductor manufacturing, emulsion polymerization for fine-tuned polymer dispersions, and solution polymerization methods that yield fluoropolymers with tailored molecular weights. Innovations within plasma etching-particularly deep reactive ion etching and reactive ion etching-are advancing microfabrication capabilities, while suspension polymerization processes are delivering enhanced particle size control for granular and powder forms. The choice of product form itself, be it emulsion, film, granule, pellet, or powder, directly influences handling, dispersion, and end-product performance characteristics across major applications.

Turning to end-use industries, aerospace, automotive, electronics, industrial processing, and medical sectors each leverage fluorochemicals to address stringent safety and performance criteria. Within these sectors, key application segments such as etching processes, pharmaceutical intermediates, propellant formulations, refrigerant solutions, specialized solvents, and surface treatments drive tailored product development and quality standards. By weaving together these multidimensional segmentation lenses, industry leaders can pinpoint high-value market niches and devise targeted growth strategies aligned with evolving customer demands.

This comprehensive research report categorizes the Fluorochemicals market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Compound Type

- Technology

- Product Form

- End-Use Industry

- Application

Highlighting Critical Regional Variations in Demand, Regulation, and Innovation Across the Americas, Europe, Middle East and Africa, and Asia-Pacific

Regional dynamics play an instrumental role in shaping fluorochemical demand patterns, regulatory pressures, and innovation pathways. In the Americas, end-users benefit from integrated supply chains and well-established regulatory frameworks that have historically driven the adoption of advanced refrigerants and surface treatments. The United States leads the way in environmental policy enforcement, while Canada is emerging as a hub for specialty fluoropolymer production, channeling research collaborations between academia and industry.

Across Europe, the Middle East, and Africa, the interplay between the European Union’s stringent chemical registration requirements and the Middle Eastern drive for industrial diversification creates a dual-track market environment. EU policies on fluorinated gas emissions are among the most rigorous globally, fostering demand for next-generation low-global-warming-potential compounds, while selective incentives in EMEA markets are encouraging regional manufacturing investments to reduce import dependency. This regulatory complexity coexists with the region’s growing focus on civilian and defense aerospace programs that rely heavily on high-performance fluoroelastomers and fluorosurfactants.

Turning to Asia-Pacific, rapid industrialization and the ongoing expansion of electronics and automotive manufacturing are fueling considerable fluorochemical consumption. Major regional players are investing in domestic capacity expansions to support rising demand for semiconductor etching processes and medical device coatings. Consequently, Asia-Pacific has become a crucible for competitive innovation, as local and global suppliers alike collaborate to deliver cost-efficient, high-quality offerings tailored to dynamic market requirements.

This comprehensive research report examines key regions that drive the evolution of the Fluorochemicals market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Moves and Competitive Landscapes Among Leading Fluorochemical Manufacturers Driving Innovation and Market Positioning

The competitive landscape of the fluorochemical industry is defined by a mix of global chemical conglomerates and specialized regional players who vie to lead in performance, sustainability, and technology. Leading manufacturers are channeling substantial resources into research and development efforts to create fluoropolymers with enhanced thermal and chemical stability, lower environmental impact fluorinated gases, and next-generation fluoroelastomer compounds that exceed industry standards for durability.

Strategic partnerships and joint ventures are also reshaping the competitive dynamics, with companies forging alliances that combine proprietary technologies with regional manufacturing expertise. Several market players have invested in downstream integration by establishing toll-manufacturing sites adjacent to major consumer industries, thereby reducing lead times and strengthening customer relationships. Meanwhile, acquisitions of niche specialty firms are enabling larger incumbents to augment their product portfolios with high-value additives and surfactant chemistries.

Supply chain resilience remains a key competitive differentiator. Companies that have diversified their raw material sourcing and invested in redundant production lines are better equipped to navigate external disruptions such as logistical bottlenecks or trade policy adjustments. As a result, these firms not only maintain consistent service levels but also reinforce trust among end users who depend on uninterrupted access to critical fluorochemical inputs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fluorochemicals market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGC Inc.

- Air Products & Chemicals, Inc.

- Alufluor AB

- Arkema SA

- Chukoh Chemical Industries, Ltd.

- Daikin Industries, Ltd.

- Derivados del Fluor, S.A.U.

- DIC Corporation

- E.I. du Pont de Nemours and Company

- Gujarat Fluorochemicals Limited

- Halocarbon Products Corporation

- Halopolymer OJSC

- Kureha Corporation

- Linde plc

- Mitsubishi Gas Chemical Company, Inc.

- Navin Fluorine International Limited

- Orbia

- Shandong Dongyue Group Co., Ltd.

- Shanghai 3F New Materials Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Solvay SA

- The 3M Company

- The Chemours Company

- Zhejiang Juhua Co., Ltd.

- Zhejiang Sanhuan Chemical Industrial Co., Ltd.

Offering Strategic Initiatives to Enhance Supply Chain Resilience, Sustainability Practices, and Technological Adoption for Industry Leaders

Industry leaders stand to gain by adopting a forward-looking approach that emphasizes sustainability, digitalization, and strategic collaboration. By accelerating the transition to low-global-warming-potential fluorinated gases and investing in closed-loop recovery systems, companies can reduce environmental impact while complying with evolving regulatory frameworks. In parallel, leveraging advanced analytics and real-time monitoring platforms can optimize production yields and minimize process inefficiencies, strengthening cost competitiveness.

Moreover, forming cross-sector alliances with end-users and technology providers can unlock co-development opportunities that align product innovation with specific application requirements. Collaborative investment in pilot facilities dedicated to novel plasma etching techniques or customized polymer blends enables manufacturers to validate product performance under real-world conditions, thereby shortening time to market. Finally, ensuring supply chain agility through dual-sourcing strategies and strategic inventory positioning will mitigate exposure to external shocks and secure uninterrupted access to critical raw materials.

Taken together, these recommendations provide a roadmap for fluorochemical companies seeking to balance growth aspirations with environmental and economic imperatives. By integrating sustainability targets, digital capabilities, and partnership ecosystems into their strategic playbooks, industry leaders can reinforce resilience and capture new value in an increasingly competitive global market.

Detailing Rigorous Research Methodology Incorporating Primary Interviews, Secondary Analysis, and Expert Consultations to Ensure Data Integrity

The research underpinning this analysis employs a rigorous, multi-tiered methodology designed to ensure the highest levels of data integrity and relevance. Primary research comprised in-depth interviews with senior executives across the fluorochemical value chain, leveraging the insights of R&D leaders, procurement specialists, and regulatory affairs experts. These firsthand perspectives were complemented by secondary research activities, which included an exhaustive review of technical journals, patent filings, environmental compliance filings, and industry association publications.

Expert consultations formed a critical pillar of the methodology. Leading academics, industry consultants, and policy analysts were engaged to validate key assumptions, interpret emerging regulatory trends, and assess the impact of technological breakthroughs. Where applicable, quantitative data from trade databases and customs records were analyzed to identify shifts in import and export flows, particularly in light of the 2025 tariff changes. Finally, all findings were triangulated through cross-verification exercises, ensuring consistency across diverse information sources and safeguarding against biases.

This structured approach enables decision-makers to rely on a balanced combination of qualitative insights and quantitative evidence, delivering a comprehensive view of the fluorochemical market. Such methodological rigor is essential for navigating the complexities of a sector driven by rapid innovation, shifting regulations, and dynamic end-use requirements.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fluorochemicals market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fluorochemicals Market, by Compound Type

- Fluorochemicals Market, by Technology

- Fluorochemicals Market, by Product Form

- Fluorochemicals Market, by End-Use Industry

- Fluorochemicals Market, by Application

- Fluorochemicals Market, by Region

- Fluorochemicals Market, by Group

- Fluorochemicals Market, by Country

- United States Fluorochemicals Market

- China Fluorochemicals Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing Core Insights and Strategic Imperatives Shaping the Future of the Fluorochemical Industry in a Rapidly Evolving Global Environment

This executive summary has illuminated the key dynamics shaping the fluorochemical industry, from the transformative impact of regulatory evolution and technological innovation to the strategic realignments driven by recent tariff measures. By examining the market through the lenses of compound classification, production processes, product formats, end-use sectors, and application areas, stakeholders gain a granular understanding of evolving customer needs and performance requirements. Regional insights underscore the significance of localized regulatory frameworks and supply chain structures, while competitive analysis highlights the strategic maneuvers of leading manufacturers seeking to fortify their market positions.

Looking ahead, the fluorochemical landscape will continue to evolve in response to environmental imperatives, digital transformation, and shifting trade policies. Organizations that align their portfolios with sustainability goals, optimize their operations through advanced process analytics, and cultivate collaborative partnerships will be best positioned to navigate uncertainty and capitalize on emerging opportunities. As the industry moves toward circular economy models and next-generation chemistries, the insights captured in this summary serve as a strategic compass, guiding stakeholders toward informed decisions and resilient growth strategies.

In conclusion, the interplay of regulation, innovation, and competitive dynamics will define the trajectory of the fluorochemical sector. Engaging with these insights empowers executives to anticipate market shifts and formulate responsive strategies that deliver both operational excellence and long-term value creation.

Connect with Associate Director Ketan Rohom to Secure Comprehensive Market Intelligence and Drive Informed Decision Making in Fluorochemical Strategies

Thank you for exploring the vital insights into the fluorochemical landscape. To capitalize on the full spectrum of strategic intelligence and practical guidance outlined in this report, reach out to Associate Director Ketan Rohom. By engaging in a one-on-one consultation, you can tailor the comprehensive findings to your organization’s unique priorities, unlock deeper data-driven perspectives, and accelerate decision-making processes. This personalized dialogue ensures that you harness the report’s nuanced analysis-from tariff implications and segmentation deep dives to regional outlooks and competitive intelligence-to inform your next moves. Connect directly with Ketan Rohom to secure exclusive access to the complete study and begin transforming these insights into actionable outcomes that drive sustainable growth, operational resilience, and technological leadership within the dynamic fluorochemical market.

- How big is the Fluorochemicals Market?

- What is the Fluorochemicals Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?