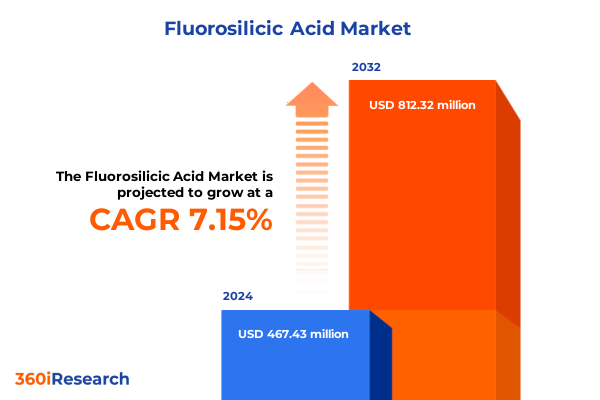

The Fluorosilicic Acid Market size was estimated at USD 493.43 million in 2025 and expected to reach USD 524.95 million in 2026, at a CAGR of 7.38% to reach USD 812.32 million by 2032.

Understanding the Fundamental Role of Fluorosilicic Acid and Its Critical Function Across Diverse Industry Applications

Fluorosilicic acid has emerged as an essential chemical in numerous industrial processes, ranging from water treatment to agricultural applications. While its technical name may remain unfamiliar to many decision-makers, its functional importance is profound. This colorless, acidic solution of silicon tetrafluoride carries the capacity to inhibit scale formation, adjust pH levels, and serve as a fumigant, making it indispensable for operators aiming to maintain operational efficiency and regulatory compliance. In recent years, the convergence of aging infrastructure challenges and heightened environmental standards has further underscored its role in modern industrial portfolios.

Moreover, the market dynamics for fluorosilicic acid continue to evolve against a backdrop of increasing water scarcity and growing demands for sustainable practices. End-users across sectors such as municipal water treatment and enhanced oil recovery are pushing suppliers to innovate with higher-purity grades and more robust distribution models. As a result, stakeholders from chemical manufacturers to end-use processors find themselves at a critical juncture, seeking actionable intelligence to navigate supply chain complexities and leverage fluorosilicic acid’s multifunctional benefits. This introduction sets the stage for a deeper analysis of the transformative shifts, trade policy impacts, and segmentation nuances defining the market today.

Examining the Major Technological Innovations and Regulatory Evolutions Shaping Fluorosilicic Acid Markets Around the World

The landscape for fluorosilicic acid is undergoing significant transformation driven by both technological innovation and evolving regulatory frameworks. In water treatment, for instance, digital monitoring platforms have been integrated into dosing systems, enabling real-time adjustments that reduce chemical waste and ensure compliance with tightening discharge limits. Simultaneously, advances in membrane separation technologies are prompting manufacturers to explore hybrid dosing strategies, blending fluorosilicic acid with alternative inhibitors to optimize both performance and cost efficiency.

Regulatory evolutions have also compelled producers to enhance their quality control measures. Stricter standards for trace metal contaminants and silica concentrations have led to substantial investments in purification processes, particularly for the food grade and pharmaceutical grade segments. As a result, technical grade suppliers are differentiating themselves through proprietary filtration systems and on-site analytic services. These shifts reflect a broader trend toward sustainable supply chain management, where transparency and environmental stewardship are now as crucial as traditional metrics like yield and purity.

Analyzing the Comprehensive Consequences of United States Tariff Adjustments on Fluorosilicic Acid Supply Chains in 2025

In 2025, the United States implemented revised tariff measures targeting a range of specialty chemicals, including fluorosilicic acid. These adjustments imposed additional duties on imported volumes, particularly from key producing regions in Asia and Europe. The cumulative effect has been an immediate uptick in landed costs for downstream users, catalyzing a search for domestic sources or tariff-exempt alternatives. Many water treatment firms have responded by entering long-term agreements with regional producers, while agricultural chemical formulators are evaluating blends that reduce reliance on imported acid.

Beyond cost implications, the tariff changes have heightened supply chain volatility. U.S. distributors now face unpredictable lead times as vessel space and port throughput become constrained by quota restrictions. In turn, some entities are embracing blended supply strategies that combine bulk shipments with drum-based emergency reserves to smooth out fluctuations. Meanwhile, manufacturers are reevaluating regional inventory hubs to mitigate the risk of shipment delays. This recalibration underscores the imperative for agile procurement frameworks capable of adapting to fiscal policy shifts without compromising operational continuity.

Deriving Deep Insight from Multi-Dimensional Segmentation Parameters in Fluorosilicic Acid Markets Spanning Purity to End Use Applications

A nuanced understanding of market segmentation reveals how fluorosilicic acid demand unfolds across multiple dimensions of type, purity, distribution, packaging, end-use, and application. When categorized by type, the food grade segment is driven by stringent safety protocols in beverage production, whereas pharmaceutical grade captures niche demand for injectable drug manufacturing. Technical grade remains the workhorse for water treatment and industrial scale inhibition, benefiting from larger batch volumes and more lenient purity requirements.

Examining purity grade offers additional clarity. Products boasting above thirty percent purity command premiums in high-demand applications like boiler corrosion inhibition, while concentrations from twenty to thirty percent strike a balance between efficacy and cost for large-scale cooling systems. Below twenty percent grades tend to serve less critical fumigation and pH control roles. Distribution channels likewise shape market access. Direct sales agreements between producer and end-user facilitate customized service packages, whereas distributor networks enable smaller-scale purchases and last-mile logistics in remote geographies.

Packaging insights further illustrate end-user preferences. Bulk deliveries minimize handling costs and are favored by municipal water authorities, even as drum-packaged units provide flexibility for pesticide production lines and enhanced oil recovery operations. Segmentation by end use industry captures divergent growth drivers: fertilizer manufacturing leverages fluorosilicic acid for micronutrient delivery, while pesticide producers utilize its fumigant properties. Enhanced oil recovery and well stimulation within oil and gas demand consistent quality, and industrial versus municipal water treatment distinguish between large-scale throughput and strict compliance priorities. Finally, the application framework underscores specialization: corrosion inhibition in boilers and cooling systems, fumigation for pest control, pH control for neutralization processes, and scale inhibition in heat exchangers and industrial boilers. Each segment’s nuances guide suppliers in tailoring product portfolios and service offerings to meet evolving user requirements.

This comprehensive research report categorizes the Fluorosilicic Acid market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Purity Grade

- Distribution Channel

- Packaging

- End Use Industry

- Application

Mapping Regional Variances and Strategic Opportunities for Fluorosilicic Acid Adoption Across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics for fluorosilicic acid reflect both established consumption patterns and emerging areas of growth. Within the Americas, North American water utilities are upgrading treatment plants to address legacy infrastructure, driving steady demand for high-purity acid. Meanwhile, Latin American agricultural sectors are increasing pesticide manufacturing capacities in response to expanding export markets, which in turn stimulates technical grade requirements. Cross-border trade within the region remains robust, supported by streamlined customs protocols under regional trade agreements.

In Europe, Middle East, and Africa, regulatory stringency in the European Union continues to shape supplier investments in analytical capabilities and eco-friendly packaging. Oil-rich economies across the Middle East retain significant demand for enhanced oil recovery formulations, prompting specialty acid customizations to meet reservoir conditions. Meanwhile, municipal expansion projects in African nations focus on basic water treatment, boosting requirements for cost-effective, lower-purity grades that can be dispatched in durable drum packaging.

Asia-Pacific markets exhibit the fastest pace of change. Rapid urbanization in Southeast Asia is fueling industrial water treatment infrastructure, creating opportunities for high-efficiency scale inhibitors. In China and India, domestic chemical producers are scaling purification capacities to serve both local and export markets, using direct sales models augmented by digital ordering platforms. Across the region, environmental regulations are tightening, compelling companies to adopt advanced pH control and corrosion inhibition systems. These regional disparities underscore why a global perspective must be complemented by tailored market entry and distribution strategies.

This comprehensive research report examines key regions that drive the evolution of the Fluorosilicic Acid market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players Driving Innovation and Competitive Dynamics in the Global Fluorosilicic Acid Market

A handful of leading chemical companies command substantial influence over the fluorosilicic acid market through integrated production networks and diversified portfolios. Major European producers have leveraged existing silicon tetrafluoride feedstock operations to secure cost advantages, while North American firms maintain strong distribution platforms that emphasize technical support and on-site analytics. In parallel, specialty chemical players in the Asia-Pacific region are expanding their purification lines to capture both domestic utility contracts and international export agreements.

Competitive dynamics are characterized by strategic partnerships and capacity expansions. Several incumbents have formed joint ventures to accelerate the development of high-purity grades tailored for pharmaceutical and food applications. Others have invested in next-generation filtration and crystallization technologies, seeking to reduce residual mineral content and comply with evolving global standards. Meanwhile, distributor alliances continue to play a critical role in penetrating fragmented markets, ensuring product availability in remote industrial hubs. Together, these company-level initiatives shape a market where scale, technical innovation, and strategic alliances underpin success.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fluorosilicic Acid market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akdeniz Kimya Sanayi ve Ticaret Anonim Şirketi

- American Elements

- Chemtrade Logistics Income Fund

- Gelest Inc.

- Hubei Xingfa Chemicals Group Co., Ltd.

- Hydrite Chemical Co.

- Morita Chemical Industries Co., Ltd.

- Occidental Chemical Corporation

- OCP S.A.

- PhosAgro PJSC

- Prayon S.A.

- Sigma-Aldrich Corporation

- Solvay S.A.

- Tessenderlo Group N.V.

- The Mosaic Company

- Univar Solutions Inc.

Empowering Industry Leaders with Proactive Strategies to Optimize Growth and Resilience in Fluorosilicic Acid Operations

Industry leaders should proactively invest in advanced purification technologies that elevate product quality and open doors to high-value segments such as pharmaceuticals and food processing. By securing strategic partnerships with research institutions and technology providers, companies can accelerate development timelines and differentiate on the basis of trace impurity profiles. Concurrently, strengthening relationships with key end-use industries through co-development programs can foster loyalty and drive long-term volume commitments.

Supply chain diversification remains equally critical. Firms must evaluate the balance between ownership of domestic production assets and reliance on imported volumes, especially in light of ongoing tariff uncertainties. Establishing modular inventories and flexible packaging capabilities permits rapid response to regional demand spikes without the burden of excess capital tied up in single-mode transport arrangements. Finally, embedding digital monitoring tools across the supply chain enhances transparency, enabling real-time risk management and ensuring continuity in volatile market conditions.

Unveiling a Robust and Transparent Research Framework Ensuring Rigor and Reliability in Fluorosilicic Acid Market Analysis

Our research methodology integrates both qualitative and quantitative techniques to ensure validity and depth of insight. Primary interviews were conducted with senior executives across the supply chain, including chemical manufacturers, distributors, and end-user procurement officers. These discussions were complemented by consultations with industry experts in water treatment and oil and gas engineering, ensuring that key practical considerations were captured.

Secondary research drew upon publicly available government documents, peer-reviewed technical journals, and patent filings to triangulate findings on production processes and regulatory requirements. Data on trade flows and tariff schedules were analyzed to quantify the impact of policy changes, while supply chain modeling assessed lead times and cost implications. All results were reviewed through an internal quality assurance process to validate consistency and accuracy, providing a robust foundation for the strategic recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fluorosilicic Acid market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fluorosilicic Acid Market, by Type

- Fluorosilicic Acid Market, by Purity Grade

- Fluorosilicic Acid Market, by Distribution Channel

- Fluorosilicic Acid Market, by Packaging

- Fluorosilicic Acid Market, by End Use Industry

- Fluorosilicic Acid Market, by Application

- Fluorosilicic Acid Market, by Region

- Fluorosilicic Acid Market, by Group

- Fluorosilicic Acid Market, by Country

- United States Fluorosilicic Acid Market

- China Fluorosilicic Acid Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Synthesizing Key Takeaways and Strategic Imperatives to Propel Future Success in the Fluorosilicic Acid Market

In synthesizing the key discoveries from this executive summary, several strategic imperatives emerge. The convergence of technological innovation and regulatory evolution is reshaping product development and service delivery, demanding that suppliers adopt integrated purification and monitoring capabilities. Trade policy volatility, notably the United States tariff adjustments of 2025, underscores the importance of flexible sourcing strategies and inventory management to maintain continuity and cost competitiveness.

Looking ahead, stakeholders who harness multi-dimensional segmentation insights can more precisely target high-value end-use verticals, from municipal water treatment to pharmaceutical applications. Regional variances highlight the necessity for tailored market entry approaches across the Americas, EMEA, and Asia-Pacific landscapes. As the market advances, success will depend on proactive collaboration between producers, distributors, and end users to co-innovate solutions that address both performance and sustainability goals. With a clear understanding of these dynamics, companies are well positioned to capitalize on emerging opportunities in the fluorosilicic acid ecosystem.

Take the Next Step Towards Comprehensive Fluorosilicic Acid Intelligence by Connecting with Ketan Rohom to Access the Full Market Research Report

To gain the detailed insights and strategic frameworks outlined in this executive summary, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in guiding stakeholders through complex chemical market landscapes ensures a tailored discussion on how this research can drive value for your organization. Reach out today to secure your access to the full report and begin transforming your fluorosilicic acid strategy with data-driven intelligence.

- How big is the Fluorosilicic Acid Market?

- What is the Fluorosilicic Acid Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?