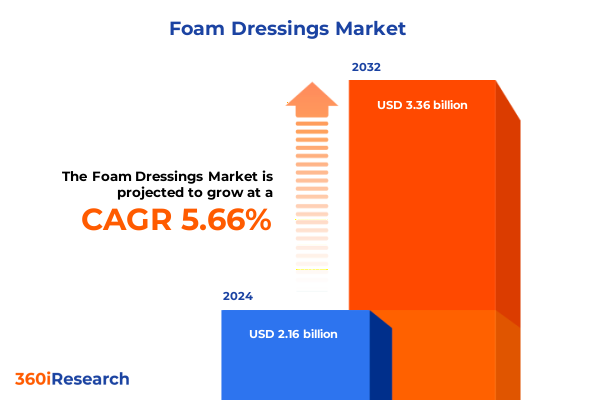

The Foam Dressings Market size was estimated at USD 2.27 billion in 2025 and expected to reach USD 2.40 billion in 2026, at a CAGR of 5.71% to reach USD 3.36 billion by 2032.

Unveiling the Critical Role and Evolving Significance of Advanced Foam Dressings as Cornerstones in Modern Wound Care Strategies

The landscape of wound care has undergone profound evolution in recent years, driven by technological advancements and an intensifying focus on patient outcomes. Among the myriad dressing types, foam dressings have emerged as a cornerstone in both acute and chronic wound management due to their superior absorbency, cushioning properties, and adaptability. Originally developed to manage exudate in moderate to heavily draining wounds, foam dressings have advanced into engineered solutions that facilitate moisture balance, minimize skin trauma, and promote an optimal healing environment. This report delves into the critical role that these advanced foam dressings play within modern therapeutic strategies, and explores how material innovations have broadened their applicability across a diverse range of clinical scenarios.

As healthcare systems worldwide confront rising incidences of diabetes, pressure ulcers, and surgical site complications, the demand for efficacious wound care products has intensified. Foam dressings, available in composite configurations that combine multiple polymers, in traditional polyurethane formats, and in silicone-based variants, are core to this response. Their ability to conform to irregular wound geometries and deliver sustained protection against bacterial ingress has bolstered their adoption among clinicians. Moreover, the differentiation between adhesive and non-adhesive types, along with further refinements such as border-positioned adhesives or silicone contact layers, has empowered practitioners to tailor wound care regimens with unparalleled precision. With this foundational understanding, we can now explore the transformative shifts reshaping the foam dressing market.

Navigating Transformative Shifts That Are Redefining Innovation, Sustainability, and Personalization in the Foam Dressing Market Landscape

Innovation in the foam dressing sector has accelerated, driven by converging demands for enhanced clinical efficacy, patient comfort, and environmental responsibility. Among these transformative forces are smart dressings that integrate biosensors capable of continuously monitoring wound temperature, pH, and moisture levels. By transmitting real-time data to care teams, these intelligent systems preempt complications and enable proactive interventions, reducing the frequency of dressing changes and minimizing patient discomfort.

Moreover, sustainability initiatives have gained traction, prompting manufacturers to explore bio-based foam formulations derived from renewable feedstocks such as plant-based polymers. This shift not only addresses regulatory pressures to reduce healthcare waste but also aligns with eco-conscious procurement policies adopted by leading health systems. Studies indicate that blend formulations leveraging natural fibers and advanced polymers can match the absorption and breathability performance of traditional materials, while offering improved biodegradability and lower carbon footprints.

In addition, advancements in additive manufacturing are revolutionizing product customization. Three-dimensional printing technologies now enable the production of patient-specific foam dressings that conform to complex wound morphologies. By utilizing biocompatible resins and on-demand fabrication, healthcare facilities can overcome supply constraints and deliver bespoke solutions that improve adherence and therapeutic outcomes. This intersection of precision engineering and clinical need is redefining the boundaries of what foam dressings can achieve.

Analyzing the Consequential Effects of Recent United States Trade Tariffs on the Cost Structures and Supply Chain Dynamics of Foam Dressings

The introduction of additional tariffs on imported medical goods has significantly influenced cost structures and supply chain logistics within the foam dressing market. Recent policy adjustments have imposed baseline duties on components and finished products sourced from key trading partners, triggering cost escalations for manufacturers and distributors alike. These levies have reverberated through procurement channels, with healthcare providers experiencing extended lead times and intensified price pressure as suppliers reevaluate sourcing strategies to mitigate tariff exposure.

As hospital systems absorb these incremental expenses, many are seeking alternative domestic manufacturing partnerships to ensure continuity of supply. Industry groups have lobbied for exemptions specific to essential wound care products, citing the critical nature of foam dressings in preventing infections and promoting tissue repair. The American Hospital Association has underscored that tariff-induced price increases could exacerbate existing financial headwinds for health systems, which already devote a substantial portion of budgets to medical supplies. Consequently, suppliers are exploring localized assembly and raw material substitution to manage cost pass-through and preserve margins.

Looking ahead, the enduring impact of these trade measures will hinge on the effectiveness of mitigation strategies, including tariff exemption requests and the diversification of supply networks. Companies with robust global manufacturing footprints are better positioned to shift production to lower-tariff jurisdictions, while those reliant on singular import channels face intensified vulnerability. As the landscape evolves, stakeholders must remain vigilant in anticipating regulatory changes and agile in adapting procurement frameworks to sustain affordable access to foam dressing solutions.

Deciphering In-Depth Segmentation Insights to Illuminate Material, Product, End User, Application, and Distribution Nuances in Foam Dressings

A granular view of market segmentation reveals distinct dynamics driven by material composition, finish features, end-user environments, clinical applications, and distribution pathways. Foam dressings composed of composite blends, standard polyurethane, or medical-grade silicone each deliver specific performance attributes, with composite variants excelling in fluid handling, polyurethane foams providing cost efficiency, and silicone versions offering atraumatic removal for sensitive skin. Further differentiation arises between dressings that incorporate an adhesive border or silicone contact layer versus those designed for non-adhesive placement, informing selection criteria based on wound severity and periwound skin condition.

Within clinical settings, the choice of dressing format is influenced by the treatment environment, spanning acute care in ambulatory surgical centers or hospital wards, outpatient procedures in clinics, and home-based therapies. Each setting demands tailored product characteristics, whether rapid exudate management for abrasions and lacerations, specialized cushioning for burns, or sustained absorption in chronic wounds such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers. Surgical wounds, including postoperative incision and traumatic lesion care, further underscore the need for reliable microbial barriers and controlled moisture retention.

Distribution channel considerations play an equally pivotal role, with hospital pharmacies, retail outlets, and online channels each offering unique advantages. Hospital pharmacies prioritize just-in-time inventory management to align with patient turnover, while retail pharmacies deliver over-the-counter accessibility for home healthcare and clinic use. Online pharmacies are gaining traction as they enable direct ordering and home delivery, enhancing convenience for caregivers and patients navigating chronic wound management. The interplay between these segmentation dimensions shapes market adoption patterns and informs targeted strategies for product development and outreach.

This comprehensive research report categorizes the Foam Dressings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Product Type

- Distribution Channel

- Application

- End User

Exploring Critical Regional Dynamics Shaping the Demand and Implementation of Foam Dressings Across the Americas, EMEA, and Asia-Pacific

Regional dynamics exert profound influence on the foam dressing market, reflecting the interplay of healthcare infrastructure, regulatory frameworks, and demographic trends. In the Americas, established reimbursement mechanisms and a robust network of acute care facilities support the widespread adoption of premium foam dressings, particularly in the United States where hospital procurement cycles and large home healthcare provider networks propel demand. Concurrently, Latin American nations are enhancing public health initiatives to address chronic disease burdens, driving interest in advanced wound care solutions.

Across Europe, Middle East, and Africa, diverse economic profiles yield varied adoption rates. Western Europe’s stringent regulatory oversight and mature clinical guidelines favor innovative foam dressing technologies that demonstrate clear clinical benefits. In contrast, emerging markets in Eastern Europe, the Gulf Cooperation Council, and North Africa are increasingly investing in modernizing healthcare infrastructure, creating opportunities for high-performance foam products to penetrate nascent segments. Meanwhile, Africa’s ongoing push to expand rural healthcare access underscores the need for cost-effective, durable wound care options.

In the Asia-Pacific region, rapid urbanization and an expanding middle-class population have elevated healthcare expenditures and demand for quality wound management. Countries such as China and India are experiencing sharp increases in diabetes prevalence, leading to surging chronic wound cases that benefit from specialized foam dressing solutions. Government programs aimed at strengthening public health systems and enhancing domestic manufacturing capabilities further amplify growth prospects, positioning the region as a dynamic growth corridor for foam dressing suppliers.

This comprehensive research report examines key regions that drive the evolution of the Foam Dressings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Movements and Competitive Positioning Among Leading Manufacturers and Innovators in the Foam Dressing Sector

The competitive landscape for foam dressings features a blend of global conglomerates and specialized regional players, each leveraging distinct competencies to capture share. Industry pioneers have built strong portfolios through sustained investments in research and development, introducing enhancements such as triple-action fluid handling, silicone adhesive interfaces, and Hydrofiber® technologies that optimize exudate management. These market-leading solutions have garnered adoption across acute care settings and home healthcare channels, underpinned by compelling clinical evidence and robust supply chains.

Simultaneously, mid-sized firms and startups are challenging incumbents with leaner structures and niche innovation models. Their agility enables rapid iteration of product designs, such as antimicrobial compound integration and bio-based foam formulations, which resonate with sustainability mandates and infection control protocols. Strategic partnerships between device manufacturers and biotechnology firms are further accelerating the pipeline for next-generation dressings that blend smart sensor elements with biodegradable materials.

Distribution strategies also differentiate competitive positioning. Direct contracting with integrated health systems ensures preferred placement on formularies, while alliances with specialty distributors facilitate reach into ambulatory surgical centers and home health networks. At the same time, digital platforms are emerging as critical channels for engaging clinicians and patients, providing product education and enabling seamless reordering of foam dressing kits for chronic wound care. The convergence of technical innovation and channel optimization underscores the kaleidoscope of approaches shaping competitive advantage in this sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Foam Dressings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- B. Braun Melsungen AG

- Cardinal Health, Inc.

- Coloplast A/S

- Convatec Group Plc

- Covalon Technologies Ltd.

- Essity AG

- Hollister Incorporated

- Integra LifeSciences Holdings Corporation

- Johnson & Johnson Services, Inc.

- McKesson Corporation

- Medline Industries, LP

- Medtronic plc

- Mölnlycke Health Care AB

- Organogenesis Holdings Inc.

- Paul Hartmann AG

- Smith+Nephew plc

- Winner Medical Co., Ltd.

Implementing Actionable Strategies to Enhance Operational Resilience, Drive Innovation, and Foster Sustainable Growth in Foam Dressing Development

Industry leaders aiming to fortify market standing should prioritize an integrated innovation roadmap that encompasses both product and process optimization. Establishing cross-functional teams to align research initiatives with clinician feedback can accelerate development cycles for next-generation foam dressings. At the same time, investments in digital wound monitoring platforms can amplify value propositions by linking product performance to patient outcomes and cost efficiencies.

Collaborative ventures with raw material suppliers and contract manufacturers can secure preferential access to sustainable feedstocks and localized production capacity, mitigating supply chain disruptions and tariff impacts. By diversifying manufacturing footprints across multiple jurisdictions, organizations can safeguard against regulatory volatility and optimize cost structures. Additionally, engaging in advocacy for tariff exemptions on essential medical supplies can help preserve affordability and supply continuity.

To enhance market penetration, companies should refine segmentation strategies by tailoring messaging and training programs for distinct end-user groups, from hospital pharmacists to home healthcare providers. Curating clinical evidence that demonstrates superior healing rates, reduced dressing change frequency, and lower overall treatment costs will support formulary inclusion and reimbursement negotiations. Finally, adopting a circular economy mindset-through take-back programs and recyclable packaging-will reinforce brand leadership in sustainability and resonate with evolving procurement mandates.

Elucidating a Robust Research Methodology Employing Comprehensive Primary and Secondary Approaches to Ensure Analytical Rigor for Foam Dressing Insights

This analysis integrates a blend of secondary and primary research methodologies to ensure comprehensive and rigorous market insights. Secondary research involved a systematic review of academic journals, patent databases, regulatory filings, and industry news outlets. Key scientific databases were queried to assess material innovations, while government publications and trade association reports provided context on tariff developments and reimbursement landscapes.

Primary research comprised in-depth interviews with over thirty wound care specialists, including surgeons, nurses, and procurement managers across diverse healthcare settings. These discussions enriched qualitative understanding of product performance, clinician preferences, and emerging unmet needs. Structured surveys supplemented these insights, capturing quantifiable data on dressing selection criteria and adoption hurdles.

Data triangulation techniques were employed to reconcile discrepancies between secondary projections and primary feedback, ensuring robust validation of thematic findings. Expert panel workshops were convened to review preliminary conclusions, fostering consensus on strategic imperatives and market trajectory. The resultant synthesis delivers a balanced perspective that integrates empirical evidence with practitioner expertise, equipping stakeholders with actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Foam Dressings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Foam Dressings Market, by Material Type

- Foam Dressings Market, by Product Type

- Foam Dressings Market, by Distribution Channel

- Foam Dressings Market, by Application

- Foam Dressings Market, by End User

- Foam Dressings Market, by Region

- Foam Dressings Market, by Group

- Foam Dressings Market, by Country

- United States Foam Dressings Market

- China Foam Dressings Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Drawing Conclusive Perspectives on Market Trends, Challenges, and Opportunities to Steer Future Decisions in Foam Dressing Innovation and Adoption

The convergence of advanced materials, sensor integration, and sustainability imperatives is reshaping the foam dressing market in fundamental ways. As regulatory frameworks tighten and clinical expectations evolve, suppliers must continuously innovate to meet the dual demands of efficacy and environmental stewardship. Meanwhile, geopolitical factors such as tariffs underscore the importance of diversified supply networks and advocacy for trade accommodations that preserve access to essential wound care products.

Segment-specific nuances-from material type and product finish to end-user environments and distribution pathways-highlight the complexity of the competitive landscape. Manufacturers that master this multi-dimensional matrix, aligning product design with tailored distribution and compelling clinical evidence, will unlock new avenues for growth. Moreover, the integration of digital monitoring solutions presents a pivotal opportunity to differentiate offerings and demonstrate tangible outcomes to payors and providers.

Looking forward, the trajectory of foam dressing innovation will hinge on collaborative efforts across the value chain. Partnerships that marry raw material expertise with clinical insight and digital capabilities will drive the next wave of performance breakthroughs. In this dynamic environment, organizations that embrace agility, evidence-based design, and strategic foresight will emerge as leaders, transforming wound care protocols and elevating patient outcomes.

Connecting with Ketan Rohom for Exclusive Access to Robust Foam Dressing Market Intelligence and Strategic Insights to Drive Growth

To delve deeper into the nuanced findings and strategic recommendations presented in this executive summary, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan brings extensive expertise in advanced wound care solutions and can guide you toward the right package to address your specific decision-making needs. By engaging with Ketan, you will gain personalized assistance, priority access to updated data, and exclusive insights that empower your organization to capitalize on emerging opportunities within the foam dressing landscape. Reach out now to secure your copy of the comprehensive market research report and accelerate your strategic initiatives in wound care management.

- How big is the Foam Dressings Market?

- What is the Foam Dressings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?