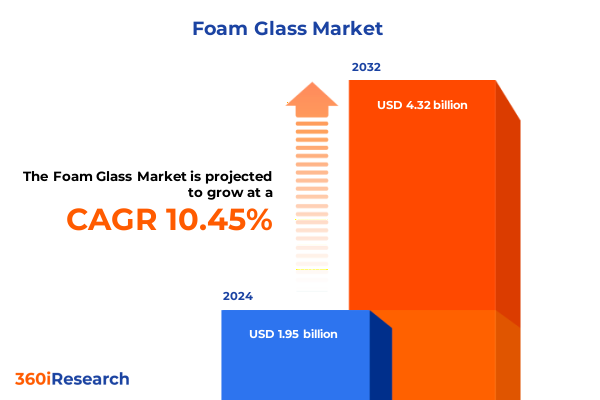

The Foam Glass Market size was estimated at USD 2.13 billion in 2025 and expected to reach USD 2.34 billion in 2026, at a CAGR of 11.31% to reach USD 4.52 billion by 2032.

Unlocking the Potential of Foam Glass as a Sustainable Solution in Construction Horticulture and Industrial Insulation Applications

Foam glass has emerged as a pivotal material across construction, horticulture, and industrial sectors, distinguished by its unique combination of thermal performance, sustainability, and durability. As organizations worldwide confront stricter energy regulations and heightened environmental expectations, foam glass offers a compelling solution that aligns with circular economy principles and green building certifications.

In construction, foam glass’s closed-cell structure and non-combustible profile address both insulation efficiency and fire safety, while in horticulture its inert composition and moisture resistance support soil amendments and hydroponic systems. Industrial applications increasingly leverage acoustic and mechanical insulation variants to protect sensitive equipment and maintain process stability under extreme conditions. In parallel, evolving design trends and the push for modular and prefabricated building approaches have further elevated foam glass’s role in modern construction methodologies.

This report delves into the critical drivers, challenges, and opportunities shaping the foam glass landscape, synthesizing insights across tariff developments, segmentation dynamics, regional trajectories, and competitive positioning. By examining these dimensions through a rigorous yet accessible lens, we provide decision makers with the clarity needed to capitalize on foam glass’s potential as a cornerstone of sustainable infrastructure and innovation.

How Technological Innovation Sustainability Mandates and Design Preferences Are Driving a Fundamental Transformation in the Foam Glass Sector

The foam glass market is experiencing a paradigm shift as technological breakthroughs, regulatory changes, and evolving stakeholder expectations converge. Innovations in manufacturing-such as the integration of nanoscale additives and hybrid composites-are elevating compressive strength and thermal conductivity to levels previously unattainable, unlocking new high-performance use cases in data centers, modular panels, and load-bearing structural elements.

At the same time, sustainability mandates and the rise of green building certifications like LEED and BREEAM are driving adoption, positioning foam glass as a preferred material for near-zero energy and net-zero projects. Producers are embracing circular economy principles by sourcing high-purity recycled glass and developing bio-binder foaming agents, thereby reducing reliance on virgin resources and lowering carbon footprints. These imperatives are further bolstered by smart building integration, where embedded sensors within foam glass insulation panels offer real-time monitoring of temperature and humidity, enhancing operational efficiency and maintenance forecasting.

Simultaneously, design preferences are shifting toward materials that combine aesthetics with performance. White foam glass finishes have gained traction in architectural facades and interior cladding, especially within high-end commercial developments in the United Arab Emirates and broader Middle East region, where advanced fire classification standards demand non-combustible solutions. As these transformative forces coalesce, foam glass is redefining the insulation and construction materials sector, creating a dynamic environment ripe for strategic investment and innovation.

Assessing the Cumulative Impact of Recent United States Tariff Measures on Foam Glass Imports and Domestic Supply Chains Heading into 2025

United States policy adjustments in early 2025 have significantly altered the cost structure for foam glass imports, particularly those originating from China. Effective February 4, 2025, the U.S. Customs and Border Protection abolished the de minimis duty exemption for shipments under $800, ensuring that all imports, regardless of value, are subject to full duty assessments. Concurrently, a universal 10 percent tariff was imposed on goods from China, including Hong Kong, additive to existing duty obligations.

These measures interact with preexisting Section 301 tariffs targeting Chinese products. Foam glass blocks classified under HTS 7016.90.10 face a base duty of 8 percent, while other foam glass articles under HTS 7016.90.50 carry a 5 percent base rate. When combined with the Section 301 surcharge of 25 percent and the new 10 percent China EO tariff, the cumulative duty burden for foam glass blocks can reach 43 percent, and 40 percent for other forms. This escalation has prompted importers to reevaluate sourcing strategies and inventory planning to mitigate cost volatility and maintain competitive pricing.

Domestic foam glass producers have seen an opportunity to strengthen supply chain resilience, investing in expanded manufacturing capacity and local partnerships to offset import pressures. At the same time, end users are exploring alternative raw material pools and long-term contracts to stabilize procurement costs. As the cumulative impact of these tariff layers becomes entrenched, industry stakeholders must remain vigilant, adapting pricing models and supply networks to navigate the evolving trade environment.

Key Insights from Multifaceted Segmentation Analysis Revealing Distinct Application Product Form End Use and Distribution Channel Dynamics

A multifaceted segmentation analysis reveals the nuanced ways foam glass applications, product forms, end uses, and distribution channels influence market dynamics. Within the construction domain, commercial and residential projects exhibit distinct insulation requirements and procurement cycles, while industrial demand bifurcates between acoustic insulation for noise-sensitive environments and mechanical insulation for temperature-critical systems. This underscores the need for tailored product portfolios that address project-specific performance and regulatory benchmarks.

Examining product forms, beads deliver exceptional versatility for grout and geotechnical fill, blocks provide structural integrity for sub-slab applications and floor leveling, and granules cater to soil amendment and lightweight concrete uses. This diversity in form factors necessitates production flexibility and innovation in particle sizing and coating technologies to meet evolving performance criteria.

End-use segmentation further delineates market opportunities, as fire protection demands rigorous non-combustibility and thermal stability, insulation solutions prioritize low thermal conductivity and moisture resistance, and landscaping and horticulture leverage foam glass’s inert nature and drainage properties. Each end-use channel presents unique formulation and certification challenges.

Distribution pathways-spanning institutional sales, OEM partnerships, value-added resellers, wholesale distributors, company websites, and e-commerce platforms-shape go-to-market strategies. Institutional channels emphasize long-term service agreements and technical support, while digital and e-commerce outlets accelerate product accessibility and customer engagement. Grasping these segmented insights enables manufacturers and service providers to optimize channel strategies and unlock latent demand.

This comprehensive research report categorizes the Foam Glass market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Form

- Distribution Channel

- Application

- End Use

Unveiling Regional Dynamics and Growth Drivers Across the Americas Europe Middle East Africa and Asia Pacific Foam Glass Markets

Regional market dynamics for foam glass vary markedly across the Americas, Europe Middle East and Africa, and Asia Pacific, underpinned by divergent regulatory landscapes, infrastructure investment priorities, and sustainability commitments. In the Americas, North American jurisdictions are witnessing accelerated adoption in modular construction and prefabricated panels, with over 500,000 cubic meters of foam glass utilized in 2023 for commercial and residential applications. Energy efficiency codes and tax incentives continue to bolster demand, driving manufacturers to deploy advanced automation in new production lines to meet scale and quality requirements.

In Europe Middle East and Africa, the push for climate-neutral buildings under the EU Green Deal and similar initiatives in Gulf Cooperation Council states is propelling foam glass integration in public infrastructure and high-end commercial towers. The material’s A1 fire classification under EN 13501-1 and compliance with circular economy regulations reinforce its appeal in these regions, where environmental declarations and life-cycle assessments are mandatory for major projects.

Asia Pacific remains the largest growth arena, driven by rapid urbanization, seismic-resilience requirements in Japan and South Korea, and expansive infrastructure programs in China and India. China’s recycling infrastructure supports over 3.1 million tons of glass waste processed in 2023, with approximately 12 percent allocated to foam glass manufacturing. In Japan, foam glass aggregates are increasingly specified for geotechnical fill in earthquake-prone zones to enhance foundation stability. These diverse regional trajectories underscore both unique challenges and tailored strategies needed to capture market share across global foam glass landscapes.

This comprehensive research report examines key regions that drive the evolution of the Foam Glass market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global Foam Glass Manufacturers Their Strategic Positions Innovation Capabilities and Competitive Differentiators in 2025

The competitive landscape of the foam glass industry is characterized by established multinationals and agile specialists. Owens Corning, following its acquisition of Pittsburgh Corning, remains a dominant force, leveraging its global footprint, integrated R&D capabilities, and extensive distribution network to advance the FOAMGLAS® brand across commercial and industrial sectors. Glapor, headquartered in Germany, has distinguished itself through automated continuous production processes and the introduction of high-strength blocks featuring compressive strengths 80 percent above conventional standards.

Liaver GmbH & Co. KG specializes in expanded glass granulate, supplying acoustic and board materials under proprietary formulations that emphasize recyclate content and low thermal conductivity. Misapor AG of Switzerland and Earthstone International of the United States are pioneering foam glass aggregates and modular panel systems, respectively, targeting sustainability-focused construction segments. Additional key participants include Uusioaines Oy in Finland, Zhejiang Dehe and Ningbo Yoyo Foam Glass in China, Polydros in Spain, and Refaglass in the Czech Republic, each contributing to regional supply chain resilience and product innovation.

These companies differentiate through strategic investments in green manufacturing, digital marketing channels, and end-to-end solution packages that combine insulation materials with accessories and technical services. By monitoring these competitive moves and partnerships, stakeholders can identify collaboration opportunities and anticipate shifts in market positioning.

This comprehensive research report delivers an in-depth overview of the principal market players in the Foam Glass market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AeroAggregates of North America, LLC

- Anhui Huichang New Material Co.,Ltd.

- Dehe Technology Group Co., LTD.

- Excelsior Ceramic Industries

- GLAPOR Werk Mitterteich GmbH

- Glavel, Inc.

- ICM Glass Kaluga LLC

- Krysteline Technologies

- Liaver GmbH & Co KG

- Misapor AG

- Ningbo Yoyo Foam Glass Co., Ltd.

- Owens Corning

- PINOSKLO

- Polydros, S.A.

- PORAVER GmbH

- Refaglass

- SCHLÜSSELBAUER Geomaterials GmbH

- Shree Bhawani Insulation Pvt. Ltd.

- Styro Insulations Mat. Ind. LLC

- Sun Refractories

- Uusioaines Oy

- Zhejiang Zhenshen Insulation Technology Corp. Ltd.

Actionable Strategies for Industry Leaders to Capitalize on Emerging Trends Enhance Resilience and Drive Sustainable Growth in Foam Glass

To thrive in the evolving foam glass sector, industry leaders must proactively embrace sustainability, innovation, and strategic partnerships. Prioritizing research into bio-based foaming agents and nanoscale reinforcement additives can yield next-generation foam glass products that deliver superior performance with reduced environmental impact. Collaborating with regulatory bodies and certification agencies will streamline compliance with emerging energy and fire safety standards, enhancing market acceptance and reducing time to specification.

Investments in digital platforms and e-commerce capabilities will expand reach into niche horticulture and DIY segments, while direct institutional partnerships with construction conglomerates can secure long-term offtake agreements. Diversifying raw material sourcing through partnerships with glass recycling facilities will mitigate tariff exposure and reinforce circular economy credentials.

Moreover, adopting advanced manufacturing technologies-such as IoT-enabled process controls and automated quality assurance systems-will drive cost optimization and product consistency. Engaging in cross-industry alliances with aerogel and polymer-based insulation providers can foster hybrid solutions that address complex thermal and acoustic challenges. By integrating these actionable strategies, companies can unlock new revenue streams, fortify supply chain resilience, and position themselves as leaders in the sustainable materials revolution.

Comprehensive Research Methodology Combining Primary Interviews Secondary Data Analysis and Rigorous Validation Protocols to Ensure Robust Market Insights

Our research framework integrates comprehensive primary and secondary methodologies to ensure the highest level of accuracy and reliability. Secondary data analysis entailed systematic reviews of trade databases, regulatory filings, company disclosures, and academic publications. Key sources included tariff schedules, patent registries, and industry white papers, enabling cross-validation of market trends and technology advancements.

Primary research encompassed in-depth interviews with sector experts, including manufacturing executives, technical consultants, architects, and procurement specialists. These qualitative engagements provided first-hand insights into evolving specifications, supply chain bottlenecks, and innovation priorities. Survey instruments targeting end users across construction, horticulture, and industrial segments further quantified adoption drivers and barriers.

Data triangulation was employed to reconcile divergent findings, applying statistical tools to normalize input and detect outliers. Rigorous validation involved iterative stakeholder reviews, peer consensus workshops, and alignment with regulatory updates effective through mid-2025. This iterative process ensured that our analysis not only reflects the current landscape but also anticipates near-term developments, empowering clients with actionable intelligence for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Foam Glass market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Foam Glass Market, by Product Form

- Foam Glass Market, by Distribution Channel

- Foam Glass Market, by Application

- Foam Glass Market, by End Use

- Foam Glass Market, by Region

- Foam Glass Market, by Group

- Foam Glass Market, by Country

- United States Foam Glass Market

- China Foam Glass Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings and Strategic Imperatives to Guide Decision Makers in Navigating the Evolving Foam Glass Landscape with Confidence

Throughout this executive summary, we have explored the confluence of innovation, policy shifts, and market segmentation that shape the foam glass industry. Sustainability mandates and green building trends underscore foam glass’s strategic value, while technological enhancements are redefining performance benchmarks. Tariff evolutions in the United States have recalibrated import dynamics, offering domestic producers renewed opportunities to capture share through localized production and resilient supply chains.

Segmentation analysis highlights differentiated needs across applications, product forms, end uses, and distribution channels, emphasizing the importance of tailored strategies. Regional deep dives reveal distinct growth drivers, from North America’s modular construction momentum to Europe’s circular economy imperatives and Asia Pacific’s infrastructure expansions.

Leading companies are responding with targeted R&D, strategic acquisitions, and digital channel optimization, while recommended actions focus on sustainable innovation, regulatory engagement, and manufacturing excellence. By synthesizing these insights, decision makers can navigate complexity, anticipate market shifts, and leverage foam glass’s unique attributes to advance energy efficiency and fire safety objectives.

Connect Directly with Ketan Rohom to Secure the Definitive Foam Glass Market Research Report and Gain Strategic Insight

For personalized guidance on leveraging these insights and securing comprehensive analysis tailored to your strategic needs, connect with Ketan Rohom, Associate Director of Sales & Marketing. Engaging with him will provide you with direct access to the full foam glass market research report, empowering your organization to make informed decisions with confidence and clarity. Reach out today to transform your understanding into competitive advantage and ensure you stay at the forefront of the foam glass industry.

- How big is the Foam Glass Market?

- What is the Foam Glass Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?