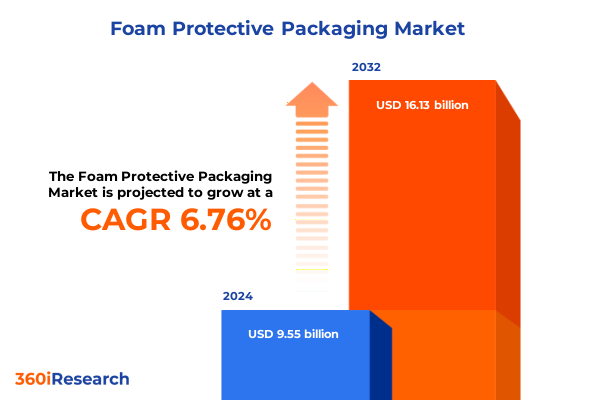

The Foam Protective Packaging Market size was estimated at USD 10.13 billion in 2025 and expected to reach USD 10.74 billion in 2026, at a CAGR of 6.86% to reach USD 16.13 billion by 2032.

Pioneering Advancements and Evolving Demands Define the Current State of Foam Protective Packaging Industry Landscape and Sustainability Focus

The foam protective packaging landscape is undergoing a profound evolution as the convergence of technological innovation, changing consumer expectations, and regulatory imperatives reshapes every facet of the value chain. As global supply chains continue to adapt to the demands of accelerated e-commerce fulfillment, foam-based solutions have risen to prominence for their ability to deliver cost-efficient, lightweight, and high-impact resistance properties. These materials are increasingly recognized not simply as commodities, but as strategic enablers that protect goods, reduce transportation costs, and contribute to brand reputation. Moreover, an intensified focus on sustainability and environmental stewardship has prompted manufacturers to explore recyclable polyethylene formulations and bio-based polyurethane blends, positioning foam protective packaging as a dynamic arena for product reinvention and innovation.

Transitioning from traditional manufacturing paradigms, the industry has also embraced advanced automation and digitalization techniques to drive efficiency and customization. Laser cutting and robotics have elevated precision in converting Blocks, Molded Shapes, Rolls, and Sheets into bespoke protective configurations, while data-driven analytics optimize material utilization and waste reduction. Concurrently, stringent regulations and voluntary initiatives aimed at minimizing single-use plastics are motivating suppliers to redefine foam structures and compositions to facilitate circular economy principles. From closed cell architectures engineered for moisture resistance to open cell designs optimized for shock attenuation, foam protective packaging is demonstrating its capacity not only to safeguard goods, but to align with larger environmental commitments.

Unprecedented Technological Innovations and Consumer Expectations Are Driving Transformative Shifts in the Protective Foam Packaging Ecosystem

Emerging technologies and shifting consumer behaviors are catalyzing transformative realignments within the foam protective packaging ecosystem. Industry leaders are deploying artificial intelligence to forecast demand fluctuations and calibrate production schedules in real time, thereby mitigating inventory overhang and expediting order fulfillment. Furthermore, the integration of digital print capabilities directly onto foam Rolls and Sheets is expanding possibilities for brand customization and anti-counterfeiting measures, enabling on-demand, high-volume production runs that respond nimbly to seasonal or promotional requirements.

Parallel to digitalization, the sector is witnessing the ascendancy of circular business models that prioritize material recovery and reprocessing. Companies are forging partnerships across the value chain to collect used foam protective components, reclaim resin, and reincorporate recycled content into new Products. This closed-loop strategy is not only reducing reliance on virgin feedstocks such as Expanded Polystyrene, Polypropylene, and Polyurethane, but also enhancing regulatory compliance as environmental legislation intensifies. Ultimately, the interplay of advanced manufacturing methods, data-centric supply chain orchestration, and circularity initiatives is redefining the parameters of value creation in foam protective packaging.

Assessing the Far Reaching Consequences of 2025 United States Tariff Measures on the Foam Protective Packaging Supply Chain and Market Dynamics

The implementation of heightened tariff measures by the United States in 2025 has introduced a new layer of complexity for foam protective packaging stakeholders. In response to Section 301 actions targeting certain imported materials, manufacturers and converters have confronted elevated costs on key inputs, prompting a strategic reevaluation of sourcing strategies. Many organizations have responded by diversifying their supplier portfolios, shifting procurement towards regions with preferential trade agreements or bolstering domestic production capacities to offset the impact of imported duty increases.

Consequently, the industry has observed a reconfiguration of supply chain flows, with some players electing to absorb incremental costs to maintain end‐customer price integrity, while others have pursued cost pass-through mechanisms. This dynamic has exerted pressure on margins, leading to consolidation among smaller independent converters and stimulating capital investments in automation to drive manufacturing efficiency. The tariff environment has also accelerated conversations around nearshoring and vertical integration, as stakeholders seek protection against future policy volatility and aim to secure resilient access to Expanded Polystyrene, Polyethylene, and Cross Linked foam inputs.

Deep Dive into Multifaceted Segmentation Revealing Intricate Variations across Product Forms Materials Structures and Industry Applications

A nuanced examination of the foam protective packaging market reveals multifaceted segmentation patterns that underscore distinct performance trajectories. Within Product Forms, equipping high-volume e-commerce distribution networks has driven robust growth in Rolls due to their scalability and compatibility with automated dispensing systems, while Blocks and Molded Shapes remain indispensable for heavy machinery and fragile equipment shipments. Concurrently, Sheets offer a versatile medium for manual and semi-automated cutting operations, facilitating rapid changeovers for seasonal or promotional packaging runs.

Material Type differentiation further accentuates market complexity. Expanded Polystyrene retains a foothold in industries prioritizing extreme stiffness and thermal insulation, whereas Polyethylene formulations-ranging from High Density Polyethylene to Linear Low Density Polyethylene and Low Density variants-are increasingly prized for their balance of impact resistance and recyclability. Polypropylene foams are gaining traction where higher temperature thresholds are required, and Polyurethane remains the go-to for customized cushioning applications that demand superior energy absorption. Examining Foam Structure, Closed Cell variants excel at moisture barriers and buoyancy, Cross Linked foams deliver enhanced resilience under repetitive stress cycles, and Open Cell architectures offer compressibility advantageous for lightweight cushioning. End User Industry demand signals align accordingly, with Automotive harnessing foam components for seating and acoustic insulation, E-Commerce channels prioritizing protective inserts that reduce weight, Electronics & Electrical sectors seeking anti-static and shock attenuating solutions, Food & Beverage relying on thermal foam partitions, Healthcare & Pharmaceuticals requiring sterile, medical-grade foams, and Industrial Manufacturing deploying robust foams for heavy equipment safeguarding.

This comprehensive research report categorizes the Foam Protective Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Form

- Material Type

- Foam Structure

- End User Industry

Global Regional Perspectives Highlighting Distinct Growth Patterns and Strategic Opportunities across the Americas EMEA and Asia Pacific Markets

Regional dynamics continue to shape the trajectory of foam protective packaging, with the Americas being propelled by the rapid expansion of e-commerce fulfillment centers and a resurgence of automotive production facilities in North America. The United States market, in particular, is benefitting from reshoring initiatives and government incentives aimed at revitalizing domestic manufacturing, leading to capacity expansions among key converters and resin suppliers. Brazil’s growing middle class is elevating demand for consumer goods packaging, thereby stimulating investments in localized polyethylene foam extrusion lines.

In Europe Middle East & Africa, stringent environmental regulations and consumer advocacy around sustainability are prompting accelerated adoption of recycled content and bio-based alternatives. Western European nations are pioneering extended producer responsibility frameworks, compelling foam suppliers to innovate in closed-loop recycling processes. The Middle East is leveraging its petrochemical infrastructure to expand Polyethylene and Cross Linked foam production, while South Africa is emerging as a hub for blended foam solutions that blend performance with cost competitiveness. Across Asia-Pacific, rapid industrialization and urbanization in China and India continue to drive demand for protective packaging in electronics exports and automotive component shipments. Manufacturers in Southeast Asia are capitalizing on regional free trade agreements to serve global OEMs, optimizing logistics corridors to deliver molded and roll foam products efficiently across continental routes.

This comprehensive research report examines key regions that drive the evolution of the Foam Protective Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Enterprises Shaping Innovation Competitive Positioning and Collaborative Dynamics within the Foam Protective Packaging Industry Landscape

Leading enterprises are aggressively investing in research and development to secure technological leadership and differentiate their product portfolios. For instance, major chemistry firms have unveiled next-generation polyolefin foams that offer enhanced toughness at reduced thickness, directly addressing rising logistics costs. Conversion specialists are forging collaborations with robotics integrators to deploy fully automated foam cutting and stacking systems, substantially improving throughput while reducing labor dependencies.

Strategic alliances between resin producers and recycling innovators have given rise to proprietary closed-loop platforms that reclaim and reprocess post-consumer foam into virgin-equivalent resins. Meanwhile, several publicly traded and privately held companies have pursued targeted mergers and acquisitions to enhance geographic reach and diversify material capabilities, particularly in high-growth segments such as bio-based Polyurethane and Cross Linked foam. These concerted efforts reflect a collective industry drive toward sustainable, technology-enabled protective packaging solutions that meet stringent performance and environmental criteria.

This comprehensive research report delivers an in-depth overview of the principal market players in the Foam Protective Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Armacell International S.A.

- BASF SE

- Covestro AG

- Dow Inc.

- DS Smith Plc

- Eurofoam GmbH

- Furukawa Electric Co., Ltd.

- Huntsman Corporation

- Innovo Packaging, LLC

- JSP Corporation

- Kaneka Corporation

- Klöckner Pentaplast Group

- Pregis LLC

- Recticel NV

- Rogers Corporation

- Rogers Foam Corporation

- SABIC

- Sealed Air Corporation

- Sekisui Chemical Co., Ltd.

- Storopack GmbH

- Trocellen GmbH

- Veritiv Corporation

- Zotefoams Plc

Strategic Imperatives and Practical Frameworks for Industry Leaders to Capitalize on Emerging Trends Challenges and Regulatory Evolutions

Industry leaders should prioritize the development and scale-up of sustainable material platforms that integrate recycled resin and bio-based chemistries, thereby aligning product portfolios with emerging environmental mandates and customer expectations. Accelerating digital transformation across manufacturing and supply chain operations-through predictive maintenance, real-time analytics, and automated quality control-will enhance responsiveness to market fluctuations and strengthen resilience against geopolitical disruptions.

Furthermore, forging strategic partnerships with logistics providers and end-user brands can facilitate joint innovation initiatives, enabling co-development of customized foam solutions tailored to complex shipping profiles. To mitigate ongoing tariff and policy uncertainties, companies should diversify sourcing networks by establishing regional hubs that optimize proximity to key demand centers. Embracing circular business models, including foam take-back programs and resin reclamation ventures, will not only reduce material costs over the long term but also enhance brand reputation in the face of increasing sustainability scrutiny.

Rigorous Methodological Blueprint Combining Qualitative Expert Interviews Quantitative Data Analytics and Comprehensive Supply Chain Assessments

The methodology underpinning this research combines rigorous qualitative and quantitative approaches to ensure comprehensive market intelligence. Primary interviews were conducted with senior executives from foam resin manufacturers, expert converters, key distributors, and major end-user companies across automotive, e-commerce, electronics, and healthcare verticals. These discussions provided firsthand perspectives on production challenges, innovation priorities, and evolving customer demands.

Complementing the primary research, extensive secondary data collection encompassed analysis of trade flow databases, proprietary customs statistics, and regulatory filings. Quantitative modeling techniques were applied to assess material consumption patterns across Product Forms and Material Types, while supply chain mapping identified critical nodes and risk concentrations. Triangulation of insights from multiple data streams ensured the validity of findings and facilitated the generation of actionable intelligence for stakeholders at every level of the foam protective packaging ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Foam Protective Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Foam Protective Packaging Market, by Product Form

- Foam Protective Packaging Market, by Material Type

- Foam Protective Packaging Market, by Foam Structure

- Foam Protective Packaging Market, by End User Industry

- Foam Protective Packaging Market, by Region

- Foam Protective Packaging Market, by Group

- Foam Protective Packaging Market, by Country

- United States Foam Protective Packaging Market

- China Foam Protective Packaging Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Capturing the Strategic Horizon of Foam Protective Packaging with Synthesis of Key Findings and Forward Looking Market Considerations

In synthesizing the prevailing trends, it is evident that foam protective packaging is at a pivotal juncture characterized by the interplay of sustainability imperatives, technological breakthroughs, and shifting policy landscapes. The proliferation of e-commerce and accelerated industrial automation continues to underpin demand, while regulatory and tariff dynamics introduce both challenges and opportunities for strategic differentiation. Detailed segmentation analysis has illuminated growth corridors across Product Forms, Material Types, Foam Structures, and End User Industries, equipping decision-makers with the insights necessary to allocate resources effectively.

Regional perspectives underscore the importance of customized market strategies that reflect local regulatory frameworks and supply chain architectures. Concurrently, leading companies are demonstrating that innovation and collaboration are vital catalysts for advancing performance while meeting sustainability goals. As the sector moves forward, stakeholders who embrace digitalization, circularity, and diversified supply chain models will be best positioned to capture value and drive long-term competitive advantage.

Secure Access to In-Depth Foam Protective Packaging Market Insights by Connecting with Ketan Rohom for Comprehensive Report Acquisition

To gain unparalleled visibility into the foam protective packaging market’s intricate dynamics and proprietary insights, reach out to Associate Director, Sales & Marketing, Ketan Rohom, to secure your copy of the full research report. Engage directly with Ketan to discuss the tailored benefits of the analysis, understand the depth of the data sets, and determine how the findings align with your strategic objectives.

This comprehensive dossier delivers granular breakdowns of segmentation performance, region-specific growth drivers, and actionable intelligence to inform investment and innovation decisions. Connecting with Ketan Rohom ensures you receive the most current edition of the report, along with bespoke support on leveraging the insights to optimize market positioning. Take the decisive step toward informed decision-making and sustainable growth by contacting Ketan today.

- How big is the Foam Protective Packaging Market?

- What is the Foam Protective Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?