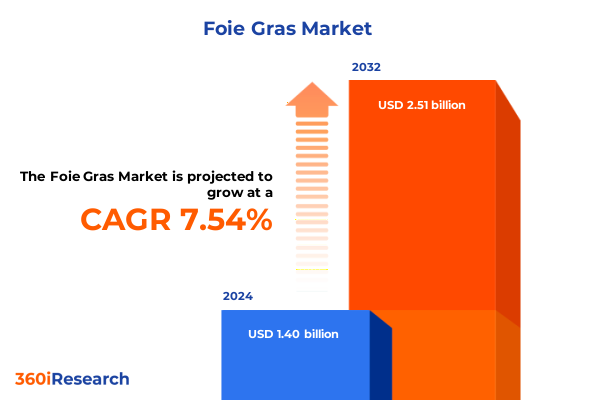

The Foie Gras Market size was estimated at USD 1.49 billion in 2025 and expected to reach USD 1.59 billion in 2026, at a CAGR of 7.69% to reach USD 2.51 billion by 2032.

Redefining the Essence of Gourmet Delicacy with a Comprehensive Overview of Foie Gras Market Fundamentals and Emerging Growth Dynamics

Foie gras has long been recognized as an emblem of culinary opulence, renowned for its luxurious texture and distinctive flavor that elevate gourmet menus worldwide. At its core, this delicacy represents centuries of artisanal tradition, yet today’s market dynamics reveal a complex interplay of consumer preferences, production practices, and regulatory frameworks. Understanding these multifaceted drivers is essential for stakeholders seeking to navigate challenges and leverage emerging opportunities in an increasingly sophisticated marketplace.

In recent years, the foie gras sector has witnessed a convergence of traditional craftsmanship and modern innovation. Producers are investing in enhanced husbandry techniques to refine quality and consistency, while pitmasters and chefs alike emphasize ethically sourced ingredients to meet rising consumer demand for transparency. Simultaneously, evolving dietary trends and sustainability concerns have prompted critical discussions about animal welfare standards and environmental impact, reshaping supply chains and marketing narratives.

This executive summary provides a foundational overview, setting the stage for a thorough examination of transformative shifts, trade policies, segmentation nuances, regional distinctives, and competitive dynamics underpinning the foie gras market. By synthesizing key insights and recommendations, this introduction equips decision-makers with the knowledge required to align strategies with market realities and unlock growth potential.

How Innovations in Sustainability, Digitalization, and Ethical Practices Are Reshaping the Foie Gras Industry’s Competitive Landscape

The foie gras landscape has experienced profound transformation driven by shifting consumer values, technological advancements, and regulatory changes. Sustainability has emerged as a critical pillar, with producers pioneering closed-loop water systems and integrating renewable energy into production facilities. These efforts not only mitigate environmental impact but also enhance brand credibility in a marketplace where conscientious consumption is increasingly nonnegotiable.

Simultaneously, digitalization has revolutionized the way gourmet products reach end users. E-commerce platforms now facilitate direct-to-consumer offerings, enabling small-scale purveyors to bypass traditional distribution channels and engage niche audiences through curated storytelling and immersive virtual tastings. At the same time, data analytics tools empower companies to anticipate demand patterns, optimize inventory levels, and tailor marketing campaigns to segmented consumer profiles.

Ethical considerations have also catalyzed innovation. Novel feeding regimens, precision animal welfare monitoring, and biopharmaceutical supplements are being tested to balance yield with humane practices. Plant-based alternatives formulated to mimic the rich mouthfeel of foie gras demonstrate the sector’s responsiveness to flexitarian trends, expanding the value chain beyond conventional production. Collectively, these shifts underscore a market transitioning toward higher transparency, agility, and consumer alignment.

Examining the Far-Reaching Consequences of 2025 Tariff Increases on Input Costs Distribution Channels and Consumer Pricing Dynamics

Since the implementation of new tariff measures in early 2025, the cumulative impact on imported foie gras components and finished products has been significant. Higher duties have incrementally increased production costs for domestic processors reliant on specialized feed ingredients sourced from international suppliers. This rise in input expenses has rippled through pricing structures, compelling producers to reassess sourcing strategies and negotiate long-term supply agreements to stabilize margins.

Concurrently, some distributors have responded by diversifying their import origins, seeking tariff-friendly jurisdictions to mitigate cost escalation. Others have accelerated partnerships with local farms, fostering greater vertical integration and supply security. However, the shift toward domestic sourcing has introduced capacity constraints, given the specialized infrastructure required for high-quality foie gras production. As a result, certain product categories have experienced intermittent availability and price volatility, impacting fine dining establishments and high-end retailers.

Consumer sensitivity to price increases has varied by segment. Premium connoisseurs have largely absorbed modest surcharges, prioritizing quality and provenance, whereas value-oriented purchasers have shown reticence amid sticker shock. Going forward, market participants will need to balance the pursuit of tariff mitigation with strategies that preserve product differentiation and uphold the premium positioning integral to foie gras’s allure.

Unlocking In-Depth Foie Gras Market Trends Through Multifaceted Segmentation Insights Spanning Type Form Channel Processing Packaging Certification and Tier Dimensions

When assessed by product type, the contrast between duck and goose foie gras uncovers divergent production timelines and flavor intensities that influence consumer preferences and pricing strategies. Duck-based offerings typically yield a milder profile with broader availability, whereas goose-derived variants command higher premiums owing to their richer, more buttery character and longer maturation periods.

According to form analysis, the distinction between fresh and frozen categories is pivotal. Fresh foie gras, subdivided into sliced cuts and whole lobes, caters primarily to haute cuisine applications demanding superior texture and immediate use. In contrast, the frozen segment includes block frozen formats and individually quick-frozen portions which extend shelf life and facilitate broader distribution, supporting both retail and foodservice channels.

Evaluating the sales channel dimension highlights a bifurcation between foodservice and retail avenues. Within foodservice, fine dining establishments remain the primary buyers, valuing bespoke presentation and exclusive sourcing. Quick service outlets, however, are experimenting with foie gras-inspired menu items to attract adventurous diners. In retail, grocery chains offer shelf-stable packaged options, while online platforms enable curated collections delivered directly to consumers’ doorsteps.

Processing variations further segment the market across block, mousse, and whole lobe formats. Block products, differentiated by high-fat and low-fat formulations, appeal to gastronomic professionals seeking consistency. Mousses, available in plain or truffle-infused versions, address gourmet snacking occasions. Whole lobe portions, prized for their intact structure, serve premium dining contexts requiring distinctive plating.

Packaging considerations emphasize canned and vacuum-packed presentations. Large and small canned formats cater to both institutional buyers and individual enthusiasts, while vacuum-packed pouches and trays optimize freshness and ease of use for retail channels and home chefs.

Certification criteria bifurcate offerings into conventional and organic standards. Organic variants, further distinguished by EU and USDA certifications, resonate with health-conscious consumers and export markets with stringent regulatory requirements.

Price-tier segmentation delineates premium and standard tiers. Luxury and super-premium subtiers emphasize exclusivity and provenance narratives, whereas mass market and mid-range options prioritize accessibility, balancing quality with affordability.

This comprehensive research report categorizes the Foie Gras market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Processing

- Packaging

- Sales Channel

Analyzing Distinct Regional Evolution Patterns in the Foie Gras Sector Across the Americas Europe Middle East Africa and Asia-Pacific Markets

Regional dynamics in the Americas reveal a mature consumer base deeply entrenched in gourmet traditions, where established distribution networks facilitate seamless access to both fresh and frozen formats. North American demand is concentrated in major metropolitan hubs with thriving fine dining scenes, while Latin American markets present growth prospects driven by rising disposable incomes and expanding foodie cultures.

Across Europe, Middle East & Africa, the trajectory is nuanced by legacy production regions in France and emerging markets in the Gulf where luxury dining is burgeoning. EU-certified organic foie gras enjoys premium positioning among European buyers, while regulatory frameworks governing animal welfare in certain member states have sparked industry debates and spurred artisanal producers to adopt enhanced transparency measures.

Asia-Pacific exhibits dynamic expansion fueled by evolving culinary preferences and increasing exposure to Western gastronomy. Major urban centers in East Asia lead consumption volumes, with high-end hotels and specialty restaurants driving demand. Southeast Asia’s burgeoning middle class is exploring specialty food items, presenting entry points for both conventional and innovative plant-based foie gras analogues. Moreover, online retail channels are pivotal in this region, enabling niche brands to reach discerning consumers despite logistical challenges.

This comprehensive research report examines key regions that drive the evolution of the Foie Gras market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring How Leading Foie Gras Brands Are Enhancing Traceability Innovating Product Lines and Strengthening Supply Chain Resilience

Leading players in the foie gras arena are differentiating through strategic investments in traceability and value-added product extensions. Legacy brands have fortified their supply chains by forging direct partnerships with certified farms, ensuring consistency in quality and compliance with evolving welfare standards. Concurrently, emerging purveyors are carving niche segments by introducing hybrid formats that blend traditional lobe preparations with innovative flavor infusions and convenient single-serve formats.

Several established groups have enhanced their market penetration by expanding digital storefronts, enabling real-time consumer engagement and bespoke ordering options. Meanwhile, smaller artisanal producers leverage storytelling and terroir-centric positioning to command higher margins and build loyal followings. Across the competitive spectrum, collaborations between chefs and manufacturers have given rise to limited-edition releases that generate buzz, demonstrate craftsmanship, and support premium pricing.

Supply chain resilience has become a focal point, driving M&A activity and joint ventures designed to secure feedstock supplies and processing capacities. By integrating vertically, companies are optimizing operational efficiencies and reducing exposure to international trade fluctuations. Additionally, sustainability initiatives-ranging from carbon-neutral production targets to regenerative agriculture partnerships-are increasingly used as differentiators to appeal to environmentally conscious stakeholders.

This comprehensive research report delivers an in-depth overview of the principal market players in the Foie Gras market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agro-Top Produits S.A.

- Comtesse Du Barry

- D'Artagnan LLC

- Ducs de Gascogne SA

- Euralis Holding SA

- Georges Bruck

- Gourmet Food World

- Hudson Valley Foie Gras Inc.

- Jiajia Food Group Co., Ltd

- Labeyrie Fine Foods SA

- Lafitte Foie Gras

- M. Rougié SAS

- Maison Delpeyrat SA

- Petrossian SAS

- The Artisan Food Company

Actionable Strategies for Industry Leaders to Enhance Welfare Compliance Diversify Supply Chains Embrace Digital Channels and Engage in Regulatory Advocacy

Industry leaders should prioritize investments in advanced animal welfare monitoring and certification programs that exceed baseline compliance, reinforcing brand integrity and consumer trust. By adopting precision husbandry technologies, producers can optimize feed conversion ratios, reduce environmental footprint, and preemptively address potential regulatory shifts related to animal welfare and sustainability.

Strategic diversification of sourcing origins can mitigate tariff-related risks and foster supply security. Companies should explore partnerships in regions with favorable trade accords and invest in localized production capacity to balance cost efficiency with premium quality demands. In parallel, strengthening collaborative relationships with fine dining chefs and culinary institutes can stimulate product innovation and cultivate aspirational brand associations.

Digital transformation remains paramount. Embracing omni-channel distribution strategies-integrating e-commerce, direct-to-consumer offerings, and experiential marketing platforms-will unlock new customer segments and boost brand visibility. Data-driven demand forecasting and dynamic pricing models can further enhance agility, enabling businesses to respond swiftly to market fluctuations and consumer sentiment shifts.

Finally, organizations must engage proactively with policymakers and industry bodies to shape constructive regulatory landscapes. By participating in collaborative research on best practices and animal welfare standards, stakeholders can drive consensus, minimize adversarial policy outcomes, and uphold the sector’s reputation as a premier provider of culinary excellence.

Comprehensive Methodological Framework Integrating Secondary Research Expert Interviews and Quantitative Surveys to Ensure Robust Market Analysis

This research employed a blended methodology combining rigorous secondary data analysis, expert consultations, and targeted primary research. Initially, relevant trade publications, academic journals, and industry reports were systematically reviewed to establish a contextual baseline and identify key variables influencing market dynamics.

Subsequently, in-depth interviews were conducted with producers, distributors, chefs, and regulatory experts across major regions to capture qualitative insights into operational challenges, emerging trends, and strategic priorities. These dialogues were supplemented by an online survey distributed to foodservice operators and retail buyers, generating quantitative data on purchasing behaviors, price sensitivities, and channel preferences.

Data triangulation techniques were applied to validate findings, cross-referencing primary inputs with secondary sources to ensure consistency and mitigate bias. Geographic segmentation analysis was underpinned by a combination of regional trade statistics and consumption data, while segmentation assessments leveraged product categorization frameworks and sales channel performance metrics.

Finally, all insights were synthesized to formulate actionable recommendations and identify future research avenues, ensuring the report’s relevance to both strategic planners and operational teams focused on capturing value in the dynamic foie gras market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Foie Gras market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Foie Gras Market, by Product Type

- Foie Gras Market, by Form

- Foie Gras Market, by Processing

- Foie Gras Market, by Packaging

- Foie Gras Market, by Sales Channel

- Foie Gras Market, by Region

- Foie Gras Market, by Group

- Foie Gras Market, by Country

- United States Foie Gras Market

- China Foie Gras Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesis of Market Dynamics Illustrating How Heritage Craftsmanship Technology and Policy Shifts Converge to Drive Future Growth

The foie gras market stands at a pivotal crossroads where tradition meets innovation. Emerging sustainability imperatives, shifting trade policies, and evolving consumer expectations are collectively propelling the sector toward a future defined by greater transparency and agility. As producers and distributors adapt to new tariff landscapes and ethical considerations, opportunities abound for those who can seamlessly integrate advanced technologies with artisanal heritage.

Segmentation insights underscore the importance of tailoring offerings across product types, forms, channels, processing methods, packaging formats, certification standards, and price tiers. Regional nuances further highlight that success in the Americas, Europe, Middle East & Africa, and Asia-Pacific hinges on localized strategies attuned to regulatory environments and consumption patterns.

Competitive dynamics reveal that firms prioritizing traceability, sustainable practices, and digital engagement will secure competitive advantage. Partnerships, mergers, and strategic alliances are reshaping the supply chain, while premium positioning and innovation in flavor and format diversification continue to drive differentiation.

Ultimately, the market’s trajectory will be defined by the balance between preserving the heritage sophistication that defines foie gras and embracing progressive practices that resonate with contemporary values. Stakeholders who navigate this balance with foresight and agility will emerge as leaders in the global gourmet landscape.

Unleash Strategic Advantages Through Direct Engagement with the Associate Director of Sales & Marketing for Exclusive Foie Gras Market Intelligence Purchase Opportunities

Are you ready to gain unparalleled insights and capitalize on the evolving foie gras market landscape? Engage with Associate Director of Sales & Marketing Ketan Rohom to secure comprehensive research that empowers decision-makers with data-driven clarity and strategic foresight. Connect today to explore customizable deliverables, subscription options, and exclusive insights tailored to your organizational needs. Elevate your competitive positioning with the depth and precision of a market intelligence solution designed for discerning leaders seeking to stay ahead of market transformations. Reach out now and ensure your business strategies are underpinned by the most authoritative research on foie gras dynamics and opportunities.

- How big is the Foie Gras Market?

- What is the Foie Gras Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?