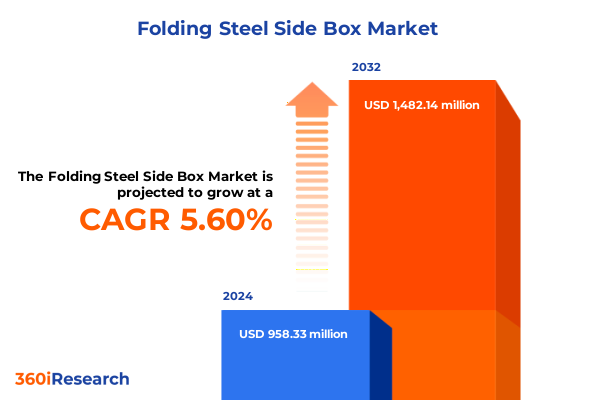

The Folding Steel Side Box Market size was estimated at USD 1.00 billion in 2025 and expected to reach USD 1.07 billion in 2026, at a CAGR of 5.65% to reach USD 1.48 billion by 2032.

Understanding the Evolution and Core Significance of Folding Steel Side Boxes in Modern Industrial Applications and Operational Efficiency

Folding steel side boxes represent a pivotal innovation in industrial load management, integrating robust steel construction with space-saving folding mechanisms that streamline storage and transportation. As industries across agriculture, construction, logistics, and mining seek more agile solutions, these collapsible containers have emerged as a versatile alternative to fixed-side bins. By allowing rapid conversion from enclosed transport to compact storage, folding side boxes enhance operational efficiency and reduce footprint in warehouses, on trucks, and within intermodal shipping containers.

The concept of foldable side panels originated from early efforts to maximize cargo volume while minimizing empty return loads. Designers leveraged advances in hinge technology and steel metallurgy to create side walls that pivot and lock securely under heavy loads. Today’s iterations incorporate automated locking systems, corrosion-resistant coatings, and modular attachments for securing tarps and liners. This evolution reflects a broader industry shift toward smarter, more adaptable equipment capable of responding to fluctuating demands without requiring extensive capital investment in multiple container types.

In the current landscape, folding steel side boxes have become essential tools for companies striving to optimize logistics and reduce total cost of ownership. Their ability to collapse flat during return trips yields significant savings in transport costs and warehouse space. Moreover, the integration of advanced materials and digital monitoring solutions has elevated performance by improving durability and enabling real-time tracking of cargo conditions. As supply chains grow more complex and customer expectations for speed and transparency rise, these innovative containers stand at the forefront of industrial efficiency.

Uncovering the Key Technological Innovations Regulatory Changes and Market Dynamics Reshaping the Folding Steel Side Box Industry Landscape

Recent years have witnessed sweeping technological breakthroughs that have reshaped the folding steel side box landscape. High-strength, low-alloy steels now deliver superior load-bearing capacity without adding weight, while precision folding mechanisms ensure consistent panel alignment and secure locking under extreme vibration and shock. Industry leaders have also introduced sensor-equipped side panels that monitor container integrity and environmental conditions, seamlessly integrating with warehouse management and telematics platforms.

Concurrently, regulatory frameworks governing heavy equipment and transport containers have tightened to prioritize safety and environmental sustainability. Revised international welding standards and stricter emissions guidelines for manufacturing processes have driven companies to adopt cleaner production methods and perform comprehensive compliance audits. These regulatory shifts have not only influenced material sourcing and fabrication techniques but also elevated the importance of documentation and traceability throughout the supply chain.

Market dynamics have evolved in response to these technological and regulatory forces. End users increasingly demand customized solutions tailored to their specific payloads and operating environments, driving manufacturers to offer modular attachments, variable wall heights, and interchangeable liners. At the same time, sustainability has become a critical consideration, prompting the development of recyclable coatings and remanufacturing programs. The convergence of innovation, regulation, and customer expectations is transforming the folding steel side box sector into a high-performance arena defined by adaptability, safety, and environmental responsibility.

Analyzing the Cumulative Impact of 2025 United States Steel Tariffs on Folding Steel Side Box Supply Chains and Cost Structures

In 2025, the United States implemented a series of steel tariffs aimed at safeguarding domestic producers and addressing trade imbalances. These measures, which targeted a broad range of imported steel products, have materially affected the cost structure of folding steel side boxes. With raw steel prices experiencing volatility, manufacturers have been forced to reassess procurement strategies, negotiate long-term contracts with domestic mills, and explore alternative alloy formulations that comply with tariff exemptions.

The introduction of Section 232 and related duties has produced a ripple effect across the supply chain. Fabricators reliant on imported coils have encountered extended lead times as domestic steel suppliers prioritize higher-margin orders. Secondary vendors, including hinge and locking mechanism producers, have also faced material shortages, leading to longer assembly cycles and selective order fulfillment. These disruptions have underscored the vulnerability of manufacturers to external geopolitical decisions and have prompted greater investment in inventory buffering and supplier diversification.

Looking ahead, companies are developing strategic responses to mitigate tariff-driven cost pressures. Some have entered joint ventures with regional steel producers to secure dedicated capacity, while others are optimizing design specifications to reduce overall material usage without compromising strength. Additionally, several organizations are evaluating lean manufacturing initiatives aimed at eliminating waste and improving throughput. Through these adaptive measures, the folding steel side box sector is demonstrating resilience in the face of evolving trade policies and shifting cost paradigms.

Revealing Critical Market Segmentation Insights Across End Use Industries Vehicle Types Distribution Channels Product Types Materials and Load Capacities

A nuanced understanding of market segmentation is essential for aligning product development and go-to-market strategies with customer requirements. In the agricultural sphere, folding side boxes designed for crop transport are optimized for bulk grain and produce, featuring smooth internal surfaces and reinforced corner posts, while livestock transport variants incorporate secure ventilation panels and easy-clean flooring. Construction applications demand side boxes configured for building materials that withstand abrasive loads and road construction debris, often integrating wear-resistant liners and heavy-duty lift points.

Vehicle type segmentation further refines market focus by addressing payload and compatibility needs. Heavy duty platforms commonly leverage single folding designs for quick access to cargo, whereas light duty vehicles benefit from double folding side walls that collapse inward to accommodate narrower chassis. Medium duty units strike a balance between access and structural integrity, with customizable wall heights, and the ultra heavy duty category supports oversized loads with reinforced hinge assemblies and bolted reinforcements.

Distribution channel choices influence customer touchpoints and service levels. Aftermarket providers specialize in retrofitting existing fleets, offering standardized kits compatible with various vehicle frames. Direct sales teams typically engage large fleet operators and OEM partnerships, delivering turnkey solutions and volume discounts. E-commerce platforms have emerged as convenient channels for smaller enterprises seeking off-the-shelf configurations, while OEM integrations embed side box fabrication within original vehicle assembly lines.

Product type, material composition, and load capacity intersect to define performance profiles. Single folding designs suit compact profiles and frequent access, and double folding variants maximize cargo flexibility. Alloy steel constructions deliver enhanced tensile strength for heavy loads above three tons, whereas mild steel options balance cost and durability for one to three ton capacities, and stainless steel solutions ensure corrosion resistance for light loads below one ton. By leveraging this multi-dimensional segmentation framework, stakeholders can tailor offerings to precise use cases and operational requirements.

This comprehensive research report categorizes the Folding Steel Side Box market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Vehicle Type

- Material

- Load Capacity

- End Use Industry

- Distribution Channel

Examining Distinct Regional Market Trends and Growth Drivers within the Folding Steel Side Box Sector in the Americas EMEA and Asia-Pacific Regions

The Americas region exhibits a diverse market characterized by mature manufacturing hubs in North America and emerging demand in Latin America. In the United States and Canada, strong agricultural and construction sectors drive adoption of folding steel side boxes that conform to stringent safety regulations and interoperability standards. Mexico’s logistics growth, fueled by reshoring trends and regional supply chain realignment, is generating interest in modular side boxes optimized for cross-border transport.

Europe, the Middle East & Africa presents a multifaceted landscape shaped by regulatory harmonization and environmental mandates. Western European markets prioritize corrosion-resistant coatings and recyclable materials in response to circular economy initiatives, while Eastern European industrialization fosters demand for heavy duty configurations. Across the Middle East, large-scale infrastructure projects and mining operations in North Africa are adopting ultra heavy duty folding side boxes capable of enduring harsh climates and abrasive loads.

Asia-Pacific commands attention due to rapid urbanization and extensive infrastructure investments. Australia’s mining sector, renowned for aggregate and ore transport, drives demand for high-capacity side boxes featuring reinforced hinges and abrasion-resistant liners. Southeast Asian construction booms require versatile containers for building materials in densely populated urban centers, and China’s logistics networks leverage light duty, foldable units to optimize container shipping yards. In each subregion, material preferences shift according to climatic challenges, with stainless steel favored in corrosive environments and alloy steels rising where strength-to-weight ratios are paramount.

This comprehensive research report examines key regions that drive the evolution of the Folding Steel Side Box market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Industry Players Competitive Strategies and Partnership Opportunities Shaping the Folding Steel Side Box Market Landscape

The competitive landscape features several leading companies that have established reputations for quality and innovation. Titan Steel Products has distinguished itself with a modular design platform that simplifies customization for diverse end uses, enabling rapid configuration changes without extensive retooling. Atlas Containers has leveraged strategic alliances with steel mills to secure priority access to premium alloys, ensuring consistent supply and predictable performance under heavy duty conditions.

TriSteel Solutions focuses on automation and digital integration, offering sensor-enabled side box kits that transmit real-time data on structural integrity and environmental exposure. This approach not only enhances preventive maintenance schedules but also supports customers in achieving safety compliance and minimizing downtime. NovaBox Industries has gained traction in the aftermarket segment, providing retrofit packages that extend the operational life of existing fleets through advanced hinge systems and wear-resistant coatings.

Meanwhile, Valiant Metalworks has pursued a vertically integrated model, combining in-house fabrication, assembly, and distribution channels to optimize lead times and reduce logistical complexity. By maintaining close coordination between engineering and sales functions, these companies are differentiating through speed to market, tailored service agreements, and comprehensive warranty programs. As consolidation and partnership activity increase, collaborative ventures and joint product development initiatives are poised to reshape the competitive dynamic further.

This comprehensive research report delivers an in-depth overview of the principal market players in the Folding Steel Side Box market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arcawa GmbH

- Bernard Krone Holding SE & Co. KG

- Bull Metal Products, Inc.

- China International Marine Containers (Group) Co., Ltd.

- DAKEN SpA

- Darshan Metal Ind. Pvt. Ltd.

- Great Dane Trailers, Inc.

- Hangzhou GreatStar Industrial Co.

- Italiana Contenitori Srl

- Jiangsu Tiema Group Co., Ltd.

- K. Hartwall Ltd.

- Kennedy Manufacturing

- Kögel Trailer GmbH & Co. KG

- Ningbo Kinbox Tools Technology Co., Ltd.

- Qingdao Boxwell Container Co., Ltd.

- Schmitz Cargobull AG

- Shure Manufacturing Corporation

- Stanley Black & Decker, Inc.

- Tirsan Treyler Sanayi A.Ş.

- Utility Trailer Manufacturing Company

- Vanguard National Trailer Group, LLC

- Wabash National Corporation

Strategic Actionable Recommendations for Industry Leaders to Optimize Performance and Seize Opportunities in the Folding Steel Side Box Market

To succeed in the competitive folding steel side box market, industry leaders must embrace advanced material technologies while maintaining stringent cost controls. Investing in high-strength, low-alloy steel formulations can yield immediate benefits through reduced component weight and improved load capacity, yet firms should concurrently evaluate life cycle costs to ensure that durability and maintenance requirements align with customer expectations.

Strategic diversification of the supply base is essential for mitigating the impact of trade tariffs and material shortages. Companies should explore partnerships with regional steel producers and develop alternative sourcing agreements to secure priority allocations. At the same time, integrating lean manufacturing principles-such as cellular production and just-in-time inventory management-can minimize waste and enhance responsiveness to fluctuating demand.

Digital transformation stands out as a critical enabler of differentiation. Organizations that implement telematics-enabled side boxes and integrate them into broader fleet management systems will unlock predictive maintenance capabilities and data-driven insights into utilization patterns. Finally, cultivating close collaborations with OEMs and logistics providers will facilitate earlier engagement in the design process, paving the way for fully integrated side box solutions that meet evolving regulatory requirements and operational benchmarks.

Detailing the Comprehensive Research Methodology and Data Collection Techniques Underpinning the Folding Steel Side Box Market Analysis

This analysis draws on a rigorous research methodology designed to capture both qualitative and quantitative dimensions of the folding steel side box market. Primary research efforts included in-depth interviews with senior executives from leading manufacturing firms, transport operators, and material suppliers to understand firsthand challenges in production, distribution, and end use applications. These conversations provided nuanced context around tariff impacts, design preferences, and service expectations.

Secondary research involved a comprehensive review of industry publications, trade association reports, and regulatory filings to track steel policy developments and emerging technological standards. Data extracted from steel production databases and logistics performance indices was triangulated with shipment records and customs data to identify patterns in regional trade flows and equipment utilization. This layered approach ensured that key findings rest on multiple, corroborating information sources.

Analytical frameworks applied include segmentation mapping, supply chain resilience assessment, and competitive benchmarking. Segmentation mapping facilitated detailed profiling of end use industries, vehicle compatibility, distribution pathways, product variants, material choices, and load classifications. Supply chain resilience assessment highlighted vulnerabilities related to tariffs and supplier concentration. Competitive benchmarking compared leading companies across innovation metrics, partnership models, and service capabilities. Together, these methodological components underpin the credibility and depth of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Folding Steel Side Box market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Folding Steel Side Box Market, by Product Type

- Folding Steel Side Box Market, by Vehicle Type

- Folding Steel Side Box Market, by Material

- Folding Steel Side Box Market, by Load Capacity

- Folding Steel Side Box Market, by End Use Industry

- Folding Steel Side Box Market, by Distribution Channel

- Folding Steel Side Box Market, by Region

- Folding Steel Side Box Market, by Group

- Folding Steel Side Box Market, by Country

- United States Folding Steel Side Box Market

- China Folding Steel Side Box Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Concluding Insights Emphasizing Strategic Imperatives and Future Trajectories in the Evolving Folding Steel Side Box Market Environment

In consolidating the insights presented throughout this summary, several strategic imperatives emerge for stakeholders in the folding steel side box market. Foremost is the importance of embracing material innovation and digital integration to deliver next-generation container solutions that address customer demands for resilience and adaptability. Companies that succeed will be those that balance the pursuit of advanced alloys and sensing capabilities with pragmatic cost management and streamlined production processes.

Furthermore, the 2025 tariff environment underscores the necessity of supply chain agility. Organizations must cultivate diversified sourcing strategies and leverage regional partnerships to protect against policy-driven disruptions. Aligning distribution models with customer preferences-whether through OEM channels, aftermarket services, or e-commerce platforms-will further enhance market responsiveness and sustain competitive advantage. As the landscape continues to evolve, firms that synthesize technological progress, regulatory compliance, and targeted segmentation will be best positioned to capitalize on long-term growth opportunities.

Drive Business Growth with Tailored Folding Steel Side Box Market Intelligence Unlock Exclusive Insights by Connecting with Ketan Rohom Today

I invite you to leverage this comprehensive analysis to gain a decisive competitive edge in the folding steel side box market. Reach out to Ketan Rohom today to secure your copy of the full market research report and unlock exclusive insights tailored to your strategic objectives. By partnering with Ketan Rohom, Associate Director of Sales & Marketing, you will gain direct access to in-depth data, expert advisory, and customized solutions designed to drive your growth and innovation. Don’t wait to transform your approach and capitalize on emerging opportunities-connect now and empower your organization with the knowledge it needs to succeed.

- How big is the Folding Steel Side Box Market?

- What is the Folding Steel Side Box Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?