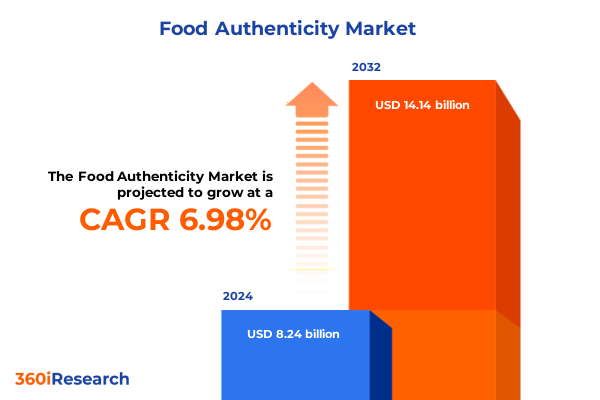

The Food Authenticity Market size was estimated at USD 8.80 billion in 2025 and expected to reach USD 9.41 billion in 2026, at a CAGR of 7.00% to reach USD 14.14 billion by 2032.

Understanding the critical role of advanced analytical tools and shifting consumer expectations in safeguarding food quality and transparency across complex global supply chains

Global food supply chains have grown increasingly intricate, spanning continents and involving myriad suppliers, intermediaries, and processing steps. This complexity has intensified the imperative for robust authenticity measures, as consumers and regulators alike demand assurances that products are unadulterated and accurately represented. Rising consumer consciousness about food origin, quality, and safety has elevated authenticity from a niche concern to a strategic business priority. Meanwhile, brand reputation and consumer trust hinge on transparent practices and verifiable testing protocols, making investment in advanced analytical capabilities an operational necessity.

Amid high-profile incidents of food adulteration and mislabeling, regulatory agencies have reinforced standards and expanded oversight to safeguard public health. Governments have introduced stricter requirements for traceability, authentication, and reporting, prompting supply chain participants to adapt swiftly or face reputational, financial, and legal repercussions. At the same time, technological breakthroughs in diagnostics, data analytics, and digital traceability are enabling more accurate, rapid, and cost-effective verification techniques. This evolution is reshaping the competitive landscape, as organizations that embrace innovation can differentiate through demonstrable quality and ethical sourcing practices.

This executive summary distills the latest industry developments, delineates transformative shifts in testing methodologies, assesses the cumulative impact of recent policy changes on tariff structures, and uncovers critical segmentation and regional insights. It also profiles leading corporations, outlines actionable strategies for market leaders, and details the rigorous research approach underpinning these findings. By synthesizing these elements, the summary offers a strategic foundation for informed decision-making and long-term value creation within the food authenticity domain.

Exploring the convergence of cutting-edge testing innovations and evolving regulatory frameworks that are reshaping global food authenticity validation

The landscape of food authenticity has undergone transformative shifts driven by the convergence of technological advancements and regulatory imperatives. Cutting-edge detection techniques, including high-performance chromatography and next-generation sequencing, have elevated the precision and speed of authenticity analyses. Simultaneously, real-time digital solutions, such as cloud-based data management platforms and traceability networks, are empowering stakeholders to monitor supply chains with unprecedented granularity. These innovations are not only enhancing the reliability of test outcomes but also facilitating proactive risk mitigation through predictive analytics and anomaly detection.

Moreover, the integration of multiple testing modalities-combining spectroscopy with molecular methods-has become increasingly common, forging a hybrid approach that balances sensitivity, specificity, and throughput. Blockchain and distributed ledger technologies are being piloted to create immutable records of origin and handling, reinforcing trust in provenance claims. Regulatory bodies across key markets are updating guidelines to accommodate these advancements, enabling faster adoption and harmonization of best practices on a global scale. These updates are fostering deeper collaboration between agencies, standard-setting organizations, and private entities to streamline certification processes and reduce redundancy.

Ultimately, these shifts are redefining what food authenticity means in a digital era. Industry participants are transitioning from reactive quality assurance to proactive authenticity assurance, leveraging data-driven insights to preempt potential breaches. This evolution underscores the strategic importance of an integrated testing ecosystem, where interoperability between instruments, software, and service providers creates seamless verification workflows and robust compliance frameworks.

Assessing the far-reaching implications of 2025 United States tariff adjustments on testing inputs, procurement strategies, and supply chain resilience

In 2025, alterations to United States tariff schedules have yielded cascading effects on the food authenticity market, impacting both the cost structure of testing inputs and the strategic sourcing decisions of manufacturers. Tariffs on imported reagents, enzymes, and specialized test strips have increased procurement expenses for many laboratory operations, prompting organizations to reassess supplier networks and inventory management practices. Simultaneously, duties on instrumentation components have driven some manufacturers to explore domestic assembly or maintenance arrangements to mitigate tariff-related cost pressures while preserving analytical performance standards.

These policy changes have also influenced the geographic distribution of testing activities, as end users seek to balance cost efficiency with supply chain resilience. Certain third party laboratories have expanded regional footprints to offer localized testing services, reducing dependency on cross-border shipments. At the same time, food and beverage producers have initiated collaborative agreements with domestic third party providers and research institutes to secure preferential pricing and minimize tariff exposure. This shift in partnership dynamics highlights the growing emphasis on nearshoring testing capabilities and diversifying service portfolios to hedge against further regulatory volatility.

As a result, the cumulative impact of 2025 tariff adjustments extends beyond immediate cost considerations, fostering structural transformations in the authentication ecosystem. Stakeholders are increasingly focused on optimizing end-to-end workflows-from sample preparation to data interpretation-through automation and strategic alliances. These adaptations reflect a broader industry trend toward agility and adaptability in response to policy-driven market constraints, reinforcing the importance of continuous monitoring of trade regulations and proactive stakeholder engagement.

Unveiling nuanced insights into food authenticity testing approaches across diverse test technologies, product formats, application areas, and end user categories

A comprehensive view of the market emerges when examining how food authenticity testing segments align with technological, product, application, and end user dimensions. Test types span chromatography based approaches-encompassing gas chromatography, high performance liquid chromatography, and liquid chromatography–mass spectrometry-to molecular DNA based methods such as loop mediated isothermal amplification, next generation sequencing, and polymerase chain reaction protocols. These techniques coexist alongside immunoassay based solutions like enzyme linked immunosorbent assays and lateral flow devices, as well as spectroscopic methods including near infrared, nuclear magnetic resonance, Raman, and ultraviolet visible spectroscopy, each offering distinct advantages in sensitivity and throughput.

Product segmentation further refines this landscape by differentiating consumable kits-comprising specialized enzymes, formulation grade reagents, and diagnostic test strips-from instrumentation platforms such as chromatographs, PCR cyclers, and spectrometers. Within spectrometry, subcategories like NIR, Raman, and UV Vis spectrometers deliver tailored performance profiles, while software and services encompass consultancy engagements, advanced data analysis applications, and maintenance contracts designed to ensure operational continuity and interpretive accuracy. This product framework supports diverse testing scenarios, from high volume central laboratory settings to agile on line or field deployments.

Applications of authenticity testing range from detecting harmful adulterants-including melamine, pesticide residues, and Sudan dye-to verifying ingredient integrity across dairy, grain, meat, and spice matrices. Organic verification services provide both certification assistance and residue evaluation, while origin confirmation protocols establish geographic lineage and species certification. End user segments include food and beverage manufacturers such as beverage producers and dairy and meat processors, alongside research institutes and third party laboratories, which comprise both government affiliated and independent testing facilities. This multi tiered segmentation underscores the complexity of the market and the need for targeted solutions across each distinct dimension.

This comprehensive research report categorizes the Food Authenticity market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Test Type

- Product

- Application

- End User

Highlighting distinct regulatory landscapes, consumer behaviors, and infrastructural drivers influencing food authenticity practices across Americas, EMEA, and Asia-Pacific regions

Distinct regional dynamics are shaping how food authenticity practices evolve across the Americas, Europe Middle East & Africa, and Asia Pacific markets. In the Americas, stringent regulatory frameworks and consumer vigilance have fostered a robust authenticity ecosystem where manufacturers and third party laboratories invest heavily in state of the art instrumentation and accredited protocols. Collaboration among government agencies, industry associations, and research centers has accelerated standardization and reduced analytical variability, reinforcing confidence in provenance claims and quality certifications.

In Europe Middle East & Africa, harmonization of stringent European Union regulations and emerging regional guidelines is driving widespread adoption of advanced analytical methods. The continent’s diverse food culture and complex trade networks demand sophisticated authentication strategies, leading to heightened use of multimodal testing and digital traceability platforms. Meanwhile, Middle Eastern markets are expanding laboratory infrastructure to support both import verification and export compliance, and African countries are increasingly engaging in capacity building initiatives to align with global quality benchmarks and reduce incidence of adulteration.

Asia Pacific exhibits rapid growth in authenticity testing adoption, fueled by heightened food safety concerns, export market requirements, and evolving consumer preferences for transparency. The region is characterized by a mix of well established laboratory hubs and developing markets, prompting international service providers to forge partnerships with local entities. Investments in portable testing solutions and digital reporting tools are rising, enabling on the ground verification at border checkpoints and production sites. Together, these regional nuances highlight the importance of tailored strategies to address regulatory landscapes, consumer demands, and infrastructural capabilities across each geography.

This comprehensive research report examines key regions that drive the evolution of the Food Authenticity market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the influential players advancing integrated technologies, strategic alliances, and service ecosystems to lead the global food authenticity sector

Industry leaders in food authenticity testing are distinguished by their breadth of technological portfolios, global service networks, and collaborative innovation models. Established instrument manufacturers continue to refine core platforms, integrating enhanced detection chemistries and modular upgrades that extend the applicability of chromatography, molecular diagnostics, and spectroscopic systems. Concurrently, specialized service providers offer turnkey testing solutions, combining on site rapid analysis with centralized laboratory follow up for confirmatory studies, thereby addressing both immediate and comprehensive authentication needs.

Strategic partnerships are increasingly prevalent, as technology developers, contract laboratories, and consultancy firms align to deliver integrated offerings spanning sample logistics, data interpretation, and regulatory guidance. Collaborative research initiatives with academic institutions and standard bodies are accelerating the validation of novel biomarkers and expanding reference libraries for origin verification. Furthermore, digital pioneers are contributing sophisticated analytics engines and cloud native platforms that enable real time monitoring of key quality indicators and facilitate automated reporting to regulatory agencies.

In this competitive landscape, organizations that invest in end to end solution architectures-encompassing hardware, software, and service ecosystems-are achieving differentiated market positions. Their ability to offer customizable testing packages, scalable laboratory networks, and predictive maintenance frameworks underscores a broader shift toward subscription based models and outcome driven engagements. These advancements reflect an industry-wide commitment to bolstering trust and transparency across complex supply chains through continuous innovation and strategic alliances.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food Authenticity market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accugen Labs, Inc.

- Agilent Technologies, Inc.

- ALS Limited

- Bio-Rad Laboratories, Inc.

- Bruker Corporation

- Bureau Veritas SA

- Danahar Corporation

- EMSL Analytical, Inc.

- Eurofins Scientific SE

- Food Forensics Limited

- FoodChain ID Group Inc.

- Institute for Environmental Health Laboratories & Consulting Group

- Intertek Group PLC

- LGC Limited

- Microbac Laboratories, Inc.

- Minerva Biolabs Inc.

- Mérieux NutriSciences Corporation

- Neogen Corporation

- NSF International

- Premier Analytical Services

- Romer Labs Division Holding GmbH by Royal DSM

- Scout Scientific LLC

- SGS S.A.

- Tentamus Group GmbH

- Thermo Fisher Scientific, Inc.

- TUV SUD

Recommending strategic investments in integrated analytical platforms, collaborative partnerships, and advanced data systems to fortify authenticity assurance

To maintain a competitive edge and bolster supply chain integrity, industry leaders should consider investing in multi modality testing platforms that seamlessly integrate chromatography, molecular, and spectroscopic techniques. These hybrid systems can deliver comprehensive analytical coverage, reducing reliance on standalone assays and optimizing laboratory throughput. Simultaneously, embedding advanced data management solutions with machine learning capabilities will facilitate predictive insights and anomaly detection, enabling preemptive interventions when deviations from authenticity benchmarks are detected.

Engaging in strategic alliances with third party laboratories, research institutes, and digital innovators can accelerate the development of standardized protocols and shared data repositories. Such collaborations will not only enhance methodological consistency but also foster broader acceptance of emerging verification approaches among regulators and industry stakeholders. Furthermore, allocating resources to rigorous staff training and certification programs will ensure that analysts remain proficient in the latest test methodologies and quality assurance procedures.

Lastly, industry leaders would benefit from piloting blockchain enabled traceability initiatives and on site rapid testing deployments to address transparency demands from farm gate to retail shelf. By combining immutable provenance records with portable diagnostic tools, organizations can create end to end authenticity narratives that resonate with consumers and regulatory bodies alike. These actionable strategies will support scalable implementation and position companies to respond nimbly to evolving market and policy landscapes.

Detailing the rigorous multi phased approach integrating secondary analysis, stakeholder interviews, and data triangulation to ensure robust insights

This report’s insights are underpinned by a rigorous multi phased research approach designed to ensure accuracy, relevance, and comprehensiveness. The study commenced with exhaustive secondary research, including analysis of regulatory guidelines, scientific journals, white papers, and industry publications, to establish foundational knowledge of current authenticity frameworks. Publicly available data on legislative updates, trade statistics, and standardization protocols were synthesized to map evolving policy landscapes and identify emerging areas of focus.

Primary research involved in depth interviews and consultations with a broad spectrum of stakeholders across the food authenticity value chain. Conversations with laboratory directors, quality assurance leaders at manufacturing firms, regulatory officials, and technology developers provided firsthand perspectives on testing challenges, investment priorities, and adoption timelines. These qualitative insights were triangulated with quantitative data points to validate trends and uncover nuanced regional and segment specific dynamics.

Data analysis incorporated multiple layers of validation, including cross referencing of supplier product specifications, instrument performance metrics, and service provider accreditation records. Segmentation frameworks were defined according to test type, product offering, application area, and end user category, ensuring consistent comparability across the market landscape. Finally, iterative review cycles with subject matter experts and peer reviewers refined the findings, guaranteeing methodological transparency and robust confidence in the conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food Authenticity market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food Authenticity Market, by Test Type

- Food Authenticity Market, by Product

- Food Authenticity Market, by Application

- Food Authenticity Market, by End User

- Food Authenticity Market, by Region

- Food Authenticity Market, by Group

- Food Authenticity Market, by Country

- United States Food Authenticity Market

- China Food Authenticity Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3021 ]

Summarizing the critical findings and strategic imperatives that underscore the quest for robust, transparent food authenticity solutions in a complex global environment

The exploration of current trends and emerging innovations underscores the pivotal role of comprehensive testing strategies in safeguarding food authenticity across a multifaceted global supply chain. From the heightened precision of chromatographic and molecular assays to the agility of portable spectroscopic devices, the industry’s evolution reflects an unwavering commitment to quality, safety, and transparency. Regulatory frameworks and tariff policies continue to shape procurement and operational decisions, prompting stakeholders to adopt hybrid testing modalities and forge new collaborative models.

Segmentation insights reveal a complex mosaic of technological, product, application, and end user dimensions, each demanding targeted approaches and specialized expertise. Regional nuances further highlight the importance of tailoring authenticity strategies to local regulatory expectations, consumer preferences, and infrastructural capacities. Leading companies are capitalizing on integrated solution architectures, strategic partnerships, and subscription based service models to differentiate their offerings and drive market advancement.

Building on these findings, actionable recommendations emphasize investment in converged testing platforms, advanced data analytics, and traceability innovations as critical enablers of future growth. The methodological rigor supporting this analysis ensures that decision makers have access to reliable, context driven intelligence. Ultimately, the insights presented here serve as a strategic compass, guiding industry participants toward robust, scalable, and consumer centric authenticity solutions in an era defined by complexity and escalating quality expectations

Connect with the Associate Director of Sales & Marketing to secure customized guidance and purchase the comprehensive food authenticity research report

We invite industry stakeholders to connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore how this comprehensive food authenticity market research report can address your specific challenges and strategic priorities. Engaging directly with his team will unlock access to in-depth analyses, bespoke data insights, and exclusive white papers that delve deeper into validation techniques and regional dynamics. By initiating a conversation, you will gain invaluable guidance on tailoring the findings to align with your organization’s testing protocols, compliance requirements, and quality control objectives. Partnering with Ketan Rohom ensures a seamless purchasing process, dedicated client support, and customized implementation roadmaps. Reach out today to secure your copy of the report and elevate your food authenticity strategies with expert-driven intelligence and actionable recommendations tailored to your unique operational needs

- How big is the Food Authenticity Market?

- What is the Food Authenticity Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?