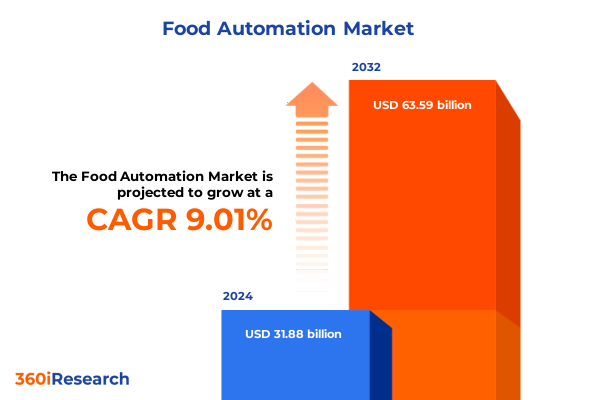

The Food Automation Market size was estimated at USD 34.76 billion in 2025 and expected to reach USD 37.54 billion in 2026, at a CAGR of 9.01% to reach USD 63.59 billion by 2032.

Emerging Food Automation Technologies Are Redefining Production Efficiency And Quality Standards Across The Global Food Industry

The intersection of robotics, artificial intelligence, and digital connectivity is ushering in a new era of food production, where automation is redefining traditional manufacturing paradigms. As labor shortages persist across the food service and processing sectors, businesses are increasingly investing in advanced automation solutions to fill workforce gaps and streamline operations. An estimated 82% of food service businesses and restaurants are actively recruiting to address labor demands, while more than half of U.S. farms report significant staffing challenges, fueling the shift toward robotics and AI-driven workflows.

Against this backdrop, early adopters are demonstrating the real-world potential of these technologies. In Silicon Valley’s Los Gatos, California, Burgerbots has launched a fast-food concept powered by ABB Robotics’ Flexpicker and YuMi systems, assembling burgers in under 30 seconds with remarkable consistency and throughput. Such implementations underscore how leading-edge automation can complement human labor by assuming repetitive tasks, reducing variability, and enabling staff to focus on higher-value customer interactions. Moreover, these deployments are receiving strong support from hospitality professionals, with surveys indicating that nearly 90% of managers and close to three-quarters of workers view robotic integration as a beneficial enhancement to operational efficiency.

Innovation in food automation is not limited to quick-service applications. From farm-to-fork agritech systems that automate harvesting to AI-enabled quality inspection platforms in processing plants, the industry is experiencing a wave of transformative technologies. Looking ahead, companies that proactively embrace these solutions will be better positioned to navigate labor market volatility, meet stringent food safety regulations, and capture the full potential of data-driven efficiencies. This introduction sets the stage for an in-depth exploration of how these shifts are reshaping the food automation landscape and what they mean for key stakeholders across the value chain.

A Convergence Of Advanced Robotics Digital Intelligence And Connectivity Is Catalyzing Unprecedented Transformation In Food Processing Workflows

The food automation landscape is undergoing a rapid metamorphosis as robotics, machine vision, and AI converge to deliver unprecedented levels of precision, speed, and adaptability. Innovative platforms now integrate real-time analytics, IoT sensors, and cloud-based control systems to optimize production lines dynamically. These technologies enable manufacturers to detect product defects, adjust process parameters, and manage maintenance schedules autonomously, minimizing downtime and ensuring consistent product quality. In 2024, nearly half of industry professionals surveyed by the Institute of Food Technologists indicated plans to invest in AI and supply chain tracking systems, while more than 30% targeted robotics and process automation initiatives as part of their 2025 digital transformation strategies.

Alongside AI-driven inspection, collaborative robots (cobots) are becoming integral to back-of-house operations, handling repetitive and ergonomically challenging tasks in close proximity to human workers. Applications such as automated dough handling in bakeries, precision slicing in meat processing, and sensor-guided packaging systems are now mainstream, delivering improvements in throughput and workplace safety. By leveraging flexible end-of-arm tooling and advanced vision systems, cobots can be rapidly redeployed across multiple tasks, allowing production lines to adapt to shifting product mixes and seasonal demands without major capital expenditures.

Moreover, machine learning algorithms are enhancing predictive maintenance and yield optimization by continuously analyzing equipment performance and product quality metrics. Food manufacturers are harnessing these insights to refine recipes, reduce waste, and accelerate new product introductions. As a result, automation is evolving beyond traditional conveyor and robotic arm installations toward intelligent, self-learning ecosystems that drive sustainable growth and operational resilience across the food supply chain.

Layered Tariff Regimes And Section 301 Duties Are Driving Cost Pressures And Strategic Supply Chain Adjustments In Food Automation Markets

In early 2025, the United States implemented a universal 10% baseline tariff on nearly all imports, representing a major shift in trade policy that directly affects automation equipment sourced globally. This across-the-board duty, effective April 2025, was layered on top of existing sector-specific tariffs, amplifying cost pressures for food automation providers and end users alike. Concurrently, Section 301 measures imposed on Chinese-origin industrial machinery-including robotics components and vision systems-remain in force, with standard rates ranging from 25% to 35% depending on product classification. As a result, Chinese-sourced automation parts now face dual levies, intensifying the financial impact on supply chains.

While the Office of the U.S. Trade Representative has extended temporary exclusions for select pandemic-related and critical machinery categories through August 31, 2025, these relief measures cover only a fraction of food automation assets. Key subheadings under HTS chapters 84 and 85 benefit from the extension, but most robotic arms, sensor modules, and AI software platforms fall outside the exclusion lists, leading to sustained tariff outlays for most industry participants. As exclusion windows narrow, manufacturers are forced to reevaluate sourcing strategies, either absorbing higher landed costs or pursuing alternative suppliers in regions not subject to additional Section 301 duties.

These layered tariffs have prompted strategic realignments across the industry. Companies are redirecting capital toward reshoring or nearshoring initiatives, investing in local production facilities, and forging partnerships with North American and European equipment suppliers. Moreover, some automation vendors are accelerating R&D efforts to develop tariff-exempt, domestically manufactured components. While these strategies mitigate immediate tariff exposure, they also introduce new complexities related to workforce training,quality certification, and capital allocation. Navigating this evolving tariff landscape will be crucial for stakeholders seeking to maintain competitive pricing and uninterrupted production schedules in food automation markets.

Multidimensional Component Application And End User Segmentation Delivers Critical Insights For Tailoring Food Automation Solutions To Diverse Industry Needs

The food automation ecosystem comprises a multifaceted array of components, applications, and end users, each presenting unique opportunities and challenges. Hardware elements such as conveyors, robotic arms, sensors, and vision systems form the backbone of automated production lines. Within conveyors alone, belt, chain, and roller variants are tailored to specific throughput and product handling requirements, while robotic arms-from articulated to delta and SCARA models-address tasks ranging from heavy-duty palletizing to delicate product manipulation. Complementing this hardware infrastructure, AI software, analytics platforms, and control systems orchestrate real-time operations, analytics, and maintenance alerts, driving continuous performance improvements.

On the application front, packaging, processing, quality inspection, and sorting represent the primary functional pillars of food automation. Processing subsegments-including cooking, cutting, and mixing-benefit from precise, repeatable automation that enhances consistency and throughput. Quality inspection systems leveraging machine vision and deep learning algorithms detect contaminants and structural defects with high accuracy, enabling rapid defect handling and overall yield optimization. Sorting platforms classify products by size, shape, and weight to ensure downstream processes maintain uniformity and comply with regulatory standards.

End users span bakeries, dairy operations, large-scale food processing plants, and quick-service restaurant chains, each with distinct production footprints and operational imperatives. Bakeries employ automated dough sheeting and proofing systems to handle seasonal spikes and artisanal product lines, while dairy facilities integrate hygienic robotic arms and clean-in-place solutions to uphold strict sanitation protocols. Food processing plants deploy comprehensive line automation for meat, poultry, and beverage production, and quick-service restaurants leverage compact automation cells to support high-volume, customizable menu offerings. Taken together, these segmentation insights illuminate the diverse functionality and strategic relevance of food automation across the value chain.

This comprehensive research report categorizes the Food Automation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Application

- End User

Regional Adoption Dynamics Highlight Varied Growth Drivers And Operational Challenges Across Americas EMEA And Asia Pacific Food Production Landscapes

Across the Americas, the United States and Canada remain focal points for food automation adoption, driven by acute labor shortages and a strong regulatory emphasis on food safety. According to FoodProcessing.com’s 2025 Manufacturing Outlook Survey, more than a third of U.S. processors cite critical workforce gaps that directly hamper production, prompting accelerated deployment of robotics and AI-assisted systems. In parallel, the ING Think report forecasts that robot density per 10,000 employees in U.S. food manufacturing will rise to approximately 135 by 2025, reflecting steady capital investment in automated lines and collaborative work cells.

Europe, the Middle East, and Africa (EMEA) present a heterogeneous automation landscape shaped by stringent EU food hygiene directives and sustainability mandates. Intel Market Research highlights the leadership of Germany in bakery automation and the Nordic region’s advanced fish processing robotics, underpinned by investments in AI-driven quality control and predictive maintenance platforms. Despite mature industrial infrastructures, SMEs face barriers due to high implementation costs and regulatory complexity, while energy-efficient solutions gain traction as companies align with regional decarbonization goals.

In the Asia-Pacific region, rapid urbanization and a burgeoning middle class are driving expansive automation in food production and packaging lines. Industry reports underscore a pronounced presence of leading robotics manufacturers-Fanuc, Yaskawa, and Mitsubishi-and significant government support for industrial automation initiatives in China and Japan. The Euromeatnews coverage of IFFA 2025 further illustrates how multifunctional robotic work cells and AI-powered sensor networks are transforming meat and alternative protein processing, enabling parallel operations and minimizing raw-material waste. Together, these regional dynamics shape a global food automation market that balances innovation, compliance, and operational scalability.

This comprehensive research report examines key regions that drive the evolution of the Food Automation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Automation Innovators Are Driving Food Industry Evolution Through Strategic Partnerships Product Diversification And Technology Investments

A cohort of leading technology providers is spearheading the transformation of food automation through strategic partnerships, product diversification, and targeted investments. ABB, for example, has gained wide recognition for its collaborative robots and system integration services, exemplified by the fast-food concept in Los Gatos where its Flexpicker and YuMi robots assemble burgers in under 30 seconds, highlighting the brand’s capabilities in high-speed food assembly applications. FANUC has responded with the Bakisto robot baker system, a collaborative solution co-developed with WIESHEU and Wanzl that autonomously handles baking tray loading, unloading, and display restocking in retail bakery environments, demonstrating the integration of AI-driven demand forecasting with robotics.

Marel, a key player in meat, fish, and poultry processing, continues to expand its portfolio of hygienic robotics and machine vision solutions, addressing the stringent regulatory demands and product diversity in processing plants. Yaskawa and Mitsubishi Electric maintain a strong presence in the Asia-Pacific region, leveraging decades of robotics expertise to deliver flexible automation cells for beverage and snack production lines. Meanwhile, software innovators such as Chef Robotics and KiwiBot are pioneering AI-powered kitchen automation platforms, focusing on food preparation and last-mile delivery tasks that redefine convenience and customization in quick-service and ghost kitchen models.

Quality inspection and traceability leaders, including Nestlé’s in-house developed AI vision systems and Danone’s partnership with Sight Machine, are embedding machine learning algorithms and real-time analytics into processing lines to detect defects, ensure compliance, and optimize yield. These strategic alliances between traditional food producers and technology startups underscore the collaborative ethos driving next-generation food automation solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food Automation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- AMETEK Inc.

- DESTACO, A Dover Company

- Emerson Electric Co.

- Falcon Autotech Pvt Ltd.

- Fanuc Corporation

- Festo Inc.

- Food Automation Pty. Ltd.

- Fortive Corporation

- GEA Group Aktiengesellschaft

- Heat and Control, Inc.

- JLS Automation

- John Bean Technologies

- Kuka AG

- MAYEKAWA MFG. CO., LTD.

- Mitsubishi Electric Corporation

- Neologic Engineers Private Limited

- NORD Drivesystems Private Limited

- Omron Electronics, LLC

- Regal Rexnord Corporation

- Rockwell Automation, Inc.

- Schneider Electric

- SPX FLOW, Inc.

- YASKAWA Electric Corporation

Actionable Strategies For Industry Leaders Focused On Enhancing Efficiency Ensuring Compliance And Maximizing Return On Food Automation Investments

Industry leaders should prioritize a holistic automation roadmap that aligns technology investments with operational priorities. Conducting a comprehensive process audit-encompassing labor-intensive touchpoints, quality control bottlenecks, and maintenance cycles-provides a clear baseline for targeted automation deployments. By integrating cobots and AI-driven inspection systems in high-impact areas first, companies can achieve rapid ROI demonstrations and build organizational support for broader digital transformation.

To mitigate tariff-induced cost pressures, procurement teams must diversify their supplier base, exploring regional partners and developing in-house component manufacturing capabilities. Collaborative research agreements with local equipment vendors can accelerate the co-development of tariff-exempt solutions tailored to specific production requirements. Concurrently, adopting modular automation architectures enables quick reconfiguration of lines to accommodate product variations and regulatory updates without extensive capital outlays.

Workforce upskilling is critical for sustaining advanced automation ecosystems. Leaders should implement structured training programs that blend classroom instruction with hands-on experience on live systems, fostering a culture of continuous learning. Partnering with technical colleges and industry consortia ensures access to a pipeline of skilled technicians and operators. Finally, establishing a governance framework that monitors performance metrics, compliance standards, and technology roadmaps will maintain alignment between automation initiatives and strategic business objectives.

Rigorous Multimethod Research Protocol Integrating Primary Expert Interviews Secondary Data And Robust Validation Ensures Integrity Of Food Automation Insights

Our research methodology combined both primary and secondary data collection to deliver balanced, evidence-based insights. Primary research featured in-depth interviews with senior executives and technical specialists from food manufacturing firms, automation integrators, and software providers. These discussions explored real-world deployment challenges, technology roadmaps, and regulatory considerations, yielding qualitative perspectives on adoption drivers and barriers.

Secondary research involved systematic reviews of trade publications, government regulations, and industry association publications. Key sources included U.S. Trade Representative rulings, European Commission hygiene directives, and Food Technology magazine’s annual surveys on digital transformation trends. This process ensured comprehensive contextual understanding and enabled the corroboration of primary interview findings.

Data triangulation and validation steps were applied rigorously. For each major insight, we cross-referenced quantitative import duty data with procurement records shared by participants. Technical performance claims for robotics and AI systems were verified against vendor specifications and third-party white papers. Finally, expert review panels-including academic researchers and industry consultants-provided critical feedback on draft outputs, ensuring both accuracy and relevance for decision-makers in the food automation domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food Automation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food Automation Market, by Component

- Food Automation Market, by Application

- Food Automation Market, by End User

- Food Automation Market, by Region

- Food Automation Market, by Group

- Food Automation Market, by Country

- United States Food Automation Market

- China Food Automation Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1431 ]

Integrating Technological Innovation Operational Agility And Strategic Alignment Will Propel Next Generation Food Automation Adoption And Competitive Advantage

The future of food automation hinges on the seamless integration of technological innovation, operational agility, and strategic foresight. As automation tools become more intelligent, flexible, and accessible, food manufacturers and service operators can achieve superior consistency, safety, and productivity. However, realizing these benefits requires a deliberate approach to technology selection, supply chain management, and workforce development.

By embedding digital capabilities-from AI-powered vision systems to cloud-native control architectures-into core processes, organizations can unlock real-time visibility and scalable performance improvements. Strategic partnerships between technology providers, food producers, and research institutions will accelerate the next wave of innovation, driving a virtuous cycle of efficiency gains and compliance assurance. Ultimately, enterprises that embrace automation as a foundational element of their growth strategy will secure a sustainable competitive advantage in an increasingly dynamic global food ecosystem.

Connect With Ketan Rohom To Secure Your Comprehensive Food Automation Market Research Report And Gain The Strategic Insights You Need To Succeed

Don’t miss the opportunity to elevate your strategic planning and operational efficiency with our comprehensive market research report. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy and unlock the insights that will drive your next wave of innovation in food automation. Engage with tailored analysis, real-world case studies, and expert guidance designed to inform your decision-making and shape your competitive advantage. Connect today to explore customized licensing options and begin leveraging these critical findings for measurable business impact.

- How big is the Food Automation Market?

- What is the Food Automation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?