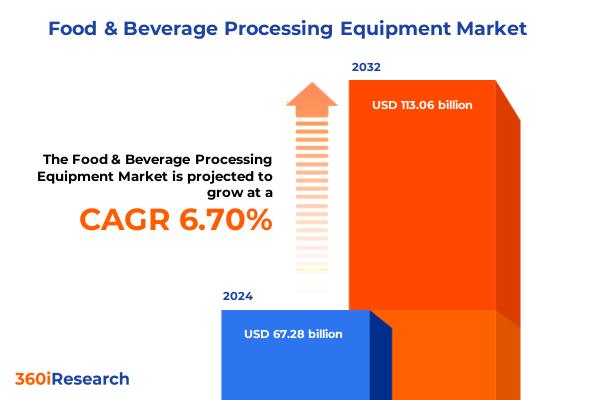

The Food & Beverage Processing Equipment Market size was estimated at USD 71.85 billion in 2025 and expected to reach USD 76.16 billion in 2026, at a CAGR of 6.69% to reach USD 113.06 billion by 2032.

Pioneering a Comprehensive Overview of the Global Food and Beverage Processing Equipment Arena Amidst Rapid Technological Evolution and Operational Demands

The food and beverage processing equipment sector is undergoing a period of rapid innovation, driven by evolving consumer expectations and stringent regulatory demands. As manufacturers strive to enhance product safety, yield, and consistency, investments in advanced machinery have become paramount. Recent advances in material science, process control, and sanitation protocols have propelled the industry toward unprecedented levels of operational excellence. Meanwhile, sustainability objectives and energy efficiency targets are reshaping equipment design considerations, creating a confluence of technological, environmental, and economic factors that define the modern manufacturing landscape.

Against this backdrop, industry stakeholders require a holistic perspective to navigate mounting complexity and capitalize on emerging opportunities. This report delivers a rigorous exploration of the forces redefining the market, from breakthrough automation technologies to shifting trade policies. By examining the interplay between technological advances, regulatory frameworks, and competitive strategies, this analysis seeks to equip decision-makers with the insights needed to chart a resilient course forward.

Unpacking the Transformative Technological, Operational, and Sustainability Shifts Redefining Food and Beverage Processing Equipment in Modern Manufacturing

Manufacturing plants are witnessing a profound transformation as digital technologies reshape traditional processing paradigms. The integration of AI-driven robotics and Internet-enabled monitoring systems has elevated predictive maintenance from theoretical concept to everyday practice. In parallel, conventional mechanical solutions continue to evolve, incorporating modular designs that streamline changeovers and minimize downtime. Regulatory bodies are reinforcing hygiene and safety standards, prompting investments in UV-based sterilization, clean-in-place systems, and advanced inspection equipment that collectively safeguard product integrity.

Moreover, sustainability considerations have emerged as a decisive driver of innovation. Energy-efficient cooling tunnels, low-waste packaging machines, and water-reduction technologies are gaining traction as manufacturers seek to reduce environmental impact without compromising throughput. These combined shifts are forging a landscape in which agility, connectivity, and sustainability converge, compelling organizations to reevaluate legacy systems and embrace integrated solutions that deliver both performance and compliance.

Evaluating the Far-Reaching Cumulative Effects of 2025 United States Tariffs on Supply Chains, Cost Structures, and Strategic Sourcing in Equipment Manufacturing

The introduction of new United States tariff measures in 2025 has exerted significant pressure on supply chains and cost structures within the processing equipment domain. Import duties on select machinery components, particularly those sourced from high-volume manufacturing regions, have driven procurement teams to reassess sourcing strategies. These elevated costs have not only affected OEM pricing models but also influenced end-user investment timelines, as budgets are stretched by unanticipated levy burdens.

In response, manufacturers are diversifying supplier networks and exploring near-shoring opportunities to mitigate exposure to fluctuating tariff regimes. Simultaneously, forward-looking organizations are renegotiating long-term contracts and leveraging strategic partnerships to distribute risk. As a result, the cumulative impact of these trade policies extends beyond immediate price adjustments, catalyzing structural changes in procurement philosophies and prompting a renewed focus on supply chain resilience.

Deriving Strategic Insights from Equipment Type, Operation Mode, Technology Integration, Automation Levels, and End Use Perspectives Shaping Market Dynamics

An in-depth examination of the market through the lens of equipment type reveals that cooling, packaging, and inspection machinery command particular attention due to heightened hygiene standards and consumer demands for fresh, high-quality products. Within this spectrum, blast chillers and freezers are increasingly critical for cold chain integrity, while aseptic and rotary fillers are pivotal in beverage and dairy applications. Boilers and pasteurizers continue to anchor heat-treatment processes, but a shift toward energy-efficient sterilizers underscores the industry’s sustainability agenda. Meanwhile, batch mixers and emulsifiers remain essential in confectionery and pharmaceutical sectors, reflecting diverse mixing requirements.

When considering the mode of operation, the trend toward continuous processing is unmistakable, driven by imperatives for consistent throughput and minimal manual intervention. This aligns with the growing integration of AI and robotics, which enables real-time quality control and predictive maintenance across both fully automatic and semi-automatic automation levels. At the same time, manual systems preserve cost-effective flexibility for small-scale producers. From an end-use perspective, bakery and beverage sectors are at the forefront of equipment upgrades, while dairy and meat processors increasingly prioritize integrated inspection systems. Together, these segmentation insights form a nuanced picture of demand drivers and innovation pathways.

This comprehensive research report categorizes the Food & Beverage Processing Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Operation Type

- Technology

- Automation Level

- End Use

Discerning Regional Dynamics Across the Americas, Europe Middle East & Africa, and Asia-Pacific to Reveal Distinctive Drivers and Constraints in Equipment Adoption

Regional disparities in market evolution are pronounced, with the Americas leading in adoption of state-of-the-art filling and inspection systems driven by rigorous food safety regulations and substantial capital investment capacity. Major beverage and dairy producers based in North America are leveraging advanced packaging machines and vision systems to satisfy consumer expectations for transparency and quality assurance. In contrast, South American markets exhibit growing enthusiasm for modular, semi-automatic solutions that balance modernization with cost sensitivity.

Within Europe Middle East & Africa, sustainability mandates are guiding investment toward low-energy heating equipment and recyclable packaging technologies. Stringent EMEA regulatory frameworks compel manufacturers to deploy advanced hygiene controls, including metal detectors and sterilization tunnels, while regional trade agreements shape preferential sourcing of domestically produced machinery. Asia-Pacific demonstrates the most dynamic growth trajectory, underpinned by rapid urbanization and escalating demand for processed foods. Here, IoT-enabled chillers, automated capping systems, and affordable semi-automatic mixers are particularly prevalent, as equipment providers tailor offerings to emerging markets in China, India, and Southeast Asia.

This comprehensive research report examines key regions that drive the evolution of the Food & Beverage Processing Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players and Their Strategic Innovations Driving Competitive Differentiation and Collaborations in Processing Equipment Solutions

Leading equipment manufacturers are distinguishing themselves through targeted innovation and strategic collaborations. For instance, one global leader in aseptic packaging continues to expand its sterile fill-line portfolio by integrating digital twins for virtual commissioning and performance optimization. Another pioneer in separation and heat-exchange technology has introduced modular skid solutions that dramatically reduce installation timelines and facilitate maintenance. Concurrently, several multinational corporations have formed alliances with software providers to embed machine learning algorithms into inspection and quality control platforms.

Smaller niche players are capitalizing on agility by specializing in next-generation mixers and emulsifiers designed for pharmaceuticals and high-value nutrition products. Across the competitive landscape, mergers and acquisitions remain a key mechanism for expanding geographic coverage and broadening technology stacks. These dynamics illustrate a market in which scale, specialization, and digital leadership coalesce to shape competitive differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food & Beverage Processing Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfa Laval AB

- Anderson Dahlen by Gray Inc.

- Baader

- Bigtem Makine A.S.

- Bucher Industries AG

- Bühler AG

- Clextral S.A.S.

- Dover Corporation

- Duravant LLC

- Fenco Food Machinery

- GEA Group AG

- Heat and Control Inc.

- JBT Corporation

- Kason Corporation

- KHS Group

- Krones AG

- Marel hf

- Matrix Packaging Machinery, LLC.

- MGT Liquid & Process Systems

- Middleby Corporation

- Neologic Engineers Private Limited

- Nichimo Co., Ltd.

- Paul Mueller Company

- ProXES GmbH

- RUSSELL FINEX SIEVES AND FILTERS PVT LTD.

- SPX Flow

- The Tetra Pak Group

- TNA Australia Solutions Pty Ltd.

- Triangle Package Machinery Company

Outlining Practical Strategic Imperatives and Technology Adoption Pathways for Industry Leaders to Enhance Operational Resilience and Competitive Advantage

Industry leaders should prioritize the deployment of modular and scalable equipment architectures to accommodate evolving production volumes and variable product portfolios. By embracing AI-driven predictive maintenance frameworks, organizations can minimize unplanned downtime and extend asset lifecycles, while IoT-enabled monitoring fosters real-time visibility across geographically dispersed facilities. Given the volatility introduced by tariff fluctuations, it is prudent to cultivate a diversified supplier base that includes regional partners capable of meeting quality and compliance standards.

Furthermore, integrating sustainable design principles-such as water-reuse systems in cleaning processes and energy-recovery heat exchangers-can yield both cost savings and environmental credentials. Upskilling the workforce in digital literacy and cross-functional problem solving will fortify adoption of advanced systems. Finally, forging strategic alliances with technology providers can accelerate the rollout of end-to-end solutions, ensuring organizations remain at the forefront of innovation and maintain a resilient competitive edge.

Detailing the Rigorous Qualitative and Quantitative Methodological Framework Underpinning the Comprehensive Analysis of the Processing Equipment Market

This analysis is grounded in a rigorous research methodology that integrates both qualitative and quantitative approaches. Primary data collection included structured interviews with senior executives at key equipment manufacturers and end-user facilities, coupled with targeted surveys designed to capture operational priorities and purchasing criteria. Secondary research encompassed detailed reviews of regulatory publications, industry association reports, peer-reviewed journals, and technical white papers to ensure comprehensive coverage of technology trends and compliance frameworks.

Data triangulation was achieved through cross-validation of insights obtained from diverse stakeholder groups, while expert workshops provided an additional layer of scrutiny. Quantitative metrics were analyzed using statistical techniques to uncover correlation patterns across segmentation variables and regional benchmarks. Throughout the process, adherence to strict data integrity protocols ensured the reliability of findings, offering stakeholders a robust foundation for informed decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food & Beverage Processing Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food & Beverage Processing Equipment Market, by Equipment Type

- Food & Beverage Processing Equipment Market, by Operation Type

- Food & Beverage Processing Equipment Market, by Technology

- Food & Beverage Processing Equipment Market, by Automation Level

- Food & Beverage Processing Equipment Market, by End Use

- Food & Beverage Processing Equipment Market, by Region

- Food & Beverage Processing Equipment Market, by Group

- Food & Beverage Processing Equipment Market, by Country

- United States Food & Beverage Processing Equipment Market

- China Food & Beverage Processing Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing Critical Learnings on Technology, Regulation, and Market Dynamics to Inform Strategic Decisions in Food and Beverage Processing Equipment

The synthesis of technological advancements, regulatory influences, and market segmentation underscores a pivotal moment for the food and beverage processing equipment industry. Organizations that effectively navigate digital transformation, tariff-induced supply chain realignments, and sector-specific demands will secure a decisive advantage. Continuous processing paradigms, AI-enhanced maintenance, and modular equipment platforms are emerging as critical enablers of efficiency and product consistency.

Regional nuances further highlight the importance of tailored strategies: capital-intensive markets demand cutting-edge automation and inspection, while high-growth regions favor adaptable, cost-efficient solutions. Leading firms are intensifying collaborations to enrich their technology portfolios and expedite time-to-market. In this dynamic environment, acting upon the actionable recommendations detailed in this report will empower industry participants to achieve operational resilience, foster sustainable practices, and drive long-term growth.

Embark on Your Competitor Edge by Engaging Directly with Ketan Rohom to Procure the Definitive Food and Beverage Processing Equipment Market Research Report Today

Engaging with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, offers a direct pathway to secure the definitive market research report on food and beverage processing equipment. Through a personalized consultation, your organization can gain access to in-depth analysis, strategic recommendations, and segmented insights tailored to your specific operational priorities. By partnering with Ketan, you will benefit from his expertise in aligning research findings with practical business objectives, ensuring that the data you receive drives tangible outcomes in efficiency, innovation, and competitive positioning.

Act now to leverage this opportunity for a comprehensive understanding of the market’s transformative trends, regulatory impacts, regional nuances, and leading technology solutions. Whether you seek to optimize your equipment portfolio, navigate shifting tariff landscapes, or implement next-generation automation and digitalization strategies, this exclusive engagement will equip your leadership team with the actionable intelligence required to make informed decisions and achieve sustainable growth.

- How big is the Food & Beverage Processing Equipment Market?

- What is the Food & Beverage Processing Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?