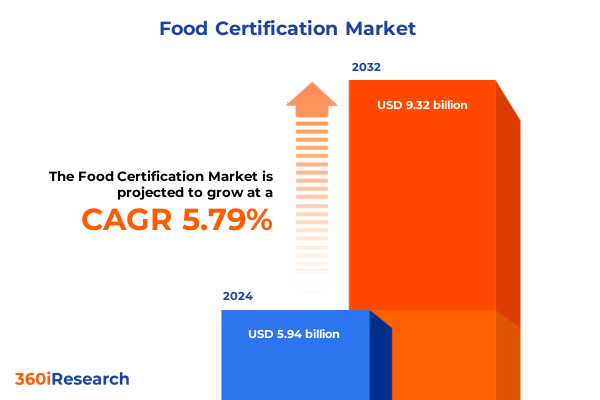

The Food Certification Market size was estimated at USD 6.26 billion in 2025 and expected to reach USD 6.60 billion in 2026, at a CAGR of 5.85% to reach USD 9.32 billion by 2032.

Unveiling the Essential Role of Food Certification in Meeting Escalating Regulatory Demands, Consumer Trust, and Market Integrity Across Borders

The global food industry is undergoing a profound transformation as consumer demands for transparency and accountability intensify. Recent surveys reveal that more than four in five adults read food labels with greater scrutiny compared to five years ago, and nearly seven in ten believe labels should include detailed sustainability and ethical sourcing information to inform their purchasing decisions. Amid growing skepticism of broad green claims, food companies are increasingly relying on third-party certifications to substantiate product safety, quality, and environmental claims, a trend that underscores the strategic value of trusted certification marks in building consumer trust.

At the same time, regulatory and standards bodies are continuously refining frameworks to safeguard public health and facilitate seamless trade. The Codex Alimentarius Commission remains the cornerstone of global harmonization, offering science-based guidelines and codes of practice that underpin national food safety regulations in over 180 member countries. In the United States, the Food Safety Modernization Act has shifted the focus from post-incident reaction to preventive controls, granting the FDA enhanced authority to conduct inspections, mandate compliance, and oversee third-party audit bodies. Parallel to these initiatives, the Global Food Safety Initiative has elevated industry expectations by benchmarking certification schemes against rigorous food safety culture requirements, driving continuous improvement across supply chains.

Charting Transformative Shifts Reshaping Food Certification from Sustainability Imperatives and Digital Traceability to Consumer-Driven Transparency Demands

Over the past five years, sustainability imperatives and consumer activism have catalyzed a fundamental shift in the priorities of food producers and retailers. Today’s buyers demand granular details about ingredient origins, production practices, and environmental footprints, leading companies to integrate certifications like Organic, Non-GMO, Fair Trade, and Rainforest Alliance into their core value propositions. This consumer pressure is compounded by heightened regulatory scrutiny around allergen control, traceability, and chemical residues, compelling brands to pursue multiple certifications to maintain market access and avoid costly recalls.

Meanwhile, technological innovation is reshaping certification processes and enabling real-time verification across complex supply chains. Blockchain solutions, IoT-enabled sensors, and AI-driven audit platforms are now integral to advanced traceability systems that support rapid root-cause analysis and incident response. These digital tools not only streamline the audit cycle but also create immutable records that enhance stakeholder confidence. As a result, food companies are embracing a dual strategy of investing in next-generation certification technologies while expanding lifestyle and safety certifications to address evolving consumer and regulatory expectations.

Assessing the Cumulative Impact of 2025 United States Tariffs on the Food Certification Ecosystem, Supply Chain Resilience, and Cost Structures

In 2025, the United States implemented a sweeping tariff regime that introduced a baseline tariff floor between 15% and 50% on imported goods, elevating the average effective rate to 20.2%, the highest level in over a century. This policy change has directly impacted food and beverage imports, with European wines, Chinese processed foods, and Vietnamese packaged goods facing steep levies ranging from 20% to 46% under a protectionist framework. While certain North American suppliers remain exempt under USMCA provisions, the broader tariff landscape has increased costs for specialty ingredients and prompted manufacturers to revisit their sourcing strategies.

The cumulative tariff burden has also imposed significant downstream effects on certification adoption and supply chain resilience. Higher input costs for imported raw materials have driven some companies to pursue domestic certification schemes and invest in local production capacity to mitigate volatility. Simultaneously, the elevated tariff environment has underscored the importance of harmonized international standards, as companies seek to maximize flexibility by holding multiple certifications that facilitate cross-border trade under varying tariff regimes.

Illuminating Critical Market Segmentation Insights Spanning Certification Types, Product Categories, Food Types, and Diverse End-User Profiles

A detailed examination of market segmentation reveals that certifications fall broadly into two principal categories: Dietary & Lifestyle Certification and Safety & Quality Certification. The former category encompasses certifications such as Fair Trade, Gluten-Free, Halal, Kosher, Non-GMO, and Organic, each addressing unique consumer and regulatory requirements related to dietary restrictions, ethical sourcing, and environmental stewardship. In parallel, Safety & Quality Certifications-namely BRC Global Standards, FSSC 22000, Good Manufacturing Practice, HACCP, ISO frameworks, and SQF-target operational controls and hazard mitigation throughout the production and distribution process.

Beyond certification types, the food certification landscape is further stratified by product categories, from bakery, confectionery, beverages, dairy, fruits, vegetables, herbs, and spices to meat, poultry, nuts, and seafood. These product segments each carry specific audit criteria and labeling mandates, reflecting the distinct risk profiles and consumer expectations inherent to each category. Segmentation based on food type differentiates between fresh and processed products, while end-user segmentation spans food manufacturers-both large enterprises and small & medium enterprises-as well as food service operators like cafés, hotels, and restaurants, and retailers including convenience stores and supermarkets & hypermarkets.

This comprehensive research report categorizes the Food Certification market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Certification Type

- Product Category

- Food Type

- End-User

Unveiling Regional Dynamics Highlighting Food Certification Trends and Growth Drivers in the Americas, Europe Middle East Africa, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping certification priorities and adoption rates across global markets. In the Americas, robust consumer demand for organic and non-GMO labels has accelerated investments in dietary and lifestyle certifications, while regulatory emphasis on food safety has driven widespread uptake of quality standards among exporters seeking to maintain access to diverse markets. North American stakeholders are increasingly integrating digital traceability systems, reflecting a strategic shift toward greater supply chain transparency and risk management.

Across Europe, the Middle East, and Africa, a tapestry of regulatory frameworks and consumer preferences underpins a multi-pronged certification approach. Western European markets uphold stringent safety accreditations alongside a surge in halal, kosher, and vegan certifications, while emerging economies in the Middle East and Africa pursue international accreditations to meet rising domestic and export demands. In the Asia-Pacific region, rapid urbanization and intensifying food safety concerns have spurred governments and industry bodies to elevate certification standards, with organic and halal credentials at the forefront of regional market expansion.

This comprehensive research report examines key regions that drive the evolution of the Food Certification market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Movers Shaping the Food Certification Sphere with Groundbreaking Partnerships and Technological Leadership

Leading players are driving innovation and consolidation within the food certification sector, leveraging strategic partnerships and technology investments to enhance service portfolios. Companies such as SGS, Bureau Veritas, Intertek, DNV, and NSF International continue to expand their audit networks and digital offerings, introducing AI-enabled risk assessments and remote auditing capabilities to meet evolving client demands. Concurrently, several certification bodies have formed alliances with blockchain and IoT providers to deliver end-to-end traceability solutions, reinforcing the integrity of certified claims from farm to fork.

Beyond traditional audit services, a new wave of specialized certification programme owners is emerging to address niche segments like insect-based proteins, plant-based alternatives, and regenerative agriculture. These niche certifications are attracting significant interest from forward-looking food manufacturers and retailers seeking to differentiate their brands and pre-empt tightening regulations around novel and sustainable food sources.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food Certification market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALS Limited

- AsureQuality Limited

- Bureau Veritas SA

- Certvalue by BLIP SNIP Consulting PVT LTD

- Control Union

- Cotecna Inspection SA

- DEKRA SE

- DNV AS

- DQS Holding GmbH

- EC International Certifications

- Eurofins Scientific SE

- Food Safety Net Services

- FoodChain ID Group, Inc.

- Intertek Group PLC

- Kiwa N.V.

- LRQA Group Limited

- MS Certification Services Pvt. Ltd.

- OneCert International

- OSS Certification Services Pvt. Ltd

- QIMA Limited

- SGS S.A.

- SIS Certifications Pvt. Ltd.

- TUV SUD AG

- UL LLC

- USB Certification

Implementing Actionable Strategies to Strengthen Food Certification Adoption, Enhance Compliance Efficiency, and Drive Sustainable Competitive Advantage

Industry leaders should prioritize a dual-track certification strategy that balances compliance, consumer trust, and cost efficiency. First, implementing integrated audit management platforms can streamline multiple certification workflows-such as FSMA alignment for preventive controls and GFSI benchmarking-thereby reducing duplication of efforts and audit fatigue among suppliers. Second, organizations must embed food safety culture at the executive and operational levels by aligning management incentives with certification performance metrics and conducting regular culture-focused audits under the latest GFSI benchmarking requirements.

Moreover, companies can seize competitive advantage by adopting digital traceability and transparency solutions. Investing in blockchain-based provenance systems and consumer-facing QR codes not only meets growing label clarity demands but also provides actionable data for risk analytics and supply chain optimization. By coupling these technological investments with strategic certification expansions-such as adding non-GMO or allergen-free credentials-industry stakeholders can reinforce brand equity and prepare for next-generation regulatory and market shifts.

Detailing a Robust Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Rigorous Quality Validation Processes

This research employs a robust mixed-methodology approach that synthesizes primary qualitative insights with comprehensive secondary data analysis. Primary research included in-depth interviews with over 30 senior executives from food manufacturers, certification bodies, and regulatory authorities, supplemented by key stakeholder workshops to validate emerging themes and strategic priorities.

Secondary research leveraged specialized databases, regulatory publications, and publicly available financial reports to map the competitive landscape, benchmark certification programmes, and analyze tariff impacts. Data triangulation was applied to ensure the consistency and reliability of findings, while an expert review panel conducted rigorous validation checks on all quantitative and qualitative inputs to maintain methodological integrity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food Certification market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food Certification Market, by Certification Type

- Food Certification Market, by Product Category

- Food Certification Market, by Food Type

- Food Certification Market, by End-User

- Food Certification Market, by Region

- Food Certification Market, by Group

- Food Certification Market, by Country

- United States Food Certification Market

- China Food Certification Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Concluding Insights Consolidating Key Findings on Food Certification Evolution, Market Drivers, and Strategic Pathways for Future Industry Leadership

The evolution of the food certification market is driven by a confluence of consumer advocacy, regulatory advancement, and technological innovation. Certification schemes have expanded beyond traditional food safety to encompass sustainability, ethical sourcing, and specialized diet claims, reflecting a dynamic environment where trust, transparency, and compliance are paramount.

As regional market priorities diverge and new tariff landscapes reshape international trade patterns, the ability to navigate complex certification requirements will distinguish industry leaders from laggards. Companies that integrate cross-functional certification strategies with digital traceability, cultural transformation, and proactive stakeholder engagement will be best positioned to capture emerging growth opportunities and reinforce their reputational resilience.

Take Advantage of Expert Support by Connecting with Ketan Rohom to Secure Comprehensive Food Certification Insights and Propel Your Business Strategy Forward

To explore the comprehensive insights and strategic analyses contained in this market research report, please reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. He can guide you through tailored solutions that address your organization’s unique food certification needs, whether you seek in-depth segmentation analyses, regional market breakdowns, or actionable recommendations for regulatory compliance and competitive differentiation. By partnering directly, you’ll gain early access to proprietary data, expert commentary, and bespoke consulting options designed to help you accelerate certification adoption and streamline supply chain processes. Don’t miss the opportunity to leverage these findings to refine your product portfolio, optimize certification strategies, and strengthen stakeholder trust-connect with Ketan today and secure your copy of the definitive global food certification market report.

- How big is the Food Certification Market?

- What is the Food Certification Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?