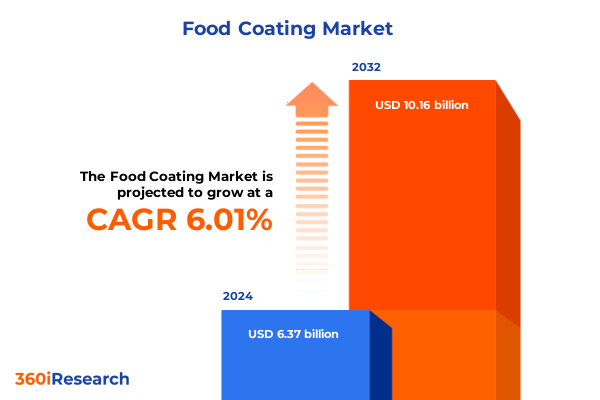

The Food Coating Market size was estimated at USD 6.75 billion in 2025 and expected to reach USD 7.13 billion in 2026, at a CAGR of 6.01% to reach USD 10.16 billion by 2032.

Unlocking the Evolving Dynamics of the Global Food Coating Sector in Response to Shifts in Consumer Preferences and Technological Developments

The food coating industry is currently experiencing an era of rapid evolution as consumer demands for clean label ingredients, enhanced sensory experiences, and nutritional benefits intensify. Global shifts in eating habits are compelling manufacturers to innovate beyond traditional batter and breading solutions, integrating film coatings that extend shelf life while satisfying health-conscious shoppers. Consequently, companies must view coating formulations not merely as functional requisites but as strategic assets that elevate brand differentiation and foster consumer loyalty.

As sustainability imperatives gain prominence, the introduction of plant-based and biodegradable coating materials is reframing market dynamics. Meanwhile, technological advancements in encapsulation and emulsion techniques are unlocking novel textures, flavors, and application efficiencies. Against this backdrop, stakeholders across the value chain-from ingredient suppliers to food service operators-are aligning on a shared objective: to harness coating innovations that meet rigorous safety standards, maintain cost effectiveness, and address emerging regulatory benchmarks. This report’s introduction establishes the foundational context needed to navigate these converging forces.

Exploring the Major Disruptive Factors Shaping the Food Coating Landscape Driven by Sustainability Innovation and Regulatory Changes

In recent years, the food coating arena has undergone transformative shifts fueled by consumer priorities for transparency and traceability. Brands are increasingly sourcing non-GMO, allergen-free, and organically certified materials to align with stricter label regulations and growing consumer scrutiny. Concurrently, the push toward digitized traceability systems has empowered end users to verify ingredient provenance, elevating the importance of blockchain-enabled supply chain solutions. Such innovations not only address compliance requirements but also build trust by offering full visibility into production and handling processes.

Moreover, circular economy principles are reshaping ingredient extraction and packaging methods. Manufacturers are repurposing byproducts from cereal and oil milling operations into flour mixes and emulsifiers, simultaneously reducing waste and lowering raw material costs. At the same time, regulatory frameworks-particularly those targeting palm oil derivatives and synthetic waxes-are prompting a reevaluation of edible films, accelerating the adoption of renewable plant-based alternatives such as carnauba and shellac substitutes. Collectively, these shifts underscore a broader trend: the food coating industry’s drive toward sustainable, digitally enabled, and consumer-centric solutions.

Analyzing How Recent Tariff Measures Have Transformed Supply Chains Cost Structures and Strategic Sourcing in the US Food Coating Industry in 2025

Since the beginning of 2021, an array of U.S. tariff measures has cumulatively impacted food coating raw material imports, with notable strain on edible film components sourced abroad. Specifically, duties levied under Section 301 on select food-grade waxes and polymers have increased landed costs, compelling buyers to reevaluate global sourcing strategies. At the same time, supplemental surcharges on packaging resin imports have indirectly inflated the cost of coated trays and film laminates, necessitating cost pass-throughs or margin compression across the value chain.

By 2025, this tariff landscape has reshaped procurement priorities, prompting a shift toward domestic supply partnerships and backward integration into raw material production. On one hand, coating formulators are forging alliances with local emulsifier manufacturers to mitigate cross-border uncertainties. On the other, some end users have opted to decentralize their sourcing footprint, diversifying import origins to minimize exposure to bilateral trade frictions. Consequently, the strategic emphasis on tariff resilience is now a core competency for any market leader looking to stabilize pricing, maintain product consistency, and preserve competitive positioning in the evolving U.S. market.

Decoding the Diverse Segmentation Layers That Drive Consumer and Industrial Demand Across Product Types Forms Applications and Distribution Channels

The food coating market’s structure is best understood through its intricate segmentation based on type, form, application, end use, and distribution channels. When examining type, formulations range from traditional batter systems to dry breading, with nuanced variations such as pre-dust and re-breading techniques providing textural complexity. Flour mixes and seasoned marinades tailored for specific culinary profiles coexist alongside advanced edible films derived from carnauba wax and shellac, each catering to distinct preservation and aesthetic requirements.

Form-based differentiation further refines this view, encompassing powder blends, liquid suspensions, and emulsions segregated into oil-in-water and water-in-oil matrices. Such diversity facilitates tailored performance characteristics like waterproofing, adhesion, and crispness retention. Across applications-from bakery coatings on breads and pastries to protective layers on fresh and frozen produce, meat, poultry, and seafood-industry innovators design bespoke recipes that address moisture migration, heat transfer, and flavor infusion. Similarly, end-use channels span industrial settings such as large-scale bakery plants and meat processing facilities to food service establishments and household kitchens, each demanding unique batch sizes, handling protocols, and shelf-life assurances. Finally, the proliferation of e-commerce now complements traditional offline distribution, granting both manufacturers and consumers enhanced accessibility to specialized coating products.

This comprehensive research report categorizes the Food Coating market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Application

- End Use

- Distribution Channel

Unveiling Regional Trends and Growth Drivers Impacting the Food Coating Market Across the Americas Europe Middle East Africa and Asia Pacific Regions

Regional dynamics reveal divergent growth vectors shaped by economic development, regulatory regimes, and culinary heritage. In the Americas, the maturation of fast-casual dining and expansion of frozen convenience offerings are driving demand for high-performance breading systems and batter mixes. At the same time, North America’s emphasis on plant-based alternatives is spurring innovation in emulsions and edible films that extend the shelf life of alternative protein products.

In Europe, Middle East & Africa, a mosaic of regulatory standards and dietary preferences dictates a dual focus on allergen management and halal-compliant coatings. European Union directives on food contact materials have elevated the importance of inert polymer barriers, while Middle Eastern markets are adopting versatile breading profiles suited for traditional flavors. Meanwhile, Africa’s emerging quick-service restaurant segment is catalyzing demand for affordable powder coatings that are easy to store and deploy.

Asia-Pacific continues to dominate volume growth, underpinned by longstanding culinary traditions and an accelerating shift to organized retail formats. Rapid urbanization in China and India is fueling a surge in bakery and snack consumption, leading to the adoption of customized seasoned mixes and marinade concentrates. Simultaneously, Southeast Asian seafood processors are standardizing coating protocols to ensure export-grade quality, reinforcing the region’s role as a global hub for value-added processing.

This comprehensive research report examines key regions that drive the evolution of the Food Coating market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Positioning Competitive Strategies and Collaborative Innovations of Leading Players Dominating the Food Coating Sector

Leading players in the food coating sphere are distinguishing themselves through vertical integration, strategic partnerships, and targeted R&D investments. Vertically integrated firms with in-house capabilities for emulsifier production and wax refinement are streamlining costs and control, which enables faster response times when adjusting formulations. At the same time, collaborations between ingredient innovators and equipment suppliers are yielding turnkey coating lines that enhance process efficiency and maintain consistency across large-scale operations.

Moreover, companies are leveraging digital platforms for remote quality monitoring and predictive maintenance, reducing downtime in critical mixing and application stations. The strategic deployment of co-manufacturing agreements has allowed emerging entrants to scale rapidly without compromising capital flexibility. Finally, intellectual property developments-ranging from proprietary anti-migration coating technologies to novel flavor encapsulation systems-are reinforcing competitive barriers and driving consolidation discussions among multinational players looking to bolster their product portfolios and geographic reach.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food Coating market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGRANA Beteiligungs-AG

- Apeel Sciences

- Archer-Daniels-Midland Company

- Ashland Inc

- Associated British Foods plc

- Bunge Limited

- Cargill Incorporated

- Corbion N V

- DuPont de Nemours Inc

- Döhler GmbH

- Givaudan S A

- Ingredion Incorporated

- International Flavors & Fragrances Inc

- Kerry Group plc

- Koninklijke DSM N V

- Newly Weds Foods

- PGP International Inc

- Puratos Group N V

- Roquette Frères S A

- RPM International Inc Mantrose-Haeuser Co Inc

- Sensient Technologies Corporation

- Solina

- Sufresca

- Sumitomo Chemical Co Ltd

- Tate & Lyle PLC

Providing Strategic Guidance for Industry Leaders to Capitalize on Emerging Trends Mitigate Risks and Enhance Competitive Advantage in Food Coatings

To capitalize on evolving market dynamics, industry leaders should pursue a triad of strategic imperatives. First, investing in eco-optimized formulations and packaging not only aligns with regulatory imperatives but also resonates with environmentally conscious consumers. By embedding circularity principles into coating design-for example, leveraging agricultural byproducts-manufacturers can differentiate their offerings and create new value streams.

Second, deepening partnerships across the supply network enhances agility in navigating tariff disruptions and raw material volatility. By forging integrated alliances with domestic emulsifier and film producers, firms can secure preferential access to critical inputs while sharing innovation risks. Third, embracing digitalization for quality assurance, traceability, and customer engagement will establish proactive risk management and foster brand transparency. Collectively, these recommendations provide a roadmap for sustained growth, resilience in the face of external shocks, and the ability to respond swiftly to nascent consumer trends.

Detailing the Comprehensive Research Approach Including Data Collection Analytical Techniques and Validation Protocols Underpinning the Food Coating Study

This study employs a multi-faceted research methodology designed to ensure data integrity and reliability. Primary research involved structured interviews and surveys with executives from ingredient suppliers, coating formulators, and end users, capturing qualitative perspectives on technological adoption and market drivers. Secondary sources included government tariff schedules, industry whitepapers, and peer-reviewed journals, which were triangulated with proprietary databases to validate emerging trends and regulatory developments.

Quantitative analysis was conducted using statistical modeling techniques to identify correlations between input cost variables and end-user pricing strategies. Sensitivity analyses assessed the impact of potential tariff escalations and raw material shortages on profitability. Finally, expert panels comprising food scientists and market strategists reviewed preliminary findings to refine key insights and ensure alignment with real-world operational considerations. This rigorous approach underpins the confidence stakeholders can place in the report’s conclusions and strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food Coating market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food Coating Market, by Type

- Food Coating Market, by Form

- Food Coating Market, by Application

- Food Coating Market, by End Use

- Food Coating Market, by Distribution Channel

- Food Coating Market, by Region

- Food Coating Market, by Group

- Food Coating Market, by Country

- United States Food Coating Market

- China Food Coating Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Summarizing the Critical Insights Future Outlook and Strategic Imperatives Necessary for Stakeholders to Navigate the Complex Food Coating Landscape

In conclusion, the food coating industry stands at the intersection of consumer-driven innovation and regulatory complexity. Technology-enabled advancements in emulsions, powder blends, and edible films are redefining product performance, while shifting trade policies and tariff measures compel a reevaluation of global sourcing strategies. Segmentation insights underscore the necessity of tailoring solutions to distinct product types, application methods, and end-user requirements, whereas regional analyses highlight the localized drivers influencing growth trajectories.

Ultimately, the ability to integrate sustainable practices, digital traceability, and collaborative supply chain partnerships will determine market leadership in this dynamic space. By adhering to the strategic imperatives outlined herein and leveraging a data-driven understanding of segmentation and regional nuances, stakeholders can navigate uncertainties, capitalize on market opportunities, and secure long-term competitive advantage.

Engage with Ketan Rohom to Secure Comprehensive Market Intelligence Insights Essential for Informed Decision Making in the Food Coating Industry

To gain deeper insights into how evolving consumer behaviors competitors’ strategies and regulatory developments will shape your approach in the food coating sector, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in translating complex research findings into actionable intelligence will help you pinpoint growth opportunities, optimize supply chain resilience, and refine product innovation roadmaps. Engage now to secure tailored support, ensure timely access to the full market research report, and bolster your strategic planning with confidence.

- How big is the Food Coating Market?

- What is the Food Coating Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?