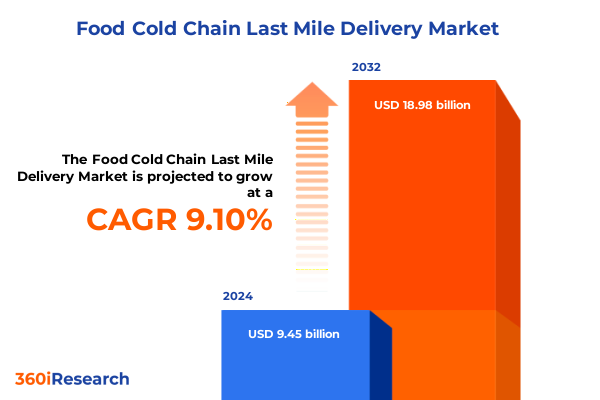

The Food Cold Chain Last Mile Delivery Market size was estimated at USD 10.24 billion in 2025 and expected to reach USD 11.09 billion in 2026, at a CAGR of 9.21% to reach USD 18.98 billion by 2032.

Understanding the Critical Role of Efficient Cold Chain Last Mile Delivery in Ensuring Food Safety, Quality Preservation, and Consumer Satisfaction

The contemporary food supply chain places unprecedented pressure on last mile delivery services to maintain uncompromising standards of safety and freshness. With consumer demand for perishable goods growing in volume and diversity, stakeholders across production, distribution, and retail must coordinate seamlessly to preserve quality from farm to fork. This segment of the supply chain bears unique complexities, including tight delivery windows, stringent temperature controls, and variable local infrastructure. Recent disruptions such as extreme weather events and changing labor dynamics have further underscored the vulnerability of existing networks. Consequently, businesses are compelled to reassess their operational frameworks, invest in robust cold chain systems, and forge collaborative partnerships to mitigate risk.

In this context, innovation emerges as the cornerstone of competitive differentiation. Advanced monitoring technologies, data analytics, and sustainable refrigeration solutions are transforming how companies respond to real-time challenges. As we embark on this report, readers will gain clarity on the evolving imperatives shaping last mile delivery strategies. Through a detailed examination of market shifts, tariff impacts, segmentation insights, and regional dynamics, we establish a foundation for industry decision-makers to navigate uncertainties and capitalize on emerging opportunities. The subsequent sections deliver a cohesive narrative, integrating technical, economic, and strategic perspectives to inform robust decision-making.

Exploring the Transformative Technological, Regulatory, and Consumer-Driven Shifts Reshaping the Food Cold Chain Last Mile Delivery Ecosystem

Over the past few years, the food cold chain landscape has undergone a profound transformation driven by technological breakthroughs and changing stakeholder expectations. Electrification of delivery fleets has accelerated as companies integrate electric delivery vehicles to curb emissions and enhance last mile efficiency. Parallel to this shift, the proliferation of IoT-enabled sensors and blockchain tracking is elevating transparency, enabling real-time visibility into temperature, location, and handling conditions. These innovations bolster food safety assurance and reduce waste by facilitating rapid response to anomalies.

Moreover, regulatory frameworks have evolved in tandem with consumer advocacy. Stricter safety guidelines and sustainability mandates prompt logistics providers to adopt greener refrigerants and embrace renewable energy sources. At the same time, e-commerce growth continues to challenge traditional delivery models by demanding higher frequency and greater flexibility. The emergence of on-demand delivery services compels incumbents to refine route optimization algorithms, collaborate with last mile couriers, and develop agile fulfillment centers. Consequently, the market now reflects a tension between cost containment and service excellence. By synthesizing these trends, stakeholders can anticipate the next wave of strategic imperatives and position themselves to lead in this dynamic environment.

Analyzing How the 2025 United States Tariff Adjustments Have Reshaped Cost Structures, Supplier Strategies, and Operational Models in Cold Chain Delivery

In 2025, the United States implemented a series of tariff adjustments targeting imported refrigeration equipment, specialty packaging materials, and related fuel components, exerting a cumulative effect on last mile delivery cost structures. These measures raised the baseline expenses for key hardware, including refrigerated trucks and temperature-controlled containers. As a direct consequence, logistics providers have revisited procurement strategies, in some cases reshoring equipment assembly or renegotiating supplier contracts to offset incremental duties.

These tariff shifts also prompted a reevaluation of network configurations. Companies with cross-border operations have optimized hub locations to minimize transnational transfers subject to higher duties, leveraging domestic consolidation centers. Additionally, the procurement of alternative refrigerants, often sourced locally to avoid import levies, has reshaped equipment maintenance routines and training requirements. Fuel tariffs, though less pronounced than hardware duties, incentivized a pivot toward electrified fleets and renewable energy integration to mitigate exposure to fluctuating import costs.

Taken together, the 2025 tariffs have catalyzed a multifaceted response. While some smaller operators faced margin pressures, leading players have capitalized on scale economies and vertical integration to preserve service levels. Ultimately, the tariff environment underscores the critical importance of adaptive sourcing and network resilience for the sustainability of cold chain last mile delivery operations.

Unveiling Critical Segmentation Insights by Transport Mode Service Type Temperature Range Delivery Type and End User for Cold Chain Efficiency Optimization

Segmenting the cold chain last mile delivery market by mode of transport uncovers distinct strategic imperatives for each asset class. Electric delivery vehicles emerge as an increasingly preferred option for urban environments where environmental regulations intersect with high-density demand. Refrigerated trucks continue to serve longer regional routes, balancing payload capacity with temperature integrity. Meanwhile, refrigerated vans offer agility for mid-sized loads navigating constrained city centers, and temperature-controlled containers enable seamless intermodal transfers between maritime and road networks, providing scalability for large-scale distribution.

When examining service type, the gulf between full truckload and less than truckload solutions highlights operational trade-offs. Full truckload operations afford direct, dedicated transport for large-volume shipments, optimizing temperature consistency but demanding high utilization rates. In contrast, less than truckload arrangements provide flexibility for smaller consignments, subdivided further into contract-based commitments that guarantee capacity and on-demand options that react swiftly to fluctuating requirements. This dichotomy underscores the tension between cost efficiency and service responsiveness.

Temperature range segmentation introduces another layer of specificity. Chilled deliveries within the 2-8°C band address items such as dairy and produce, where strict thermal limits are critical to extend shelf life. Slightly warmer 8-15°C deliveries accommodate less perishable goods, enabling mixed-load consolidation. On the frozen side, blast-frozen shipments require rapid temperature drop cycles to preserve structural integrity, while deep-frozen transport ensures long-term preservation for items like specialty seafood or pharmaceuticals. These distinctions drive diverse equipment needs and handling protocols.

This comprehensive research report categorizes the Food Cold Chain Last Mile Delivery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Mode Of Transport

- Service Type

- Temperature Range

- Delivery Type

- End User

Revealing Distinct Regional Dynamics Affecting Cold Chain Last Mile Delivery Efficiency in the Americas Europe Middle East Africa and Asia Pacific Markets

Across the Americas, leading markets exhibit extensive integration of advanced cold chain infrastructures, from large-scale consolidation centers in North America to rapidly expanding refrigerated networks in Latin America. The United States remains a hub for innovation in electric delivery vehicles and digital monitoring solutions, while Brazil and Mexico invest in expanding regional cold storage capacities. As a result, operators in this region continue to refine cross-border logistics corridors, focusing on harmonizing standards and improving connectivity.

In Europe, the Middle East, and Africa, divergent regulatory frameworks challenge cross-regional operations. Western Europe mandates stringent emissions targets and safety certifications, spurring adoption of synthetic and natural refrigerants. Meanwhile, emerging markets in Eastern Europe and the Middle East emphasize capacity building, driven by growing retail and hospitality sectors. Africa’s cold chain infrastructure remains nascent but is rapidly evolving through public-private partnerships that enhance rural connectivity. Collectively, the EMEA region underscores the importance of regulatory alignment and infrastructure investment.

Asia-Pacific presents a tapestry of maturity levels, from advanced logistics networks in Japan, South Korea, and Australia to fast-growing markets in India and Southeast Asia. Rapid urbanization and e-commerce expansion exert intense pressure on last mile services, while rising disposable incomes drive demand for premium perishables and pharmaceutical products. Consequently, regional players invest heavily in refrigerated asset fleets, digital platforms, and workforce training to manage complexity. These regional variances reveal where investment and strategic focus can yield the greatest impact.

This comprehensive research report examines key regions that drive the evolution of the Food Cold Chain Last Mile Delivery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players’ Strategic Innovations Collaborations and Competitive Differentiators Driving Cold Chain Last Mile Delivery Excellence

Leading players in the cold chain last mile delivery sector have adopted differentiated strategies to maintain competitive advantage. One major logistics provider has established an integrated end-to-end platform that connects producers, carriers, and retailers through a unified digital dashboard, enhancing visibility and collaboration. Another prominent operator has formed strategic alliances with clean energy suppliers to develop renewable-powered cold storage hubs, significantly reducing carbon footprints and operating costs.

Several innovative startups have captured market attention by offering specialized on-demand refrigerated van services tailored to small-scale food artisans and local grocers. These nimble players leverage predictive analytics to forecast demand hotspots and deploy mobile micro-fulfillment units that integrate seamlessly with third-party aggregators. At the same time established freight companies are upgrading their fleets with alternative refrigerants and embarking on pilot programs for autonomous delivery vehicles to test feasibility in controlled urban environments.

Collaborative ecosystems also define the competitive landscape. Industry consortiums bring together equipment manufacturers, software vendors, and last mile carriers to co-develop interoperability standards and best practices. Through these coalitions, participants share learnings on thermal barrier technologies, cold chain risk management, and regulatory compliance, driving collective progress and raising the bar for service excellence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food Cold Chain Last Mile Delivery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Americold Logistics, LLC

- Burris Logistics, LLC

- ID Logistics S.A.

- Kloosterboer B.V.

- Lineage Logistics, LLC

- NewCold Advanced Cold Logistics B.V.

- Nichirei Logistics Group, Inc.

- Preferred Freezer Services, LLC

- Rhenus SE & Co. KG

- VersaCold Logistics Services CM Ltd.

Providing Actionable Strategic Recommendations for Industry Leaders to Enhance Resilience Innovation and Sustainability in Cold Chain Last Mile Delivery Operations

Industry leaders must account for evolving customer expectations and regulatory landscapes when crafting their strategic roadmaps. First, investing in scalable electrification and renewable energy solutions will mitigate future fuel volatility and align with tightening emission standards. By integrating solar power at distribution centers and deploying electric delivery vehicles, operators can achieve cost stability and differentiate through sustainability credentials. Next, embracing advanced sensor networks and predictive analytics enhances route optimization and proactive quality control, reducing spoilage risks and operational disruptions.

Furthermore, partnerships with local stakeholders and third-party couriers can extend reach and responsiveness without the capital burden of fleet expansion. Collaborative models foster shared accountability for temperature integrity and leverage existing delivery infrastructures to meet fluctuating demand. At the same time, organizations should prioritize workforce training programs focused on cold chain best practices and digital platform proficiency, ensuring personnel can manage emerging technologies and comply with evolving safety protocols.

Lastly, establishing agile procurement frameworks that diversify supplier bases for equipment and consumables will safeguard against tariff fluctuations and geopolitical uncertainties. By combining centralized sourcing strategies with regional supplier networks, companies can balance cost efficiency with resilience. These actionable steps, underpinned by robust performance metrics, will position industry leaders to navigate dynamic market conditions and seize growth opportunities.

Detailing the Comprehensive Multi Layered Research Methodology Employed Including Qualitative Interviews Secondary Analysis and Expert Validation Techniques

This report’s findings derive from a rigorous research framework encompassing both qualitative and quantitative approaches. Initially, we conducted in-depth interviews with key executives from logistics providers, refrigeration equipment manufacturers, and regulatory bodies. These dialogues illuminated practical challenges, strategic priorities, and emergent trends shaping last mile delivery operations.

Complementing these primary insights, our team performed systematic secondary analysis of industry publications, regulatory guidelines, and peer-reviewed studies to ground our observations in established best practices. We also examined case studies spanning diverse regions to capture the multifaceted nature of cold chain logistics under varying regulatory and infrastructural contexts. Throughout the process, our analysts applied thematic coding to distill recurring patterns and validate critical hypotheses.

Finally, expert workshops provided a forum to vet preliminary conclusions and refine strategic recommendations. Participants, including supply chain academics and technology innovators, offered feedback that ensured our conclusions reflect both theoretical rigor and real-world applicability. This layered methodology guarantees that our insights possess both depth and operational relevance for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food Cold Chain Last Mile Delivery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food Cold Chain Last Mile Delivery Market, by Mode Of Transport

- Food Cold Chain Last Mile Delivery Market, by Service Type

- Food Cold Chain Last Mile Delivery Market, by Temperature Range

- Food Cold Chain Last Mile Delivery Market, by Delivery Type

- Food Cold Chain Last Mile Delivery Market, by End User

- Food Cold Chain Last Mile Delivery Market, by Region

- Food Cold Chain Last Mile Delivery Market, by Group

- Food Cold Chain Last Mile Delivery Market, by Country

- United States Food Cold Chain Last Mile Delivery Market

- China Food Cold Chain Last Mile Delivery Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Summarizing Key Takeaways and Forward Looking Perspectives to Guide Stakeholders Through the Evolving Cold Chain Last Mile Delivery Landscape

In synthesizing the multifaceted dimensions of food cold chain last mile delivery, several overarching themes emerge. First, technological innovation and sustainability are inextricably linked, with electrification and advanced monitoring systems forming the cornerstone of future-ready networks. Second, regulatory shifts and tariff policies continue to exert profound influence on strategic sourcing and operational configurations, underscoring the need for adaptive procurement and network design.

Third, segmentation by transport mode, service type, temperature range, and delivery pace reveals nuanced requirements that demand tailored solutions rather than one-size-fits-all approaches. Organizations that align asset choices and service models with specific cargo profiles achieve superior performance and cost efficiency. Additionally, regional disparities-from mature markets in North America and Europe to growth opportunities in Asia-Pacific-highlight where targeted investments can yield outsized returns.

Collectively, these insights underscore the importance of an integrated strategy that balances innovation, collaboration, and resilience. As the cold chain last mile landscape continues to evolve, stakeholders equipped with a holistic understanding of these dynamics will be best positioned to drive growth, maintain competitive advantage, and deliver exceptional value across the supply chain.

Engaging Invitation to Connect with Ketan Rohom Associate Director Sales and Marketing to Acquire the Definitive Cold Chain Last Mile Delivery Market Research Report

To access comprehensive insights, in-depth analysis, and strategic guidance tailored to your needs, reach out to Ketan Rohom Associate Director Sales & Marketing. He stands ready to guide you through the report’s findings and ensure you have the critical information needed to stay ahead in the rapidly evolving cold chain last mile delivery sector. Engage directly with Ketan to discuss customized solutions, explore licensing options, or arrange a briefing that highlights the report’s strategic implications for your operations. Don’t miss this opportunity to leverage expert-led research that illuminates emerging opportunities, mitigates risks, and propels your business growth. Connect with Ketan today to secure your copy and transform your last mile delivery approach into a competitive advantage

- How big is the Food Cold Chain Last Mile Delivery Market?

- What is the Food Cold Chain Last Mile Delivery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?