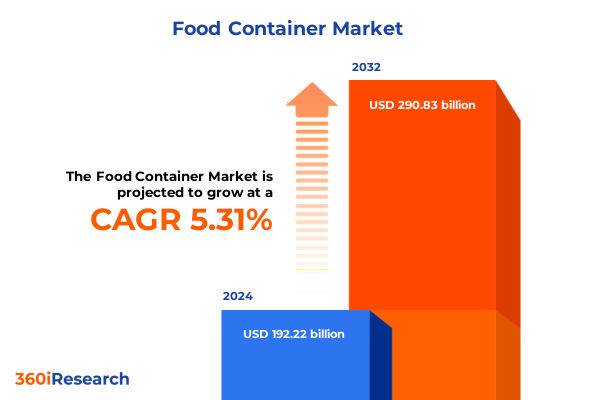

The Food Container Market size was estimated at USD 202.00 billion in 2025 and expected to reach USD 212.29 billion in 2026, at a CAGR of 5.34% to reach USD 290.83 billion by 2032.

Exploring the Expansive Realm of Food Containers and the Evolving Innovations, Sustainability Drivers, and Market Forces Reshaping Global Packaging Solutions

Over recent years, food container solutions have undergone a profound transformation, transitioning from simple functional vessels to sophisticated platforms that marry performance with environmental responsibility. The convergence of shifting consumer values, regulatory stringency, and technological breakthroughs has propelled packaging to the forefront of strategic supply chain considerations. As end users increasingly prioritize health, safety, and ecological impact, manufacturers and brand owners face mounting pressure to adopt materials and designs that reduce waste while preserving product integrity. The sustainability imperative is no longer a peripheral concern but a central driver shaping innovation roadmaps and capital investments in the sector, with a reported 64% of buyers indicating a preference for products housed in sustainable packaging and half of consumers willing to pay a premium for such options.

In parallel, the rise of advanced manufacturing techniques-ranging from automated blow molding to precision thermoforming-has enabled the rapid prototyping and scalable production of bespoke container geometries tailored to specific food categories and cold chain requirements. Integration of smart features, such as freshness sensors and RFID tracking modules, further underscores the transition of food containers from passive enclosures to interactive tools capable of enhancing traceability and consumer engagement. As this evolving landscape continues to unfold, it becomes essential for stakeholders to understand the foundational forces and emerging dynamics that will define competitive positioning and growth trajectories within the global food container market.

Identifying Pivotal Transformations Driving the Food Container Landscape Through Technological Advancements and Consumer Behavior Evolution

In recent years, transformative shifts have redefined the food container market, prompting a fundamental realignment of strategic priorities. Advances in material science are unlocking next-generation alternatives such as polylactic acid (PLA), bamboo composites, and sugarcane bagasse, which not only deliver robust barrier properties but also offer a significantly reduced ecological footprint compared to conventional plastics. The surge of these biopolymers reflects a broader industry pivot toward a circular economy ethos, driven by regulatory frameworks and consumer activism that collectively demand a departure from single-use paradigms.

Concurrently, the digitalization of manufacturing and distribution processes has introduced new efficiencies and transparency into the supply chain. From end-to-end visibility platforms to artificial intelligence–powered quality control systems, brands are increasingly leveraging data-driven tools to optimize container design, reduce downtime, and enhance predictive maintenance. This integration of Industry 4.0 principles is elevating the role of food containers from simple preservation vessels to integrated components within intelligent logistics networks. Such a holistic approach not only mitigates risk but also unlocks opportunities for agile customization, positioning forward-thinking players to respond swiftly to emerging consumer preferences and market disruptions.

Assessing the Cumulative Implications of United States Tariffs Enforced in 2025 on Input Costs, Supply Chains, and Manufacturer Strategies in Packaging

The introduction and expansion of United States tariffs in 2025 have generated significant headwinds across the food container value chain, influencing both input costs and supply chain configurations. Early in the year, presidential proclamations restored and expanded Section 232 tariffs-first reinstating a true 25% duty on steel and aluminum to address national security concerns, and subsequently phasing out all exemptions to apply these levies universally as of March 12, 2025. With aluminum tariffs rising from 10% to 25% at that juncture, and steel tariffs following suit, manufacturers reliant on metal closure and composite structures experienced immediate cost inflation and sought alternative sources or material substitutions.

By June 4, 2025, a further escalation increased the additional Section 232 duties on both steel and aluminum derivatives to 50%, a move designed to shield domestic producers but one that reverberated through downstream packaging converters. These cumulative tariff measures have compelled industry participants to reevaluate sourcing strategies, expand domestic tooling capabilities, and negotiate long-term agreements with raw material suppliers to stabilize input pricing. In parallel, the elevated tariffs have accelerated the adoption of alternative materials, such as engineered plastics and fiber-based substrates, as organizations pursue both cost containment and compliance with sustainability benchmarks.

Revealing In-Depth Segmentation Insights That Drive Food Container Demand Across Materials, Types, Usage Patterns, Applications, End Users, and Distribution Channels

A nuanced understanding of market segmentation illuminates the multifaceted drivers of demand in the food container arena. When dissecting the market by material, products constructed from ceramics-encompassing porcelain and stoneware-occupy a premium niche prized for thermal stability and aesthetic appeal, whereas glass offers transparent, non-reactive enclosures ideally suited to high-visibility retail packaging. Metal solutions, comprising aluminum and steel, continue to deliver strength and barrier performance, albeit with growing cost volatility amid tariff fluctuations. Paperboard is leveraged primarily for cartons and lightweight disposable applications, while a diverse array of plastic resins-including polyethylene, polypropylene, and polyvinyl chloride-underpins the majority of single-use and reusable containers due to their versatility and cost competitiveness.

When viewed through the lens of product type, boxes and cartons serve as versatile bulk and secondary packaging, whereas cans remain emblematic of shelf-stable food preservation. Cups, tubes, jars, and bottles accommodate liquid and semi-solid consumables, and pouches and bags offer flexible, space-efficient solutions favored in snack and on-the-go segments. Usage differentiation highlights the tension between single-use formats-integral to convenience and food safety protocols-and reusable offerings that align with escalating environmental mandates. Application-based dynamics drive development of specialized containers tailored to bakery and confectionery goods, dairy products, fresh and frozen fruits and vegetables, meat and seafood varieties, and ready-to-eat meals or snacks. Within these categories, sub-divisions such as fresh produce versus frozen produce, fresh meat versus processed seafood, and pre-cooked meals versus snack segments each present distinct functional and regulatory requirements. End-user considerations span from industrial food processors and institutional food service channels, including cafeterias and restaurants, to household consumers and retail or supermarket operations. Finally, distribution channels bifurcate into offline pathways-where traditional grocery and food service dominate-and online platforms that prioritize lightweight, protective formats compatible with direct-to-consumer shipping.

This comprehensive research report categorizes the Food Container market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Material

- Product Type

- Usage

- Application

- End User

- Distribution Channel

Uncovering Key Regional Dynamics Influencing Food Container Adoption and Innovation Across the Americas, EMEA, and Asia-Pacific Markets

Regional market dynamics profoundly shape food container innovation and adoption, reflecting unique cultural preferences, regulatory environments, and supply chain infrastructures. In the Americas, demand is buoyed by high per-capita consumption of convenience and ready-to-eat foods, alongside robust e-commerce ecosystems that necessitate protective and tamper-evident packaging. Industry players in North America are at the vanguard of smart packaging technologies, integrating freshness indicators and lightweight composites to address consumer expectations for transparency, safety, and convenience.

Within Europe, Middle East, and Africa, regulatory frameworks such as Extended Producer Responsibility (EPR) laws and ambitious plastic waste reduction targets have accelerated the uptake of recyclable and compostable containers. European stakeholders, in particular, are pioneering circular economy initiatives that incentivize the reuse of rigid packaging materials and foster collaboration between brand owners, converters, and waste management entities. Meanwhile, the expanding consumer base in the Middle East and Africa is driving growth in both traditional retail packaging and innovative flexible formats adapted to local product portfolios.

Asia-Pacific stands out as the fastest-growing region, propelled by rapid urbanization, rising disposable incomes, and an expanding middle class in China, India, and Southeast Asia. The convergence of nuclear household trends and a burgeoning food delivery culture has underpinned surging demand for stackable, leak-proof, and space-efficient containers. Concurrently, government initiatives targeting single-use plastic bans have stimulated R&D investments in biodegradable and recyclable solutions, positioning the region at the forefront of sustainable packaging breakthroughs.

This comprehensive research report examines key regions that drive the evolution of the Food Container market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Emerging Competitors Shaping the Food Container Ecosystem Through Strategic Partnerships and Technological Leadership

The competitive landscape of the food container market is defined by a blend of global packaging conglomerates and specialized innovators, each leveraging unique capabilities to capture value across the supply chain. Amcor plc stands out for its comprehensive portfolio spanning flexible films to rigid containers, underpinned by substantial R&D investments and a track record of strategic acquisitions, including its transformative merger with Berry Global in late 2024. This consolidation has broadened Amcor’s geographic footprint and bolstered its ability to offer end-to-end packaging solutions across over 140 countries.

Tetra Pak International, renowned for its aseptic carton systems, continues to drive category expansion through proprietary sterilization technologies and service-based models that integrate equipment leasing with maintenance and training. Silgan Holdings has carved a leadership position in metal closures and rigid containers, benefiting from deep OEM relationships and a diversified portfolio that spans food, beverage, and household products. Meanwhile, Sonoco Products Company and Sealed Air Corporation are distinguished by their innovative approach to protective packaging and barrier films, catering to high-volume consumer goods applications. A cohort of agile regional players and material specialists-such as Huhtamaki, Ball Corporation, and Reynolds Group-round out the ecosystem, each advancing niche capabilities through targeted product launches and sustainability alliances.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food Container market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALPLA Werke Alwin Lehner GmbH & Co KG

- Amcor PLC

- Anchor Glass Container Corporation

- Ardagh Group S.A.

- Asahi Kasei Corporation

- Ball Corporation

- Berry Global, Inc.

- Constantia Flexibles Group GmbH

- Crown Holdings Incorporated

- Daio Paper Corporation

- Fuling Global Inc.

- Gerresheimer AG

- Graham Packaging Company Incorporated

- Huhtamäki Oyj

- Kaneka Corporation

- Klockner Pentaplast Group

- Mitsubishi Chemical Corporation

- Mondi Group

- Owens-Illinois Group Incorporated

- Pactiv Evergreen Inc.

- Reynolds Group Holdings Limited

- Sealed Air Corporation

- Silgan Holdings, Inc.

- Smurfit Kappa Group

- Sonoco Products Company

- Tetra Pak Group

- Toppan Printing Co., Ltd.

Actionable Strategies for Industry Leaders to Navigate Market Complexities, Enhance Sustainability, and Capitalize on Emerging Packaging Trends

To thrive amid complex cost pressures and evolving sustainability mandates, industry leaders should prioritize a dual focus on material innovation and supply chain resiliency. Leveraging advanced analytics to forecast raw material volatility and optimize purchase timing can mitigate the impact of tariff-driven cost inflation. Strategic partnerships with resin producers and fiber suppliers can secure preferential access to next-generation biopolymers and recyclable flutes, facilitating a seamless transition toward circular packaging models.

Simultaneously, organizations must embed sustainability objectives within product development roadmaps by adopting design-for-recycling principles and exploring substrate blends that balance performance with end-of-life recoverability. Piloting smart packaging applications-such as time-temperature indicators and QR-based traceability tags-can enhance consumer engagement and unlock value in direct-to-consumer channels. By aligning internal incentives with external regulatory targets, and by engaging proactively with policymakers and waste management stakeholders, companies can accelerate the adoption of eco-conscious packaging and strengthen brand equity in increasingly discerning markets.

Detailing Rigorous Research Methodology Combining Primary Engagements and Secondary Data Sources to Ensure Comprehensive Food Container Market Analysis

This research study harnessed a comprehensive methodology that begins with extensive secondary research, drawing on regulatory filings, industry publications, trade association reports, and company disclosures to map the macroeconomic, geopolitical, and technological landscape influencing food container markets. Government announcements, such as presidential proclamations on Section 232 tariff adjustments, served as primary source material to ascertain trade policy impacts and timeline specifics.

Complementing this, primary research comprised structured interviews with senior executives across material suppliers, packaging converters, brand owners, and logistics service providers, designed to validate emerging trends, operational challenges, and strategic priorities. The integration of both quantitative insights and qualitative perspectives enabled triangulation of findings, ensuring robust conclusions. Data consolidation and cross-verification were performed using proprietary analytical frameworks, with continual revisions informed by peer benchmarking and expert review panels, culminating in a market intelligence report tailored to the strategic needs of industry decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food Container market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food Container Market, by Product Material

- Food Container Market, by Product Type

- Food Container Market, by Usage

- Food Container Market, by Application

- Food Container Market, by End User

- Food Container Market, by Distribution Channel

- Food Container Market, by Region

- Food Container Market, by Group

- Food Container Market, by Country

- United States Food Container Market

- China Food Container Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Summarizing Critical Conclusions and Strategic Takeaways That Illuminate Future Trajectories in the Evolving Food Container Market Landscape

The food container market stands at a pivotal juncture, where sustainability mandates, consumer expectations, and trade policy shifts converge to redefine competitive advantage. Organizations that proactively embrace circular design frameworks and invest in next-generation materials will gain early mover advantages in both mature and emerging markets. Likewise, the integration of smart packaging functionalities is poised to unlock new service-based revenue streams and fortify supply chain transparency.

Amidst tariff-induced cost pressures, resilient sourcing strategies and strategic supplier alliances are indispensable for maintaining margin integrity. Simultaneously, regional market differentiation-driven by regulatory environments in EMEA, e-commerce growth in the Americas, and rapid consumer adoption in Asia-Pacific-demands tailored go-to-market approaches. By synthesizing these insights into coherent growth roadmaps, industry participants can anticipate disruptions, capitalize on innovation inflection points, and secure long-term leadership in the evolving food container ecosystem.

Engage with Ketan Rohom for Exclusive Access to the Comprehensive Food Container Market Research Report and Drive Informed Packaging Decisions

To explore the full breadth of insights and strategic guidance contained in this comprehensive market research report, engage directly with Ketan Rohom, Associate Director, Sales & Marketing. His expertise and personalized support will ensure that your organization secures the precise data, analysis, and recommendations necessary to drive informed decisions in the dynamic food container market. Reach out to Ketan Rohom to discuss customized licensing options, exclusive study extracts, and tailored consulting packages that address your unique business objectives. By partnering with him, you’ll gain immediate access to proprietary intelligence on emerging trends, tariff impacts, segmentation nuances, and competitor benchmarks, empowering your team to chart a confident course through evolving packaging challenges and opportunities.

- How big is the Food Container Market?

- What is the Food Container Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?