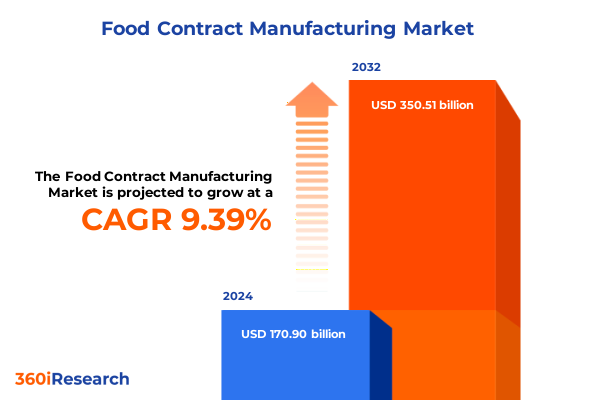

The Food Contract Manufacturing Market size was estimated at USD 186.62 billion in 2025 and expected to reach USD 203.78 billion in 2026, at a CAGR of 9.42% to reach USD 350.51 billion by 2032.

Stepping into the Heart of Food Contract Manufacturing Where Evolving Consumer Demands and Advanced Operations Shape Future Food Production

Contract manufacturing in the food sector has emerged as a vital bridge between visionary brands and state-of-the-art production capabilities. As consumer expectations evolve faster than ever, companies seek partners who can deliver high-quality products at scale while navigating complex regulatory, logistical, and sustainability challenges. This executive summary explores how leading contract manufacturers are rising to meet the demand for innovation, agility, and end-to-end quality assurance in a competitive global market.

In the wake of shifting dietary preferences, stringent safety standards, and the proliferation of direct-to-consumer channels, the contract manufacturing ecosystem must continuously adapt. From initial ideation to final distribution, manufacturers are embracing new technologies and processes to optimize throughput, reduce waste, and maintain total transparency. As we delve into the following sections, we will outline transformative shifts, examine the cumulative impact of U.S. tariff policies, and present actionable recommendations to help decision-makers harness opportunities and mitigate risks in this dynamic landscape.

Charting the Transformative Shifts That Are Redefining Ingredients Processes and Partnerships in the Food Contract Manufacturing Sector

Recent years have seen a wave of transformative shifts reshaping every facet of food contract manufacturing. Advances in process technologies such as high-pressure processing and aseptic systems are enabling manufacturers to extend shelf lives and preserve nutritional integrity without relying on additives. Concurrently, digital integration across the value chain-leveraging IoT sensors, AI-driven quality control, and blockchain traceability-has elevated transparency and operational resilience, essential for building consumer trust in an era of heightened scrutiny.

Parallel to these technological advancements, consumer behavior is undergoing a profound transformation. Growing demand for clean label, organic, and plant-based offerings has prompted manufacturers to retool production lines originally designed for conventional products. Sustainability considerations, from sourcing regenerative ingredients to adopting recyclable and compostable packaging formats such as pouches and cartons, have become non negotiable priorities. These converging trends are compelling contract manufacturers to forge deeper partnerships with suppliers, invest in flexible lines across extrusion, fermentation, and thermal processing, and redefine agility in a market where speed to shelf now underpins competitive advantage.

Assessing the Far Reaching Operational and Sourcing Consequences of 2025 United States Tariffs on Food Manufacturing Inputs

In 2025, the cumulative impact of United States tariffs on imported ingredients and packaging materials has become a critical operational consideration for food contract manufacturers. Heightened duties on certain dairy proteins, fruit concentrates, and thermoformed plastic trays have driven up input costs, squeezing margins and challenging manufacturers to maintain price competitiveness. In response, many companies have deepened domestic sourcing relationships, prioritizing vertically integrated supply chains that can buffer against tariff volatility.

Simultaneously, manufacturers are exploring innovative material substitutions, from plant-derived bioplastics to ingredient blends that maintain functional performance while avoiding high-duty lines. Strategic hedging and longer-term procurement contracts have emerged as key tools to manage cost uncertainty. While tariffs have introduced additional layers of complexity, they have also accelerated a shift toward localized and resilient sourcing networks, encouraging contract manufacturers to reexamine risk exposure, optimize inventory strategies, and reinforce supply chain transparency to satisfy both regulatory requirements and brand commitments.

Unveiling Deep Segmentation Insights Spanning Product Types Processes Pack Formats Ingredient Categories and Distribution Routes

The food contract manufacturing market exhibits distinct behaviors when analyzed through lenses of product type, process type, packaging format, ingredient type, and distribution channel. Bakery product lines, for instance, have seen renewed investment in clean label formulations and aseptic processing to extend freshness. Beverage manufacturing partners have prioritized high-pressure processing for cold-pressed juices, while ready-to-eat meal producers are embracing extrusion technology to simulate textures in plant-based offerings. Across all segments, pouches and cartons are gaining prominence for liquid and semi-liquid foods, whereas trays continue to serve frozen and ready meals, prompting manufacturers to adapt their packaging infrastructure accordingly.

Ingredient diversification is also reshaping capacity usage: organic and plant-based formulations now require separate allergen-controlled facilities, which has altered floor-plan design and maintenance protocols. Distribution channels have likewise influenced production planning, with e-commerce orders demanding smaller batch runs and more complex fulfillment logistics compared to large-volume institutional or food-service contracts. Understanding these cross-cutting segmentation dynamics empowers contract manufacturers to align capital investments, workforce training, and supply chain partnerships with the precise needs of each market niche.

This comprehensive research report categorizes the Food Contract Manufacturing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Process Type

- Packaging Format

- Ingredient Type

- Distribution Channel

Highlighting Key Regional Dynamics Influencing Production Efficiency Regulatory Compliance and Consumer Demand Trajectories

Regional variances profoundly shape operational efficiencies, regulatory compliance, and consumer preferences within the global food contract manufacturing landscape. In the Americas, the proximity of integrated grain, fruit, and dairy producing regions offers manufacturers reduced lead times and favorable economies of scale; freshwater availability and established logistics corridors further support large-scale operations. Conversely, Europe, the Middle East & Africa present a fragmented regulatory environment, requiring contract manufacturers to navigate divergent food safety standards and sustainability mandates while leveraging premium ingredient reputations to cater to discerning consumers.

In contrast, the Asia-Pacific region stands out for its rapid urbanization, burgeoning middle-class demand, and strong government support for food processing infrastructure. Emerging markets across Southeast Asia offer cost-effective manufacturing hubs, yet demand advanced automation investments to meet rising quality requirements. Across all regions, manufacturers that tailor production footprints and develop nimble sourcing strategies to address local regulatory frameworks and consumer trend heterogeneity will capture the greatest value and ensure long-term resilience.

This comprehensive research report examines key regions that drive the evolution of the Food Contract Manufacturing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders That Excel Through Technical Diversification Collaboration and Agile Operational Frameworks

Leading contract manufacturers are distinguished by their ability to integrate deep technical expertise with robust quality management frameworks and agile operational models. Organizations with diversified process portfolios, spanning aseptic to high-pressure and fermentation capabilities, can pivot quickly to capture emerging trend surges such as plant-based dairy alternatives or functional beverages. Companies that invest in modular production lines and maintain separate allergen and organic-certified zones gain a competitive edge by fulfilling stringent brand specifications at scale.

Moreover, best-in-class manufacturers demonstrate excellence in collaborative innovation, co-developing formulations with clients and leveraging pilot-scale facilities to accelerate time to market. Strategic partnerships with packaging specialists and ingredient innovators enable streamlined transitions to sustainable formats and novel protein sources. Those firms that have established global distribution networks, coupled with integrated digital platforms for order management and traceability, consistently outpace peers in fulfilling complex multichannel contracts, minimizing lead times, and mitigating compliance risks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food Contract Manufacturing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Action Pak, Inc.

- Baldwin Richardson Foods Co.

- Brady Enterprises, Inc.

- Century Foods International LLC

- Christy Quality Foods Pvt. Ltd.

- Craft Cannery

- ETA Lumis Foods

- Fibro Foods Pvt. Ltd.

- Gopal Food Product

- HACO AG

- Hearthside Food Solutions LLC

- Heartland Food Products Group

- Helander

- Hindustan Foods Limited

- Nikken Foods Co., Ltd.

- Nutrascience Labs, Inc.

- Omniblend Pty Ltd.

- PacMoore Products, Inc.

- Subco Foods, Inc.

- Thrive Foods LLC

Driving Sustainable Growth by Prioritizing Strategic Partnerships Digitalization and Workforce Development

To thrive amid intensifying competition and evolving regulatory landscapes, industry leaders should prioritize a blend of strategic partnerships, technological investments, and organizational agility. Building long-term alliances with ingredient suppliers specializing in clean label and plant-based innovations will secure access to differentiated raw materials. Concurrently, deploying digital twins and predictive maintenance systems across critical equipment can reduce downtime and improve throughput reliability.

Operational flexibility must be underpinned by workforce development programs that equip employees with cross-functional skills in process control, quality assurance, and regulatory compliance. Establishing dedicated market intelligence functions will help track consumer demand shifts and tariff policy changes in real time, enabling proactive adaptation. Lastly, embedding sustainability metrics into core performance indicators-from energy usage and water efficiency to packaging recyclability-will both satisfy brand partner requirements and resonate with end consumers who increasingly demand transparency and environmental stewardship.

Outlining a Robust Research Methodology Blending Industry Interviews Regulatory Data and Pilot Plant Case Studies

This research employs a multifaceted approach, combining primary interviews with senior executives at leading contract manufacturing firms, ingredient suppliers, and packaging specialists, along with extensive secondary research drawing on regulatory filings, trade association reports, and academic publications. Qualitative insights from pilot plant tours and client case studies are synthesized to identify best practices and innovation hotspots across processing, packaging, and supply chain management.

Quantitative data collection involves tracking tariff schedules, import/export statistics, and regional investment trends to map cost and regulatory pressures. Segmentation analyses integrate process, product, packaging, ingredient, and distribution variables to reveal granular performance drivers. Rigorous data validation and triangulation across multiple sources ensure the credibility and relevance of all findings to support actionable insights for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food Contract Manufacturing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food Contract Manufacturing Market, by Product Type

- Food Contract Manufacturing Market, by Process Type

- Food Contract Manufacturing Market, by Packaging Format

- Food Contract Manufacturing Market, by Ingredient Type

- Food Contract Manufacturing Market, by Distribution Channel

- Food Contract Manufacturing Market, by Region

- Food Contract Manufacturing Market, by Group

- Food Contract Manufacturing Market, by Country

- United States Food Contract Manufacturing Market

- China Food Contract Manufacturing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Strategic Imperatives for Sustainable Competitive Advantage in Food Contract Manufacturing

In an era defined by rapid innovation and shifting global trade dynamics, contract manufacturers stand at the nexus of opportunity and uncertainty. Embracing advanced processing technologies, resilient sourcing strategies, and modular operational designs will enable organizations to capitalize on burgeoning clean label and plant-based trends. By aligning segmentation-driven insights with regional nuances and tariff considerations, manufacturers can craft targeted growth strategies that balance efficiency, compliance, and consumer appeal.

Looking ahead, the capacity to integrate digital traceability, optimize resource intensity, and foster collaborative partnerships across the value chain will determine which players emerge as long-term market leaders. As decision-makers navigate this complex environment, the strategic imperatives outlined here provide a clear roadmap for sustaining competitive advantage and delivering value to both brand partners and end consumers.

Unlock Exclusive Insights and Elevate Your Food Contract Manufacturing Strategy by Connecting with Ketan Rohom Today

Don’t let evolving industry dynamics leave your organization behind. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive market research report today and gain unparalleled insights into the food contract manufacturing landscape. Discover decisive strategies tailored to emerging consumer trends, regulatory landscapes, tariff impacts, and innovation pathways to position your business at the forefront of transformation. Contact Ketan to empower your strategic planning and drive sustained competitive advantage in a rapidly evolving market.

- How big is the Food Contract Manufacturing Market?

- What is the Food Contract Manufacturing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?