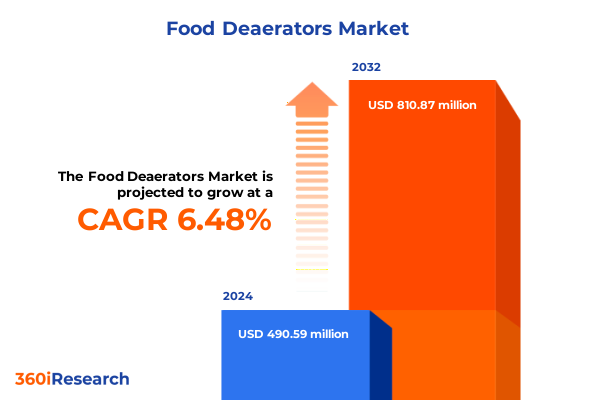

The Food Deaerators Market size was estimated at USD 521.85 million in 2025 and expected to reach USD 559.23 million in 2026, at a CAGR of 6.49% to reach USD 810.87 million by 2032.

Unveiling the Critical Role of Deaeration Technologies in Ensuring Quality Efficiency and Sustainability Across the Modern Food Processing Industry

Food deaeration stands at the forefront of preserving product integrity and extending shelf life across a broad range of food and beverage applications. By removing dissolved gases such as oxygen and carbon dioxide, deaerators protect sensitive liquids from oxidative degradation, microbial growth, and inconsistencies in flavor and appearance. Modern food processing environments demand precise gas removal to maintain the organoleptic and nutritional qualities of juices, dairy-based beverages, and delicate sauces, all while ensuring compliance with stringent food safety regulations. As consumer preferences evolve toward premium, clean-label offerings, the role of high-performance deaeration systems has become integral to delivering reliable product quality at scale.

The competitive landscape for deaeration equipment is shaped by rapid advancements in process automation, material science, and thermal management. Manufacturers are under pressure to integrate efficient, sanitary, and energy-conscious solutions into existing production lines without compromising throughput or flexibility. This executive summary provides an authoritative overview of the transformative factors driving the food deaerator market, equipping decision-makers with a clear understanding of current industry paradigms and the actionable intelligence necessary to navigate complexity with confidence.

Navigating Disruption and Innovation as Sustainability Automation and Digitalization Transform Food Deaeration Practices for Enhanced Operational Performance

The food processing sector is undergoing a paradigm shift as sustainability mandates intersect with advancements in automation and data-driven control. Traditional steam-heated deaerators are increasingly supplanted by systems featuring advanced heat recovery and membrane-based separation, enabling manufacturers to achieve superior gas removal rates at lower energy consumption. Real-time monitoring via integrated sensors and IoT platforms has emerged as a standard for predictive maintenance and process optimization, reducing downtime and supporting seamless traceability throughout production workflows. Concurrently, computational fluid dynamics (CFD) is now leveraged in the design phase to fine-tune deaerator geometries, boosting operational efficiency while meeting evolving hygiene requirements without imposing significant maintenance burdens.

In addition, the amalgamation of inline processing technologies-such as pasteurization, filtration, and deaeration-has streamlined production lines, allowing simultaneous gas removal and thermal treatment steps that shorten cycle times and lower capital expenditure. Energy-efficient designs paired with renewable energy integrations, such as solar-assisted vacuum pumps, reflect a broader commitment to reducing carbon footprints. These converging trends are redefining best practices, as manufacturers seek equipment that not only meets performance targets but also aligns with corporate sustainability goals and emerging regulatory frameworks.

Assessing the Total Cost Impact and Supply Chain Rebalancing Driven by New Section 301 Tariffs on Critical Deaeration Equipment Imports

Throughout 2025, cumulative adjustments to United States import duties under Section 301 have reshaped the cost structure for equipment critical to food deaeration processes. The Office of the United States Trade Representative (USTR) finalized increases in tariffs on items such as solar wafers and polysilicon to 50 percent, along with a 25 percent duty on tungsten products, effective January 1, 2025, in an effort to bolster domestic clean energy investments and enhance supply chain resilience. Additionally, an escalation in baseline duties for industrial machinery classified under key HTS chapters has driven manufacturers to reassess sourcing strategies for deaerator components, many of which fall within Chapters 84 and 85 and face additional 25 percent duties unless specific exclusions are granted.

These tariff revisions have prompted a recalibration of capital budgets, as OEMs and end users grapple with higher landed costs and extended lead times. To mitigate financial impact, stakeholders have accelerated exclusion requests and evaluated alternative supply chain routes while intensifying local assembly initiatives. The net effect has been a reorientation toward suppliers offering flexible exclusion processes, as well as a heightened emphasis on modular, in-country manufacturing capabilities that can bypass punitive tariffs. In turn, the market is witnessing a gradual localization of deaeration system production, aimed at sustaining continuity of supply amid an increasingly protectionist trade environment.

Integrating End-Use Specific Performance Requirements and Technological Options to Drive Competitive Differentiation in the Food Deaerators Market

The food deaerators market encompasses a complex range of user requirements and technological solutions. Industrial-scale operations demand robust systems capable of handling high-volume throughput, while commercial producers often prioritize flexibility and ease of integration. Mechanical deaeration methods remain widely adopted for their simplicity, yet membrane-based solutions are gaining traction for their precise gas separation and minimal thermal impact. Thermal deaeration continues to serve niche segments where heat application enhances functionality, notably in products requiring pasteurization simultaneously with gas removal.

Capacity range also plays a critical role in equipment selection. Enterprises processing up to 500 liters per hour appreciate compact deaerator units that deliver consistent performance without occupying extensive floor space. Mid-range throughput requirements between 501 and 2000 liters per hour call for medium-sized modules that balance efficiency with operational economy. High-capacity operations exceeding 2000 liters per hour necessitate large-scale skid-mounted or modular systems engineered for continuous running and integration with automated control architectures.

The spectrum of applications further diversifies the market. Beverage producers have specific needs for beer clarification, juice stabilization, soft drink preservation, and water deaeration, each demanding tailored deaerator designs to maintain flavor profiles and carbonation levels. Dairy processors leverage deaerators in cheese and milk production to enhance product texture and longevity, often coupling them with aseptic treatment. Meanwhile, the food processing segment-covering processed fruits and vegetable purées-requires gentle deaeration that preserves particulate integrity. Equipment typologies, including plate, spray, and vacuum deaerators, offer distinct operational benefits. Spray systems bifurcate into high-pressure and low-pressure variants, while vacuum units feature horizontal or vertical designs to suit layout constraints and process specifics.

This comprehensive research report categorizes the Food Deaerators market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Capacity Range

- Equipment Type

- Application

- End Use Industry

Contrasting Adoption Rates and Regulatory Drivers Across the Americas EMEA and Asia-Pacific Highlight Regional Divergence in Equipment Choices

Regional dynamics exert a profound influence on food deaerator adoption patterns. In the Americas, a mature regulatory environment and well-established supply chains have fostered widespread deployment of advanced deaerators, particularly among large beverage and dairy conglomerates. Manufacturers in North America have emphasized systems with energy recovery and IoT-enabled monitoring to meet stringent sustainability commitments and optimize capital efficiency.

Across Europe, Middle East & Africa, regulatory frameworks around food safety and environmental impact have accelerated the uptake of hygienic designs and low-emission technologies. EU directives on energy efficiency and water usage have spurred investment in membrane deaeration and heat recovery solutions, while expanding foodservice sectors in the Middle East and Africa have driven demand for modular, scalable equipment tailored to diverse climates.

Asia-Pacific stands out for its rapid industrialization and rising consumer appetite for premium, shelf-stable products. Beverage producers in China and India are transitioning from entry-level mechanical deaerators to hybrid systems that combine thermal and membrane technologies, seeking to reduce spoilage rates and support burgeoning export markets. In Southeast Asia, smaller operators favor compact, cost-effective units that can service a blend of beverage and food processing lines, reflecting an agile approach to emerging local market opportunities.

This comprehensive research report examines key regions that drive the evolution of the Food Deaerators market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Showcasing Pioneering Solutions from Alfa Laval GEA SPX Flow and JBT Underscores the Importance of Partnership and Continuous Innovation

Leading equipment providers have differentiated through targeted innovation and strategic partnerships. Alfa Laval’s Alrox vacuum deaeration modules deliver high oxygen removal for viscous products while preserving aroma compounds via optional condensers, catering to juice and specialty beverage producers seeking superior flavor retention. GEA’s water deaeration systems, including its DIOX two-stage and VARIDOX variants, address the needs of both hot and cold processing environments in brewery and nonalcoholic beverage lines, emphasizing hygienic operation and minimal energy input. SPX Flow has earned recognition for sustainability with its APV Aseptic Rapid Recovery System, which leverages patented pigging technology to reduce product waste from 4 percent to 0.5 percent and slash water usage in dairy and aseptic beverage processes.

JBT Corporation remains a prominent competitor, integrating deaeration functionality into its UHT processing lines for fruit juices and flavored dairy, enhancing boiler feedwater temperature control and aroma recirculation through vapor condensation while providing compact designs for space-constrained plants. Each of these vendors cultivates recurring revenue streams through aftermarket service agreements, digital monitoring platforms, and exclusion support mechanisms that help end users navigate evolving tariff landscapes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food Deaerators market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfa Laval AB

- Biesterfeld AG

- Centec LLC

- Central States Industrial Equipment & Service, Inc.

- EnviroSep, Inc.

- GEA Group AG

- Indeck Power Equipment Company

- Jaygo, Inc.

- John Bean Technologies Corporation (JBT)

- Mepaco

- Parker Boiler Co.

- Pentair PLC

- PerMix Mixers

- Process Equipment Solutions, LLC

- Shakumbhari Engineering Works

- Special Projects International Inc.

- Spirax-Sarco Engineering plc

- SPX FLOW, Inc.

- Sterling Deaerator Comany

- Sterling Process Equipment and Services, Inc.

- Stork Technical Services Holding B.V.

- TechniBlend, Inc.

- The Cornell Machine Company

- The Fulton Companies

- Wenzhou Leno Machinery Co.,ltd

Aligning Technology Pilots Regulatory Engagement and Supplier Collaboration to Optimize Deaeration Performance and Cost Management

To stay ahead in a shifting marketplace, industry leaders should prioritize integration of advanced monitoring technologies that deliver real-time visibility into deaeration performance, enabling rapid response to operational deviations and reducing unplanned downtime. Cultivating local manufacturing or assembly partnerships can help mitigate rising import costs and expedite delivery timelines in the face of ongoing trade uncertainties. Equally, pursuing proactive tariff exclusion requests under Section 301 for critical machinery can lower total cost of ownership and safeguard budget allocations for future capital projects.

Investing in pilot installations that combine membrane and thermal deaeration offers a pathway to assess energy savings and product quality improvements before scaling full production. Companies should also engage in cross-functional collaboration between R&D, procurement, and sustainability teams to align equipment choices with broader ESG targets. Finally, fostering tighter ties with equipment vendors for joint development of custom modules or service agreements can create competitive advantages by ensuring access to the latest process innovations and specialized maintenance support.

Employing a Robust Multi-Source Research Framework Blending Primary End-User Feedback Technical Benchmarks and Trade Data Analysis

This research was conducted using a rigorous, multi-tiered methodology that integrates primary interviews with equipment manufacturers, end-user surveys across beverage dairy and food processing segments, and secondary data from public filings, technical publications, and regulatory documentation. Trade data from the USTR and HTS classifications were analyzed to quantify tariff impacts, while patent databases and industry conferences provided insights into emerging technological advances.

Qualitative findings were triangulated with vendor case studies and customer testimonials to validate performance claims and ascertain application-specific benefits. Where applicable, computational models and energy consumption benchmarks from independent engineering assessments informed the comparative analysis of energy-efficient designs. The aggregation and synthesis of these diverse inputs ensure that the resulting strategic recommendations are both data-driven and aligned with current market realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food Deaerators market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food Deaerators Market, by Technology

- Food Deaerators Market, by Capacity Range

- Food Deaerators Market, by Equipment Type

- Food Deaerators Market, by Application

- Food Deaerators Market, by End Use Industry

- Food Deaerators Market, by Region

- Food Deaerators Market, by Group

- Food Deaerators Market, by Country

- United States Food Deaerators Market

- China Food Deaerators Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Insights on the Imperative to Integrate Quality Driven Innovation and Supply Chain Resilience in Food Deaeration Strategies

Food deaeration technology sits at the nexus of quality assurance, operational efficiency, and sustainability imperatives for the modern food processing industry. As market dynamics evolve under the influence of regulatory adjustments, consumer trends, and tariff fluctuations, stakeholders must adopt a holistic approach to equipment selection and process design. Embracing advanced control systems, modular designs, and localized manufacturing can help mitigate supply chain risks and optimize total cost of ownership.

Ultimately, the companies that succeed will be those that fuse technological agility with strategic foresight, leveraging comprehensive market insights to align capital investments with long-term efficiency and environmental objectives. By doing so, they will not only safeguard product integrity but also establish enduring competitive advantages in an increasingly discerning global marketplace.

Empower Strategic Growth with Direct Access to Our In-Depth Food Deaerators Market Report Through a Personalized Consultation with Ketan Rohom

Unlock unparalleled insights and actionable intelligence by securing your comprehensive market research report on Food Deaerators today. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to ensure your organization capitalizes on the latest technological advancements, regulatory shifts, and competitive benchmarks shaping the food deaeration landscape. Whether you seek to optimize procurement strategies, validate product development roadmaps, or align your growth initiatives with regional dynamics, our tailored report will deliver the clarity and foresight you need. Reach out now to explore flexible licensing options, sample chapters, and bespoke advisory services designed to propel your business forward.

- How big is the Food Deaerators Market?

- What is the Food Deaerators Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?