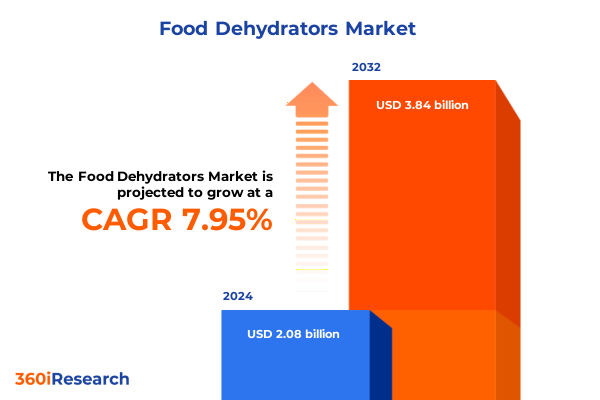

The Food Dehydrators Market size was estimated at USD 2.23 billion in 2025 and expected to reach USD 2.40 billion in 2026, at a CAGR of 8.06% to reach USD 3.84 billion by 2032.

Setting the Stage for Evolution in Food Dehydration: Unveiling the Critical Drivers Shaping the Modern Dehydrator Ecosystem Globally

The contemporary food preservation landscape is experiencing a profound shift as consumers and businesses alike prioritize nutritional retention, shelf-life extension, and resource efficiency. Traditional methods of sun-drying and rudimentary heat-based dehydration are rapidly giving way to sophisticated systems that leverage precise airflow controls and innovative moisture-extraction technologies. These advanced dehydrators are not merely appliances; they serve as pivotal enablers of supply chain resilience by reducing food spoilage and facilitating inventory management across vast distribution networks. This evolution underscores the critical role of dehydration technology in addressing the global imperative to minimize food waste, especially amid logistical complexities and fluctuating agricultural yield cycles. For instance, modern farmers and food processors are integrating heat pump dehydration to achieve up to 50% energy savings compared to conventional methods, significantly lowering operational costs while preserving nutrient profiles more effectively than ever before.

Meanwhile, at the consumer level, market feedback indicates a surge in demand for appliances that offer consistent performance, intuitive digital interfaces, and even preset programs for diverse food categories. Rigorous product evaluations conducted by culinary experts have propelled models featuring multi-tray designs and stainless-steel construction to prominence, reflecting a balance of durability and precision control in kitchen environments. These consumer preferences are driving manufacturers to refine unit ergonomics, reduce noise emissions, and streamline cleaning processes, ensuring that dehydrators integrate seamlessly into home routines without compromising on professional-grade outputs.

Transitioning between commercial and residential spheres, the industry is also witnessing growing endorsement of solar-powered dehydration solutions, particularly in regions with unreliable grid infrastructure. Award-winning prototypes developed with phase-change materials and IoT-enabled climate monitoring are facilitating low-cost drying in rural settings, where traditional energy sources may be scarce. Such decentralized dehydration models are empowering local entrepreneurs, fostering community self-sufficiency, and reinforcing supply networks in both emerging and established markets.

Unprecedented Technological Innovations and Evolving Consumer Preferences Fuel Dynamic Shifts in the Global Food Dehydration Landscape

Technological innovation is reshaping the food dehydrator sector with unprecedented velocity, as Internet of Things integration and automation become integral features of both consumer and industrial models. By embedding IoT sensors, manufacturers enable real-time monitoring of humidity, temperature, and airflow, granting users remote control and analytics-driven insights to optimize dehydration cycles and predict maintenance needs. These advancements have reduced manual oversight by up to 28.5% in large-scale operations, fostering consistency across batches and elevating product quality standards.

Concurrently, sustainability considerations are catalyzing a pivot toward energy-efficient and eco-friendly designs. The introduction of heat pump technology in dehydrators is a hallmark of this shift, offering up to 60% lower energy consumption compared to conventional hot-air methods. As a result, companies are marketing devices that not only dry foods more uniformly but also align with global emissions reduction goals. Solar-electric hybrid units have emerged as viable solutions in off-grid regions and green-certified facilities, bolstering brand differentiation in a crowded marketplace.

In parallel, consumer behaviors are undergoing a metamorphosis, with an emphasis on clean-label and plant-based diets driving demand for dehydrated fruits, vegetables, and snack formulations free from additives. Market observers note that health-oriented consumers are increasingly adopting dehydration for meal prep and artisanal culinary experimentation, underscoring the appliance’s expanding role within lifestyle and wellness narratives. These converging forces-digitization, energy optimization, and wellness alignment-are converging to redefine product roadmaps, compel strategic R&D investments, and establish new benchmarks for performance and functionality across the food dehydration ecosystem.

Analyzing the Far-reaching Consequences of 2025 United States Tariff Measures on Food Dehydrator Manufacturing Supply Chains and Cost Structures

In mid-2024, the United States Trade Representative announced that exclusions for thousands of Chinese-origin machinery categories, including industrial dehydrators and their component parts, would lapse by May 2025, reinstating 25% Section 301 tariffs on those imports. This policy reversal has exerted immediate pressure on manufacturers reliant on specialized heating elements and precision airflow modules sourced from China, prompting urgent reconfigurations of global supply chains.

To mitigate duty impacts, U.S. dehydrator producers have petitioned for case-by-case tariff exclusions, submitting detailed requests to USTR outlining the absence of viable alternatives and the strategic importance of specific machinery components. While some firms have secured temporary relief through the new exclusion process, most relief measures expire by May 31, 2025, leaving residual cost exposure and uncertainty for capital-intensive production lines.

Moreover, ancillary costs associated with documentation, customs brokerage, and potential supply re-sourcing have amplified production expenses by an estimated mid-single digit percentage across the sector. Consequently, leading manufacturers are diversifying procurement portfolios by qualifying third-country suppliers in Southeast Asia and Eastern Europe, although these alternatives currently lack the economies of scale and technical specialization previously available from Chinese OEMs. This strategic pivot underscores the tariffs’ cumulative impact, compelling industry participants to recalibrate sourcing strategies, buffer inventory cycles, and ingest new regulatory compliance workflows.

Deriving Deeply Nuanced Market Understanding through Multidimensional Segmentation across End Users Distribution Channels Technology Product Types and More

Insight into segmented market dynamics reveals nuanced performance drivers across end-user categories and distribution channels. Within commercial operations, bakeries exploit high-capacity stackable tray dehydrators to extend production runs of fruit leathers and specialty snack lines, while food processing plants integrate conveyor belt systems for continuous bulk drying of pet food and herbs. Restaurants, by contrast, prefer shelf dehydrators that offer rapid recipe flexibility and easy sanitation cycles. Residential users bifurcate into home kitchens-where smaller footprint tray dehydrators serve herb-drying and snack-preparation needs-and small-scale entrepreneurs leveraging portable units for artisanal product development.

The distribution matrix extends from department store showrooms showcasing premium digital models to hypermarket aisles stocked with plug-and-play stackable units, while specialty stores curate freeze-dry and vacuum equipment for niche culinary applications. Online retail platforms, meanwhile, facilitate direct-to-consumer sales of both entry-level and advanced dehydrators, offering bundled recipe kits and extended warranty options that augment value propositions.

Product type differentiation underscores the industry’s breadth: mass manufacturers of drum dehydrators pursue vertical airflow mechanisms to maximize throughput, whereas boutique suppliers emphasize infrared and hot-air hybrid units for precise layer-by-layer drying. Freeze drying remains a high-end application, preserving delicate flower essences and premium fruit textures, albeit at a substantially higher price point.

Technological segmentation further stratifies the market into freeze, hot-air, infrared, and vacuum modalities, each optimized for specific moisture profiles and textural outcomes. Across applications, fruits and vegetables dominate adoption, but meat jerky and snack production are catalyzing new entrants in the pet food and medicinal herb spaces. Capacity tiers-high, medium, low-align with operational scale and throughput needs, while electric and solar power sources define specifications for grid-tied facilities versus off-grid agricultural deployments. These multidimensional insights illuminate the complex interplay of user requirements, technological capabilities, and channel preferences shaping the food dehydrator market today.

This comprehensive research report categorizes the Food Dehydrators market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Capacity

- Power Source

- End User

- Distribution Channel

- Application

Mapping Regional Performance Dynamics across Americas Europe Middle East Africa and Asia Pacific to Expose Growth Patterns and Strategic Opportunities

The Americas region continues to lead in e-commerce distribution of dehydration systems, with U.S. online grocery sales for ancillary pantry staples climbing by double-digit rates in Q3 2024, signaling robust consumer engagement and seamless logistics integration. North American manufacturers benefit from advanced cold-chain infrastructure and a dense retail footprint, driving pervasive adoption in both professional and domestic kitchens.

In Europe, stakeholders are preparing for the implementation of stringent ecodesign and standby power regulations that take effect in mid-2025, mandating heat pump technology for household appliances and imposing limits on off-mode consumption. These mandates are expected to accelerate the transition toward ultra-efficient dehydrators and reshape product development pipelines to align with regional sustainability directives.

Meanwhile, Asia-Pacific markets are characterized by rapid urbanization and growing health-conscious consumption, particularly in China and India. Innovative low-cost solar dryers, developed through collaborations between research institutes and agri-startups, are proliferating in rural communities to reduce post-harvest losses and increase farm incomes. Field implementations of these solar solutions demonstrate significant reductions in produce spoilage and empower local value chains to capture higher market premiums for dried spices and fruits.

Across these regions, variable regulatory landscapes, infrastructure maturity, and local consumer priorities are driving differentiated product roadmaps and bespoke go-to-market strategies, underscoring the importance of region-specific intelligence for competitive positioning.

This comprehensive research report examines key regions that drive the evolution of the Food Dehydrators market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Corporations and Emerging Disruptors Driving Competitive Advantage and Innovation Trajectories within the Food Dehydrator Sector

Leading companies are intensifying their focus on advanced automation, energy efficiency, and sustainable power options to maintain competitive advantage. Nyle Dehydrators, for example, has leveraged heat pump technology to cut energy consumption by up to half compared to conventional models, positioning itself as a leader in eco-friendly industrial dehydration solutions. Excalibur and Nesco, long-standing household appliance brands, continue to refine multi-tray configurations, integrating digital timers and precision airflow controls to meet evolving consumer expectations for reliability and ease of use.

On the high-end end-use spectrum, specialty providers such as Buhler and GEA Group are embedding IoT-enabled monitoring and predictive analytics into their large-scale dehydrators, driving operational efficiencies of over 28% in pilot installations. These capabilities enable facilities to optimize cycle parameters in real time, minimizing manual intervention and reducing downtime through proactive maintenance alerts.

Emerging players like Turatti Group have gained traction by offering solar-electric hybrid models that cater to sustainability mandates and off-grid requirements, garnering adoption rates north of 40% in select food processing clusters keen on lowering carbon footprints. SPX Flow’s fully automated dehydration systems are further streamlining large-scale production, achieving labor cost reductions approaching 40% while delivering consistent product quality at high throughput volumes.

Collectively, these key companies are shaping market trajectories through targeted R&D investments, strategic partnerships, and geographically tailored product portfolios, reflecting a convergence of technological innovation, regulatory alignment, and shifting end-user demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food Dehydrators market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aroma Housewares Company

- Buff a lo Appliances

- Cabela's LLC

- Chefman, LLC

- EcoTech Solutions

- Excalibur Products, Inc.

- Foshan Mel-Tech Electrical Appliances Co., Ltd.

- Gourmia LLC

- Gourmia, LLC

- Guangdong IKE Industrial Co., Ltd.

- Hamilton Beach Brands Holding Company, Inc.

- Kerone Engineering Solutions Ltd.

- Kihara Works Co., Ltd.

- Koolatron Corporation

- LEM Products Holding LLC

- National Presto Industries, Inc.

- NESCO Ltd.

- NutriChef Kitchen LLC

- STX International, Inc.

- The Metal Ware Corporation

- The Sausage Maker, Inc.

- Tribest Corporation

- Tristar Products, Inc.

- Weston Brands, LLC

Formulating Impactful Strategic Recommendations to Empower Industry Leaders in Optimizing Operations Adapting to Tariff Pressures and Enhancing Market Resilience

Industry leaders must proactively diversify supply chains to mitigate exposure to reinstated tariffs on Chinese-sourced machinery by qualifying alternative suppliers in ASEAN and Eastern Europe, and by optimizing inventory buffers during exclusion request periods. Establishing strategic sourcing alliances and dual-supplier frameworks can ensure continuity of critical component inflows while hedge arrangements dampen cost volatility.

Simultaneously, accelerating investments in energy-efficient technologies-such as heat pump and solar-hybrid dehydration systems-aligns with global sustainability mandates and regulatory evolutions in regions like Europe, where stringent ecodesign rules take effect in mid-2025. Early adoption of these advanced modalities can unlock operational cost savings and improve carbon accounting metrics essential for environmental, social, and governance reporting.

Moreover, companies should amplify differentiation through digital and value-add services by embedding IoT-driven analytics for predictive maintenance and performance benchmarking. Offering cloud-based dashboards and smart app integrations enhances customer stickiness and unlocks recurring revenue streams from service subscriptions. Partnerships with software providers can expedite go-to-market timelines and fortify data-driven product roadmaps.

Finally, organizations need to deepen collaboration with research institutions, standards bodies, and local agri-enterprises to co-develop decentralized solar dehydration models that address rural market needs. Such initiatives strengthen brand equity, unlock new revenue channels in emerging geographies, and contribute to community empowerment through technology transfer.

Ensuring Research Integrity through Rigorous Multi-source Methodology Integrating Primary Stakeholder Insights Secondary Data and Comprehensive Analyses

This report integrates primary and secondary research methodologies to ensure robust and unbiased analysis. Primary research encompassed in-depth interviews with senior executives across dehydrator manufacturers, commercial end-users, and technology providers, complemented by expert panel discussions focusing on supply chain resilience, regulatory projections, and innovation roadmaps.

Secondary research involved comprehensive review of trade publications, government regulations, and industry news sources, including USTR announcements, European Commission ecodesign directives, and peer-reviewed technical briefs on dehydration technologies. High-level tariff data was cross-validated against USTR filings and third-party trade counsel advisories to quantify policy impacts accurately.

Market segmentation was performed using a bottom-up approach, mapping product types, technologies, capacity tiers, and power sources to real-world adoption patterns observed through sales channel analyses in both offline retail and e-commerce platforms. Regional frameworks were constructed by synthesizing macroeconomic indicators, regulatory timelines, and infrastructure maturity indices.

Quantitative data sets were analyzed using statistical models to discern adoption trends, cost structures, and efficiency differentials, while qualitative insights from industry leaders provided context on strategic decision-making. This blended methodology ensures comprehensive coverage and actionable intelligence for stakeholders seeking to navigate the evolving food dehydrator landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food Dehydrators market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food Dehydrators Market, by Product Type

- Food Dehydrators Market, by Technology

- Food Dehydrators Market, by Capacity

- Food Dehydrators Market, by Power Source

- Food Dehydrators Market, by End User

- Food Dehydrators Market, by Distribution Channel

- Food Dehydrators Market, by Application

- Food Dehydrators Market, by Region

- Food Dehydrators Market, by Group

- Food Dehydrators Market, by Country

- United States Food Dehydrators Market

- China Food Dehydrators Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Distilling Key Takeaways and Strategic Imperatives that Illuminate the Future of Food Dehydration Technologies Amid Market and Regulatory Evolutions

As the food dehydration sector advances, it stands at the intersection of technological transformation, regulatory realignment, and shifting consumer demands. Emerging IoT-enabled automation capabilities are redefining operational benchmarks, while heat pump and solar-hybrid solutions are driving the next wave of energy efficiency and sustainability alignment. Concurrently, the reinstatement of Section 301 tariffs has catalyzed supply chain diversification and cost management initiatives, underscoring the agility required to navigate dynamic trade landscapes.

Segment-specific insights reveal a multifaceted market structure-from high-capacity industrial conveyor systems to compact residential tray units-each tailored to nuanced end-user requirements and distribution frameworks. Regional divergences in regulatory environments and infrastructure maturity further highlight the necessity of localized go-to-market strategies.

Ultimately, organizations that anticipate regulatory shifts, embrace sustainable technology roadmaps, and leverage data-driven service models will secure competitive advantage in a rapidly evolving ecosystem. By synthesizing multifarious trends into coherent strategic initiatives, businesses can capitalize on growth vectors and mitigate emerging risks, ensuring resilience and sustained market leadership.

Connect with Ketan Rohom, Associate Director of Sales and Marketing, to Unlock Strategic Market Intelligence and Propel Your Food Dehydration Business Growth

Seize the opportunity to deepen your understanding of the intricate dynamics shaping the food dehydrator industry by securing access to this comprehensive research report. Engage directly with Ketan Rohom, Associate Director, Sales & Marketing, who can guide you through the extensive insights, data interpretations, and actionable intelligence contained within the study. Reach out to arrange a personalized demonstration of the report’s highlights, discuss tailored research services, or initiate the purchasing process. Position your organization at the forefront of market developments, overcome emerging challenges, and capitalize on strategic growth prospects with expert support from Ketan’s team. Take the next step toward informed decision-making and gain a competitive advantage in the food dehydration sector today.

- How big is the Food Dehydrators Market?

- What is the Food Dehydrators Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?