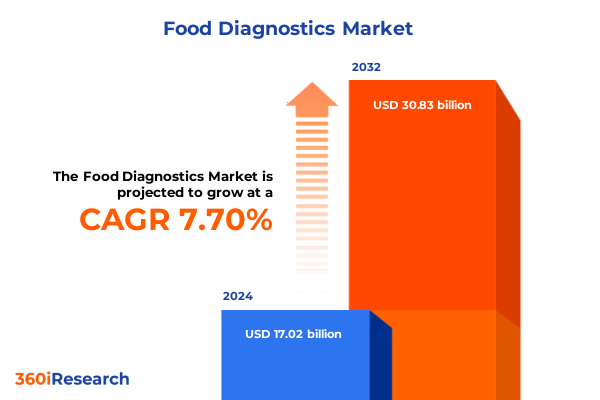

The Food Diagnostics Market size was estimated at USD 18.28 billion in 2025 and expected to reach USD 19.63 billion in 2026, at a CAGR of 7.75% to reach USD 30.83 billion by 2032.

Exploring the Vital Role of Advanced Food Diagnostics in Safeguarding Quality and Consumer Confidence Across Global Supply Chains

The rapid evolution of global food supply chains has elevated the importance of rigorous diagnostics to unprecedented levels. Heightened consumer awareness of food safety, coupled with increasingly stringent regulatory standards, has compelled stakeholders to adopt advanced testing methodologies. These developments underscore a fundamental truth: the integrity of every ingredient and finished product hinges on the reliability of diagnostic processes. As industry players grapple with complex risks-from allergen cross-contamination to economically motivated adulteration-innovations in analytical techniques have emerged as critical enablers of quality assurance and risk mitigation.

Moreover, the convergence of digital transformation and biotechnology is reshaping diagnostic workflows. Artificial intelligence and machine learning algorithms are now augmenting traditional laboratory methods, delivering predictive insights that anticipate potential safety issues before they manifest. Simultaneously, molecular biology-based platforms are offering unparalleled specificity, enabling detection of trace-level contaminants with remarkable accuracy. In this context, laboratories and manufacturers are not merely reacting to threats; they are proactively fortifying their operations through strategic investments in instrumentation, software solutions, and specialized services. Transitioning from a reactionary to a preventive paradigm, the food diagnostics sector is steering towards a future where data-driven decision making ensures both consumer protection and regulatory compliance.

Navigating Transformative Shifts Reshaping the Food Diagnostics Industry Through Technological Innovation and Regulatory Evolution in 2025

The landscape of food diagnostics is undergoing seismic shifts, driven by the interplay of emergent technologies and evolving policy frameworks. Traditional chemical analysis techniques such as chromatography are now supplemented by spectrometry and electrophoresis methods that offer deeper resolution of complex matrices. At the same time, immunological assays including ELISA, lateral flow, and fluorescence immunoassays are attaining new levels of sensitivity, enabling faster and more cost-effective screening for mycotoxins, pathogens, and allergens.

Concurrently, digital and predictive tools are revolutionizing the sector through remote monitoring, real-time data analytics, and cloud-based platforms. Predictive models harnessing big data insights are forecasting contamination risks and optimizing sampling protocols. Beyond technology, regulatory agencies worldwide are harmonizing food safety standards, fostering cross-border data sharing, and incentivizing the adoption of innovative diagnostics. These transformative forces are not isolated; rather, they are converging to create an integrated ecosystem where stakeholders collaborate to elevate the overall safety and transparency of the food supply chain.

Assessing the Cumulative Impact of United States Tariffs Implemented in 2025 on Food Diagnostics Supply Chains and Cost Structures

In 2025, a fresh slate of United States tariffs targeting key diagnostic components has introduced complex challenges for food testing laboratories and manufacturers. Tariffs on imported chromatography columns, spectrometers, and antibody reagents have driven up costs and strained procurement timelines. Suppliers are grappling with extended lead times as they navigate increased customs duties and compliance requirements, leading many to explore regional sourcing alternatives or to broaden their supplier networks to mitigate disruptions.

Despite these hurdles, some industry participants are harnessing the situation as a catalyst for innovation. Strategic stockpiling of critical reagents and adoption of in-house reagent production are emerging as viable responses to tariff pressures. Additionally, companies are increasingly validating alternative technologies and methods to diversify their toolkits. Over time, this resilience is likely to yield a more agile diagnostics market, wherein laboratories and instrument manufacturers collectively optimize cost structures and maintain service quality amid shifting trade landscapes.

Unveiling Critical Segmentation Insights Spanning Product Types, Testing Modalities, Technology Platforms, Applications, and End Users in Food Diagnostics

A nuanced examination of market segmentation unveils distinct channels of growth and specialization within the food diagnostics arena. When segmenting by product type across instruments & kits, services, and software, it becomes evident that each category fulfills unique yet interdependent roles. Instruments and kits form the backbone of physical testing capabilities, services deliver essential expertise and validation support, and software platforms integrate data management, analytics, and reporting functionalities into cohesive workflows.

Shifting focus to testing type highlights the diversity of analytical objectives. Authenticity and traceability testing underpin claims of origin and ingredient provenance, while quality testing ensures product attributes such as texture and nutritional composition meet defined standards. Safety testing, encompassing allergen screening, mycotoxin analysis, pathogen detection, and residue evaluation, remains the cornerstone of consumer protection. Insights derived from these areas guide both end-point release decisions and continuous quality improvement protocols.

Delving into technology distinctions reveals how chemical analysis methods, digital and predictive tools, immunological approaches, and molecular biology-based platforms each contribute specialized advantages. Chromatography, electrophoresis, and spectrometry deliver detailed compositional profiles. Digital models forecast contamination risks and optimize sampling. ELISA, fluorescence immunoassays, lateral flow assays, and radioimmunoassays provide rapid screening capabilities. Meanwhile, molecular biology techniques enable high-fidelity detection of DNA and RNA-based threats.

Applications span across bakery & confectionery, beverages, dairy products, fruits & vegetables, meat, poultry & seafood, and processed food products, with each category driving unique diagnostic requirements. Finally, end users-comprising food & beverage manufacturers, government agencies, laboratories, and research institutes-harness these insights to calibrate testing protocols, inform policy decisions, and advance scientific understanding of food safety risks.

This comprehensive research report categorizes the Food Diagnostics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Testing Type

- Technology

- Application

- End User

Delivering Comprehensive Regional Insights Highlighting Trends, Opportunities, and Challenges Across Americas, Europe Middle East & Africa, and Asia-Pacific

Regional dynamics exert a profound influence on the strategic priorities and operational models within the food diagnostics sector. In the Americas, strong regulatory oversight and consumer demand for transparency have elevated allergen and pathogen testing as predominant focus areas. Supply chain diversity across North and South facilitates cross-border collaboration on harmonized testing standards, while the presence of major instrument manufacturers reinforces local service and support networks.

Across Europe, the Middle East, and Africa, regulatory harmonization under frameworks like the European Union’s food safety directives is driving the adoption of high-resolution spectrometry and chromatography solutions. Concurrently, emerging economies in the Middle East and Africa are investing in digital platforms to leapfrog legacy infrastructure, enabling remote sample monitoring and cloud-based result dissemination.

In the Asia-Pacific region, rapid urbanization and dietary diversification are spurring heightened investment in molecular biology-based platforms. Countries with large export-oriented food industries are prioritizing residue and contamination screening to meet international import tolerances. Additionally, the proliferation of domestic diagnostic start-ups is fostering a competitive landscape, accelerating the introduction of cost-effective, point-of-need testing solutions that cater to small-scale producers and large corporations alike.

This comprehensive research report examines key regions that drive the evolution of the Food Diagnostics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Prominent Industry Players Driving Innovation, Strategic Collaborations, and Competitive Dynamics in the Food Diagnostics Market Ecosystem

Leading companies in the food diagnostics space are distinguished by their ability to integrate advanced technologies, forge strategic alliances, and expand service portfolios. Global instrument manufacturers have bolstered their offerings through cross-industry collaborations, incorporating digital analytics and remote monitoring into their core products. Meanwhile, specialized service providers have differentiated themselves by offering end-to-end validation and compliance support, leveraging expertise in allergen, mycotoxin, and pathogen testing.

Innovative software vendors are establishing themselves as pivotal players by delivering platforms that unify laboratory information management, data analytics, and regulatory reporting. These ecosystems facilitate real-time decision making and foster streamlined workflows. Simultaneously, emerging entrants are gaining traction through niche solutions, such as rapid lateral flow assays for on-site screening and portable spectrometers for field applications, intensifying competition and driving down time-to-result across multiple segments.

Collectively, these company strategies reflect a broader trend toward integrated diagnostic ecosystems, wherein hardware, software, and services converge to deliver comprehensive food safety, quality, and authenticity solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food Diagnostics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- ALS Limited

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Bruker Corporation

- Bureau Veritas S.A.

- Cotecna Group

- Danaher Corporation

- Eurofins Scientific SE

- FoodChain ID Group Inc.

- Hitachi, Ltd.

- Intertek Group plc

- Merck KGaA

- Mettler Toledo International Inc.

- Microbac Laboratories, Inc.

- Neogen Corporation

- Nikon Instruments Inc.

- PerkinElmer Inc.

- QIAGEN Hamburg GmbH

- Sartorius AG

- SGS S.A.

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

- TÜV SÜD GmbH

- Waters Corporation

Empowering Industry Leaders with Actionable Strategies to Enhance Diagnostic Capabilities, Streamline Operations, and Accelerate Growth in Food Safety Testing

Industry leaders must adopt a proactive stance to harness emerging opportunities and fortify operational resilience. First, investing in digitalization of laboratory workflows will unlock predictive analytics capabilities, empowering teams to anticipate risks and optimize resource allocation. Parallel adoption of molecular biology-based platforms will enhance detection sensitivity, particularly for trace contaminants and novel pathogens.

Simultaneously, organizations should cultivate strategic partnerships with reagent suppliers and academic institutions to co-develop custom assay kits and accelerate validation processes. This collaborative approach not only mitigates supply chain disruptions but also fosters continuous methodological innovation. In addition, standardizing data formats and embracing interoperable software solutions will streamline regulatory reporting and facilitate cross-organizational knowledge sharing.

Finally, allocating resources toward workforce training-focused on next-generation diagnostic techniques and data interpretation-will secure long-term competitive advantage. By embedding these initiatives into broader corporate strategies, leaders will not only enhance diagnostic capabilities but will also achieve sustainable growth in an increasingly complex regulatory and trade environment.

Detailing Rigorous Research Methodology Employed to Gather Insights, Validate Data, and Ensure Reliability of Findings in Food Diagnostics Analysis

The research underpinning this analysis was conducted through a multi-phased methodology designed to ensure depth, accuracy, and relevance. Comprehensive secondary research began with the review of peer-reviewed journals, regulatory white papers, and technology vendor documentation to identify key trends in diagnostic assays, instrumentation, and software platforms. These findings were validated against publicly available policy frameworks and industry association guidelines.

Primary research involved structured interviews with senior laboratory directors, quality assurance managers, and regulatory affairs specialists across leading food manufacturers and independent testing firms. These engagements provided direct insights into practical challenges, technology adoption criteria, and pricing considerations. Quantitative data was further corroborated through an examination of procurement databases and service contract records, offering real-world perspectives on lead times and cost fluctuations.

Finally, all information was subjected to rigorous cross-validation and expert review to eliminate inconsistencies and to ensure that the conclusions presented accurately reflect current industry dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food Diagnostics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food Diagnostics Market, by Product Type

- Food Diagnostics Market, by Testing Type

- Food Diagnostics Market, by Technology

- Food Diagnostics Market, by Application

- Food Diagnostics Market, by End User

- Food Diagnostics Market, by Region

- Food Diagnostics Market, by Group

- Food Diagnostics Market, by Country

- United States Food Diagnostics Market

- China Food Diagnostics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing Key Insights and Emphasizing the Strategic Importance of Advanced Food Diagnostics for Future-Proofing Quality, Safety, and Market Resilience

Bringing together these diverse insights reveals a cohesive narrative: the food diagnostics sector is advancing rapidly, propelled by technological innovation, shifting regulatory landscapes, and the imperative to safeguard public health. From the refinement of chemical analysis techniques to the proliferation of digital predictive tools, each development contributes to a robust ecosystem of solutions that enhance accuracy, speed, and transparency.

Moreover, the sector’s adaptive response to trade-induced cost pressures underscores a growing resilience, as stakeholders reconfigure supply chains and explore alternative sourcing models. Segmentation analysis further illuminates nuanced growth drivers across product types, testing modalities, applications, and end-user groups, while regional insights highlight the importance of tailored approaches in diverse market environments.

As companies and laboratories continue to collaborate across hardware, software, and service domains, the collective momentum will drive ongoing improvements in food safety and quality assurance. This trajectory positions the industry to meet emerging challenges head-on, ensuring that innovation remains aligned with the overarching goal of protecting consumer health and reinforcing confidence in the global food supply.

Connect with Ketan Rohom to Unlock Comprehensive Insights and Secure Your Access to the Definitive Food Diagnostics Market Research Report Today

Take the next step toward fortifying your organization’s competitive edge in food safety testing by engaging directly with Ketan Rohom, Associate Director of Sales & Marketing. Leverage this unique opportunity to gain tailored guidance, secure exclusive access to in-depth analyses, and benefit from personalized support throughout your decision-making journey. Discover how our definitive market research report can empower your strategic initiatives, streamline procurement, and drive operational efficiency.

Act now to align with industry-leading insights and position your business for sustained success in an evolving diagnostics landscape. Reach out to Ketan today to arrange a private briefing, explore customized research packages, and unlock the comprehensive intelligence needed to outpace competitive challenges and capitalize on emerging opportunities.

- How big is the Food Diagnostics Market?

- What is the Food Diagnostics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?