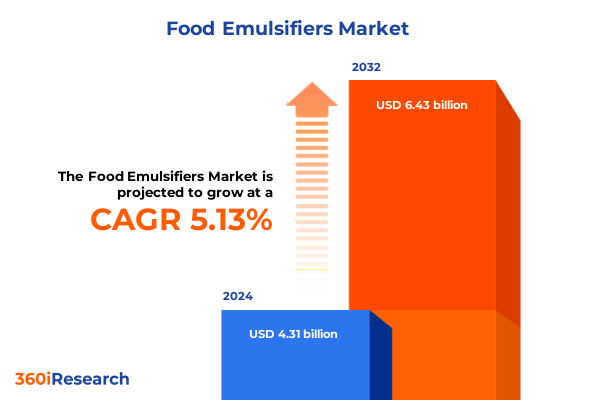

The Food Emulsifiers Market size was estimated at USD 4.53 billion in 2025 and expected to reach USD 4.72 billion in 2026, at a CAGR of 5.12% to reach USD 6.43 billion by 2032.

Revealing the Fundamental Importance of Food Emulsifiers in Driving Product Quality Shelf Life Extension and Consumer Satisfaction Across the Industry

The landscape of modern food production is underpinned by the indispensable role of emulsifiers, which constitute a critical category of functional ingredients that optimize texture, stability, and sensory experience in a wide array of culinary applications. Emulsifiers facilitate the blending of immiscible phases such as oil and water, ensuring homogenous product consistency and preventing phase separation over shelf life. This technical function not only enhances the visual and mouthfeel properties of products but also underlies consumer perceptions of quality and freshness, which have become pivotal in an increasingly competitive marketplace.

Over the past decade, the demand for novel emulsifier solutions has intensified as manufacturers strive to meet evolving consumer preferences for cleaner labels, plant-based offerings, and fortified formulations. In response, the industry has witnessed an upsurge in both traditional lecithin variants sourced from rapeseed, soybean, and sunflower, and advanced synthetically derived compounds such as polyglycerol esters and sorbitan esters. This confluence of natural and engineered technologies is reshaping product development pipelines, driving cross-functional collaboration among R&D, quality assurance, and marketing teams.

Within this document, we embark on a thorough exploration of the food emulsifier segment, encompassing in-depth segmentation across product type, source, form, technology, grade, and application. We further examine the transformative impacts of recent policy changes, including the cumulative effect of United States tariffs in 2025, and distill key actionable insights for stakeholders seeking to fortify their market position. Through a structured analysis, this report lays the groundwork for informed strategic decision-making in an industry defined by rapid innovation and dynamic consumer demands.

Unveiling the Major Technological Regulatory and Consumer Driven Transformations Reshaping the Global Food Emulsifier Landscape in Recent Years

In recent years, the food emulsifier market has undergone a profound metamorphosis driven by simultaneous advances in regulatory frameworks, technological innovation, and shifting consumer expectations. Regulatory bodies have introduced more stringent labeling requirements and health-related guidelines, prompting manufacturers to reformulate products and transition from synthetic surfactants to naturally derived alternatives like sunflower and rapeseed lecithin. This regulatory impetus has elevated transparency and fueled a surge in demand for clean-label emulsifiers, signaling a transformative shift in ingredient sourcing and product positioning.

From a technological standpoint, enzymatic processes have emerged as a game-changing innovation, delivering enhanced specificity in molecular structure and improved functional performance compared to traditional chemical synthesis. These developments have unlocked new possibilities in tailoring emulsifier properties for targeted applications, such as low-fat bakery products and plant-based dairy alternatives. At the same time, digitalization of supply chain management and predictive analytics are enabling real-time quality monitoring and demand forecasting, thereby reducing raw material waste and accelerating time-to-market for novel formulations.

Consumer-driven trends are equally consequential, with a marked increase in preference for plant-based and fortified foods. Manufacturers are responding by integrating emulsifiers that not only deliver stability but also contribute to nutritional profiles, such as phospholipid-rich lecithins and high-performance sucrose esters. Together, these regulatory, technological, and consumer forces are reshaping the emulsifier landscape, forging a competitive frontier defined by innovation agility and sustainability commitments.

Analyzing the Combined Effects of Recent United States Tariff Measures on Raw Material Costs Supply Chains and Competitive Dynamics in 2025

The imposition of fresh tariff measures by the United States in early 2025 has acted as a critical inflection point for the global food emulsifier supply chain. By raising duties on imported raw materials such as polyglycerol esters and mono- and diglycerides derived from certain vegetable sources, the cost dynamics for processors and formulators have shifted markedly. This policy adjustment has heightened scrutiny on sourcing strategies, compelling stakeholders to reassess reliance on imported feedstocks and to strengthen domestic procurement channels.

As a result of these cumulative tariff impacts, manufacturers have encountered increased input costs that cascade through production processes, ultimately influencing pricing structures at the finished-goods level. To mitigate margin compression, some organizations have accelerated their diversification of supply portfolios while investing in alternative enzymatic synthesis platforms that leverage locally available substrates. Concurrently, distributors and co-packers have entered collaborative negotiations to establish more resilient contractual terms, balancing upfront financial exposure against long-term partnership security.

Furthermore, this tariff landscape has stimulated renewed conversations around vertical integration and localized manufacturing capabilities. Organizations are evaluating strategic investments in domestic processing facilities and backward integration into oilseed pressing operations, aiming to insulate themselves from future trade volatility. The interplay between policy-driven cost pressures and adaptive supply chain reconfiguration underscores the necessity for dynamic risk management frameworks and reinforces the strategic importance of flexible sourcing in a tariff-sensitive environment.

Unlocking Comprehensive Market Segmentation Insights by Product Source Form Technology Grade and Application to Illuminate Diverse Emulsifier Demand Patterns

A multifaceted segmentation framework serves as the backbone for understanding the nuanced demand profiles within the food emulsifier market. When examined through the lens of product type, the industry encompasses lecithin, mono and diglycerides, polyglycerol esters, sorbitan esters, and sucrose esters, each delivering distinct functional attributes. Within lecithin, subsegments including rapeseed, soybean, and sunflower lecithins offer variations in phospholipid content and emulsification efficiency, while mono and diglycerides sourced from both animal and vegetable origins present different regulatory and label-claim considerations.

Evaluating the market by source further delineates supply chain dependencies across rapeseed, soybean, and sunflower crops, each with unique agronomic cycles and regional production capacities. The form in which emulsifiers are delivered-whether as cake, liquid, or powder-impacts handling protocols, solubility rates, and storage requirements, influencing processing line configurations and operational efficiencies.

The application of chemical synthesis versus enzymatic technology drives divergent resource utilization and environmental footprints, with enzymatic approaches gaining favor for their specificity and lower energy requirements. A grade-based segmentation into cosmetic, food, and pharmaceutical grades highlights the critical quality thresholds and regulatory clearances required for end-use markets. Finally, application-based segmentation spans across bakery and confectionery, beverages, convenience food, cosmetics and pharmaceuticals, dairy products, meat and poultry, and sauces and dressings, with further subdivisions such as breads, cakes, chocolate, dairy-based and plant-based beverages, frozen foods, and ready meals, among others. This comprehensive approach underscores the intricate mosaic of demand drivers shaping emulsifier innovation and adoption patterns.

This comprehensive research report categorizes the Food Emulsifiers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Source

- Form

- Technology

- Grade

- Application

Comparing Regional Market Dynamics Across the Americas Europe Middle East Africa and Asia Pacific to Highlight Distinct Emulsifier Adoption and Growth Drivers

Regional dynamics play a pivotal role in dictating the trajectory of the food emulsifier market, with distinct growth drivers and challenges evident across the Americas, Europe Middle East and Africa, and Asia Pacific. In the Americas, strong investment in ingredient innovation and a mature regulatory environment have fostered rapid adoption of high-performance emulsifiers in baked goods, confectionery, and dairy segments. Local agricultural endowments for soybean and sunflower cultivation underpin competitive domestic lecithin production, contributing to supply chain resilience.

Overlapping yet diverse market structures in Europe, the Middle East, and Africa reveal both advanced regulatory harmonization in the European Union and growth opportunities in Middle Eastern convenience foods and African dairy sectors. European manufacturers are increasingly prioritizing enzymatic technologies and organic certifications, whereas emerging markets are leveraging emulsifiers to extend product shelf life and support urban retail expansion.

Asia Pacific presents the most dynamic growth frontier, driven by expanding plant-based food trends, rising per capita consumption of processed foods, and significant investments in local manufacturing capacities. Rapeseed and soybean lecithin producers are strategically extending their footprint, while regional R&D centers focus on developing emulsifiers tailored to local taste preferences and regulatory frameworks. Collectively, these regional insights elucidate how geographic nuances shape emulsifier selection, innovation strategies, and partnership models.

This comprehensive research report examines key regions that drive the evolution of the Food Emulsifiers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Emulsifier Manufacturers Strategic Partnerships and Innovation Portfolios That Define Competitive Positioning in the Global Food Emulsifier Sector

The competitive landscape within the food emulsifier industry is characterized by a blend of multinational chemical conglomerates, specialized ingredient houses, and agile regional players. Leading manufacturers have distinguished themselves through robust R&D pipelines that yield novel product formulations, encompassing both plant-derived phospholipids and next-generation synthetic esters designed for high-performance applications.

Strategic collaborations and joint ventures have become commonplace, with global firms partnering with biotech companies to co-develop enzymatic processes and with agricultural cooperatives to secure traceable raw material supplies. This interconnected ecosystem extends to toll processors and contract manufacturers that provide scale and technical expertise, enabling the rapid commercialization of new emulsifier blends tailored to niche markets like clean label, organic, and plant-based sectors.

Innovation portfolios are further enriched by proprietary purification techniques that enhance functional purity and sensory neutrality. As sustainability emerges as a core differentiator, leading companies are investing in life cycle assessments and circular economy initiatives, ranging from waste oil valorization to on-site biomass energy integration. These strategic priorities underscore the evolving role of food emulsifier suppliers as co-creators of value rather than mere commodity vendors.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food Emulsifiers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AAK AB

- Archer-Daniels-Midland Company

- Ashland Global Holdings Inc.

- BASF SE

- Beldem S.A.

- Bunge Limited

- Cargill Incorporated

- Corbion N.V.

- Dow Inc.

- DuPont de Nemours Inc.

- Fuji Oil Holdings Inc.

- Givaudan SA

- Glanbia plc

- Ingredion Incorporated

- Kerry Group plc

- Lactalis Group

- Lonza Group Ltd.

- Novozymes A/S

- Palsgaard A/S

- Riken Vitamin Co. Ltd.

- Royal DSM N.V.

- Solvay S.A.

- Stepan Company

- Tate & Lyle PLC

Presenting Targeted Actionable Strategies for Industry Leaders to Enhance Innovation Optimize Supply Chains and Capitalize on Emerging Trends in Food Emulsifier Markets

To navigate the complexities of the modern food emulsifier market and seize emerging opportunities, industry leaders should prioritize several strategic initiatives. First, intensifying investment in enzymatic synthesis platforms will not only diversify product offerings but also reduce environmental footprints and energy consumption, aligning with both regulatory expectations and consumer demands for sustainable ingredients.

Moreover, expanding partnerships across the value chain-spanning agricultural cooperatives, biotech firms, and toll manufacturers-will strengthen supply chain resilience and foster co-innovation. Such collaborations can facilitate access to novel feedstocks, accelerate process scale-up, and support rapid market entry for differentiated emulsifier solutions.

In parallel, organizations should implement advanced digital tools for predictive demand planning and quality assurance, enabling proactive management of raw material fluctuations and expedited response to formulation challenges. Lastly, crafting clear and transparent clean-label narratives will enhance brand credibility and cater to the growing cohort of health-conscious consumers. By synchronizing these initiatives, companies can fortify competitive advantage and drive sustainable growth in this dynamic industry.

Detailing a Rigorous Mixed Methods Research Approach Combining Primary Stakeholder Interviews Secondary Data Analysis and Quantitative Modeling to Ensure Valid Insights

The insights presented in this report are grounded in a rigorous mixed-methods research paradigm designed to ensure both breadth and depth of analysis. Primary research involved in-depth interviews with senior executives across leading emulsifier manufacturers, distributors, and end users within the bakery, dairy, and plant-based food sectors. These conversations provided granular perspectives on technology adoption, regulatory compliance, and go-to-market strategies.

Complementing primary findings, secondary research encompassed detailed reviews of regulatory filings, patent databases, and industry conference proceedings to map out emerging technological platforms and market entry strategies. Quantitative modeling techniques were employed to assess supply chain cost dynamics under various tariff scenarios, while scenario planning workshops validated potential market trajectories and risk mitigation approaches.

Throughout the research process, data triangulation ensured the reliability of insights, with cross-verification between stakeholder interviews, published literature, and proprietary databases. This methodological rigor underpins the credibility of our analysis and equips decision-makers with actionable intelligence calibrated to the intricate realities of the food emulsifier landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food Emulsifiers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food Emulsifiers Market, by Product Type

- Food Emulsifiers Market, by Source

- Food Emulsifiers Market, by Form

- Food Emulsifiers Market, by Technology

- Food Emulsifiers Market, by Grade

- Food Emulsifiers Market, by Application

- Food Emulsifiers Market, by Region

- Food Emulsifiers Market, by Group

- Food Emulsifiers Market, by Country

- United States Food Emulsifiers Market

- China Food Emulsifiers Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2703 ]

Summarizing Key Findings and Strategic Imperatives from the Food Emulsifier Market Analysis to Guide Informed Decision Making and Investment Priorities

The evolving food emulsifier market is defined by the convergence of technological innovation, regulatory transformation, and shifting consumer preferences toward clean-label and plant-based solutions. Recent tariff measures have further underscored the strategic importance of resilient sourcing and flexible production capabilities. Together, these factors reinforce the need for dynamic risk management frameworks and collaborative value-chain partnerships.

By leveraging a detailed segmentation analysis and region-specific insights, stakeholders can pinpoint targeted growth opportunities and refine their product development roadmaps. Strategic investments in enzymatic synthesis, digital supply chain tools, and transparent labeling narratives will be critical in securing competitive differentiation. Ultimately, the companies that harmonize operational excellence with sustainability commitments and innovation agility will be best positioned to thrive in this rapidly advancing sector.

Drive Your Competitive Advantage Today by Securing a Tailored Food Emulsifier Market Research Report Through Collaboration with Ketan Rohom Associate Director Sales Marketing

To obtain a comprehensive understanding of the evolving food emulsifier market and to gain privileged access to detailed analysis across segmentation, regional, and competitive dimensions, we invite you to engage directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan’s expertise in delivering actionable market intelligence will help tailor insights to your strategic needs and ensure that your organization capitalizes on emerging opportunities in ingredient innovation and supply chain optimization. Connect with Ketan to discuss customized research packages, pricing options, and exclusive add-on services that can accelerate your decision-making process and drive growth in this dynamic market. Your next competitive advantage awaits-reach out today and secure the definitive resource for navigating the complex landscape of food emulsifiers

- How big is the Food Emulsifiers Market?

- What is the Food Emulsifiers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?