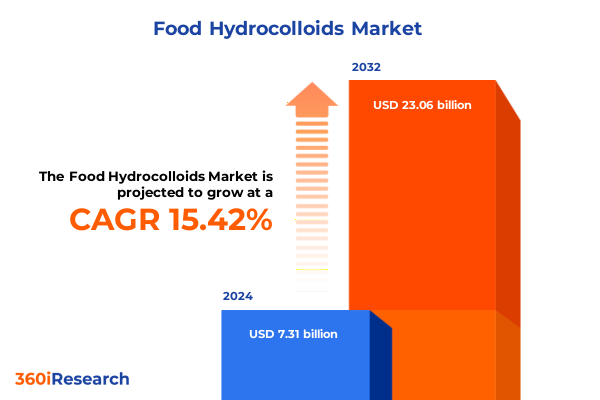

The Food Hydrocolloids Market size was estimated at USD 8.47 billion in 2025 and expected to reach USD 9.59 billion in 2026, at a CAGR of 15.37% to reach USD 23.06 billion by 2032.

Discover How Evolving Consumer Values and Regulatory Pressures Are Reshaping the Role of Hydrocolloids in Food Innovation

Food hydrocolloids have emerged as indispensable ingredients in modern food formulation, serving functions that range from texture modification to shelf-life extension. Their unique molecular structures enable precise control over rheology, stabilization, and sensory attributes, meeting the evolving demands of health-conscious consumers. Over the past decade, manufacturers have increasingly embraced hydrocolloids to deliver clean-label claims, plant-based alternatives, and multifunctional ingredients across diverse product portfolios.

As consumer preferences shift toward naturalness and functionality, hydrocolloids are positioned at the intersection of taste, texture, and nutrition. Concurrently, regulatory frameworks are tightening around food additives, pushing suppliers to innovate with non-allergenic, sustainable sources. Against this backdrop, the competitive landscape is characterized by strategic partnerships, targeted acquisitions, and investments in biotechnological production methods. Understanding these dynamics is crucial for stakeholders aiming to sustain growth and differentiate their offerings in a crowded marketplace.

This executive summary synthesizes the most pertinent trends shaping the food hydrocolloids sector, examines the implications of recent policy shifts, and highlights actionable strategies for market participants. Through a rigorous analysis of segmentation, regional performance, and company-level initiatives, this report delivers a clear roadmap for navigating uncertainties and capitalizing on emerging opportunities.

Uncover the Key Drivers of Innovation That Are Prompting a Paradigm Shift in Hydrocolloid Development and Application

The food hydrocolloids landscape is undergoing rapid transformation, driven by multiple converging trends that extend beyond traditional ingredient performance. Foremost among these shifts is the acceleration of clean-label mandates, which has prompted formulators to replace synthetic gums with naturally derived alternatives sourced from plants and microbes. In parallel, the proliferation of plant-based diets has compelled manufacturers to reengineer texturization systems, leading to breakthroughs in kombu seaweed extracts and microbial fermentation platforms.

Technological advancements in digital process control and high-throughput screening are also redefining R&D workflows, enabling suppliers to iterate novel hydrocolloid structures with tailored functional profiles. As a result, we are witnessing a surge in proprietary gel matrices designed to enhance mouthfeel, moisture retention, and freeze-thaw stability. Meanwhile, sustainability imperatives are driving the adoption of circular supply chains, where byproducts from food processing are upcycled into value-added hydrocolloid streams.

Deeper collaboration between ingredient innovators and food manufacturers is further facilitating co-development of bespoke solutions, accelerating time-to-market for differentiated products. Taken together, these transformative shifts underscore the critical need for agile strategies that balance regulatory compliance, cost efficiency, and consumer appeal in the evolving hydrocolloid arena.

Examine How the 2025 Import Duty Increases on Hydrocolloids Have Catalyzed Supply Chain Realignment and Pricing Strategies

In early 2025, the United States enacted a series of incremental tariff adjustments targeting imported food hydrocolloids, cumulatively raising duties by up to 25 percent on key categories. These measures were introduced to bolster domestic production capabilities and to address perceived trade imbalances in agricultural processing. As a direct consequence, many formulators witnessed elevated raw material costs, prompting a reevaluation of sourcing strategies and prompting strategic reallocation toward domestic or near-shored suppliers.

The tariff landscape has also incentivized investments in local manufacturing infrastructure, with several leading players committing capital to expand gelatine and microbial gum production capacity within North America. Although these initiatives aim to mitigate exposure to import duties, they require substantial lead times and capital outlay, presenting short-term supply constraints. In response, manufacturers are exploring alternative hydrocolloid blends and hybrid systems to achieve functionality parity at a lower landed cost.

Moreover, the cumulative tariff impact extends beyond cost inflation, influencing formulation decisions and product positioning. Some companies have reformulated portfolio offerings to emphasize locally sourced, sustainable ingredients, thereby appealing to both cost-conscious and eco-centric consumers. As the tariff regime evolves, stakeholders must continuously monitor policy developments and adapt procurement strategies to safeguard margin stability and supply chain resilience.

Gain In-Depth Understanding of How Functionality, Origin, Application and Physical Form Drive Strategic Positioning in Hydrocolloids Markets

When dissecting the food hydrocolloids market through the lens of functional type, it encompasses a spectrum from emulsifiers to thickeners, each with distinct molecular characteristics and application niches. Emulsifiers such as lecithin and mono and diglycerides facilitate oil-water dispersion, while polysorbates and sorbitan esters target specialized encapsulation and stability functions. Film formers including methylcellulose, pullulan, sodium caseinate, and whey protein deliver barrier properties and controlled release attributes critical for novelty formats and sensitive ingredients.

Gelling agents, represented by agar, alginate, carrageenan, and gelatin, underpin textural design across confectionery and meat systems, enabling chefs and engineers to craft novel mouthfeels. Stabilizers such as carrageenan, guar gum, locust bean gum, and xanthan gum synergize with other polymers to maintain suspension and prevent phase separation. Meanwhile, thickeners like cellulose ethers, maltodextrin, pectin, and starch are leveraged for viscosity modulation and mouth-coating effects in sauces, dressings, and dairy alternatives.

Source differentiation reveals a tripartite division: animal-based, microbial-based, and plant-based origins. Animal-based hydrocolloids such as bovine and pork gelatin, alongside milk proteins, boast gelation and emulsification prowess. Microbial-derived gum matrices including dextran, gellan gum, and xanthan gum offer consistent quality and tailored functional performance. Plant-based streams span fruit, root and tuber, seaweed, and seed derivatives, aligning with vegan and clean-label imperatives.

Application domains extend from bakery and confectionery to beverages, dairy and frozen desserts, functional foods and meat systems, pet nutrition, and sauces and dressings. Within each application, subsegments like bread and cakes, nonalcoholic beverages, ice cream, nutraceuticals, sausages, wet pet food, and mayonnaise demonstrate the versatility of hydrocolloid technologies. Finally, physical form-granular, liquid, and powder-further stratifies supplier offerings, with granules available in agglomerated or extruded grades, liquids in aqueous and oil suspensions, and powders processed via drum or spray drying to suit handling and solubility requirements.

This comprehensive research report categorizes the Food Hydrocolloids market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Source

- Application

- Form

Explore the Distinct Regional Dynamics in North America, EMEA and APAC That Shape Adoption and Innovation of Hydrocolloid Solutions

The Americas region maintains a dominant role in hydrocolloid innovation and production, driven by substantial investments in fermentation-based gums and collagen systems. North American manufacturers benefit from proximity to major food producers, robust R&D infrastructure, and supportive trade policies for locally produced agricultural ingredients. This synergy has fostered product launches that emphasize clean-label polysaccharides and tailored texturizing systems for baked goods, beverages, and dairy applications.

Transitioning to Europe, the Middle East and Africa, stringent regulatory frameworks and consumer demand for natural functional ingredients have spurred growth in seaweed-derived hydrocolloids such as carrageenan and alginate. EMEA formulators leverage advanced extraction technologies to enhance purity and performance while meeting stringent EU clean-label regulations. In parallel, the Middle Eastern meat processing sector is increasingly adopting gel agents to optimize yield and texture in processed meats, reflecting a blend of tradition and innovation.

In Asia-Pacific, rising disposable incomes, expanding fast-food chains, and a burgeoning functional food market accelerate hydrocolloid adoption, particularly in sauces, dressings, and ready-to-eat snacks. The region’s large-scale production of plant-based starches and gums enables cost-competitive sourcing and localized customization. Furthermore, APAC suppliers are at the forefront of collaborating with foodservice operators to co-develop hydrocolloid blends tailored for high-temperature and high-shear processing environments. Collectively, these regional dynamics underscore the importance of aligning sourcing, innovation, and regulatory strategies to leverage geographic strengths.

This comprehensive research report examines key regions that drive the evolution of the Food Hydrocolloids market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveil How Strategic Collaborations, Next-Generation Processing and Sustainability Focus Are Redefining Leadership in Hydrocolloid Supply

Global ingredient suppliers have intensified efforts to capture value in the food hydrocolloids arena by pursuing targeted acquisitions, joint ventures, and capacity expansions. Established players with legacy starch and gum portfolios are diversifying upstream into microbial fermentation and plant extraction to broaden their value proposition. Concurrently, specialty firms are forging partnerships with biotechnology companies to commercialize next-generation gelling agents and emulsifiers with enhanced functionality.

Strategic alliances between raw material producers and food manufacturers are becoming increasingly prevalent, enabling co-investment in pilot plants and application labs. This collaborative approach accelerates the translation of early-stage R&D into commercial offerings, fostering shorter innovation cycles. Moreover, leading hydrocolloid companies are investing in digital traceability platforms and sustainability metrics to provide end-to-end transparency, responding to buyer demands for provenance and environmental stewardship.

Competitive differentiation is also evident in proprietary processing technologies, such as ultrafiltration for protein-based film formers and low-energy spray drying techniques for heat-sensitive polysaccharides. Companies leveraging modular manufacturing systems can adjust production scales rapidly, mitigating supply risks and optimizing operational efficiency. As the competitive landscape sharpens, those that strategically integrate technological capabilities, sustainability credentials, and customer-centric services will emerge as market frontrunners.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food Hydrocolloids market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer Daniels Midland Company

- Ashland Global Holdings Inc.

- BASF SE

- Cargill, Incorporated

- DSM N.V.

- DuPont de Nemours, Inc.

- Fufeng Group Co., Ltd.

- Gelita AG

- Hindustan Gum & Chemicals Ltd.

- Ingredion Incorporated

- J.F. Hydrocolloids, Inc.

- J.M. Huber Corporation

- Jungbunzlauer Suisse AG

- Kerry Group plc

- Meihua Holdings Group Co., Ltd.

- Palsgaard A/S

- Roquette Frères

- Rousselot B.V.

- Tate & Lyle plc

- TIC Gums, Inc.

Unlock Competitive Advantage by Embedding Data Intelligence, Co-Innovation and Sustainability into Hydrocolloid Strategies

Industry leaders should prioritize integration of advanced analytics into supply chain decision-making to anticipate fluctuations in feedstock availability and tariff impacts. By leveraging machine learning models to forecast demand patterns, organizations can optimize inventory levels and reduce risk associated with price volatility. Furthermore, investing in modular, flexible production assets will enable rapid scale-up of emerging hydrocolloid grades, ensuring responsiveness to novel application requests.

Companies must also deepen partnerships with ingredient innovators to co-develop multi-functional hydrocolloid blends that cater to clean-label, plant-based, and reduced-sugar trends. Collaborative R&D ventures offer a pathway to share risk, accelerate validation processes, and secure exclusive rights to breakthrough technologies. Additionally, industry participants should adopt comprehensive lifecycle assessments to quantify environmental footprints, strengthening sustainability narratives that resonate with consumers and regulatory bodies alike.

Finally, leaders should explore differentiated go-to-market strategies by bundling technical support services, formulation toolkits, and digital traceability offerings. This consultative approach not only enhances customer loyalty but also expands revenue streams beyond commodity sales. By aligning organizational priorities around agility, collaboration, and sustainability, hydrocolloid suppliers can secure competitive advantage in a rapidly evolving marketplace.

Understand the Comprehensive Mixed-Methods Research Design Combining Secondary Analysis, Expert Interviews and Scenario Modeling

This report is underpinned by a robust mixed-methods approach, commencing with an exhaustive review of peer-reviewed journals, patent filings, regulatory databases, and industry position papers. Secondary research established the macro-environmental context and identified key players, while specialized databases provided insights into trade flows, production capacities, and tariff regimes. To validate secondary findings, over fifty in-depth interviews were conducted with C-level executives, research scientists, and procurement leaders across ingredient suppliers, food manufacturers, and regulatory agencies.

Quantitative data were triangulated through cross-referencing of public financial disclosures, trade volume statistics, and proprietary cost modeling. Qualitative interviews complemented this by uncovering nuanced perspectives on innovation pipelines, formulation challenges, and strategic priorities. Scenario analyses explored varying tariff outcomes and feedstock disruptions, projecting their potential impact on supply chain configurations and price structures. Furthermore, regional workshops and expert panels informed segmentation frameworks, ensuring that application categories and functional types accurately reflect real-world usage patterns.

The integration of primary and secondary data, coupled with iterative validation through expert engagements, ensures that the insights presented are both comprehensive and credible. This methodological rigor provides stakeholders with a high-fidelity compass for strategic planning and investment decisions in the food hydrocolloids sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food Hydrocolloids market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food Hydrocolloids Market, by Type

- Food Hydrocolloids Market, by Source

- Food Hydrocolloids Market, by Application

- Food Hydrocolloids Market, by Form

- Food Hydrocolloids Market, by Region

- Food Hydrocolloids Market, by Group

- Food Hydrocolloids Market, by Country

- United States Food Hydrocolloids Market

- China Food Hydrocolloids Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3657 ]

Synthesize the Key Findings Illustrating How Agility, Collaboration and Transparency Will Define Future Leaders in Food Hydrocolloids

In summary, the food hydrocolloids market is at a critical inflection point where consumer preferences, regulatory shifts, and technological breakthroughs converge to reshape ingredient strategies. The cumulative impact of 2025 tariff adjustments has not only altered cost dynamics but has also accelerated domestic production initiatives and formulation innovation. As participants realign sourcing networks and invest in next-generation processing, the competitive landscape will reward those capable of marrying functional performance with sustainability and cost efficiency.

Segmentation insights reveal that a deep understanding of type, source, application, and form is essential for delivering tailored solutions that meet specific industry needs. Regional analyses underscore the importance of aligning innovation and regulatory compliance with geographic market characteristics, from the robust R&D ecosystems of the Americas to the stringent clean-label standards in EMEA and the rapid growth of APAC foodservice.

Looking ahead, success will depend on agility, collaborative R&D, and digital transformation across the value chain. Organizations that embed predictive analytics into their supply chain operations, co-innovate with strategic partners, and transparently communicate environmental credentials will command leadership positions. The actionable recommendations outlined offer a clear pathway to navigate uncertainties and capture growth opportunities in this dynamic landscape.

Empower Your Organization with Customized Insights by Partnering Directly with Our Sales Leader on Hydrocolloids Research

To gain a comprehensive understanding of the evolving food hydrocolloids market and to equip your organization with actionable insights, we invite you to engage with our in-depth research report. By connecting with Ketan Rohom, Associate Director of Sales & Marketing, you will secure tailored guidance on how to leverage emerging trends, navigate regulatory complexities, and capitalize on disruptive innovations. Our findings will empower you to refine your strategic initiatives, optimize supply chain resilience, and accelerate product development pipelines.

Contacting Ketan Rohom will also grant you access to exclusive data appendices, scenario analyses, and advisory consultations that are designed to address your specific business questions. Whether you are exploring new plant-based gelling technologies, assessing the impact of tariffs on import strategies, or identifying white-space opportunities across high-growth applications, our research delivers the clarity and direction you need. Engage with our team today to drive measurable growth and stay ahead of the competition in the competitive landscape of food hydrocolloids.

- How big is the Food Hydrocolloids Market?

- What is the Food Hydrocolloids Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?