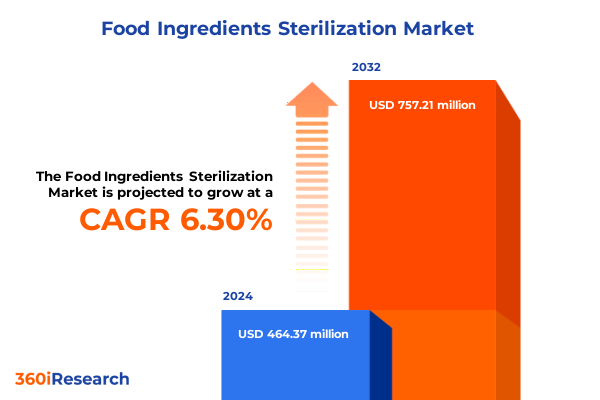

The Food Ingredients Sterilization Market size was estimated at USD 491.99 million in 2025 and expected to reach USD 525.92 million in 2026, at a CAGR of 6.35% to reach USD 757.21 million by 2032.

Unearthing the Crucial Role of Ingredient Sterilization in Safeguarding Food Safety and Ensuring Uncompromising Product Quality across Global Supply Chains

Food ingredient sterilization serves as the frontline defense against microbial contamination, ensuring that products meet stringent safety standards and maintain the integrity that consumers demand. By neutralizing bacteria, molds, yeasts, and spores, sterilization not only protects public health but also preserves flavor, nutritional value, and shelf life. In an era defined by heightened regulatory oversight and global supply chains, ingredient sterilization has become a critical checkpoint that underpins trust between manufacturers, retailers, and end consumers.

The escalation of foodborne illness outbreaks, coupled with expanded regulatory frameworks such as the Food Safety Modernization Act and its international counterparts, has intensified pressure on stakeholders to adopt robust sterilization protocols. At the same time, evolving consumer preferences for minimally processed and clean-label foods have spurred innovation in non-thermal techniques that can deliver safety without compromising sensory attributes. These trends are driving a convergence of technology investments, operational refinement, and cross-sector collaboration. As a result, food ingredient sterilization is no longer a back-end process; it has emerged as a strategic priority that shapes product development, supply chain resilience, and brand reputation.

How Emerging Technologies and Regulatory Dynamics Are Redefining Food Ingredient Sterilization toward a More Sustainable and Resilient Industry Framework

Rapid advancements in sterilization technologies and shifting regulatory landscapes are fundamentally redefining the way food ingredients are processed and protected. Through the integration of digital monitoring systems and real-time analytics, manufacturers are gaining unprecedented visibility into critical control points. This digital transformation enables continuous validation of sterilization efficacy, allowing operations teams to preemptively identify deviations and optimize cycle parameters based on data-driven insights.

Concurrently, sustainability imperatives are catalyzing the adoption of greener sterilization methods. Techniques such as high-pressure processing and gas plasma systems are gaining traction because they significantly reduce water usage, energy consumption, and chemical residues compared to conventional methods. Emerging irradiation platforms, including electron beam and X-ray treatments, are also reshaping the landscape by offering rapid, cold sterilization that preserves heat-sensitive ingredients. Regulatory agencies around the world are updating guidance to accommodate these next-generation solutions, while consumer demand for transparency is prompting the incorporation of blockchain-enabled traceability for ultimate process accountability. As a result, the industry is transitioning from one-size-fits-all approaches to highly tailored sterilization regimens that align with specific ingredient profiles and sustainability goals.

Assessing the Far-Reaching Consequences of 2025 U.S. Tariff Adjustments on Food Ingredient Sterilization Supply Chains and Cost Structures for Market Players

In 2025, the United States implemented a new wave of tariffs that has reverberated across the food ingredient sterilization market, compelling stakeholders to revisit sourcing strategies and recalibrate cost structures. The increased duties on imported filtration membranes, irradiation equipment, and chemical sterilants have driven up input costs for domestic processors. These changes have prompted manufacturers to accelerate investments in local production capabilities and to explore alternative sterilization chemistries that fall outside the scope of the tariff schedule.

Meanwhile, the ripple effects of these measures extend beyond direct cost increases. Supply chain agility has become paramount as market participants reconfigure procurement to mitigate delivery lead times and reduce exposure to tariffs. Some organizations have engaged in strategic partnerships with regional equipment suppliers, while others have diversified into thermal and UV-based systems that enjoy preferential tariff treatment. Importantly, end users are negotiating contractual adjustments to offset rising sterilization expenses, often passing a portion of the increased costs downstream. In turn, ingredient suppliers are intensifying efforts to demonstrate the value-added benefits of advanced sterilization by highlighting reduced waste, enhanced shelf stability, and diminished recall risks.

Delving into Segmentation Nuances Reveals Diverse Sterilization Techniques, Ingredient Types, Equipment Variations, Processes, and End-User Applications Driving Strategic Focus

A nuanced understanding of market segmentation is vital for strategic decision making in the food ingredient sterilization arena. When examining techniques, the landscape spans chemical processes such as chlorine dioxide and ethylene oxide, each offering unique efficacy profiles against a broad spectrum of pathogens. Filtration methods encompass microfiltration, nanofiltration and ultrafiltration units, which are selected based on particle removal requirements and throughput capacities. Irradiation technologies include electron beam, gamma ray and X-ray systems, noted for their non-thermal mode of action, while thermal approaches leverage dry heat and wet heat to achieve targeted microbial inactivation.

Diving deeper, ingredient type plays a decisive role in method selection. Delicate flavors, natural colors and vitamins require gentler conditions, whereas oils, fats and proteins may tolerate more robust sterilization. Dairy cultures and enzymatic preparations demand precise control to preserve functional properties, and spices and seasonings benefit from high-efficiency pathogen reduction without flavor degradation. The equipment portfolio available to processors is equally diverse, ranging from autoclaves and tunnel pasteurizers-including both HTST and UHT tunnels-to UV systems and high-pressure units. Continuous and batch operations offer trade-offs in throughput, flexibility and capital investment, and end users in food processing facilities and research laboratories demand customizable solutions to align with their operational cadence and regulatory mandates.

This comprehensive research report categorizes the Food Ingredients Sterilization market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technique

- Ingredient Type

- Equipment Type

- Process

- End User

Uncovering Regional Divergences in Food Ingredient Sterilization Demands and Infrastructure across the Americas, Europe Middle East & Africa, and Asia-Pacific Markets

Regional dynamics shape the adoption and evolution of sterilization technologies across the globe. In the Americas, stringent regulations enforced by the U.S. Food and Drug Administration and Health Canada have spurred widespread modernization of sterilization infrastructure. Manufacturers in North America are investing heavily in pilot facilities and validation laboratories to meet traceability requirements, while Latin American markets are rapidly expanding their domestic capabilities to reduce reliance on imported sterilants and equipment.

Europe, the Middle East and Africa collectively exhibit a tapestry of regulatory frameworks and market maturity. The European Union’s emphasis on chemical reduction has accelerated the uptake of high-pressure processing and membrane-based approaches, whereas local standards in several Middle Eastern nations are driving customized irradiation installations to satisfy halal compliance and cold-chain stability. In Africa, emerging industrial hubs are balancing cost considerations with food security objectives, frequently leveraging mobile sterilization units and modular systems to serve distributed processing sites.

Across the Asia-Pacific region, surging demand in China, India and Southeast Asia is fueling large-scale expansion projects. Regulatory agencies in major markets have issued updated guidelines on irradiation thresholds and residual chemical limits, prompting multinational ingredient suppliers to harmonize processes across geographies. Innovative financing models and public-private partnerships are unlocking access to advanced equipment, empowering both multinational corporations and local enterprises to adopt next-generation sterilization solutions.

This comprehensive research report examines key regions that drive the evolution of the Food Ingredients Sterilization market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Players Shaping the Food Ingredient Sterilization Landscape through Innovation, Strategic Partnerships, and Comprehensive Service Portfolios

Leading players in the food ingredient sterilization sector are differentiating themselves through a combination of technological innovation, strategic partnerships and comprehensive service portfolios. Many have established dedicated research centers where multi-disciplinary teams collaborate to refine process parameters for new ingredients, ensuring that emerging flavors, fibers and functional components can be safely integrated into modern formulations. By securing partnerships with equipment manufacturers and reagent suppliers, these companies offer end-to-end solutions that encompass feasibility studies, process validation, and after-sales technical support.

In addition, key stakeholders have pursued targeted acquisitions to bolster their geographic reach and expand their method offerings. For instance, some providers have acquired specialized membrane filtration startups to enhance their micro- and nanofiltration capabilities, while others have integrated irradiation service providers to deliver turnkey pathogen control services. A growing number have embraced digital augmentation, embedding sensors and remote monitoring tools into sterilization systems to offer subscription-based performance analytics. Collectively, these strategies underscore an industry moving toward integrated, value-added models that not only deliver sterility assurance but also generate actionable insights for continuous improvement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food Ingredients Sterilization market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Aditya Birla Chemicals (India) Limited

- Akzo Nobel N.V.

- Arkema S.A.

- Balchem Corporation

- Camlin Fine Sciences Ltd.

- Chemtex Speciality Limited

- Ecolab Inc.

- Evonik Industries AG

- FINKTEC GmbH

- Hansol Chemical Co., Ltd.

- Kemin Industries, Inc.

- LANXESS AG

- Lennox Industries Inc.

- Lenntech B.V.

- Mitsubishi Gas Chemical Company, Inc.

- National Peroxide Ltd.

- Nouryon

- OCI Company Ltd.

- PeroxyChem LLC

- Solvay S.A.

- Stepan Company

- STERIS plc

- Taekwang Industrial Co., Ltd.

- Trojan Technologies Group ULC

Actionable Strategies for Industry Leaders to Optimize Sterilization Protocols, Embrace Emerging Technologies, and Navigate Regulatory Complexities Effectively

To maintain a competitive edge, industry leaders should prioritize the optimization of sterilization protocols through rigorous validation and continuous improvement. By implementing real-time monitoring platforms that alert operators to deviations, manufacturers can minimize batch rejections and maximize yield. Embracing non-thermal technologies such as high-pressure processing and gas plasma systems will also reduce energy usage and support sustainability targets without compromising microbial inactivation.

Simultaneously, cultivating strong relationships with regulatory agencies can expedite the introduction of novel sterilants and equipment. Engaging in pre-submission consultations and providing robust data packages can pave the way for accelerated approvals. On the supply chain front, diversifying procurement channels for critical consumables-including membranes, chemical reagents and irradiation sources-mitigates risk and enhances resilience in the face of trade policy shifts. Finally, cross-functional collaboration between R&D, quality assurance, and operations teams is essential to align sterilization strategies with evolving consumer preferences for clean labels and minimal processing. This integrated approach will empower organizations to navigate complexity while driving continuous performance gains.

Unraveling the Rigorous Research Methodology Behind the Comprehensive Analysis of Food Ingredient Sterilization Market Dynamics and Trends

This analysis of the food ingredient sterilization market draws upon a multi-tiered research methodology designed to ensure both breadth and depth of insight. Primary research comprised in-depth interviews with industry executives, process engineers and regulatory specialists, providing qualitative perspectives on technology adoption, cost drivers and strategic priorities. These viewpoints were supplemented by quantitative surveys targeting operations managers and technical directors to capture detailed data on process parameters, equipment utilization and investment trends.

Secondary research involved a comprehensive review of government regulations, standards body publications and peer-reviewed journals to contextualize best practices and emerging innovations. Publicly disclosed financial reports and patent filings were analyzed to map competitive landscapes and technology trajectories. The research team employed rigorous triangulation techniques to cross-verify data points, enhancing reliability by reconciling findings from diverse sources. Expert validation panels, comprising academics and industry veterans, reviewed preliminary conclusions to confirm technical accuracy and practical relevance. This robust approach ensures that the insights presented here offer a holistic view of market dynamics, enabling stakeholders to make well-informed strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food Ingredients Sterilization market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food Ingredients Sterilization Market, by Technique

- Food Ingredients Sterilization Market, by Ingredient Type

- Food Ingredients Sterilization Market, by Equipment Type

- Food Ingredients Sterilization Market, by Process

- Food Ingredients Sterilization Market, by End User

- Food Ingredients Sterilization Market, by Region

- Food Ingredients Sterilization Market, by Group

- Food Ingredients Sterilization Market, by Country

- United States Food Ingredients Sterilization Market

- China Food Ingredients Sterilization Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing Key Insights to Highlight the Imperative Next Steps for Stakeholders in the Evolutive Food Ingredient Sterilization Ecosystem

The evolving landscape of food ingredient sterilization is marked by a confluence of technological innovation, shifting regulatory requirements and dynamic trade policies. Organizations that harness advanced digital tools for process monitoring will be well positioned to achieve operational excellence while meeting sustainability commitments. At the same time, strategic segmentation-tailoring techniques and equipment to specific ingredient types and use cases-remains central to delivering cost-effective, high-quality outcomes.

Regional variations underscore the importance of adaptive strategies that respect local regulations, market maturity and supply chain realities. Meanwhile, leading companies are setting new benchmarks through integrated service models and strategic collaborations that span the entire sterilization ecosystem. To thrive in this environment, stakeholders must adopt an agile mindset, continuously refining protocols and fostering cross-functional alignment. By applying the insights outlined in this executive summary, industry participants can capitalize on emerging opportunities, mitigate evolving risks and chart a course toward a safer, more efficient, and more resilient food system.

Connect with Ketan Rohom to Unlock Exclusive Access to the Definitive Market Research Report on Food Ingredient Sterilization and Propel Your Strategic Initiatives Forward

Ready to propel your strategic initiatives with unparalleled insights into the food ingredient sterilization landscape? Reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to request exclusive access to the full market research report and secure a competitive advantage through data-driven decision making

- How big is the Food Ingredients Sterilization Market?

- What is the Food Ingredients Sterilization Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?