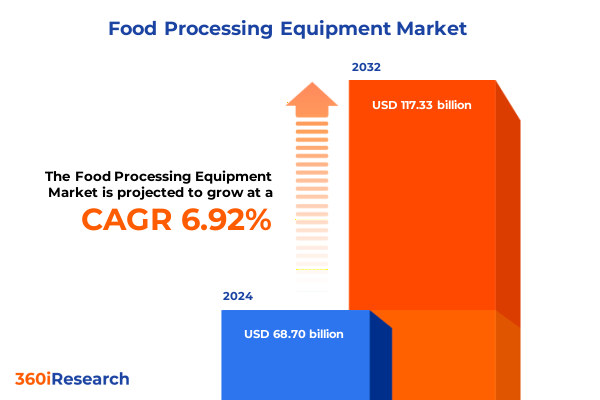

The Food Processing Equipment Market size was estimated at USD 73.35 billion in 2025 and expected to reach USD 78.33 billion in 2026, at a CAGR of 6.94% to reach USD 117.33 billion by 2032.

Exploring the Evolutionary Trajectory of Food Processing Equipment in an Era of Rapid Technological Advancement and Consumer Demand Shifts

The food processing equipment sector stands at a pivotal juncture where rapid technological advancements, evolving regulatory frameworks, and shifting consumer preferences converge to redefine industry norms. In recent years, manufacturers and end users alike have witnessed a profound transformation driven by demands for greater operational efficiency, stringent food safety standards, and heightened sustainability metrics. These dynamics have catalyzed a relentless drive toward automation, digital integration, and energy- and resource-efficient designs, reshaping the very foundation of how raw agricultural commodities are harvested, prepared, and delivered to global markets.

Simultaneously, modern consumers are exhibiting heightened awareness of nutritional quality, traceability, and environmental impact, compelling food and beverage manufacturers to reevaluate their processing strategies. This confluence of factors has created both significant opportunities and complex challenges for equipment suppliers seeking to navigate an environment characterized by rapid iteration, regulatory scrutiny, and supply chain volatility. As industry participants contend with material cost pressures, talent shortages, and fluctuating trade conditions, a clear understanding of these transformative forces is essential for charting a course toward resilience and growth.

Against this backdrop, this executive summary delves into the most salient trends shaping the food processing equipment market, explores the ramifications of recent policy shifts, and provides strategic insights into segmentation dynamics, regional distinctions, competitive positioning, and actionable recommendations-all intended to equip stakeholders with the clarity and foresight needed to thrive in an era of unprecedented change.

Unveiling the Disruptive Trends Reshaping the Food Processing Equipment Landscape Across Automation Sustainability and Digital Integration

Over the past decade, the food processing equipment landscape has been revolutionized by a triad of disruptive trends: the proliferation of automation, the ascendance of sustainability imperatives, and the integration of digital and data-driven technologies. Automation has transcended basic mechanization to encompass advanced robotics and machine learning, enabling equipment to self-optimize for throughput, yield, and energy consumption. Concurrently, sustainability considerations have prompted a shift toward equipment designs that minimize water usage, reduce waste generation, and facilitate circular economy initiatives, addressing both environmental concerns and cost containment objectives.

Layered atop these shifts is the digital revolution, where sensors, Internet of Things connectivity, and advanced analytics are providing unparalleled visibility into process flows, predictive maintenance, and quality control. Through real-time data streams and cloud-based platforms, manufacturers can now adapt production schedules on the fly, detect anomalies before they escalate, and trace ingredients from source to shelf with unprecedented granularity. This convergence of automation, sustainability, and digitalization has not only elevated operational capabilities but also redefined supplier and end-user expectations, demanding holistic solutions rather than discrete pieces of machinery.

As these transformative trends continue to accelerate, the industry is also witnessing rising collaboration between equipment suppliers, software developers, and research institutions. Such partnerships are fostering rapid prototyping of next-generation processors that blend modularity, scalability, and adaptive intelligence. Collectively, these evolutionary forces are setting the stage for a new era of agile, resilient, and environmentally responsible food processing systems.

Assessing the Ripple Effects of 2025 United States Trade Tariffs on Supply Chain Stability Equipment Sourcing and Cost Structures in Food Processing

In 2025, the imposition of escalated tariffs by the United States on a range of imported processing machinery has introduced a new layer of complexity to equipment sourcing and supply chain strategies. Manufacturers that historically relied on competitively priced foreign components and finished machines have been compelled to reassess their procurement models, exploring alternative supply networks or accelerating domestic production partnerships. This recalibration has created ripple effects throughout the value chain, influencing lead times, spare parts availability, and total cost of ownership calculations.

These tariff measures have also incentivized equipment suppliers to adapt product design and sourcing strategies, favoring local content for critical subsystems to mitigate tariff burdens, while in parallel exploring nearshoring in adjacent regions to maintain cost competitiveness and responsiveness. At the same time, end users are balancing short-term price pressures against long-term strategic benefits of diversified supply chains, including risk mitigation against future policy volatility.

The cumulative impact extends beyond procurement dynamics to influence capital expenditure planning, as finance teams reevaluate return-on-investment benchmarks in light of higher acquisition costs and potential supply disruptions. In some cases, this has prompted a renewed emphasis on upgrading existing machinery through retrofits and digital enhancements rather than full system replacements. Collectively, these adaptations underscore the resilience of the industry, demonstrating an ability to pivot sourcing strategies, optimize equipment lifecycles, and maintain operational continuity despite evolving trade policy landscapes.

Delving into Multifaceted Market Segmentation Dimensions Illuminating Equipment Type Operation Capacity Technology Application and End User Variances

A nuanced understanding of market segmentation offers deep insights into where growth can be driven and where competitive pressure intensifies. When viewed through the lens of equipment type, the landscape encompasses systems for blanching and cooking, cutting and slicing, drying and dehydration, grinding and milling, mixing and kneading, packaging, and sorting and grading. Each category exhibits distinct performance criteria and innovation trajectories, from high-precision slicing systems designed for delicate produce to robust dehydrators engineered for plant-based protein ingredients.

Segmentation by mode of operation reveals divergent value propositions between fully automatic, semi-automatic, and manual equipment lines, with automation premium features driving adoption among large-scale processors seeking consistency and throughput, while semi-automatic and manual systems retain appeal among smaller operations prioritizing capital efficiency and operational flexibility. Capacity-based segmentation further differentiates the market, spanning large-scale installations capable of thousands of units per hour to medium and small-scale processors catering to specialty, artisanal, or emerging product lines.

Technological segmentation underscores the rising prominence of cryogenic and thermal processing, with cryogenic grinding and frozen processing equipment enabling novel textural and nutritional outcomes, while thermal systems-ranging from frying to pasteurization and sterilization equipment-continue to evolve with enhanced energy efficiency and process control. Application-focused segmentation spans bakery and confectionery, beverage, dairy, fruit and vegetable, and meat processing, each presenting unique quality, safety, and efficiency imperatives. Finally, strategic positioning varies across end users, from large food and beverage manufacturers to foodservice operators and retail and supermarket chains, illustrating how customer-specific requirements shape equipment design and service models.

This comprehensive research report categorizes the Food Processing Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Mode Of Operation

- Capacity

- Technology

- Application

- End User

Mapping Regional Dynamics and Growth Catalysts Shaping Food Processing Equipment Adoption Across Americas Europe Middle East Africa and Asia Pacific

Regional market dynamics in the food processing equipment industry reflect a tapestry of economic growth rates, regulatory priorities, and consumer consumption patterns. In the Americas, the emphasis remains on achieving operational excellence through automation and digitalization, supported by mature infrastructure and robust capital investment. North American producers are particularly focused on advanced processing systems that ensure traceability, meet rigorous food safety standards, and deliver consistent product quality to large retail and foodservice channels.

Meanwhile, in Europe, the Middle East, and Africa, diverse regulatory landscapes and supply chain structures are driving a spectrum of equipment needs. European producers are often early adopters of resource- and energy-saving technologies, leveraging incentives and regulations to transition toward net-zero manufacturing. In contrast, Middle East and African markets are experiencing growing demand for modular, scalable solutions that can accommodate fluctuating production volumes and enable rapid entry into new product segments.

Across Asia-Pacific, expansive population growth and evolving dietary trends are fueling demand for high-capacity processing equipment capable of supporting large-scale beverage and dairy lines, as well as emerging plant-based protein initiatives. Companies in this region are strategically investing in local manufacturing hubs and service networks to accelerate delivery times and customize offerings for varied culinary traditions. Collectively, these regional dynamics underscore the importance of tailored go-to-market strategies and localized support models to address unique customer requirements and unlock growth potential in each territory.

This comprehensive research report examines key regions that drive the evolution of the Food Processing Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Competitive Strategies and Innovation Trajectories of Leading Manufacturers and Emerging Players in Food Processing Equipment Ecosystem

The competitive landscape of food processing equipment is characterized by established multinational manufacturers collaborating with agile, innovation-driven challengers. Leading global equipment providers differentiate themselves through end-to-end solution portfolios, integrating hardware, software, and aftermarket services to deliver turnkey processing lines. These incumbents often leverage extensive research and development capabilities to pioneer advanced materials, hygienic designs, and energy-optimized systems.

Concurrently, smaller specialized players are making inroads by focusing on niche segments, such as low-volume artisanal production or novel processing methods. These emerging companies frequently adopt an open-architecture approach, facilitating seamless integration with third-party control systems and cloud platforms. Strategic partnerships, joint ventures, and targeted acquisitions have become commonplace as both large and small entities seek to expand geographic reach, fill technology gaps, and accelerate time-to-market for next-generation equipment.

In parallel, software providers and digital enablers are forging alliances with equipment manufacturers to embed analytics, remote monitoring, and predictive maintenance capabilities directly into processing lines. This evolving ecosystem is redefining the notion of competitive advantage, shifting from product-centric differentiation to service-oriented models that emphasize uptime assurance, lifecycle optimization, and continuous performance improvement. As competition intensifies, the ability to orchestrate holistic solutions-spanning hardware, digital platforms, and support services-will be critical in securing long-term customer partnerships and fostering sustained growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food Processing Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfa Laval AB

- Alto-Shaam Inc.

- Amica Group

- Breville Group

- Bühler AG

- Electrolux AB

- GEA Group AG

- Godrej & Boyce Mfg. Co. Ltd.

- Haier Group

- Hamilton Beach Brands, Inc.

- Hisense International Co., Ltd.

- Illinois Tool Works Inc.

- JBT Corporation

- Krones AG

- LG Electronics Inc.

- Midea Group Co. Ltd.

- Miele & Cie KG

- Panasonic Holdings Corporation

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- Sharp Corporation

- SMEG S.p.A.

- Sub-Zero Group, Inc.

- Toshiba Lifestyle Products and Services Corporation

- Whirlpool Corporation

Strategic Roadmap for Industry Leaders to Capitalize on Technological Innovations Regulatory Shifts and Sustainability Imperatives in Food Processing

To thrive amid accelerating change, industry leaders should prioritize a strategic roadmap that balances technological investment with regulatory agility and sustainability commitments. First, embedding advanced automation and digitalization within core processing lines is essential to achieve high throughput, consistent quality, and proactive maintenance-enabling real-time decision-making and minimizing downtime. Executives should assess legacy systems for retrofit opportunities that can deliver rapid performance enhancements without necessitating full-capital outlays.

Simultaneously, aligning equipment design and operations with evolving environmental mandates will not only mitigate compliance risks but also unlock cost savings through reduced energy and water consumption. Leaders are advised to pursue lifecycle assessments and collaborate with engineering partners to integrate renewable energy sources and waste-to-value solutions. On the regulatory front, maintaining close engagement with trade associations and policy forums can help anticipate tariff fluctuations, secure advantage in trade negotiations, and shape standards that influence future equipment requirements.

Finally, fostering cross-functional collaboration between R&D, procurement, and customer success teams will drive a unified perspective on market needs, enabling the development of modular, scalable solutions that anticipate emerging consumer trends-whether that entails plant-based protein processing or enhanced clean-label applications. By executing a balanced strategy that weaves together technological innovation, sustainable practices, and regulatory foresight, industry leaders can position their organizations for durable competitive advantage and long-term growth.

Unraveling Rigorous Research Design and Methodological Approaches Underpinning Comprehensive Analysis of Food Processing Equipment Market Dynamics

The analytical framework underpinning this executive summary is founded on a multi-tiered research design that combines qualitative and quantitative methodologies. Primary research initiatives involved in-depth interviews with key executives across equipment manufacturers, food and beverage producers, and foodservice operators to capture firsthand perspectives on emerging trends, pain points, and investment priorities. Secondary research encompassed a thorough review of industry publications, trade association reports, patent filings, and regulatory documents to contextualize evolving standards and innovation trajectories.

To ensure segmentation accuracy, the market was systematically dissected by equipment type-spanning blanching and cooking through sorting and grading-mode of operation classifications, capacity tiers, technological distinctions between cryogenic and thermal processes, and application and end-user categories. This layered approach provided clarity on distinct value drivers and adoption dynamics across each segment. Regional analyses were informed by trade data, infrastructure assessments, and macroeconomic indicators to highlight growth catalysts and operational challenges unique to the Americas, Europe Middle East and Africa, and Asia-Pacific corridors.

Competitive profiling entailed mapping product portfolios, R&D investments, strategic partnerships, and digital capabilities of leading manufacturers and innovative challengers. Triangulation of data sources, combined with rigorous validation protocols, ensured that conclusions and recommendations are grounded in both empirical evidence and expert consensus. This comprehensive methodology delivers a balanced, nuanced perspective on market dynamics, empowering stakeholders with actionable insights for strategic planning and investment decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food Processing Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food Processing Equipment Market, by Equipment Type

- Food Processing Equipment Market, by Mode Of Operation

- Food Processing Equipment Market, by Capacity

- Food Processing Equipment Market, by Technology

- Food Processing Equipment Market, by Application

- Food Processing Equipment Market, by End User

- Food Processing Equipment Market, by Region

- Food Processing Equipment Market, by Group

- Food Processing Equipment Market, by Country

- United States Food Processing Equipment Market

- China Food Processing Equipment Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Critical Insights and Emerging Opportunities for Stakeholders Navigating the Future of Food Processing Equipment in a Changing Industry

In summary, the food processing equipment industry is undergoing a period of profound transformation driven by technological breakthroughs, shifting consumer expectations, and dynamic policy landscapes. Automation, sustainability, and digitalization are no longer optional but have become fundamental pillars of competitive differentiation. Simultaneously, the impact of new trade tariffs has underscored the importance of resilient supply chain strategies, local sourcing, and lifecycle optimization through retrofits and upgrades.

Segmentation analyses highlight the need for customized solutions across diverse equipment types, operational modes, capacity requirements, technologies, applications, and end-user profiles. Regional insights emphasize the distinct regulatory environments and investment priorities that shape adoption trends across the Americas, Europe Middle East and Africa, and Asia-Pacific. Competitive dynamics are evolving toward integrated offerings that blend hardware, software, and services, reinforcing the imperative for collaboration and open architectures.

For stakeholders navigating this complex terrain, success will hinge on the ability to anticipate market shifts, harness cross-functional synergies, and cultivate partnerships that drive continuous innovation. By synthesizing these critical insights and emerging opportunities, this executive summary equips decision-makers with the strategic clarity required to chart a forward-looking course in the ever-evolving landscape of food processing equipment.

Take the Next Step Towards Gaining Competitive Advantage in Food Processing Equipment by Partnering with Ketan Rohom for In-Depth Market Insights

To unlock unparalleled depth of knowledge and actionable intelligence in the competitive landscape of food processing equipment, engaging directly with Ketan Rohom as Associate Director of Sales & Marketing will provide personalized guidance. Through a collaborative consultation, industry leaders can gain tailored insights into emerging trends, transformative technologies, and strategic opportunities that resonate with their unique business objectives. By partnering with Ketan Rohom, decision-makers will benefit from a consultative approach that aligns market intelligence with operational objectives, ensuring a clear roadmap to achieving growth, efficiency, and innovation. Seize this opportunity to refine your strategic playbook and secure a lasting competitive edge in the rapidly evolving realm of food processing equipment. Contact Ketan Rohom today to arrange an in-depth discussion and take the first step toward future-ready, informed decision-making.

- How big is the Food Processing Equipment Market?

- What is the Food Processing Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?