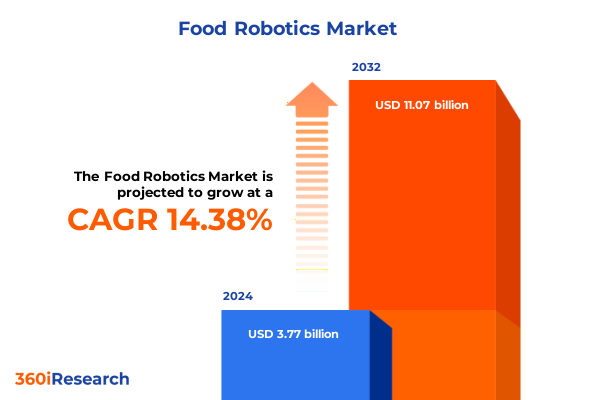

The Food Robotics Market size was estimated at USD 4.31 billion in 2025 and expected to reach USD 4.90 billion in 2026, at a CAGR of 14.41% to reach USD 11.07 billion by 2032.

How Robotics Are Addressing Critical Labor Shortages and Operational Challenges in Modern Food Production and Service Environments

The food industry is facing an unprecedented convergence of labor shortages, wage inflation, and stringent safety regulations that are driving organizations toward automation as a critical means of maintaining productivity. Persistent gaps in staffing, especially in processing and packaging roles, have left roughly a quarter of food manufacturing positions unfilled, compelling companies to explore alternatives that can deliver consistent output without the volatility of human labor. Rising minimum wages, which have climbed by approximately 15% since 2020, further intensify operational cost pressures, making the economic case for robotic solutions increasingly compelling across the sector. In parallel, heightened regulatory scrutiny around food safety has accelerated demand for automated inspection and quality control systems capable of meeting strict compliance mandates with minimal error.

Emerging Transformational Trends Redefining Food Robotics From Cloud-Connected Intelligence to Robotics-As-A-Service Models

As the food sector embraces Industry 4.0 and looks toward the collaborative future of Industry 5.0, transformative shifts are emerging that are redefining how robotics are conceived, deployed, and monetized. Cloud-connected intelligence is enabling remote monitoring and predictive maintenance of robotic fleets, allowing food processors to optimize system uptime and reduce unplanned disruptions. Coupled with advancements in machine vision, these integrated platforms empower real-time quality inspection of delicate products such as fresh produce and baked goods with accuracy levels exceeding those achievable by manual inspection. Moreover, the rise of robotics-as-a-service models is lowering the entry barriers for smaller operators, enabling pay-per-use or subscription-based access to packing and palletizing robots without large upfront capital expenditures. At the same time, modular and reconfigurable robot designs are offering unprecedented flexibility, allowing food and beverage manufacturers to quickly adapt to changing product lines and seasonal demands, heralding a new era of agile, scalable automation.

Analysis of the Far-Reaching Cumulative Effects of 2025 United States Tariffs on Food Robotics Supply Chains and Cost Structures

In early 2025, U.S. trade policy introduced a universal baseline tariff of 10% on virtually all imports, effective April, that now underpins every component in food robotics supply chains, from sensors to actuators. Layered on top of this, the extension of pre-existing Section 301 duties with an additional 10% levy on Chinese goods has resulted in tariff rates near 35% on critical robot parts such as precision actuators and vision sensors. Semiconductor chips sourced from China now face tariffs up to 50%, while Taiwanese semiconductors carry levies of 32% and South Korean motors have surged under 25% duties. These elevated cost structures have disrupted procurement strategies, triggered component shortages, and forced many food robotics integrators to revisit global sourcing footprints.

Deep Insights Into How Robot Type End Use Application Payload Capacity and Operation Mode Shape the Food Robotics Market Dynamics

A detailed examination of the food robotics landscape reveals five critical segmentation dimensions that collectively shape market dynamics. By robot type, articulated, Cartesian, delta, and SCARA configurations each offer unique kinematic advantages, with delta and Cartesian solutions often favored for high-speed sorting and packing operations. Considering end use, sectors such as cold chain logistics, food and beverage manufacturing, food service, and retail each impose distinct performance criteria, mandating tailored automation strategies to meet temperature control, hygiene, and throughput requirements. Application-based distinctions further refine system selection, whether for inspection tasks requiring high-resolution vision systems, packaging operations demanding precise material handling, palletizing workflows reliant on robust payload capacities, processing environments where water and washdown resistance are paramount, or sorting functions that prioritize speed and gentle handling. Payload capacity segments-from sub-5 kg tasks like product picking, through mid-range 5–50 kg material handling, to heavy-duty operations exceeding 50 kg-dictate the structural design and safety features of robotic arms. Finally, the choice between autonomous and semi-autonomous operation modes determines the level of human oversight and integration complexity, balancing full automation with collaborative robot deployments alongside human workers.

This comprehensive research report categorizes the Food Robotics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Robot Type

- Payload Capacity

- Operation Mode

- Application

- End Use

Critical Regional Variations Influencing Adoption of Food Robotics Across the Americas Europe Middle East Africa and Asia-Pacific

Regional markets for food robotics exhibit pronounced variation driven by local labor economics, regulatory frameworks, and technology ecosystems. In the Americas, persistent labor shortages and escalating wage pressures in the United States and Canada have fueled rapid adoption of both in-store service robots and back-of-house processing systems. Federal initiatives such as the CHIPS and Science Act are simultaneously strengthening domestic semiconductor and component supply chains, offering potential resilience against international tariff shocks. Across Europe, the Middle East, and Africa, stringent food safety regulations and EU funding under Horizon Europe have catalyzed investments in vision-guided inspection robots and collaborative cobots, particularly within high-value-added food processing clusters. Demand in the Middle East and Africa is emerging around urban food production and cold chain optimization to mitigate geographic and climatic challenges. In the Asia-Pacific region, rapid urbanization and vast food manufacturing hubs in China, Japan, and South Korea drive sophisticated automation deployments; meanwhile, supportive industrial policies and established robotics supply chains are positioning APAC as both a leading adopter and exporter of food-focused robotic solutions.

This comprehensive research report examines key regions that drive the evolution of the Food Robotics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Leading Global and Emerging Companies Pioneering Innovation and Competitive Strategies in Food Robotics

The competitive landscape of food robotics spans established industrial automation giants and agile startups introducing niche innovations. Companies like ABB, FANUC, KUKA, and Yaskawa continue to leverage decades of experience in high-precision robotics to deliver robust systems for food processing and packaging lines. Meanwhile Boston Dynamics and Agility Robotics are pioneering humanoid and legged platforms with potential back-of-house applications, though they face integration hurdles and price pressures induced by tariffs. On the emerging frontier, Formic has demonstrated the viability of robots-as-a-service models with packing and palletizing deployments in over 100 U.S. factories across the food and beverage sector, resulting in a 17% surge in usage in early 2025. AgTech startups such as Bonsai Robotics are addressing agricultural labor challenges with vision-driven harvest robots, securing $15 million in Series A funding to expand trials in orchards worldwide. Additionally, Miso Robotics’ cobot solutions, exemplified by Flippy and Chippy, continue to gain traction in quick-service restaurant pilots, underscoring the growing role of collaborative platforms in high-turnover food service environments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food Robotics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Bear Robotics Inc

- Cafe X Technologies Inc

- Chef Robotics

- Dexai Robotics

- Doosan Robotics

- Emerson Electric Co

- Epson

- FANUC Corporation

- Flexicell Inc

- GEA Group AG

- Heat and Control Inc

- JBT Corporation

- Kawasaki Heavy Industries Ltd

- Key Technology Inc

- Krones AG

- KUKA AG

- Mayekawa Manufacturing Company Ltd

- Miso Robotics Inc

- Mitsubishi Electric Corporation

- OMRON Corporation

- Picnic Technologies Inc

- Robert Bosch GmbH

- Rockwell Automation Inc

- Siemens AG

- Soft Robotics Inc

- Stäubli International AG

- Universal Robots

- Yaskawa Electric Corporation

Actionable Strategic Recommendations to Empower Industry Leaders to Optimize Food Robotics Implementation and Drive Operational Excellence

Industry leaders seeking to capitalize on robotics innovations should prioritize the development of resilient, diversified supply chains that can weather tariff volatility by combining domestic sourcing with strategic nearshoring partnerships. Investing in workforce upskilling programs, particularly in robotics programming, maintenance, and data analytics, will ensure that organizations can maximize system uptime and agility. Organizations should embrace subscription and pay-per-use models to reduce capital intensity while fostering flexibility in automation scale-up or reconfiguration. Strategic collaborations between integrators, component manufacturers, and end users can accelerate customization of robotic systems for specialized food applications, such as high-throughput sorting of delicate produce or hygienic packaging in moisture-sensitive environments. Finally, rigorous ROI analyses that incorporate total cost of ownership, including tariff impacts and ongoing maintenance, will drive informed decision-making and support the business case for sustained automation investments.

Comprehensive Research Methodology Leveraging Multi-Source Data Collection and Expert Validation to Illuminate Food Robotics Market Trends

Our research methodology integrates a rigorous blend of primary and secondary data collection, ensuring both depth and reliability in our analysis of the food robotics market. We conducted structured interviews with C-level executives, line operators, and technology providers to capture firsthand insights into strategic priorities, operational challenges, and emerging use cases. Parallel desk research drew upon industry publications, regulatory filings, and patent databases to map technology trends and competitive dynamics. Quantitative data was validated through triangulation across multiple publicly available and proprietary sources to mitigate bias and enhance accuracy. Case studies and proof-of-concept deployments were reviewed to assess real-world performance metrics, while expert panels provided independent validation of our segmentation frameworks and key findings. This multifaceted approach supports a comprehensive, fact-based perspective on market drivers, barriers, and opportunities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food Robotics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food Robotics Market, by Robot Type

- Food Robotics Market, by Payload Capacity

- Food Robotics Market, by Operation Mode

- Food Robotics Market, by Application

- Food Robotics Market, by End Use

- Food Robotics Market, by Region

- Food Robotics Market, by Group

- Food Robotics Market, by Country

- United States Food Robotics Market

- China Food Robotics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Summarizing Key Takeaways Highlighting the Strategic Imperatives for Embracing Robotics in the Evolving Food Industry Landscape

The intersection of labor dynamics, regulatory imperatives, and technological innovation is reshaping the food industry’s approach to automation. Robotics solutions are evolving from rigid, high-investment assets into flexible, service-oriented platforms that align with both large-scale manufacturers and agile food service operators. As organizations confront tariff-induced cost pressures, strategic sourcing, and modular system design will become essential components of competitive differentiation. Concurrently, the maturation of AI-driven vision systems and collaborative robots is expanding the addressable scope of automation to include delicate handling, quality inspection, and dynamic environments previously reserved for human workers. Embracing these developments, and integrating them into a cohesive digital strategy, will define the next generation of operational excellence and resilience across the global food value chain.

Engage With Ketan Rohom to Unlock Exclusive Insights and Secure the Full Food Robotics Market Research Report Today

If you’re ready to delve deeper into the transformative potential of robotics in the food industry, our comprehensive report provides the detailed analysis and strategic guidance you need to stay ahead of the curve. With exclusive insights into global regulatory shifts, segmentation trends, and competitive landscapes, this research equips you with the knowledge to make informed investment and operational decisions. Reach out to Ketan Rohom, Associate Director, Sales & Marketing, to discover how you can secure access to the full report. Let’s work together to drive innovation and competitive advantage through advanced food robotics solutions.

- How big is the Food Robotics Market?

- What is the Food Robotics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?