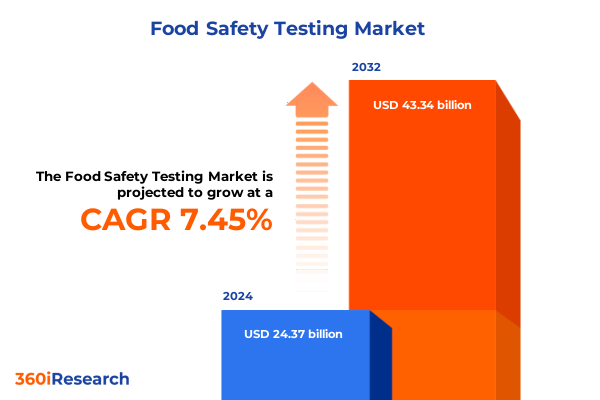

The Food Safety Testing Market size was estimated at USD 26.06 billion in 2025 and expected to reach USD 27.90 billion in 2026, at a CAGR of 7.53% to reach USD 43.34 billion by 2032.

Unlocking the Vital Role of Comprehensive Food Safety Testing in Safeguarding Public Health and Strengthening Consumer Confidence Across Global Supply Chains

Food safety testing has emerged as a cornerstone in protecting public health amidst increasingly complex global supply chains and heightened consumer expectations. As food producers and regulatory bodies contend with a proliferating array of hazards-from emerging biological threats to legacy chemical contaminants-comprehensive analytical scrutiny is more critical than ever. This introductory overview highlights the fundamental role of testing laboratories in detecting allergens, mycotoxins, pathogens, heavy metals, genetically modified organisms, and pesticide residues, ensuring that products reaching consumers adhere to the highest safety benchmarks.

In parallel, evolving regulatory frameworks across multiple jurisdictions continue to raise the bar for permissible limits and validation requirements, compelling market participants to adopt more stringent protocols. The introduction of harmonized standards and cross-border agreements has intensified competition among laboratories to deliver faster turnaround times, higher throughput, and more robust quality assurance measures. As a result, investment in cutting-edge instrumentation and method development has accelerated, laying the foundation for transformative shifts across the food safety landscape.

Navigating the Convergence of Advanced Analytical Technologies and Regulatory Pressures Reshaping the Food Safety Testing Ecosystem Worldwide

Recent years have witnessed a rapid convergence of advanced analytical technologies and regulatory imperatives, fundamentally reshaping the food safety testing ecosystem. Chromatography and spectrometry platforms have achieved new levels of sensitivity and selectivity, enabling the quantification of trace-level contaminants that once eluded detection. At the same time, an expanding portfolio of rapid methods-including biosensors, lateral flow assays, and polymerase chain reaction techniques-has democratized on-site testing, allowing producers and distributors to identify potential hazards in near real time.

Furthermore, digitalization initiatives and data integration solutions have begun to transform laboratory workflows, enhancing traceability from sample intake through data reporting. Artificial intelligence and machine learning algorithms are now being piloted to predict contamination events and optimize resource allocation. Meanwhile, traditional culture-based assays and immunoassays remain foundational for certain regulatory requirements, but they are increasingly being complemented by innovative high-throughput protocols that reduce analysis time and labor intensity. As these technological advances continue to intersect with heightened global standards, stakeholders across the value chain are realigning their strategies to harness efficiencies and maintain compliance.

Examining How 2025 United States Tariff Adjustments Have Intensified Import Dynamics and Adjusted Cost Structures for Food Safety Testing Services

The tariff revisions enacted by the United States in early 2025 have exerted a nuanced impact on the economics of food safety testing. Adjustments to import duties on critical reagents, testing equipment, and sample preparation materials have led to a recalibration of cost structures among both domestic and multinational laboratories. While certain categories of consumables faced increased tariffs-raising procurement expenses-other items experienced relief under revised harmonized system codes, prompting strategic realignments in sourcing and inventory management.

Concurrently, these tariff changes influenced supply chain decisions, as some market participants shifted to regional suppliers in North America to mitigate the volatility of cross-border logistics and duties. For laboratories that rely heavily on specialized chromatographic columns or spectrometry detectors from overseas manufacturers, the duty increases have put pressure on service pricing and profit margins. In contrast, providers with vertically integrated supply chains or localized partnerships have gained competitive advantage by offering more stable pricing and shorter lead times. As a result, the 2025 tariff landscape has underscored the importance of supply chain resilience and cost optimization in maintaining service excellence.

Dissecting Critical Segmentation Dimensions to Illuminate Category-Specific Testing Trends and Underlying Drivers Across All Food Safety Parameters

Insight into the market segmentation reveals distinct drivers and challenges across diverse testing categories. Target-tested analyses span allergens, genetically modified organisms, heavy metals, mycotoxins, pathogens, and pesticides, with each segment presenting unique analytical complexities. Allergen testing delves into eggs, gluten, milk, peanuts, and soy to address escalating consumer sensitivities, while heavy metal assessments focus on arsenic, lead, and mercury, driven by stringent regulatory thresholds. Pathogen screening encompasses Campylobacter, E. coli, Listeria, and Salmonella, reflecting the critical need to prevent foodborne illnesses. Mycotoxin monitoring addresses fungal metabolites such as aflatoxin and ochratoxin, and pesticide residue evaluation targets carbamates, organophosphates, and pyrethroids, responding to both agricultural practices and import standards.

When viewing the market through the lens of offering, consumables and equipment remain fundamental to laboratory operations, whereas services-including contract testing, method validation, and consulting-are expanding in response to the growing complexity of regulatory compliance. Technology segmentation highlights the dominance of chromatography and spectrometry for comprehensive multi-residue analysis, while rapid methods such as biosensors, lateral flow assays, and PCR platforms gain traction for on-site and point-of-decision testing. Traditional approaches like culture-based assays and immunoassays continue to serve as benchmarks for regulatory acceptance.

Application-based segmentation underscores the breadth of testing needs across dairy products and its subcategories cheese and fluid milk, fruits and vegetables with distinctions between dried fruits and fresh produce, meat and poultry, and processed foods subdivided into canned foods, frozen foods, and ready-to-eat meals. End-use segmentation differentiates food companies seeking in-house quality assurance, specialized food safety testing laboratories offering third-party validation, and retail and food service providers requiring verification to protect brand reputation. Each of these dimensions informs strategic priorities, investment decisions, and service development in the competitive testing landscape.

This comprehensive research report categorizes the Food Safety Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Target Tested

- Offering

- Technology

- Application

- End-Use

Comparative Evaluation of Regional Dynamics Highlighting the Distinct Growth Catalysts and Compliance Landscapes Across Americas, EMEA, and Asia-Pacific

Regional dynamics in the Americas reflect a mature regulatory environment characterized by the U.S. Food and Drug Administration’s continuous modernization initiatives and Canada’s robust federal-provincial frameworks. This landscape drives steady demand for advanced testing services, prompting laboratories to enhance capacity and reduce sample turnaround times. Market participants are also navigating evolving traceability mandates and implementing cloud-based data platforms to streamline compliance reporting throughout North America.

In Europe, Middle East & Africa, the European Union’s evolving directives on residue limits and allergen labeling steer harmonized testing standards, while the United Kingdom negotiates its post-Brexit regulatory alignment. At the same time, oil-rich Gulf states and South Africa are investing heavily in domestic laboratory networks to support food security goals and reduce reliance on imports. This confluence of regulatory rigor and infrastructure expansion fosters a diverse testing ecosystem where both international and local providers compete.

Meanwhile, the Asia-Pacific region emerges as a high-growth arena, fueled by rapid industrialization, population density, and heightened consumer awareness. China’s extensive food safety reforms have catalyzed significant capacity-building among domestic laboratories, and India’s tightening of permissible contaminant levels has accelerated demand for third-party testing. Southeast Asian nations are likewise scaling up certification programs, while Australia and Japan maintain stringent quality benchmarks, collectively making the region a focal point for technology providers and service innovators.

This comprehensive research report examines key regions that drive the evolution of the Food Safety Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Stakeholders Demonstrating Strategic Investments, Collaborative Initiatives, and Innovation Drivers in Food Safety Testing

Leading stakeholders in the food safety testing arena are distinguished by their strategic investments in laboratory infrastructure and method innovation. Global service providers have prioritized the expansion of networked laboratories to deliver rapid and standardized testing across multiple geographies, leveraging high-end chromatography and spectrometry systems alongside rapid assay platforms. Partnerships between equipment manufacturers and testing laboratories have accelerated the development of integrated analytical solutions, enhancing data accuracy and operational efficiency.

Collaborative initiatives among major players have also focused on digital transformation, with investments in laboratory information management systems that support real-time tracking, automated data analysis, and secure client portals. Some organizations have expanded their service portfolios to include consulting on regulatory compliance, risk management, and supply chain verification, thereby positioning themselves as end-to-end partners for food companies. This strategic diversification reflects a broader industry trend toward value-added services that complement core analytical testing and address evolving customer needs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food Safety Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- ALS Limited

- Anitox Corp.

- Anresco, Inc.

- AsureQuality

- Avantor Inc.

- Bio-Rad Laboratories, Inc.

- BioFront Technologies

- BioMérieux S.A.

- Charles River Laboratories International, Inc.

- Charm Sciences, Inc.

- Chr. Hansen Holding A/S

- Clear Labs, Inc.

- COPAN Diagnostics Inc.

- Deibel Laboratories, Inc.

- EMSL Analytical, Inc.

- Equinox Labs

- Eurofins Scientific SE

- Evergreen Sciences, Inc.

- Hygiena LLC

- Illumina, Inc.

- Intertek Group PLC

- Merck KGaA

- Microbac Laboratories, Inc.

- Mérieux NutriSciences Corporation

- Neogen Corporation

- PerkinElmer Inc.

- Promega Corporation

- Qiagen N.V.

- R J Hill Laboratories Limited

- R-Biopharm AG

- Romer Labs Division Holding GmbH

- SCIEX by Danaher Corporation

- SGS S.A.

- Spectacular Labs

- SwissDeCode SA

- Symbio Laboratories

- Thermo Fisher Scientific Inc.

- TÜV SÜD AG

- UL LLC

- Waters Corporation

Strategic Imperatives for Industry Leaders to Capitalize on Technological Advancements and Regulatory Developments in Food Safety Testing

Industry leaders should consider prioritizing investments in rapid testing platforms to complement traditional laboratory approaches and provide clients with accelerated decision-making capabilities. Integrating biosensors and PCR-based systems alongside chromatographic and spectrometric analyses can create a hybrid service model that balances throughput, sensitivity, and cost efficiency. Additionally, fostering partnerships with domestic reagent suppliers will mitigate exposure to tariff fluctuations and strengthen supply chain resilience.

Strategic adoption of digital laboratory management tools can streamline sample workflows and enhance traceability, supporting compliance with tightening regulations across multiple jurisdictions. Firms are also encouraged to develop modular service suites that bundle analytical testing with regulatory consulting, training programs, and proactive risk assessments. By diversifying their offerings, laboratories and food companies can deepen client relationships and capture higher-value engagements. Finally, establishing forums for cross-industry collaboration on method standardization and data sharing can drive collective innovation and elevate overall food safety outcomes.

Detailing a Robust Research Framework Integrating Primary Insights, Secondary Data Analysis, and Multi-Modal Verification to Ensure Comprehensive Coverage

This research employed a rigorous framework that combined primary and secondary data collection to ensure comprehensive coverage of the food safety testing market. In-depth interviews were conducted with industry executives, laboratory directors, and regulatory specialists to capture firsthand perspectives on operational challenges, investment priorities, and technology adoption trends. These discussions were supplemented by a thorough review of peer-reviewed publications, patent filings, and regulatory agency reports to validate market dynamics and method evolution.

Data triangulation techniques were utilized to reconcile inputs from diverse sources, aligning qualitative insights with quantitative benchmarks where applicable. A multi-tiered validation process involved cross-checking findings with external experts and key opinion leaders to ensure reliability and minimize bias. Throughout the study, strict confidentiality protocols and quality assurance measures guided the analysis, resulting in a robust, transparent methodology that supports informed decision-making for stakeholders across the food safety testing ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food Safety Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food Safety Testing Market, by Target Tested

- Food Safety Testing Market, by Offering

- Food Safety Testing Market, by Technology

- Food Safety Testing Market, by Application

- Food Safety Testing Market, by End-Use

- Food Safety Testing Market, by Region

- Food Safety Testing Market, by Group

- Food Safety Testing Market, by Country

- United States Food Safety Testing Market

- China Food Safety Testing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Summarizing Key Findings and Emphasizing the Strategic Significance of Rigorous Food Safety Testing Amid Evolving Market and Regulatory Landscapes

In summary, the food safety testing sector stands at an inflection point driven by technological innovation, evolving regulatory mandates, and shifting economic factors such as tariff adjustments. Advanced analytical platforms and rapid methods are converging to meet the growing demand for faster, more precise detection of a broad spectrum of contaminants. Regional regulatory landscapes and trade policies are reshaping supply chain dynamics, compelling market participants to enhance operational resilience and strategic agility.

As laboratories and food companies align their investments with these trends, the integration of digital solutions and diversified service portfolios will be critical to maintaining competitiveness. By adopting best practices in method standardization, supply chain collaboration, and risk management, stakeholders can ensure the integrity of the global food supply and safeguard public health in an increasingly complex environment.

Engage with Ketan Rohom to Secure Exclusive Access to the Comprehensive Food Safety Testing Market Research Report for Informed Strategic Decisions

I invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore how this exhaustive report can inform your strategic initiatives and strengthen your market positioning. Engaging with Ketan will ensure you receive a tailored overview of key trends and insights directly aligned with your business objectives, unlocking the actionable intelligence needed to navigate emerging challenges and seize new opportunities in food safety testing. Seize this opportunity to invest in strategic clarity and data-driven decision making-reach out to Ketan Rohom today to secure your copy of the comprehensive market research report and position your organization for sustained success in an increasingly complex regulatory and technological landscape.

- How big is the Food Safety Testing Market?

- What is the Food Safety Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?