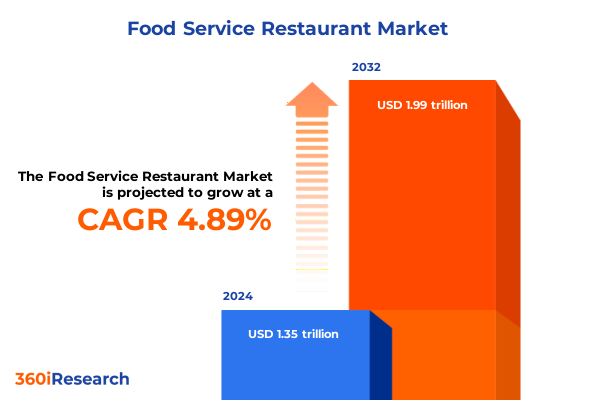

The Food Service Restaurant Market size was estimated at USD 1.42 trillion in 2025 and expected to reach USD 1.49 trillion in 2026, at a CAGR of 4.92% to reach USD 1.99 trillion by 2032.

Unveiling the dynamic trajectory of the foodservice restaurant sector through an executive overview highlighting pivotal forces shaping future growth

In an era defined by rapid technological breakthroughs and shifting consumer behaviors, the foodservice restaurant industry stands at a pivotal juncture. Stakeholders across the ecosystem-from multiunit operators to independent cafés-are balancing the urgency of digital transformation with the timeless imperative of culinary excellence. As diners recalibrate their expectations around convenience, health, and value, operators must adapt their operational blueprints and brand propositions to remain relevant in an increasingly competitive marketplace.

Against this backdrop, this executive summary distills the core forces reshaping foodservice restaurants, spotlighting emerging patterns in consumer engagement, operational resilience, and supply chain agility. By tracing the interplay between macroeconomic pressures, policy developments, and market-level innovations, this overview equips decision-makers with the contextual understanding needed to navigate complexity. Through qualitative insights and strategic perspective, readers will discover how to harness transformative trends without sacrificing the distinctive culinary experiences that drive brand loyalty.

Revealing the seismic shifts in consumer preferences and operational models revolutionizing foodservice restaurant landscapes nationwide

Over the past two years, the foodservice restaurant landscape has undergone a profound metamorphosis, fueled by both consumer-driven and operational imperatives. Rapid adoption of digital ordering platforms has redefined guest interactions, enabling seamless experiences through mobile apps and web-based interfaces. Simultaneously, operators have invested heavily in automation technologies-from robotic food preparation to AI-powered inventory management-to streamline labor deployment and mitigate margin pressures. As a result, hybrid models combining in-store, curbside pickup, and delivery have become the new norm rather than the exception.

Equally transformative is the rising consumer emphasis on sustainability and wellness. Patrons now expect transparent sourcing, eco-friendly packaging, and menu items that cater to emerging dietary trends. In response, leading operators have begun integrating regenerative agriculture partnerships and compostable serviceware into core processes. Furthermore, the proliferation of cloud kitchens and virtual brands has unlocked new avenues for geographic expansion without the capital intensity of traditional brick-and-mortar footprints. Through these converging forces, the industry has reimagined operational playbooks, marrying digital-first convenience with differentiated culinary offerings to capture today’s discerning consumer.

Assessing the cascading effects of 2025 United States tariffs on foodservice restaurant supply chains and cost structures across the nation

In early 2025, the United States implemented a series of targeted tariffs on imported metals, produce, and packaging supplies critical to foodservice operations. The cumulative impact has reverberated across supply chains, driving up input costs and necessitating renegotiation of vendor agreements. Operators reliant on aluminum beverage cans and steel food prep equipment have particularly felt downstream price pressures, prompting procurement teams to seek domestic sources and re-evaluate stocking strategies.

Moreover, increased duties on specialty ingredients from select trading partners have accelerated menu rationalization efforts. To preserve margin integrity, many chains have substituted imported garnishes with locally grown alternatives and adjusted portion sizes. Meanwhile, independent operators have turned to cooperative purchasing arrangements to mitigate single-source risk and dilute tariff burden. In aggregate, these shifts have catalyzed a broader movement toward supply chain resilience, emphasizing supplier diversification, lead-time optimization, and contingency planning in the face of evolving trade policy.

Deconstructing consumer and operational segments to illuminate nuanced growth pathways within diverse foodservice restaurant environments

Deep segmentation analysis reveals that different operational formats are charting unique growth pathways. Counter service establishments have leveraged speed of transaction and targeted digital loyalty initiatives to attract time-pressed guests. Limited service operators, by contrast, are refining menu simplicity to ensure consistency across high-volume settings. In quick service restaurants, investments in curbside pickup and self-service kiosks have unlocked efficiency gains while catering to contact-free preferences.

Channel dynamics further underscore competitive differentiation. Off premise offerings such as catering, delivery, and takeout now account for a significant share of guest spend, driven by convenience-seeking behaviors and remote work patterns. Yet, back-of-house footprints are also being reinvested to support in restaurant dining and enhanced outdoor seating, where experiential ambience and community engagement remain powerful drawcards. The interplay between these channels has impelled operators to pursue omnichannel cohesion, integrating digital menus and unified order pipelines.

Culinary diversity continues to broaden as American, Chinese, Italian, Japanese, and Mexican cuisines adapt to local tastes and dietary trends. While Italian concepts have leaned into premium ingredients to command higher checks, Mexican offerings have leaned into bold, flavor-forward profiles that resonate with multicultural demographics. Price tier stratification has also surfaced new competitive battlegrounds: midscale venues emphasize balanced menus at accessible price points, whereas the luxury and upscale segments invest in chef-driven innovations and curated wine programs. Value-oriented brands, conversely, deploy promotional bundling to reinforce perceived affordability without eroding brand equity.

Meal type segmentation illustrates shifting consumption patterns throughout the day. Breakfast menus have incorporated health-forward bowls and plant-based proteins to capture morning traffic, while lunch and dinner services now feature rapid turnaround models for on-the-go professionals. Snack occasions-ranging from shareable appetizers to dessert-centric kiosks-are emerging as incremental revenue drivers. Ownership structures shape these outcomes as well, with chain operators-whether local, regional, or national-scaling proven formats and standardized training, while independent restaurants remain agile, tailoring menus to hyper-local palates.

This comprehensive research report categorizes the Food Service Restaurant market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Dish Type

- Cuisine Type

- Meal Type

- Ownership Model

- Ordering Channel

Comparative regional analysis exposing distinct market behaviors and opportunity corridors across the Americas EMEA and Asia-Pacific regions

Regional markets exhibit differentiated adoption curves and competitive intensities. In the Americas, particularly the United States and Canada, the digital pivot has reached advanced maturity, with loyalty ecosystems and contactless transactions forming foundational pillars of guest engagement. Operators in this region continue to refine omnichannel strategies by aligning app-based promotions with in-store experiences and sophisticated data analytics.

Across Europe, the Middle East, and Africa, regulatory complexities and cultural heterogeneity shape market trajectories. While Western European countries emphasize sustainability mandates and calorie labeling, Middle Eastern markets are witnessing rapid expansion of premium casual dining concepts, supported by tourism and robust urbanization. Africa, albeit nascent in digital infrastructure, is experiencing a surge of quick service entrants leveraging mobile money platforms and localized menus to penetrate tier-two cities.

In the Asia-Pacific, a fertile ground for innovation, operators are experimenting with AI-driven kitchens, facial recognition ordering, and robot delivery. Urban centers in China, Japan, and Australia serve as incubators for contactless convenience, whereas emerging markets in Southeast Asia display a high appetite for international cuisine fused with regional spices. Within this tri-regional context, successful operators calibrate offerings to local regulations, cultural nuances, and technology readiness to optimize guest value and operational efficiency.

This comprehensive research report examines key regions that drive the evolution of the Food Service Restaurant market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing top foodservice operators to extract competitive strategies and innovative initiatives that drive market leadership and resilience

Leading chains and notable independents are forging the competitive frontier through differentiated strategies. Prominent operators maintain advantage by deploying advanced analytics to personalize promotions, streamline labor scheduling, and forecast demand spikes. Concurrently, disruptive newcomers are carving niche appeal with hyper-local sourcing, chef partnerships, and immersive dining concepts that double as brand marketing showcases.

Strategic alliances have also emerged as a powerful lever. Collaborative ventures between technology providers and restaurant groups have lowered barriers to entry for automation and seamless digital integration. Additionally, alliances with third-party delivery platforms extend guest reach, though they require delicate margin reconciliation. Several organizations have counterbalanced these costs by launching proprietary delivery services, thereby retaining direct customer relationships and unlocking higher service fees.

Investment in menu innovation has become another differentiator. Operators are introducing limited-time offerings that tap into cultural moments and seasonal produce, driving urgency and frequency of visits. Meanwhile, cross-industry partnerships-such as co-branded beverage alliances and retail distribution tie-ins-amplify brand visibility and diversify revenue portfolios. By weaving these tactics into cohesive strategies, industry leaders reinforce their market positions and anticipate the evolving needs of a fragmenting consumer base.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food Service Restaurant market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Dairy Queen Corporation

- Aramark

- Azzurri Group Ltd.

- Big Boy Restaurant Group LLC

- Bojangles OpCo, LLC

- Cajun Operating Company

- Carl’s Jr. Restaurants LLC

- Chick-fil-A, Inc.

- Chipotle Mexican Grill, Inc.

- Culver Franchising System, LLC

- Domino's Pizza, Inc..

- Five Guys Enterprises, LLC

- Hunt Brothers Pizza, LLC

- Inspire Brands, Inc.

- Jack in the Box Inc.

- Little Caesar Enterprises, Inc.

- Long John Silver's, LLC

- McDonald's Corporation

- Panda Restaurant Group, Inc.

- Papa John's International, Inc.

- Restaurant Brands International Inc.

- Seven & i Holdings Co.,Ltd.

- Sodexo Group

- Starbucks Corporation

- Steak n Shake Enterprises, Inc. by Biglari Holdings Inc.

- Subway IP LLC

- Wendy's International, LLC

- White Monkey F&B LLP

- Yum! Brands, Inc.

- Zaxby’s SPE Franchisor LLC

Formulating strategic imperatives and executable tactics enabling industry leaders to harness emerging trends and strengthen competitive positions

Industry leaders must prioritize digital infrastructure as the backbone of omnichannel delivery and personalized engagement. Investing in robust point-of-sale systems, integrated ordering apps, and customer relationship management platforms will enable seamless interactions across dine-in, pickup, and delivery channels. In tandem, cultivating data literacy within leadership and operational teams ensures actionable insights translate into real-time decision-making.

To mitigate external disruptions, diversifying supply chains is crucial. Establishing agreements with multiple domestic and international suppliers guards against tariff shocks and logistical bottlenecks. Moreover, adopting vendor scorecards to monitor quality, lead-time performance, and sustainability metrics reinforces consistent brand standards and supports ESG goals.

Operators should also incorporate sustainable practices across all facets of the business. Transitioning to recyclable or compostable packaging, optimizing energy usage through smart appliances, and reducing food waste via AI-powered forecasting not only resonate with eco-conscious diners but also yield long-term cost savings. Engaging guests through transparent sustainability narratives further cements brand loyalty and enhances reputational advantage.

Finally, segmentation-driven marketing will unlock targeted growth opportunities. By aligning menu innovations and promotional campaigns to specific segments-be it the premium dinner crowd, breakfast commuters, or snack-moment consumers-operators can heighten relevance and maximize return on marketing spend. Collaborations with regional influencers and localized events can amplify these efforts, driving foot traffic and user-generated brand advocacy.

Detailing the rigorous research framework and data acquisition methodologies employed to validate insights within the foodservice restaurant study

This comprehensive analysis draws upon a multi-phase research process that integrates both qualitative and quantitative methodologies. Primary research comprised in-depth interviews with senior executives from leading restaurant chains and independent operators, enabling nuanced understanding of strategic priorities and operational challenges. These conversations were complemented by online surveys distributed to a representative sample of multiunit managers and franchise owners, capturing real-time data on technology adoption, menu development, and customer engagement practices.

Secondary research entailed rigorous review of industry publications, government trade data, and financial filings-carefully curated to exclude proprietary or pay-walled market intelligence sources. Triangulation methods were employed to reconcile disparate data points, ensuring consistency across qualitative insights and numerical findings. All assumptions were validated by an expert advisory panel composed of supply chain specialists, culinary consultants, and consumer behavior analysts.

Throughout the study, strict protocols governed data integrity and reproducibility. A standardized coding scheme was applied to qualitative transcripts, while statistical tests assessed the reliability of survey results. The research framework was iteratively refined in collaboration with sector experts to guarantee that the final insights reflect both current realities and emergent trends within the foodservice restaurant domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food Service Restaurant market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food Service Restaurant Market, by Service Type

- Food Service Restaurant Market, by Dish Type

- Food Service Restaurant Market, by Cuisine Type

- Food Service Restaurant Market, by Meal Type

- Food Service Restaurant Market, by Ownership Model

- Food Service Restaurant Market, by Ordering Channel

- Food Service Restaurant Market, by Region

- Food Service Restaurant Market, by Group

- Food Service Restaurant Market, by Country

- United States Food Service Restaurant Market

- China Food Service Restaurant Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3975 ]

Consolidating essential takeaways and forward-looking considerations to empower informed decision-making in the foodservice restaurant industry landscape

This executive summary has illuminated the central forces propelling the foodservice restaurant industry forward, from digital acceleration and sustainable supply chain reinvention to the nuanced impacts of 2025 tariff policy. Through deep segmentation analysis and regional benchmarking, operators can pinpoint high-value opportunities and tailor strategies to distinct guest preferences and regulatory environments.

The collective insights underscore a singular imperative: agility. As consumer expectations continue to evolve, and external headwinds persist, operators that embody flexibility in format, channel, and menu composition will outpace static competitors. By leveraging data-driven decision-making, investing in resilient supplier networks, and fostering a culture of continuous innovation, the industry can not only weather current disruptions but also chart a course for sustained growth.

Ultimately, the path to enduring success lies in harmonizing technological advancement with the timeless art of hospitality. The strategies and observations articulated herein provide a blueprint for leaders committed to delivering quality experiences, building brand affinity, and maintaining operational excellence in an ever-changing market.

Connect directly with Ketan Rohom to access expert guidance and secure the market research report driving strategic growth in foodservice restaurants

To explore how this comprehensive analysis can inform your strategic initiatives, you are invited to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. By engaging with Ketan, you will gain tailored insights into the specific dynamics affecting your operations and learn how to leverage these findings to achieve competitive advantage. Reach out today to secure your copy of the full market research report and position your organization at the forefront of innovation and growth within the foodservice restaurant industry.

- How big is the Food Service Restaurant Market?

- What is the Food Service Restaurant Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?