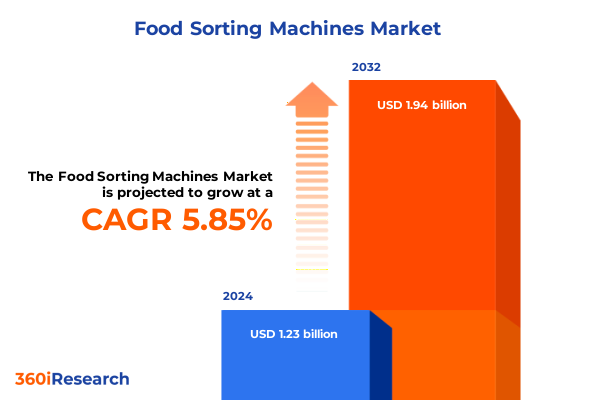

The Food Sorting Machines Market size was estimated at USD 1.30 billion in 2025 and expected to reach USD 1.37 billion in 2026, at a CAGR of 5.84% to reach USD 1.94 billion by 2032.

Introducing the Evolution and Strategic Importance of Advanced Food Sorting Technologies Across Modern Global Supply Chains and Quality Assurance

The landscape of food sorting machinery has evolved into a cornerstone of modern supply chain efficiency, driven by the industry’s relentless pursuit of quality, safety, and traceability. In recent years, manufacturers and processors have confronted increasing demands from regulators, retailers, and end consumers, all of whom expect stringent controls over foreign object detection, defect removal, and adherence to strict hygiene standards. As a result, sorting equipment has transcended its traditional role as a simple grading tool, emerging as an essential asset for minimizing waste, ensuring compliance, and preserving brand integrity.

This executive summary introduces the fundamental shifts that underpin the contemporary food sorting market. It examines how technological innovation, regulatory adjustments, and evolving consumer preferences are reshaping value chains from farm to fork. By weaving together insights across multiple axes - including automation, product categories, and geographical differentiation - this introduction sets the stage for a deeper exploration of how decision makers can harness these trends to secure competitive advantage and operational resilience.

Emerging Technological Innovations and Automation Trends Redefining Efficiency and Accuracy in Contemporary Food Sorting Operations

In a period defined by rapid technological breakthroughs, food sorting machines have undergone a profound transformation. Innovations in optical sorting leverage high-resolution cameras and sophisticated algorithms to distinguish between subtle color variations and nuanced shape anomalies, while multi energy X-ray systems enable real time inspection for both density and internal defects. Concurrently, integration of machine learning frameworks has elevated defect recognition capabilities, empowering equipment to adapt to new product lines and quality parameters with minimal manual intervention.

Moreover, the shift toward fully automatic solutions is accelerating as processors aim to reduce labor dependencies and uphold consistent throughput under stringent hygiene protocols. This transition is further supported by magnetic sorting advances for ferrous metal removal and enhanced infrared techniques for moisture and foreign organic matter detection. These converging trends are reshaping operational footprints, enabling facilities to reengineer process flows around continuous, high speed inspection systems that deliver uncompromised accuracy.

As a result, industry stakeholders must continually assess emergent technologies and recalibrate their capital budgets to incorporate next generation sorting platforms that meet evolving demands for efficiency, traceability, and regulatory compliance.

Analyzing the Comprehensive Effects of 2025 United States Tariffs on Food Sorting Machine Importation and Manufacturing Ecosystem

The imposition of new United States tariffs in 2025 has introduced a complex layer of cost and supply chain management for food processing equipment. By imposing higher duties on select components and finished systems imported from key manufacturing hubs, these measures have prompted businesses to revisit sourcing strategies and explore domestic assembly options. As import costs climbed, procurement teams have initiated comparative analyses between overseas OEMs and local integrators, evaluating total landed costs that encompass tariffs, logistics, and potential downtime.

In response, many equipment suppliers have established regional assembly lines or forged partnerships with North American distributors to mitigate duty impacts and preserve competitive pricing. This strategic pivot has also spurred investments in local manufacturing capabilities, resulting in accelerated lead times and more responsive service models. While some of these shifts have temporarily increased capital expenditure requirements, they have ultimately fostered greater supply chain resilience and reduced exposure to international trade volatility.

Looking ahead, the cumulative impact of these tariffs will continue to influence procurement decisions, vendor negotiations, and inventory planning. Stakeholders must maintain vigilant oversight of evolving tariff schedules and trade agreements to navigate these headwinds and optimize their equipment investment strategies.

Deciphering Market Segmentation Nuances to Unlock Targeted Opportunities in Food Sorting Solutions Across Diverse Technology and Product Verticals

A nuanced view of the market emerges when examining the industry through multiple segmentation lenses anchored by technology, product type, end user, and automation level. From a technological standpoint, inspection systems range from infrared sorting that discerns moisture and foreign organic matter to magnetic sorting designed for ferrous particle removal. Metal detection offers an additional layer of safety, while optical sorting - encompassing color sorting, defect sorting, and shape sorting modalities - elevates precision grading. Complementing these are X ray sorting solutions available in single energy and multi energy configurations, each tailored to specific density and product throughput requirements.

Turning to product categories, the machinery landscape serves a diverse array of segments including bakery and confectionery as well as dairy and grains and nuts. In the fruits and vegetables arena, differentiation between dried, fresh, and frozen offerings drives distinct equipment specifications. Meanwhile, meat and seafood processors demand robust systems capable of handling variable densities and moisture levels without compromising detection accuracy. Each of these verticals presents unique quality control parameters that guide system selection and configuration.

Assessing end users reveals a spectrum of operational environments, from high volume bakery lines to specialized dairy plants and food processing facilities. Meat and seafood processors similarly depend on equipment that can withstand rigorous washdown cycles and maintain consistent performance under fluctuating throughput demands. Finally, automation level segmentation spans fully automatic systems that require minimal human intervention to semi automatic and manual operations, enabling a range of cost and scalability profiles for diverse processing footprints.

This multidimensional segmentation framework empowers stakeholders to align technology investments with specific operational, product, and quality objectives, unlocking targeted opportunities for performance enhancement and risk mitigation.

This comprehensive research report categorizes the Food Sorting Machines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Product Type

- Automation Level

- End User

Uncovering Regional Market Dynamics Influencing Growth Trajectories of Food Sorting Equipment in Americas Europe Middle East Africa and Asia Pacific

Regional dynamics exert a profound influence on equipment adoption patterns and growth trajectories across the Americas, Europe Middle East and Africa, and Asia Pacific. In the Americas, demand is driven by large scale processing facilities prioritizing automation to mitigate labor constraints and ensure food safety compliance. Investment is particularly strong in North America, where stringent regulatory frameworks and consumer demand for defect free produce catalyze equipment upgrades and retrofits.

In Europe Middle East and Africa, the market displays heterogeneous growth. Western European processors emphasize sustainability and resource conservation, adopting systems that minimize waste and optimize yield, while emerging economies in the Middle East and Africa invest selectively in versatile platforms to support expanding dairy and bakery sectors. Meanwhile, trade facilitation initiatives in certain African regions are gradually opening new corridors for equipment importation.

Across Asia Pacific, rapid expansion of organized food retail and evolving foodservice channels are accelerating equipment modernization. Markets such as China and India showcase a rising appetite for advanced optical and X ray sorting solutions, driven by heightened consumer awareness of food quality and safety. At the same time, Southeast Asian processors leverage semi automatic and fully automatic platforms to bridge cost sensitivity with quality expectations.

Recognizing these regional idiosyncrasies enables suppliers and end users to tailor go to market strategies, allocate resources for service networks, and align product portfolios with localized demand drivers.

This comprehensive research report examines key regions that drive the evolution of the Food Sorting Machines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Industry Players Strategic Collaborations and Competitive Differentiators Driving Innovation in the Global Food Sorting Machinery Landscape

Key industry participants have distinguished themselves through rigorous innovation roadmaps, strategic alliances, and comprehensive service offerings. A leading global original equipment manufacturer has continued to expand its optical sorting portfolio, integrating artificial intelligence engines that reduce false rejects and adapt to new defect profiles. Another specialized inspection solutions provider has partnered with a robotics integrator to deliver fully automated end of line cells capable of continuous operation in high throughput environments.

At the same time, metal detection and X ray sorting pioneers have broadened their global footprints by establishing localized calibration and maintenance centers, ensuring rapid response to service requests and minimizing equipment downtime. Meanwhile, emerging players focused on niche applications - such as frozen fruits and nuts - have leveraged modular architectures that enable processors to scale capacity incrementally without significant capital outlay.

Competitive differentiation also stems from value added services, including remote performance monitoring, augmented reality guided repairs, and predictive maintenance analytics. These capabilities not only enhance uptime but also foster deeper customer relationships, as service leaders collaborate with end users to optimize inspection recipes, adjust sorting thresholds, and align output quality with evolving brand requirements. Collectively, these strategic imperatives are defining the competitive contours of the food sorting machinery landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food Sorting Machines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aweta GmbH

- Binder+Co AG

- BoMill AB

- Bühler Group

- Cimbria A/S

- Compac Sorting Equipment Ltd.

- Conceptronic S.A.S.

- Elbicon NV

- Food Machinery Australia Pty Ltd.

- Greefa Machinebouw B.V.

- Hefei Taihe Optoelectronic Technology Co., Ltd.

- InLine Vision Systems

- LOMA Systems

- Meyer GmbH

- Newtec Group A/S

- Odenberg Engineering GmbH

- Pellenc S.A.

- Raytec Vision S.p.A.

- Satake Corporation

- Sesotec GmbH

- TOMRA Systems ASA

Strategic Actionable Recommendations for Industry Leaders to Accelerate Adoption and Optimize ROI in Advanced Food Sorting Solutions

Industry leaders should prioritize strategic investments in next generation inspection technologies to maintain competitive differentiation. By evaluating and adopting adaptive optical sorting systems powered by advanced machine learning, processors can significantly reduce product waste while enhancing throughput consistency. Simultaneously, forging alliances with regional manufacturing partners will mitigate tariff exposure and streamline aftermarket service capabilities, ensuring both cost efficiency and rapid response to maintenance needs.

Moreover, implementing a phased automation roadmap allows businesses to balance capital deployment with operational readiness. Starting with semi automatic units for lower volume lines and transitioning to fully automatic cells as volumes scale enables a predictable return on investment trajectory. Meanwhile, integrating remote monitoring and predictive analytics platforms will yield actionable insights into equipment performance, helping to preempt issues and optimize sorting recipes in real time.

Finally, engaging in continuous training programs for in house maintenance teams will empower organizations to maximize equipment uptime and adapt swiftly to changing product portfolios. By combining technological foresight, strategic partnerships, and operational excellence, industry leaders can secure long term value and resilience in an increasingly quality conscious market.

Comprehensive Research Methodology Integrating Qualitative Analysis Quantitative Data and Multi Stage Validation for Food Sorting Market Insights

This market analysis is underpinned by a rigorous research methodology that blends detailed primary interviews with processing facility managers, equipment OEMs, and distribution partners, alongside comprehensive secondary research across regulatory filings, technical white papers, and industry journals. Data was synthesized through a multi stage validation process, ensuring that insights reflect current market realities, emerging innovations, and logistics considerations driven by recent tariff changes.

Quantitative feedback was gathered via structured surveys distributed to procurement professionals across key end user segments, capturing preferences for automation level, technology performance criteria, and service expectations. These data points were triangulated with shipment and import export records to validate regional demand patterns and supplier footprints. Additionally, scenario analyses were conducted to assess the potential impact of evolving trade policies and technology adoption curves.

Expert panels convened throughout the study provided iterative feedback on segmentation frameworks, competitive landscapes, and strategic imperatives. This collaborative approach ensured that the resulting insights are both actionable for decision makers and sufficiently granular to inform procurement, investment, and product development strategies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food Sorting Machines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food Sorting Machines Market, by Technology

- Food Sorting Machines Market, by Product Type

- Food Sorting Machines Market, by Automation Level

- Food Sorting Machines Market, by End User

- Food Sorting Machines Market, by Region

- Food Sorting Machines Market, by Group

- Food Sorting Machines Market, by Country

- United States Food Sorting Machines Market

- China Food Sorting Machines Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding Perspectives on Future Trajectories and Strategic Imperatives Guiding the Evolution of Food Sorting Machine Technologies

In conclusion, the food sorting machinery sector stands at the intersection of technological innovation, regulatory evolution, and shifting consumer expectations. Advanced optical and X ray inspection systems are redefining standards for safety and quality, while automation transitions are reshaping labor models and process architectures. Concurrently, 2025 tariff adjustments have underscored the importance of supply chain agility and localized manufacturing partnerships.

By adopting a segmentation driven approach - considering technology modalities from infrared and magnetic sorting to defect and shape detection, product type focuses from bakery to seafood, end user requirements, and automation levels - stakeholders can make informed decisions that align with both operational objectives and market demands. Regionally, nuanced growth drivers across the Americas, Europe Middle East Africa, and Asia Pacific necessitate tailored go to market strategies and service deployments.

As leading players continue to innovate and expand service portfolios, processors that proactively embrace these trends, calibrate their sourcing strategies, and invest in training and analytics will be best positioned to secure lasting competitive advantage. The convergence of precise inspection capabilities and strategic agility promises a future where waste is minimized, quality is maximized, and consumer trust is reinforced.

Take the Next Step to Empower Your Business with In Depth Food Sorting Market Insights by Connecting with Ketan Rohom to Secure Your Report

For decision makers seeking to harness the strategic edge afforded by comprehensive analysis of global and regional food sorting trends, a direct connection with Ketan Rohom offers an invaluable opportunity. As the Associate Director of Sales & Marketing, he is uniquely positioned to guide you through the intricacies of the report structure, highlight areas of critical impact, and demonstrate how these insights can be applied to optimize equipment procurement, streamline operational processes, and reinforce quality assurance measures.

Initiating this collaboration will empower your team with actionable intelligence tailored to your specific business imperatives. Engage with an expert who understands the nuances of advanced inspection technologies, tariff implications, segmentation dynamics, and regional growth drivers. By securing your copy of the market research report, you will access in-depth profiles, proprietary data models, and scenario analyses designed to support strategic planning and investment prioritization.

Contact Ketan Rohom today to take the next step toward elevating your competitive advantage in an increasingly automated and quality-driven food processing environment. His expertise will ensure you leverage the report’s findings to drive sustainable growth and maintain a leadership position in the evolving food sorting machinery landscape.

- How big is the Food Sorting Machines Market?

- What is the Food Sorting Machines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?