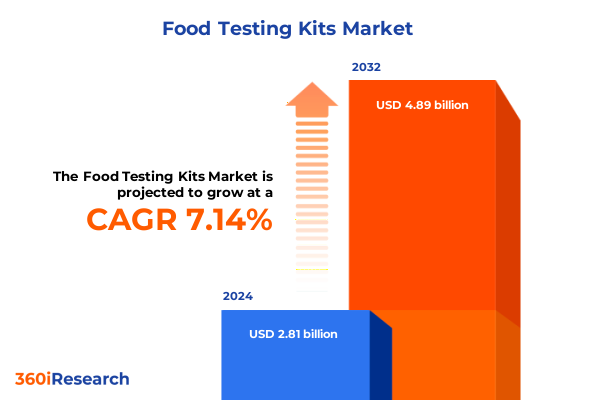

The Food Testing Kits Market size was estimated at USD 3.00 billion in 2025 and expected to reach USD 3.21 billion in 2026, at a CAGR of 7.20% to reach USD 4.89 billion by 2032.

Exploring the Critical Role of Cutting-Edge Food Testing Kits in Enhancing Safety Protocols and Safeguarding Public Health Across Supply Chains

Exploring the Critical Role of Cutting-Edge Food Testing Kits in Enhancing Safety Protocols and Safeguarding Public Health Across Supply Chains

Food safety remains a paramount concern for stakeholders across the global supply chain, where outbreaks of contamination can erode consumer trust, trigger costly recalls, and invite regulatory scrutiny. In response, food testing kits have emerged as indispensable tools for detecting hazards, from pathogens and mycotoxins to allergens and genetically modified organisms. These solutions enable on-site, rapid analysis that extends far beyond traditional laboratory workflows, empowering food manufacturers, service providers, and research laboratories to implement robust quality controls and uphold the highest standards of product integrity.

The adoption of advanced testing kits reflects a broader move towards proactive risk management, as tight regulatory frameworks in the United States and other major markets mandate rigorous monitoring at every stage-from raw ingredient sourcing through final product distribution. Technological enhancements in portable immunoassay devices, miniaturized molecular platforms, and spectroscopic instruments have accelerated testing cycles and reduced dependency on centralized labs. As a result, organizations can swiftly identify contamination events, deploy corrective actions, and reinforce consumer confidence in an increasingly transparent marketplace.

Unprecedented Technological Innovations and Regulatory Reforms Redefining the Food Testing Kits Industry to Deliver Enhanced Precision, Speed, and Compliance

Unprecedented Technological Innovations and Regulatory Reforms Redefining the Food Testing Kits Industry to Deliver Enhanced Precision, Speed, and Compliance

The past five years have witnessed a confluence of technological breakthroughs and regulatory refinements that collectively reshape the food testing kit landscape. Digital connectivity now underpins end-to-end traceability, enabling stakeholders to integrate IoT-enabled sensors with cloud-based analytics for real-time hazard detection. Machine learning algorithms refine predictive models by correlating test results with environmental factors and historical data, driving continuous improvement in assay performance. In parallel, streamlined regulatory pathways introduced by agencies such as the FDA have facilitated faster approvals for novel assays, reflecting a growing recognition of the critical role that rapid on-site testing plays in outbreak prevention and supply chain resilience.

This transformative period is also characterized by heightened collaboration among kit manufacturers, research institutions, and technology partners. Strategic alliances accelerate the translation of lab-scale innovations-such as high-throughput PCR workflows and advanced infrared spectroscopy-into field-deployable formats. Such partnerships enable rapid iteration, ensuring that testing solutions remain aligned with evolving contamination profiles and shifting consumer preferences. As a result, the industry is better equipped to address emerging threats, whether from novel pathogens or changes in global food supply chains.

Assessing the Compounded Effects of 2025 United States Tariffs on the Food Testing Kits Market Dynamics and Global Trade Pathways

Assessing the Compounded Effects of 2025 United States Tariffs on the Food Testing Kits Market Dynamics and Global Trade Pathways

In early 2025, the United States implemented a new set of tariffs on imported analytical reagents and testing equipment critical to food safety workflows. These measures have led to a notable uptick in landed costs for imported chromatography columns, specialized antibodies for immunoassays, and molecular reagents. Consequently, organizations have had to recalibrate procurement strategies, balancing between domestic suppliers that command price premiums and international partners seeking ways to mitigate tariff liabilities.

This tariff environment has encouraged manufacturers to localize certain production processes and invest in in-country capacity for reagent formulation, column packing, and instrument assembly. While this shift has bolstered domestic manufacturing ecosystems and reduced lead times, it has also increased unit costs, prompting end users to explore pooled procurement models and long-term supply agreements. Moreover, the higher entry barriers for new foreign entrants have narrowed the competitive landscape, underscoring the importance of strategic partnerships with established domestic suppliers to ensure continuity of testing operations.

In-Depth Segmentation Perspectives Unveiling Key Trends across Technologies, Targets, Samples, End-Users, and Distribution Channels for Food Testing Kits

In-Depth Segmentation Perspectives Unveiling Key Trends across Technologies, Targets, Samples, End-Users, and Distribution Channels for Food Testing Kits

Analyzing the market through a technology lens reveals that chromatography-based systems continue to drive demand, with gas chromatography emerging as the preferred choice for volatile contaminant profiling, while liquid chromatography supports high-resolution separation of complex matrices. Immunoassay-based kits remain vital for rapid allergen screening, whereas infrared spectroscopy tools gain traction in commodity grading and authenticity testing. Mass spectrometry platforms underpin high-confidence identification of trace contaminants, and PCR-based solutions support definitive pathogen detection through precise nucleic acid amplification.

When viewed by target tested, consumer and regulatory priorities around allergen labeling, GMO detection, and verification of meat species have intensified testing frequency, while pathogen monitoring retains its status as a non-negotiable safety requirement. Sample type segmentation highlights robust demand for kits evaluating cereals, grains, pulses, and dairy products, alongside growing uptake in fresh produce testing. Meat, poultry, seafood, nuts, seeds, and spices demand specialized kits, and packaged foods-from canned goods to frozen entrees-require versatile assay compatibility. End-user segmentation underscores the critical role of large-enterprise food manufacturers investing in in-house testing, the agility of small and medium enterprises leveraging outsourced services, and the specialized capacity of academic and private research laboratories. Finally, distribution channels reveal a resurgence in offline direct sales models supported by technical service teams, complemented by expanding online portals that offer streamlined ordering and digital post-purchase support.

This comprehensive research report categorizes the Food Testing Kits market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Target Tested

- Sample Type

- End-User

- Distribution Channel

Comparative Regional Dynamics Highlighting Growth Drivers and Challenges for Food Testing Kits across Americas, EMEA, and Asia-Pacific Markets

Comparative Regional Dynamics Highlighting Growth Drivers and Challenges for Food Testing Kits across Americas, EMEA, and Asia-Pacific Markets

In the Americas, stringent regulatory frameworks in the United States and Canada have catalyzed widespread adoption of rapid on-site testing kits, with food processors and service providers prioritizing compliance and traceability. Mexico’s growing food processing sector has also embraced affordable immunoassay and PCR-based kits, spurred by expanding export opportunities to North America. A strong distribution network and well-established laboratory infrastructure underpin this region’s leadership in kit procurement.

Europe, the Middle East, and Africa present a diverse tapestry of regulatory regimes and infrastructural maturity. Within the European Union, harmonized legislation shapes standardized testing protocols, driving demand for high-throughput chromatography and mass spectrometry solutions. In the Middle East, burgeoning food service sectors in the Gulf Cooperation Council states invest in portable kits to ensure rapid pathogen screening. Africa’s evolving agricultural economies are gradually scaling diagnostic capacity, focusing on low-cost immunoassays that address mycotoxin contamination in staple grains.

Asia-Pacific represents a high-growth frontier, driven by population-scale food production and rising consumer awareness of food safety. China’s strategic initiatives to expand domestic analytical capacity have supported local kit manufacturers, while Southeast Asian exporters leverage PCR-based pathogen detection to meet stringent import standards. Australia and Japan further contribute sophisticated spectroscopic and chromatography expertise, reflecting a balanced mix of academic research and commercial application.

This comprehensive research report examines key regions that drive the evolution of the Food Testing Kits market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Competitive Intelligence Revealing the Innovators, Market Leaders, and Emerging Players Shaping the Food Testing Kits Landscape

Strategic Competitive Intelligence Revealing the Innovators, Market Leaders, and Emerging Players Shaping the Food Testing Kits Landscape

The competitive arena for food testing kits is anchored by global instrument and reagent providers that blend broad product portfolios with deep regulatory experience. Several established players continue to expand their chromatography and spectroscopy offerings through targeted acquisitions and R&D collaborations. These companies invest heavily in application support services and digital platforms, enhancing end-user engagement and boosting kit utilization rates. At the same time, specialist firms focused on immunoassay and molecular diagnostics are carving out niche positions by delivering ultra-rapid lateral flow assays and portable PCR systems tailored to on-farm and field operations.

Emerging entrants, particularly those originating from adjacent industries such as clinical diagnostics and environmental testing, are leveraging cross-sector expertise to introduce hybrid platforms capable of multiplex analysis. These new players frequently partner with academic institutions to validate novel assay chemistries, accelerating time to market. In this dynamic environment, the ability to differentiate through service excellence, software integration, and ongoing technical training has become a defining competitive edge. Successful companies will be those that combine robust core technologies with agile application development to meet the increasingly varied needs of end users.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food Testing Kits market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- bioMérieux S.A.

- Charm Sciences, Inc.

- Creative Diagnostics

- Ecolab Inc.

- FOSS A/S

- Merck KGaA

- Neogen Corporation

- PerkinElmer, Inc.

- QIAGEN N.V.

- R-Biopharm AG

- Randox Laboratories Ltd.

- Romer Labs Division Holding GmbH

- Romer Labs Inc.

- Scigiene Corporation

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

- Unisensor S.A.

- WATERS Corporation

- Zoetis Inc.

Strategic Imperatives and Tactical Recommendations Empowering Industry Leaders to Optimize Food Testing Kit Adoption and Operational Efficiency

Strategic Imperatives and Tactical Recommendations Empowering Industry Leaders to Optimize Food Testing Kit Adoption and Operational Efficiency

To capitalize on rapid technological evolution and shifting regulatory landscapes, organizations should prioritize strategic partnerships with kit developers that offer scalable platforms and comprehensive technical support. By fostering joint development agreements, end users can co-create assays tailored to specific matrix challenges, accelerating validation timelines and securing early access to next-generation technologies. In parallel, leveraging pooled procurement or consortia-based purchasing models can mitigate cost pressures imposed by tariffs, while enabling volume discounts and predictable supply chain performance.

Operational excellence requires a concerted focus on workforce training and cross-functional collaboration. Empowering quality assurance teams with hands-on training in multiplex immunoassay techniques and spectroscopic data interpretation enhances analytical accuracy. Meanwhile, integrating digital traceability systems that link raw material and product testing results enriches data fidelity and streamlines compliance reporting. Finally, piloting new distribution strategies-such as hybrid direct-to-facility and web-enabled ordering-can optimize service delivery by balancing personalized technical consultations with efficient e-commerce workflows.

Robust Multimodal Research Framework Integrating Primary Interviews, Secondary Data, and Analytical Rigor to Yield Reliable Food Testing Kit Market Insights

Robust Multimodal Research Framework Integrating Primary Interviews, Secondary Data, and Analytical Rigor to Yield Reliable Food Testing Kit Market Insights

This research leverages a combination of expert consultations, proprietary surveys, and publicly available regulatory documents to build a comprehensive perspective on food testing kit trends. Primary input was obtained through structured interviews with senior quality assurance leaders at food manufacturing enterprises, in addition to product managers from leading kit suppliers. These dialogues provided nuanced understanding of procurement drivers, technology evaluation criteria, and pain points associated with implementation, ensuring that the analysis reflects real-world decision-making processes.

Secondary research involved a systematic review of trade association publications, government agency guidelines, and leading scientific journals to validate technological advancements and regulatory developments. Data triangulation was employed to reconcile disparate sources and enhance the credibility of insights. Qualitative findings were supplemented with quantitative metrics derived from industry surveys, enabling cross-validation. Throughout the research process, rigorous checks and peer reviews were conducted to uphold methodological transparency and analytical integrity, resulting in actionable conclusions that support strategic planning for stakeholders at every level of the food testing value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food Testing Kits market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food Testing Kits Market, by Technology

- Food Testing Kits Market, by Target Tested

- Food Testing Kits Market, by Sample Type

- Food Testing Kits Market, by End-User

- Food Testing Kits Market, by Distribution Channel

- Food Testing Kits Market, by Region

- Food Testing Kits Market, by Group

- Food Testing Kits Market, by Country

- United States Food Testing Kits Market

- China Food Testing Kits Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesis of Critical Insights Charting the Future Trajectory of Food Testing Kit Innovations, Market Dynamics, and Regulatory Evolution

Synthesis of Critical Insights Charting the Future Trajectory of Food Testing Kit Innovations, Market Dynamics, and Regulatory Evolution

The convergence of advanced analytical technologies, dynamic regulatory environments, and evolving end-user requirements underscores a pivotal moment for the food testing kit sector. As companies harness automation, digitalization, and data analytics, kit performance is set to become faster and more accurate, enabling real-time decision making across diverse operational settings. The cumulative impact of newly implemented tariffs has accelerated domestic capacity building, reshaping global supply chains and prompting end users to adopt collaborative procurement models.

Looking ahead, success will hinge on the ability to integrate cross-functional expertise, from assay development through data management. Strategic partnerships and agile R&D investments will drive differentiation, while regional nuances in regulatory rigor and end-user maturity will shape technology adoption curves. By embracing a customer-centric lens-anchored in ongoing training, robust service infrastructures, and seamless e-commerce experiences-industry participants can secure competitive advantage and safeguard public health in an increasingly complex food ecosystem.

Engage with Ketan Rohom to Secure Comprehensive Food Testing Kit Market Intelligence and Drive Informed Strategic Decisions

For leaders seeking to harness comprehensive insights into evolving food testing kit dynamics, engaging with an experienced strategic partner offers an invaluable opportunity to accelerate informed decision-making. By connecting with Ketan Rohom, Associate Director, Sales & Marketing, you gain direct access to an in-depth report that delivers actionable intelligence on emerging technologies, regulatory shifts, and competitive benchmarks. This collaboration ensures you receive tailor-made guidance on navigating tariffs, optimizing supplier networks, and prioritizing high-impact segments for investment.

Seize this moment to differentiate your organization by equipping your team with robust market data, expert-driven analysis, and forward-looking recommendations. Reach out to schedule a personalized consultation and secure the strategic advantage needed to thrive amid dynamic market forces. Elevate your market positioning-and fuel sustainable growth-by accessing the definitive resource for food testing kit market intelligence today

- How big is the Food Testing Kits Market?

- What is the Food Testing Kits Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?