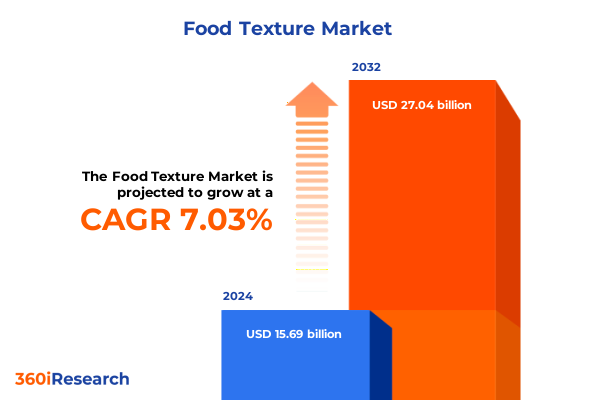

The Food Texture Market size was estimated at USD 16.74 billion in 2025 and expected to reach USD 17.87 billion in 2026, at a CAGR of 7.08% to reach USD 27.04 billion by 2032.

Unveiling the Pivotal Role of Texture Innovation in Shaping Modern Food Experiences Across Diverse Consumer Preferences and Culinary Applications

In an era where sensory appeal plays a pivotal role in consumer choice, texture has emerged as the defining dimension of culinary innovation and product differentiation. The intricate interplay of mouthfeel, consistency, and structural integrity shapes not only palates but also purchase decisions. As manufacturers strive to stand out in saturated categories, mastering texture becomes essential for creating signature experiences that resonate with diverse demographic segments. This report introduces the critical importance of texture as a strategic lever for driving brand loyalty and premium positioning.

Against the backdrop of shifting consumer values-ranging from clean label preferences to demand for indulgent yet healthful formulations-texture innovation bridges functionality and sensory delight. Emerging processing technologies, novel ingredient systems, and cross-disciplinary research converge to unlock new textural possibilities, from aerated confections that melt on contact to gelled dressings with dynamic viscosity profiles. The interplay of regulatory changes, supply chain complexities, and sustainability imperatives further amplifies the importance of resilient texture strategies.

By examining the overarching landscape of texture innovation, this analysis sets the stage for an in-depth exploration of the major forces reshaping ingredient sourcing, regional adoption patterns, and competitive differentiation. Executives, R&D leaders, and supply chain strategists will find actionable insights to guide formulation priorities, partnership opportunities, and investment decisions. Through a comprehensive, data-driven approach, the report emphasizes texture as a powerful driver of consumer engagement and market growth.

Examining the Key Forces Driving a Paradigm Shift in Food Texture Innovation for Enhanced Sensory Satisfaction and Health Optimization

The food texture landscape is undergoing a profound transformation as manufacturers respond to converging trends in health, personalization, and sustainability. First, the rise of health-conscious consumers has amplified the demand for fibers, proteins, and hydrocolloids that deliver both functional benefits and appealing mouthfeels. This shift has encouraged ingredient suppliers to innovate cleaner labels and multifunctional blends that satisfy nutrition targets without compromising sensory quality.

Simultaneously, personalization technologies-from digital consumer profiling to small-batch production-enable brands to tailor texture profiles to specific occasions and demographics. The ability to modulate creaminess, crunch, or aeration on demand fosters deeper consumer engagement and allows for targeted marketing initiatives that highlight textural uniqueness. Moreover, the emphasis on sustainable sourcing ushers in a wave of plant-based and upcycled ingredients, driving continuous refinement of starches, emulsifiers, and fibers to replicate traditional textures in eco-friendly formats.

Advances in processing techniques such as ultrasonic homogenization and 3D food printing are further redefining what is possible in texture design. These technologies support precise control over microstructure, facilitating innovative formats like layered gels and extruded snacks with complex internal geometries. As a result, industry stakeholders must navigate a landscape that rewards agility, collaboration, and cross-sector R&D alliances. Embracing these transformative forces will be crucial for staying competitive and meeting the evolving expectations of today’s discerning consumers.

Assessing the Broad Repercussions of Recent United States Tariff Policies on Ingredient Sourcing and Food Texture Innovation Cost Structures

The introduction of new tariff schedules by the United States government in 2025 has had a significant bearing on the cost and availability of texture-modifying ingredients. Tariffs imposed on imported hydrocolloids, specialized starches, and certain protein isolates have prompted food manufacturers to reassess long-established supply chain models. As import costs rise, organizations face heightened pressure to diversify sourcing or invest in domestic production capabilities to mitigate price volatility.

In response, many companies have begun forging strategic partnerships with local growers and processors to secure reliable access to critical raw materials. This realignment has driven a spike in contract development agreements and joint ventures, particularly in the dairy and plant-protein segments. At the same time, R&D teams are accelerating reformulation initiatives, exploring alternative ingredient classes such as upcycled seaweed extracts or fermentation-derived proteins to maintain desired texture profiles without exposing margins to tariff-driven fluctuations.

These dynamics underscore the need for a resilient, multi-tiered sourcing strategy that balances cost efficiency with quality consistency. By leveraging data-driven supply chain visibility and predictive analytics, businesses can anticipate tariff revisions and proactively adjust procurement plans. Consequently, maintaining close communication channels with trade advisors and regulatory bodies becomes essential for aligning product roadmaps with evolving policy landscapes.

Revealing Insights Across Multidimensional Segmentation Pillars Illuminating Opportunities in Texture Applications Ingredient Sources and End Uses

The complexity of the food texture market emerges most clearly when examined through multiple segmentation lenses. Applications spanning bakery, beverages, and dairy drive distinct textural requirements, from the creamy melt of ice cream to the aerated snap of chocolate confections. Meanwhile, sauces and dressings demand gelled structures that balance pourability and cling. Each end use-whether in retail-ready snacks or industrial food manufacturing-introduces unique challenges, such as shelf stability or rapid reconstitution.

Texture types range from the extruded brilliance of aerated formats to the sleek flow of smooth emulsions, each underpinned by a tailored suite of hydrocolloids or protein blends. The extended heat resistance of hot-set gels versus cold-set counterparts exemplifies how processing methods intersect with ingredient functionality to achieve specific mouthfeels. Ingredient segmentation reveals a delicate dance among emulsifiers, fibers, and starch matrices, while source segmentation illuminates trade-offs between animal-derived proteins, dairy fractions, and plant-based alternatives like cereal or fruit extracts.

End-use channels-from the immediacy demands of foodservice environments to the rigorous quality controls of supermarkets-further shape texture innovation priorities. Food manufacturers and OEMs in industrial settings often require bulk ingredient solutions with consistent rheological profiles, while restaurant operators seek versatile systems that streamline back-of-house operations. Understanding these overlapping segmentation pillars is critical for identifying white spaces and aligning product development strategies with the nuanced needs of each market segment.

This comprehensive research report categorizes the Food Texture market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Texture Type

- Ingredient

- Source

- Application

- End Use

Uncovering Distinct Regional Dynamics Shaping Food Texture Adoption and Innovation Trends Across Americas Europe Middle East Africa and Asia Pacific Markets

Regional market dynamics exert a profound influence on texture innovation trajectories and consumer acceptance patterns. In the Americas, the convergence of convenience-driven snack formats and clean-label advocacy prioritizes aerated and crunchy profiles formulated with recognizable ingredients. Manufacturers in North America are thus intensifying efforts to replace synthetic emulsifiers with natural fibers and to adapt chewy formats for on-the-go consumption.

Across Europe, Middle East, and Africa, premiumization trends and established dairy traditions sustain robust demand for creamy and gelled textures, particularly in cheese, yogurt, and artisanal desserts. Regulatory frameworks that encourage clean labeling and allergen transparency further steer producers toward natural hydrocolloids and fermentation-based proteins. Moreover, localized taste preferences drive the customization of spice-infused gels and texturally layered sauces.

Asia-Pacific markets, characterized by rapid growth in plant-based alternatives and traditional texture-rich snacks, offer fertile ground for innovative applications of extruded aeration and hot-set gel technologies. Regional specialties such as konjac-derived gels and rice-based thickeners inform global R&D pipelines, while e-commerce proliferation accelerates the adoption of novel snack textures. As cross-border collaborations expand, companies must tailor texture solutions to diverse regulatory standards and cultural palates to capitalize on each region’s unique growth drivers.

This comprehensive research report examines key regions that drive the evolution of the Food Texture market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players Driving Innovation Collaboration and Competitive Differentiation in Food Texture Technology Solutions Worldwide

Leading players in the texture innovation arena span ingredient supply, specialized toll manufacturing, and cross-sector technology developers. Global conglomerates with vertically integrated portfolios are leveraging R&D investments to introduce modular texture systems that streamline application across multiple food categories. Simultaneously, agile mid-sized firms are carving out niches by focusing on specialty hydrocolloids or plant-protein extracts that meet stringent clean-label criteria.

Strategic collaborations and acquisitions underscore the competitive landscape, as established ingredient houses partner with biotech startups to co-develop novel protein isolates or fermentation-derived texturants. Innovation centers situated near major culinary hubs facilitate real-time consumer feedback loops, accelerating co-creation of texture solutions tailored to emerging taste trends. These partnerships often extend to co-manufacturers and brand owners, enabling rapid scale-up and market testing of new textural concepts.

Competitive differentiation increasingly hinges on proprietary processing capabilities as well as ingredient purity and traceability. Companies that can demonstrate end-to-end transparency-from raw material sourcing to finished product performance-gain valuable leverage with retailers and foodservice operators. As a result, investment in digital twins and blockchain-enabled traceability platforms is on the rise, solidifying the role of robust data frameworks in underpinning texture-related value propositions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food Texture market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGT Food and Ingredients

- Archer Daniels Midland Co.

- Ashland Global Holdings Inc.

- Axiom Foods, Inc.

- Beneo GmbH

- Cargill, Incorporated

- Chr. Hansen Holding A/S

- Cosucra Groupe Warcoing SA

- CP Kelco U.S., Inc.

- Crown Soya Protein Group Company

- DACSA Group

- Devansoy Inc.

- dsm-firmenich Nutritional Products AG

- DuPont de Nemours, Inc.

- Emsland Group

- Foodchem International Corporation

- GEMEF INDUSTRIES

- Gushen Biological Technology Group Co., Ltd

- Ingredion Incorporated

- Kerry Group plc

- Koninklijke DSM N.V.

- MGP Ingredients, Inc.

- Puris Proteins LLC

- Sonic Biochem Extractions Pvt. Ltd.

- Sotexpro S.A. by Gemef Industries

- Sun Nutrafoods Inc.

- Tate & Lyle PLC

- Victoria Group A.D.

- Vippy Industries Ltd.

- Wilmar International Limited

Strategic Imperatives and Tactical Recommendations Empowering Industry Leaders to Leverage Texture Innovations for Competitive Advantage and Consumer Engagement

To capitalize on texture-driven market opportunities, industry leaders should prioritize the establishment of integrated innovation hubs that unite R&D, supply chain, and consumer insights teams. By fostering cross-functional collaboration, organizations can accelerate the translation of sensory research into scalable formulations. Investing in pilot-scale processing lines for texture prototypes will enable rapid iteration and mitigate commercial risks associated with large-scale rollouts.

Additionally, adopting advanced analytics for real-time monitoring of rheological properties can optimize production consistency and reduce waste. Companies should explore partnerships with technology providers that offer digital sensory platforms, enabling virtual consumer testing and texture simulation before physical sampling. This approach not only shortens development cycles but also refines targeting of specific demographic or regional preferences.

From a strategic sourcing perspective, diversifying ingredient procurement across animal, dairy, and plant-based origins safeguards against supply disruptions and tariff fluctuations. Establishing regional supplier alliances and evaluating alternative texturants such as upcycled byproducts or fermentation-derived compounds can enhance both sustainability credentials and innovation pipelines. Finally, bold marketing initiatives that showcase unique texture narratives-coupled with transparent ingredient storytelling-will differentiate brands and deepen consumer engagement.

Transparent and Rigorous Research Methodology Ensuring Credible Insights Through Comprehensive Primary and Secondary Data Analysis and Expert Consultations

This research leverages a rigorous methodology combining comprehensive secondary research with targeted primary engagements. Secondary analysis encompassed peer-reviewed journals, industry white papers, and regulatory filings to map the historical evolution of texture-related ingredient technologies and policy frameworks. Concurrently, a series of in-depth interviews with R&D executives, sensory scientists, and supply chain directors provided nuanced perspectives on real-world formulation challenges and innovation priorities.

Data triangulation techniques were applied to ensure consistency across diverse information streams, while a structured expert panel reviewed preliminary findings to validate key insights. Quantitative inputs were further enriched through proprietary surveys administered to food manufacturers across the Americas, EMEA, and Asia-Pacific regions. Quality control measures included iterative feedback loops with industry consultants and adherence to transparent documentation protocols, guaranteeing the credibility and reproducibility of the analysis.

By integrating both qualitative and quantitative dimensions, the methodology delivers a balanced, evidence-based panorama of the texture innovation landscape. The combination of global secondary sources and localized primary inputs ensures actionable relevance for decision-makers operating in varied market contexts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food Texture market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food Texture Market, by Texture Type

- Food Texture Market, by Ingredient

- Food Texture Market, by Source

- Food Texture Market, by Application

- Food Texture Market, by End Use

- Food Texture Market, by Region

- Food Texture Market, by Group

- Food Texture Market, by Country

- United States Food Texture Market

- China Food Texture Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Consolidating Key Takeaways and Future Directions Emphasizing the Significance of Texture Innovation in Driving Growth and Consumer Satisfaction

Drawing together the strands of market dynamics, segmentation insights, and strategic imperatives, it is evident that texture innovation stands at the nexus of consumer satisfaction and competitive differentiation. Organizations that integrate agile sourcing strategies, advanced processing technologies, and multi-regional consumer data will be best positioned to thrive amidst evolving policy landscapes and shifting taste preferences.

The cumulative impact of tariff changes underscores the necessity of adaptable supply chains and proactive stakeholder engagement, while segmentation analysis highlights untapped opportunities across applications, texture types, and end-use channels. Regional insights further illuminate how cultural nuances shape textural desirability, guiding tailored product roadmaps that resonate with local consumers.

As leading companies continue to invest in collaboration, proprietary processing, and traceability platforms, the competitive battleground will pivot toward the ability to deliver consistent, novel textural experiences at scale. By aligning R&D investments with strategic recommendations, industry leaders can transform texture from a functional attribute into a compelling brand differentiator and growth driver.

Connect with the Associate Director of Sales and Marketing to Secure This Comprehensive Market Research Report and Elevate Your Strategic Decision Making

For tailored insights that align with your strategic goals and operational challenges, connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure this comprehensive market research report. Engaging directly with a dedicated expert will allow you to explore bespoke data packages and custom consulting options, ensuring you derive maximum value and actionable intelligence. Initiating this collaboration will position your organization to respond proactively to evolving texture innovation landscapes, fortify supply chain resilience, and capitalize on emerging opportunities.

By partnering with an experienced sales and marketing liaison, you can obtain priority access to in-depth analyses, real-time updates on tariff impacts, and tailored segmentation deep dives. This direct engagement streamlines the acquisition process and accelerates your time to insight, enabling your team to implement informed strategies without delay. Reach out today to transform market complexity into a competitive advantage and unlock the full potential of texture-driven product innovation.

- How big is the Food Texture Market?

- What is the Food Texture Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?