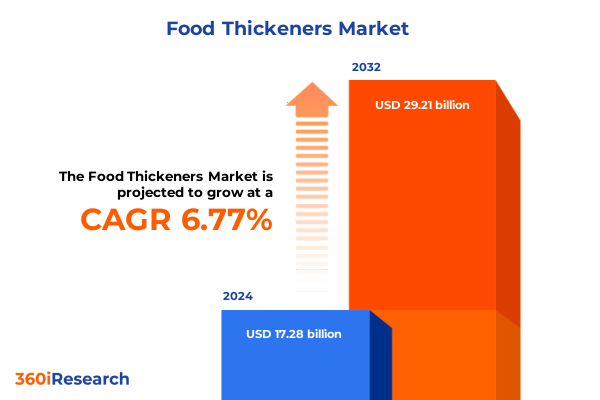

The Food Thickeners Market size was estimated at USD 18.37 billion in 2025 and expected to reach USD 19.55 billion in 2026, at a CAGR of 6.85% to reach USD 29.21 billion by 2032.

Unveiling the Critical Role of Food Thickeners in Crafting Texture, Stability, and Consumer Appeal Across Diverse Food Products

Food thickeners have become indispensable ingredients for formulators striving to optimize texture, stability, and mouthfeel across a broad range of products. These versatile additives create desirable consistency in everything from sauces and dressings to beverages and soups, balancing functional performance with consumer expectations for clean labels and natural ingredients. By modulating viscosity, flow, and stability, thickeners enable manufacturers to achieve targeted sensory profiles, extend shelf life, and maintain product integrity under diverse processing conditions.

In recent years, heightened consumer awareness around ingredient transparency and plant-based solutions has elevated the importance of novel thickening agents. Regulatory scrutiny on synthetic additives has further accelerated the drive toward natural hydrocolloids and protein-based alternatives that deliver reliable performance without compromising on label claims. As innovation in extraction techniques, enzymatic modification and hybrid formulations expands the toolkit available to food scientists, the evolving role of thickeners continues to shape the future of product development across all segments of the food industry.

The integration of data-driven insights and digital process controls has also enhanced the reproducibility and scalability of thickener applications at industrial scale. By leveraging advanced rheology modeling and pilot-scale validation, R&D teams can predict performance outcomes more precisely, reducing time-to-market and minimizing costly reformulation cycles. This strategic interplay between ingredient selection, functionality and processing optimization underscores why an executive-level understanding of thickener dynamics is essential for decision-makers aiming to maintain competitive advantage in an increasingly complex marketplace.

Navigating the Transformative Shifts in Food Thickener Innovation Driven by Consumer Trends, Sustainability Goals, and Technological Advancements

The food thickener landscape has undergone transformative shifts driven by consumer demand for transparency and sustainability. Clean-label mandates have propelled hydrocolloid-based solutions to the forefront as formulators seek plant-derived agents like pectin, xanthan gum and alginate that combine robust functionality with label-friendly perception. Concurrently, protein-based thickeners have gained traction as brands tap into the growing interest in high-protein nutritional positioning and applications spanning medical nutrition to sports recovery. These shifts underscore a broader industry imperative to align product performance with evolving consumer values.

Technological innovations are also reshaping product capabilities and processing efficiencies. Enzymatic modifications and precision extraction techniques have steered development toward tailor-made starch-based thickeners with optimized molecular weight profiles, delivering consistent viscosity even under extreme thermal or acidic conditions. At the same time, advances in encapsulation and controlled-release systems enable multifunctional ingredients that provide both texture enhancement and nutritional fortification. Together, these trends are redefining the role of thickeners as functional co-ingredients rather than solely viscosity modifiers.

Sustainability and circularity have emerged as critical priorities, prompting suppliers to explore upcycling of by-products and improved resource stewardship. Replacing synthetic variants with cellulose ethers or polyacrylamide alternatives that derive from renewable feedstocks has minimized environmental impact while ensuring performance benchmarks are met. In parallel, digital supply chain platforms and blockchain-enabled traceability solutions are increasing transparency around origin, quality and extraction practices, fostering stronger partnerships between ingredient suppliers and end manufacturers. This convergence of consumer-driven sustainability goals, regulatory realignment and cutting-edge process innovations marks a new era of strategic importance for food thickeners.

Assessing the Far-Reaching Impact of 2025 United States Tariffs on Raw Materials and Pricing Dynamics in the Food Thickener Industry

The introduction of tariff measures by the United States in early 2025 has significantly altered the input cost structure for many key thickener raw materials. Heightened duties on imported guar gum, carrageenan and other hydrocolloid precursors have amplified price volatility and increased procurement complexity. As a result, processors have been compelled to reassess sourcing strategies, intensify negotiations with existing suppliers and consider domestic or alternative feedstock options to mitigate margin erosion.

Tariff-induced cost pressures have had a downstream impact on product formulation decisions and commercialization timelines. To compensate for elevated ingredient costs, some manufacturers have optimized formulations by blending more cost-effective starch-based thickeners or reducing usage levels without compromising functional performance. Others have pursued captive supply agreements or vertical integration with extraction partners to gain greater control over raw material inputs and buffer against external policy changes.

Beyond direct material costs, the broader logistics ecosystem has experienced heightened uncertainty. Increased duty burdens have prompted customs inspection intensification and elongated clearance times at key ports, triggering inventory management challenges and tighter working capital cycles. In response, organizations are accelerating investments in digital procurement platforms that provide real-time visibility into landed costs, tariff classifications and supplier compliance. Such strategic adjustments illustrate how evolving trade policy has exerted a cumulative influence on the operational and financial dynamics of the food thickener value chain.

Unlocking Comprehensive Segmentation Insights to Guide Strategic Positioning Across Product Types, Forms, Channels, Applications and End-Use Industries

When examining thickener products through the lens of product type segmentation, the market can be understood in terms of four distinct categories. Hydrocolloid-based thickeners encompass a suite of naturally derived polysaccharides including alginate, carrageenan, guar gum, pectin and xanthan gum, each offering unique gelling and stabilizing properties. Protein-based thickeners comprise casein, gelatin and soy protein variants prized for their emulsification and mouthfeel enhancement. Starch-based options include native starch alongside modified formulations such as acid modified, cross-linked, oxidized and pregelatinized starches that deliver predictable viscosity under varying pH and temperature conditions. Synthetic thickeners cover cellulose ethers like carboxymethyl cellulose and hydroxypropyl methylcellulose, as well as polyacrylamide, offering high thermal stability and controlled thickening performance.

Analysis by form reveals that granules remain a staple format for ease of handling and dispersion efficiency, while liquid thickeners are marketed as concentrate and premix systems for rapid integration into wet processing lines. Powder thickeners present drum-dried and spray-dried variations tailored for uniform rehydration properties. Tablet and capsule forms address niche applications in nutraceutical and medical nutrition segments where precise dosage and convenience are paramount. This multidimensional view of product forms illustrates the necessity for manufacturers to align physical format with production workflows and application requirements.

Distribution channels are bifurcated into offline and online routes to market. Traditional brick-and-mortar distribution continues to serve large-scale food processors and institutional clients through specialized ingredient distributors and wholesalers. Simultaneously, online platforms have gained prominence among smaller formulators and emerging brands seeking streamlined ordering, rapid delivery and broader access to global ingredient portfolios. This dual-channel framework underscores the importance of an omnichannel go-to-market strategy for suppliers targeting diverse customer segments.

Application segmentation spans bakery items such as bread, cakes and pastries, cookies and biscuits; beverage categories including fruit beverages like juices and nectars alongside non-dairy offerings; confectionery products covering candies and jams and spreads with subtypes like fruit jam and nut spread; dairy applications encompassing cheese, ice cream and yogurt types from drinking to Greek formats; sauces and dressings including marinades, pasta sauce and salad dressings from cream-based to vinaigrette styles; as well as soups and broths ranging from clear varieties to cream soups like mushroom and tomato. Simultaneously, end-use industries cover cosmetics, food processing, foodservice, household and pharmaceutical sectors, with the latter segmenting further into medical nutrition and nutraceuticals. This comprehensive segmentation framework enables stakeholders to pinpoint emerging growth pockets and tailor development efforts to specific functional and regulatory needs.

This comprehensive research report categorizes the Food Thickeners market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Source

- Application

- End-Use Industry

- Distribution Channel

Highlighting Critical Regional Dynamics and Growth Drivers Shaping the Demand for Food Thickeners Across Americas, EMEA, and Asia-Pacific Markets

The Americas region stands out as a mature market with well-established supply chains and a strong emphasis on clean-label and natural ingredient trends. Leading industrial clusters in North America have been early adopters of advanced hydrocolloid and protein-based thickeners, leveraging local R&D capabilities to optimize formulations for high-volume applications such as sauces, dressings and dairy products. In South America, growing demand for convenience foods and beverages has spurred incremental growth, supported by expanding distribution networks and increasing consumer purchasing power.

Europe, Middle East and Africa (EMEA) reflect a heterogeneous landscape where regulatory frameworks and consumer preferences vary significantly across subregions. Western Europe continues to drive premium product innovation, particularly in dairy and confectionery, underpinned by stringent quality standards and robust labeling regulations. In contrast, the Middle East exhibits rapid growth in beverage and confectionery segments fueled by urbanization and a rising youth demographic. Africa remains an emergent opportunity zone as infrastructural development enhances cold chain capacity and local processing capabilities.

Asia-Pacific dominates global volume demand, propelled by large-scale manufacturing hubs in China, India and Southeast Asia. Regional formulators prioritize cost-efficient starch-based thickeners, yet a shift toward premium hydrocolloids is gaining pace in response to urban middle-class preferences and evolving export standards. Japan and Australia lead in high-value specialty thickeners, benefiting from stringent domestic safety regulations and high consumer sensitivity to quality. Across the region, investments in sustainable agriculture and supply chain traceability are becoming critical differentiators for ingredient suppliers seeking to establish long-term partnerships.

This comprehensive research report examines key regions that drive the evolution of the Food Thickeners market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry-Leading Players and Their Strategic Initiatives Transforming the Competitive Landscape in the Food Thickener Sector

Leading ingredient suppliers have intensified strategic initiatives to consolidate their market positioning and accelerate portfolio expansion. Key players have pursued targeted acquisitions and joint ventures to broaden capabilities across natural and synthetic thickening agents. By integrating specialty hydrocolloid producers and advanced biopolymer divisions, these organizations aim to deliver end-to-end solutions from raw material sourcing to functional testing and application support.

Research and development remain core differentiators, with major players dedicating significant resources toward novel extraction technologies, clean-label reformulations and application-specific performance enhancements. Partnerships with academic institutions and startup accelerators have fostered rapid prototyping of hybrid thickener systems that combine the attributes of multiple polymer classes. In parallel, investments in pilot facilities and analytical laboratories enable faster validation cycles and in-house testing under industrial processing conditions.

On the commercial front, top suppliers have expanded digital engagement models, leveraging e-commerce platforms and technical customer portals to facilitate interactive formulation design and batch tracking. This integrated approach supports end-users in optimizing product stability, texture and cost efficiency. To complement these digital offerings, training programs and formulation workshops reinforce customer relationships and provide hands-on expertise to accelerate new product launches.

Sustainability is a strategic priority, driving manufacturers to source responsibly and minimize environmental footprints. Companies have announced ambitious targets around water stewardship, waste reduction and carbon neutrality, often underpinned by third-party sustainability certifications and transparent reporting frameworks. By aligning product development trajectories with industry-wide decarbonization efforts, leading players are cementing their reputations as trusted partners in the evolving food ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food Thickeners market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABF Ingredients Limited

- ABITEC

- Adani Group

- Ajinomoto Co., Inc.

- Archer Daniels Midland Company

- Ashland Global Holdings Inc.

- BASF SE

- Biovencer Healthcare Private Limited

- Brenntag SE

- Bunge Limited

- Bühler AG

- Cargill, Incorporated

- Catalynt

- Chr. Hansen Holding A/S

- Corbion NV

- CP Kelco

- Darling Ingredients Inc.

- Deosen Biochemical

- Döhler GmbH

- Eco-Farms

- EHL Ingredients

- Emsland Group

- Essex Food Ingredients

- FoodCare Co.,Ltd.

- Foodguys

- Fuerst Day Lawson Ltd.

- Fufeng Group

- GELITA AG

- Givaudan SA

- Glanbia PLC

- GNF CHEMICAL CO.,LTD.

- Goshu Yakuhin Co.,Ltd.

- HH Industries Limited

- Hosokawa Alpine Group

- Ingredion Incorporated

- International Flavors & Fragrances Inc

- Jungbunzlauer Suisse AG

- Kemin Industries, Inc.

- Kent Precision Foods Group, Inc.

- Kerry Group plc

- Koninklijke DSM N.V.

- Lyons Health Labs

- Maruzen Chemicals Co., Ltd.

- Morinaga Nutritional Foods

- Naturex S.A

- Naturex S.A.

- Nexira

- Olam Group Limited

- Palsgaard A/S

- Roquette Frères S.A.

- Royal Avebe

- SNF Group

- Solvay S.A.

- SunOpta Inc.

- SUNUS CO., LTD.

- Taiyo Kagaku Co.,Ltd.

- Tate & Lyle PLC

- Tereos S.A.

- Wright Process Systems

Formulating Actionable Recommendations to Capitalize on Emerging Opportunities and Mitigate Risks in the Evolving Food Thickener Market Environment

Industry leaders should consider diversifying their raw material portfolios to include both traditional hydrocolloid sources and emerging bio-based alternatives. By establishing multi-tiered supplier networks and investing in regional processing capacities, organizations can hedge against supply disruptions and tariff fluctuations while maintaining consistent quality standards. This strategic diversification reduces dependency on single-source imports and enhances resilience across the value chain.

Embracing clean-label innovation is paramount, requiring R&D teams to collaborate with cross-functional stakeholders to validate natural thickener blends that meet consumer expectations without sacrificing performance. Rapid screening platforms and rheological modeling should be employed to iterate formulations quickly and identify optimum ingredient synergies. Additionally, companies should invest in market intelligence capabilities to monitor emerging consumer preferences and regulatory developments in real time.

Companies can further optimize cost structures by deploying digital procurement and inventory management tools that provide real-time transparency into landed cost drivers, tariff classifications and supplier compliance metrics. Enhanced analytics can inform strategic sourcing decisions, while scenario planning modules help forecast the impact of potential policy changes or raw material shortages. By integrating these digital solutions, businesses can streamline operations and safeguard margins under volatile market conditions.

Sustainability must be embedded across R&D, manufacturing and supply chain functions through measurable targets and third-party validations. Firms should explore circular economy opportunities such as upcycling process by-products into functional ingredients and adopting renewable energy sources within production facilities. Cooperative sustainability initiatives with end-users and suppliers can amplify collective impact and reinforce brand integrity in an increasingly environmentally conscious market.

Detailing a Robust Research Methodology Underpinning the Compilation and Validation of Critical Data for the Food Thickener Industry Analysis

The research methodology underpinning this analysis combined comprehensive secondary research with targeted primary engagements to validate findings and ensure robust data integrity. Secondary sources included academic publications, industry whitepapers, ingredient supplier technical documents and trade association reports. These data points were synthesized to identify prevailing trends, regulatory landscapes and emerging technological innovations within the food thickener sector.

Primary research comprised in-depth interviews with senior R&D, procurement and technical leadership from leading ingredient manufacturers, food processors and academic experts. These discussions provided granular insights into formulation challenges, supply chain dynamics and strategic imperatives. Interview outcomes were triangulated with secondary data to confirm consistency and uncover nuanced perspectives on market developments and future growth drivers.

A dual bottom-up and top-down approach was employed to map out segmentation hierarchies, regional market influences and competitive landscapes. Product-level analysis leveraged ingredient usage data and application volumes, while regional modeling incorporated macroeconomic indicators and trade policy parameters. Iterative validation rounds with subject-matter experts refined the segmentation framework and ensured the alignment of insights with real-world operational contexts.

Rigorous data quality checks and cross-functional review sessions were conducted to mitigate bias and validate analytical methodologies. All quantitative metrics were subjected to coherence and sanity checks, and qualitative observations were corroborated through multiple independent sources. This structured research protocol underpins the strategic recommendations and executive insights presented in this summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food Thickeners market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food Thickeners Market, by Product Type

- Food Thickeners Market, by Form

- Food Thickeners Market, by Source

- Food Thickeners Market, by Application

- Food Thickeners Market, by End-Use Industry

- Food Thickeners Market, by Distribution Channel

- Food Thickeners Market, by Region

- Food Thickeners Market, by Group

- Food Thickeners Market, by Country

- United States Food Thickeners Market

- China Food Thickeners Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2703 ]

Synthesizing Key Insights to Reinforce the Strategic Importance of Food Thickeners in Driving Innovation, Quality, and Profitability Across the Value Chain

In synthesizing the key insights from this analysis, it becomes clear that food thickeners occupy a pivotal position in the modern food industry, influencing product quality, consumer perception and operational efficiency. The evolving consumer demand for clean-label ingredients and functional performance has intensified innovation around hydrocolloid, protein and starch-based thickeners, while technological advancements continue to expand formulation capabilities.

The 2025 tariff landscape in the United States underscores the necessity for agile sourcing strategies and digital procurement solutions to counteract input cost volatility. Strategic segmentation analysis has illuminated diverse growth pockets across product types, forms, channels, applications and end-use industries, enabling stakeholders to pinpoint high-potential niches. Regionally, varying dynamics in the Americas, EMEA and Asia-Pacific highlight the importance of tailored market approaches.

Competitive intelligence reveals that leading companies are bolstering their portfolios through M&A, R&D investments and sustainability initiatives, thereby solidifying their roles as trusted ingredient partners. The actionable recommendations provided herein offer a roadmap for industry participants to strengthen supply chain resilience, embrace clean-label reformulation, leverage digital tools and embed sustainability throughout operations.

Taken together, these findings affirm that a strategic focus on innovation, operational agility and collaborative partnerships will be critical for organizations seeking to maintain relevance and profitability in the rapidly evolving food thickener market. Decision-makers equipped with these insights are well-positioned to navigate emerging challenges and capture new opportunities across the global value chain.

Take the Next Step Toward Informed Decision-Making and Partner with Ketan Rohom to Unlock Comprehensive Food Thickener Market Insights

To explore these executive insights in greater depth and gain access to the complete market research report, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. His expertise will help you navigate tailored research packages, licensing options and value-added service offerings that align with your strategic objectives.

Secure your competitive advantage by engaging with a dedicated specialist who can provide customized support, including in-depth data presentations, one-on-one briefings and ongoing advisory services. Contact Ketan Rohom to discuss your specific challenges and discover how this comprehensive analysis can inform your next product development cycle and propel your business forward.

- How big is the Food Thickeners Market?

- What is the Food Thickeners Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?