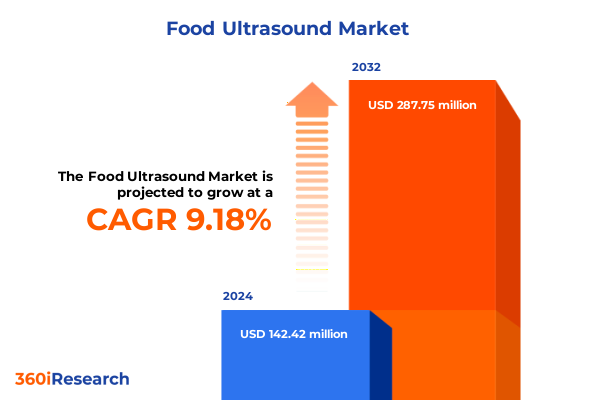

The Food Ultrasound Market size was estimated at USD 155.28 million in 2025 and expected to reach USD 167.42 million in 2026, at a CAGR of 9.21% to reach USD 287.75 million by 2032.

Unveiling the Critical Importance of Ultrasound Technology in Revolutionizing Food Processing Through Enhanced Precision Safety and Quality Standards

Food ultrasound technology has emerged as a cornerstone innovation in modern food processing, leveraging high-frequency acoustic waves to deliver precise and non-invasive treatment across a wide array of applications. From its roots in laboratory-scale bench-top equipment to its integration into inline production lines and the proliferation of portable devices, ultrasound has demonstrated transformative potential in cleaning, homogenization, emulsification, and quality inspection. As global supply chains become more complex and consumer expectations for safety and quality intensify, the demand for ultrasound solutions that can enhance process reliability, reduce energy consumption, and minimize chemical additives is accelerating. This report provides a definitive exploration of these developments, setting the stage for strategic decision-making in an increasingly competitive marketplace.

Navigating the intricate ecosystem of food processing requires an understanding of the technological, regulatory, and supply chain factors that shape market dynamics. This introduction outlines the fundamental principles of ultrasound applications, highlighting how acoustic cavitation, resonance effects, and digital control interfaces converge to deliver consistent outcomes. By distilling recent advances in materials engineering and system design, this section establishes the context for subsequent analysis of market drivers, tariff impacts, segmentation nuances, regional landscapes, and competitive positioning. Readers will gain clarity on the scope and objectives of the study, which is structured to illuminate actionable insights without diving into quantitative estimations, thus delivering a balanced, expert-level vantage point for stakeholders.

Exploring the Pivotal Transformations Driving Ultrasound Applications in Food Processing From Lab Benches to Automated Inline and Portable Systems

Over the past decade, the Food Ultrasound landscape has undergone pivotal transformations as manufacturers seek ever-greater levels of automation, sustainability, and integration. Traditional benchtop equipment, once relegated to laboratory and small-batch pilot operations, has evolved into robust industrial benches capable of handling continuous processes at scale. Concurrently, inline ultrasound systems-whether integrated seamlessly into existing production lines or deployed as standalone modules-have gained favor for real-time monitoring and quality control. This shift has been amplified by advancements in portable, battery-operated units that empower on-site testing in remote or decentralized facilities, aligning with the broader trend toward agile manufacturing.

Complementing these hardware shifts, the convergence of Industry 4.0 digital protocols with ultrasound platforms has redefined process monitoring and data analytics. High-speed sensors and machine-learning algorithms now interpret acoustic signatures to detect compositional variations, identify structural defects, and optimize energy input dynamically. Moreover, the emphasis on green processing has propelled interest in ultrasound’s ability to minimize water use and reduce reliance on chemical agents, reinforcing its appeal across dairy, bakery, and meat applications. Taken together, these transformative developments are reshaping expectations around throughput, product consistency, and regulatory compliance, marking a new era in food processing innovation.

Assessing the Aggregate Effects of 2025 United States Tariffs on Food Ultrasound Equipment Supply Chains Manufacturing Costs and Market Dynamics

In early 2025, revisions to U.S. import duties on critical components-such as piezoelectric transducers, precision electronics, and specialized alloys-have exerted a significant ripple effect on equipment costs and supply chain strategies. Manufacturers of ultrasound systems, which rely on sophisticated sensors and finely tuned signal amplifiers, have encountered increased procurement expenses that challenge historic sourcing models. This tariff recalibration has incentivized a reevaluation of supplier networks, prompting many to diversify beyond traditional East Asian and European vendors to include alternate markets in Southeast Asia and Latin America.

As procurement teams adapt, the consequence has been a recalibration of manufacturing footprints. Some producers have accelerated onshore assembly to mitigate exposure to import levies, investing in localized quality assurance and service capabilities. Others have renegotiated contracts, seeking concessions from suppliers in exchange for volume guarantees or co-development partnerships. These realignments have also influenced downstream stakeholders: end-users are now placing greater emphasis on long-term service agreements and modular designs that facilitate component replacement without full-system downtime. While the full fiscal impact is still unfolding, it is clear that the 2025 tariffs have catalyzed a strategic shift toward resilience and supply chain agility in the food ultrasound ecosystem.

Decoding Key Segment-Specific Drivers and Opportunities Across Equipment Types Technologies Frequencies Power Outputs End-User Industries and Applications

Disaggregating the market by equipment type reveals nuanced trajectories across benchtop, inline, and portable solutions, each tailored to specific operational demands. Industrial benches continue to dominate large-scale production environments, whereas laboratory benches support R&D and pilot testing where precision and repeatability are paramount. Inline systems are gaining traction in continuous processes that demand minimal intervention, with integrated modules enabling real-time control while standalone variants offer flexibility for retrofitting existing lines. Portable units-whether battery-operated models that facilitate field quality checks or wired devices that ensure continuous power-address the growing need for mobility and rapid deployment in multi-site manufacturing contexts.

Technological segmentation further differentiates contact ultrasound-executed through direct contact probes or immersion setups-from non-contact methods such as air-coupled and through-transmission configurations. This delineation underscores a choice between high energy transfer efficiency and non-invasive measurement, depending on the sensitivity requirements of the end product. The frequency spectrum, spanning low to medium to high bands, directly influences penetration depth and resolution; low frequencies excel in bulk processing applications, while high frequencies enable detailed surface analysis. Similarly, power output categories reflect the balance between energy intensity and system footprint, with high-output units driving aggressive mixing or emulsification, and medium to low-output devices catering to gentle homogenization and quality inspection.

End-user industry analysis highlights distinct adoption patterns: bakery and confectionery operations value ultrasound for emulsion stability and dough aeration, beverage producers leverage it for extraction enhancement in juices and alcoholic products as well as degassing soft drinks, and dairy processors deploy it across cheese curd handling, milk standardization, and yogurt texturization. Meat and poultry facilities prioritize defect detection and thickness measurement to ensure trimming precision and product uniformity. Across applications-ranging from cleaning and emulsification to homogenization, process monitoring, and a tiered approach to quality inspection that encompasses composition analysis, defect detection, and thickness measurement-these segmented insights illuminate where value is highest and where unmet needs persist.

This comprehensive research report categorizes the Food Ultrasound market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Technology

- Frequency Range

- Power Output

- End-User Industry

- Application

Unveiling Regional Nuances Impacting Ultrasound Adoption Growth and Strategic Priorities in the Americas Europe Middle East Africa and Asia-Pacific Markets

The Americas region reflects a mature market characterized by stringent food safety regulations, robust investment in process optimization, and a well-established infrastructure for adopting advanced inspection technologies. In North America, demand for inline quality monitoring is particularly strong in dairy and meat processing facilities, driven by consumer expectations for traceability and consistency. Conversely, Latin American markets are emerging as growth corridors as investments in modernizing abattoirs and beverage bottling lines accelerate the uptake of portable and benchtop ultrasound units, often supported by government initiatives to enhance export competitiveness.

Europe, the Middle East, and Africa present a tapestry of opportunity and challenge. Western Europe’s sustainability mandates have positioned ultrasound as a tool for reducing chemical and water consumption in bakery and beverage operations, while Eastern European manufacturers prioritize cost-effective benchtop systems for small-scale dairy facilities. The Middle East, buoyed by expanding hospitality and foodservice sectors, increasingly adopts portable inspection tools for on-site quality verification, and select African markets are laying groundwork for broader integration through partnerships aimed at building local technical expertise.

In Asia-Pacific, rapid industrialization and evolving consumption patterns underpin a dynamic landscape. China’s emphasis on automation and digitalization has spurred demand for integrated inline ultrasound solutions, particularly in juice extraction and soft drink carbonization. Meanwhile, India’s dairy cooperatives and burgeoning bakery chains are deploying low- to medium-frequency bench-top systems to boost throughput and maintain product uniformity. Across Southeast Asia, portable devices facilitate decentralized quality checks in borderless supply chains, enabling processors to respond swiftly to regulatory audits and consumer feedback. These regional distinctions underscore the importance of tailoring technology portfolios and go-to-market strategies to local operational realities.

This comprehensive research report examines key regions that drive the evolution of the Food Ultrasound market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives Innovations and Collaborative Efforts by Leading Ultrasound Technology Providers Shaping Market Dynamics and Leadership

Leading ultrasound technology providers have embarked on a series of strategic initiatives to solidify their market positions and extend their technological edge. Many established players have expanded research and development centers to pioneer new transducer materials and digital control software, reflecting an industry-wide pivot toward intellectual property-driven differentiation. Collaborative ventures with academic institutions and food industry consortia have yielded joint pilots that validate novel applications, such as ultrasound-assisted natural extraction of flavors and on-line defect detection in high-speed poultry lines.

In parallel, several key manufacturers have formed alliances with automation and robotics integrators to deliver turnkey solutions that blend ultrasound with vision systems and automated handling. This multidisciplinary approach accelerates time to value by reducing engineering complexity for end-users. Geographic expansion has also been a focal point: companies with deep roots in Europe and North America have established assembly and service centers in Asia-Pacific and Latin America to shorten lead times and nurture local technical support networks. Additionally, select providers have launched subscription-based models for software updates and remote diagnostics, aligning their offerings with the broader trend toward servitization in industrial equipment.

These strategic maneuvers are reshaping competitive dynamics, as product portfolios evolve from standalone hardware to integrated ecosystems that deliver both performance and data-driven insights. By emphasizing scalability, ease of integration, and lifecycle support, leading providers are setting a new benchmark for how ultrasound technologies can deliver sustained operational value.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food Ultrasound market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Sonic Processing Systems

- Branson Ultrasonics Corporation

- Cavitus AG

- Dukane Corporation

- FoodTools, Inc.

- Herrmann Ultrasonics GmbH & Co. KG

- Hielscher Ultrasonics GmbH

- Industrial Sonomechanics, LLC

- Innovative Ultrasonics Pty Ltd

- Marchant Schmidt, Inc.

- MS Ultraschall Technologie GmbH

- MS Ultrasonic Technology Group

- Qsonica LLC

- Ralsonics Research Private Limited

- RINCO ULTRASONICS AG

- SAIREM SAS

- Sonic Italia Srl

- Sonics & Materials, Inc.

- SONOTRONIC Nagel GmbH

- TELSONIC AG

Delivering Actionable Recommendations to Empower Industry Leaders to Capitalize on Emerging Trends and Overcome Challenges in Food Ultrasound Technology

Industry leaders can harness several strategic imperatives to capitalize on the momentum in food ultrasound technology. First, prioritizing modular, interoperable system designs allows equipment to adapt to evolving production layouts and accommodate future expansions without extensive reengineering. By investing in open architecture software platforms, manufacturers can ensure seamless integration with existing process control systems and facilitate continuous data exchange.

Second, forging partnerships with specialized component suppliers and academic research centers can accelerate the development of proprietary transducer materials and advanced signal-processing algorithms. This approach not only deepens technological differentiation but also diversifies supply risks by building a network of strategic collaborators. Third, diversifying geographical sourcing and assembly footprints helps buffer against trade policy shifts and logistical disruptions, ensuring reliable access to critical components even under tariff pressure.

Fourth, embedding sustainability criteria into product roadmaps-such as energy-efficient power modules and recyclable housing materials-aligns offerings with corporate responsibility mandates and resonates with environmentally conscious consumers. Fifth, expanding service portfolios to include predictive maintenance analytics and remote troubleshooting supports long-term customer relationships and creates recurring revenue streams. Finally, tailoring end-user support programs for high-growth segments, such as convenience food manufacturers and artisanal dairy cooperatives, ensures that solutions address specific pain points in product consistency, throughput, and regulatory compliance.

Detailing Comprehensive Research Methodology Employed to Gather Validate and Analyze Qualitative and Quantitative Insights on Food Ultrasound Market Dynamics

This analysis employs a multi-tiered research methodology designed to balance comprehensive secondary research with targeted primary insights. Initially, an extensive review of academic publications, patent filings, and industry white papers was conducted to map the evolution of ultrasound principles, equipment design, and application case studies. Regulatory frameworks and trade policy documentation were examined to understand how sanitary mandates and tariff changes influence adoption patterns.

Primary research involved in-depth interviews with equipment OEM executives, process engineers at leading food manufacturers, and technical consultants specializing in acoustic sensing technologies. These qualitative conversations were augmented by a series of advisory board workshops that triangulated emerging trends and validated segmentation variables. A rigorous data triangulation process cross-referenced supplier catalogs, technical datasheets, and installation statistics to ensure consistency and relevance of the insights presented.

Analytical frameworks such as SWOT and Porter’s Five Forces were applied to assess the competitive landscape, while thematic analysis distilled best practices and innovation pathways. A structured segmentation matrix was then used to align market dynamics with equipment types, technologies, frequencies, power outputs, end-user industries, and specific applications. The result is a robust qualitative portrayal of the Food Ultrasound sector, grounded in expert inputs and validated by multiple data streams to inform strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food Ultrasound market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food Ultrasound Market, by Equipment Type

- Food Ultrasound Market, by Technology

- Food Ultrasound Market, by Frequency Range

- Food Ultrasound Market, by Power Output

- Food Ultrasound Market, by End-User Industry

- Food Ultrasound Market, by Application

- Food Ultrasound Market, by Region

- Food Ultrasound Market, by Group

- Food Ultrasound Market, by Country

- United States Food Ultrasound Market

- China Food Ultrasound Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Summarizing Core Findings and Strategic Imperatives Illuminating the Path Forward for Stakeholders Leveraging Ultrasound Solutions in Food Processing

The collective insights from this report underscore the vital role of ultrasound in driving operational excellence and quality assurance in food processing. The industry stands at a crossroads where advanced benchtop, inline, and portable systems converge with sophisticated sensing technologies to meet evolving regulatory, sustainability, and efficiency imperatives. Tariff-induced supply chain realignments have further highlighted the need for resilience, prompting manufacturers to embrace local assembly, modular designs, and diverse sourcing strategies.

Segmentation analysis reveals that targeted applications-from dairy homogenization and bakery emulsification to non-invasive defect detection-offer distinct pathways for value creation. Regional examinations reinforce the importance of customizing technology offerings to local requirements, whether serving highly regulated North American plants, sustainability-led European operations, or high-growth Asia-Pacific facilities. Strategic moves by leading providers-spanning collaborative R&D, digital servitization, and geographic expansion-illustrate a vibrant competitive arena where differentiation is anchored in intellectual property and customer-centric service models.

Ultimately, stakeholders equipped with the actionable recommendations presented here can navigate the complexities of the Food Ultrasound landscape with confidence. By aligning innovation agendas with sustainability goals, supply chain resilience, and end-user challenges, industry participants can position themselves to capture emerging opportunities and safeguard long-term growth.

Inviting Decision-Makers to Connect with Ketan Rohom Associate Director Sales & Marketing to Access the Comprehensive Food Ultrasound Market Research Report

To explore the full depth of the Food Ultrasound market, decision-makers are invited to connect with Ketan Rohom, Associate Director of Sales & Marketing. Engaging directly with Ketan will provide tailored guidance on how this comprehensive report can support strategic planning, operational optimization, and competitive positioning. By securing your copy, you will gain exclusive access to in-depth analyses that translate cutting-edge research into actionable insights for elevating product quality, enhancing process efficiency, and driving sustainable growth. Don’t miss the opportunity to leverage this expertise to navigate the evolving landscape of ultrasound applications in the food industry; reach out today to ensure your organization remains at the forefront of innovation.

- How big is the Food Ultrasound Market?

- What is the Food Ultrasound Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?