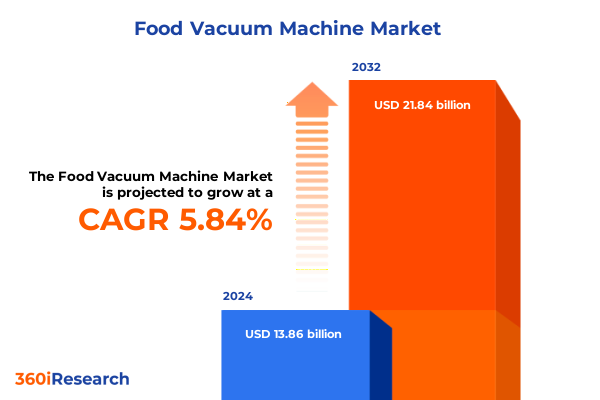

The Food Vacuum Machine Market size was estimated at USD 14.65 billion in 2025 and expected to reach USD 15.50 billion in 2026, at a CAGR of 5.86% to reach USD 21.84 billion by 2032.

Revolutionizing Food Preservation and Safety with Cutting-Edge Vacuum Packaging Innovations Driving Sustainable Industry Transformation and Consumer Confidence

The food vacuum packaging sector has emerged as a cornerstone of modern food preservation and safety strategies, driven by increasing consumer demand for extended shelf life and enhanced food quality. Advances in vacuum technologies have reshaped how processors, retailers, and home users approach spoilage reduction, microbial control, and nutrient retention. Against a backdrop of evolving regulatory standards for food contact materials and hygiene, manufacturers are racing to deliver solutions that balance performance, energy efficiency, and ease of use.

In this context, our executive summary sets the stage for a comprehensive exploration of the food vacuum machine landscape. It outlines the transformative trends, tariff influences, segmentation nuances, and regional dynamics that define current market realities. By synthesizing key company developments and offering actionable recommendations, this introduction provides decision-makers with a roadmap to navigate complexities and seize growth opportunities in a competitive global arena.

Embracing Digital Integration and Advanced Sensor Technologies Shaping the Next Era of Food Vacuum Packaging Solutions Across Global Supply Chains

Over the past five years, the food vacuum packaging market has undergone a profound metamorphosis, spurred by the integration of digital controls, smart sensors, and data analytics into traditional sealing systems. IoT-enabled vacuum chambers now provide real-time monitoring of pressure, temperature, and residual oxygen levels, enabling predictive maintenance protocols and reducing downtime. These connectivity features not only streamline production workflows but also empower quality assurance teams to uphold stringent safety compliance across multiple product lines.

Concurrently, the push toward sustainability has driven material innovation, with biodegradable and recyclable barrier films replacing legacy polymers in many packaging applications. Vacuum equipment manufacturers are adapting by developing energy-efficient vacuum pumps and compact footprint designs that minimize resource consumption. These collective shifts are reshaping value propositions for end users, prompting investment in next-generation solutions that offer seamless automation, traceability, and lower total cost of ownership.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Measures on the Food Vacuum Packaging Equipment Ecosystem and Supply Chain Dynamics

The cumulative effect of 25% Section 301 tariffs on Chinese imports, maintained under the current administration, continues to elevate landed costs for vacuum machine components such as high-precision sensors and specialized compressor modules. Although select tariff exclusions were extended through mid-2025 to support supply chain transitions, many manufacturers have already begun to restructure procurement strategies by diversifying sourcing to Southeast Asia and Eastern Europe to mitigate exposure to these duties.

In addition, January 2025 saw the introduction of a targeted tariff on imported agricultural machinery, explicitly covering vacuum packing equipment used in rice processing and other food applications. This measure has prompted distributors and end users to reassess total cost of ownership, factoring in higher upfront duties and increased maintenance service premiums. As a result, domestic machine suppliers that qualify for favorable duty classifications have gained renewed attention, and long-term contracts are being negotiated with an eye toward minimizing capital expenditure and protecting margin integrity.

Unveiling Critical Market Segmentation Insights Highlighting Type End User Technology Packaging and Distribution Dynamics Within the Food Vacuum Machine Sector

A nuanced understanding of market segmentation reveals the diverse needs that drive demand for food vacuum machines. Chamber systems, with internal vacuum chambers accommodating batch sizes of various dimensions, appeal to high-volume food processors seeking consistent sealing performance. External models offer cost-effective solutions for smaller operations, while tray-based units enable quick cycle times and are favored by retail delis and small-format kitchens.

When considering end-user segments, commercial applications dominate, with food processing plants prioritizing throughput and integration with automated packaging lines. Within this domain, horeca operators emphasize compact designs and intuitive controls, whereas retail grocers value modular configurations that can adapt to seasonal packaging requirements. Conversely, residential users gravitate toward tabletop solutions for home kitchens, seeking ease of use, aesthetic appeal, and multi-functionality.

Technological differentiation further segments the market, with single-chamber units serving entry-level demands, double-chamber systems balancing speed and versatility, and multi-chamber platforms catering to ultra-high throughput environments. Packaging format also influences purchase decisions: vacuum jars and trays support sous-vide meal kits and gourmet preparations, while vacuum pouches remain the standard for bulk protein and produce packaging.

Finally, distribution dynamics play a pivotal role in market accessibility. Offline channels, including department stores and specialist hardware retailers, offer hands-on demonstrations and localized service networks, while online direct-to-consumer channels enable brand-owned digital engagement. Ecommerce platforms, with their vast assortment and logistical reach, drive impulse purchases and facilitate subscription-based vacuum pouch refills.

This comprehensive research report categorizes the Food Vacuum Machine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- Packaging Type

- End User

- Distribution Channel

Analyzing Diverse Regional Market Patterns and Growth Drivers Shaping the Food Vacuum Packaging Industry Across the Americas EMEA and Asia Pacific

Regional market trajectories for food vacuum machines exhibit distinct growth drivers across the Americas, EMEA, and Asia-Pacific. In North America, rising consumer preference for meal prep services and off-premise dining has fueled investment in mid-scale chamber systems capable of handling artisanal and value-add food lines. Manufacturers in the United States and Canada are focusing on modular automation and plug-and-play compatibility to meet evolving quality and traceability standards.

Within Europe, Middle East, and Africa (EMEA), stringent food safety regulations and sustainability mandates are shaping equipment specifications. European producers emphasize ultra-low oxygen residuals and compatibility with compostable packaging materials. In the Middle East and Africa, improving cold chain infrastructure and expanding retail networks are unlocking new opportunities for tray and external vacuum solutions.

Asia-Pacific stands out for its rapid expansion in food processing capacity and a growing middle-class demand for packaged fresh and ready-to-cook products. Countries such as China, India, and Southeast Asian markets are investing heavily in domestic manufacturing of vacuum components, spurred by local content requirements and import substitution policies. This has resulted in competitive pricing pressure and a broader array of entry-level units tailored to small- and medium-scale food producers.

This comprehensive research report examines key regions that drive the evolution of the Food Vacuum Machine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Competitive Movements and Innovation Profiles of Leading Manufacturers in the Food Vacuum Machine Market Ecosystem

Leading companies in the food vacuum machine arena are advancing product portfolios through strategic partnerships and targeted R&D investments. Multivac has unveiled a new series of intelligent chamber machines featuring AI-driven cycle optimization, enabling processors to fine-tune gas flush parameters and sealing temperatures in real time. VacMaster continues to strengthen its residential product lineup with compact, multi-purpose systems that integrate vacuum sealing and marinating functions.

Meanwhile, Bühler is expanding its presence in the Asia-Pacific region by co-locating vacuum pump manufacturing with local machine assembly facilities, reducing logistics costs and tariff exposure. Cryovac, under the Sealed Air umbrella, has introduced next-generation barrier films compatible with high-speed tray sealing equipment, reinforcing its leadership in food safety solutions.

Smaller innovators are also carving out niches through subscription-based business models. Companies such as Caso Design and FoodSaver have launched proprietary fresh-pack cartridges and digital recipe platforms, leveraging e-commerce channels to foster direct consumer engagement. This convergence of hardware, consumables, and digital services is redefining value chains and prompting incumbents to explore adjacent revenue streams.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food Vacuum Machine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AIE Pack S.p.A.

- AMAC Technologies

- Electrolux Professional AB

- GEA Group Aktiengesellschaft

- Henkelman B.V.

- ILPRA S.r.l.

- MULTIVAC Sepp Haggenmüller GmbH & Co. KG

- ORVED S.r.l.

- Proseal UK Ltd

- Reepack S.p.A.

- Sealed Air Corporation

- SIAT S.p.A.

- ULMA Packaging, Soc. Coop.

- VacMaster

Actionable Strategic Recommendations to Accelerate Growth Improve Efficiency and Bolster Market Leadership in the Evolving Food Vacuum Machine Industry

To thrive amid intensifying competition and regulatory complexity, industry leaders should prioritize investments in modular automation that align with customer demands for scalability and flexibility. Developing retrofit kits for legacy vacuum systems can unlock aftermarket revenue and foster long-term customer loyalty by reducing total cost of ownership.

In parallel, harnessing IoT frameworks to deliver real-time machine performance analytics will differentiate offerings in both commercial and residential segments. By embedding predictive maintenance algorithms, companies can transition from transactional equipment sales to subscription-based service models, capturing recurring revenue and deepening client relationships.

Furthermore, supply chain resilience can be bolstered by diversifying component sourcing to regions with favorable trade agreements, thereby mitigating tariff volatility and logistical disruptions. Establishing strategic alliances with barrier film suppliers and vacuum pump specialists will secure critical inputs and enable co-development of next-generation materials.

Finally, tailored go-to-market tactics, such as localized training programs for horeca operators and digital content campaigns for home chefs, will ensure that product benefits are communicated effectively. Combining technical support networks with immersive user experiences can drive adoption and reinforce brand equity across distribution channels.

Comprehensive Research Methodology Encompassing Data Collection Analytical Frameworks and Validation Protocols Employed for Market Insights Generation

This research integrates both primary and secondary methodologies to ensure comprehensive and accurate market insights. Primary research comprised in-depth interviews with C-level executives and procurement managers at leading food processing and packaging companies. These conversations provided qualitative perspectives on purchasing criteria, operational challenges, and strategic priorities.

Secondary research encompassed analysis of industry reports, regulatory documents, company financial filings, and reputable news outlets. Data triangulation was performed by cross-validating findings from multiple sources and reconciling quantitative metrics with expert interviews. An analytical framework combining SWOT and Porter's Five Forces was applied to evaluate competitive intensity, supplier dynamics, and potential market entry barriers.

Rigorous validation protocols involved peer reviews by domain specialists and statistical consistency checks for survey-based data points. All sources were assessed for credibility, with preference given to government publications, industry associations, and peer-reviewed journals. This multi-layered approach ensures that the report’s conclusions and recommendations are built on a robust evidentiary foundation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food Vacuum Machine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food Vacuum Machine Market, by Type

- Food Vacuum Machine Market, by Technology

- Food Vacuum Machine Market, by Packaging Type

- Food Vacuum Machine Market, by End User

- Food Vacuum Machine Market, by Distribution Channel

- Food Vacuum Machine Market, by Region

- Food Vacuum Machine Market, by Group

- Food Vacuum Machine Market, by Country

- United States Food Vacuum Machine Market

- China Food Vacuum Machine Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesis of Critical Insights Underscoring the Strategic Implications and Future Pathways for Stakeholders in the Dynamic Food Vacuum Packaging Sector

The confluence of digital integration, sustainability imperatives, and geopolitical factors has established a new paradigm for the food vacuum packaging market. Tariff landscapes continue to influence supply chain configurations, while segmentation insights have highlighted the diverse requirements of chamber, external, and tray systems across commercial and residential end users.

Regional analysis underscores that the Americas are focused on automation scalability, EMEA on regulatory compliance and material innovation, and Asia-Pacific on cost-optimized manufacturing and rapid capacity expansion. Competitive intelligence reveals that incumbents are strengthening portfolios through AI-driven optimizations and service-oriented models, while emerging players explore subscription-led engagements and digital platforms.

For stakeholders aiming to capitalize on these trends, strategic clarity on product differentiation, distribution strategies, and sourcing resilience will be paramount. Investing in modular technologies, forging cross-industry partnerships, and adopting data-centric service offerings will define market leaders over the coming years.

Ultimately, this executive summary provides a strategic blueprint for navigating the complexities and unlocking value in a market where technological excellence, tariff agility, and end-user centricity converge.

Secure Your Comprehensive Food Vacuum Machine Market Report Today with Ketan Rohom Associate Director Sales and Marketing to Unlock Strategic Insights

Don’t miss out on the opportunity to gain a competitive edge in the rapidly evolving food vacuum packaging market by securing your in-depth research report today. Ketan Rohom, Associate Director of Sales and Marketing, is ready to guide you through the exclusive insights, comprehensive analysis, and strategic recommendations tailored to your organization’s growth objectives.

Engage with Ketan to discuss how the report’s granular segmentation analysis, regional intelligence, and tariff impact assessment can empower your product development, pricing strategies, and go-to-market planning. Reach out now to unlock customized briefings, priority access to executive summaries, and bespoke consulting packages designed to maximize your ROI and accelerate your market leadership trajectory.

- How big is the Food Vacuum Machine Market?

- What is the Food Vacuum Machine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?