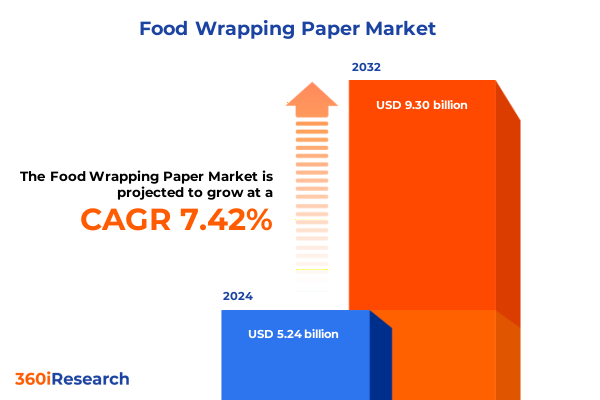

The Food Wrapping Paper Market size was estimated at USD 5.64 billion in 2025 and expected to reach USD 6.08 billion in 2026, at a CAGR of 7.40% to reach USD 9.30 billion by 2032.

Unveiling the Strategic Importance and Evolving Role of Food Wrapping Paper in Safeguarding Freshness and Meeting Modern Packaging Demands

In today’s complex food ecosystem, wrapping paper serves as the frontline guardian of quality and safety from processing facilities to consumer tables. It operates at the intersection of material science, regulatory compliance, and consumer psychology, ensuring that products maintain optimal freshness while adhering to stringent food contact requirements. As environmental awareness and convenience become paramount considerations for brands, the functionality and composition of wrapping media have taken on heightened significance, influencing purchasing decisions and brand loyalty.

Furthermore, evolving consumer preferences for transparent sourcing and minimal environmental footprint have propelled innovations in barrier coatings, fiber blends, and printing technologies. These advancements enable packaging to fulfill multi-faceted roles-preserving flavor integrity, preventing oxidative degradation, and conveying brand narratives through high-resolution graphics. The dynamic interplay between performance and sustainability has elevated wrapping paper beyond a commoditized substrate to a strategic asset in competitive differentiation.

Consequently, a holistic understanding of the food wrapping paper segment is essential for stakeholders aiming to navigate shifting market dynamics. By examining the materials landscape, assessing regulatory developments, and exploring emerging value propositions, this study seeks to equip decision-makers with a comprehensive lens through which to envision future trajectories. In doing so, it underscores the pivotal function of wrapping paper in not only safeguarding product quality but also in shaping the next generation of sustainable packaging solutions.

Navigating the Sustainability Revolution and Technological Innovations That Are Redefining the Food Wrapping Paper Landscape Across Global Value Chains

A new era of environmental stewardship has catalyzed the emergence of compostable substrates and bio-based fiber blends in food wrapping applications. Brands are increasingly turning to agronomic by-products such as agricultural residues to develop recyclable and home-compostable papers that meet rigorous certification standards. This shift toward circularity is complemented by enhanced supply chain traceability, which allows manufacturers and retailers to communicate compliance with evolving eco-regulatory frameworks and bolster consumer trust. In parallel, industry alliances and public-private partnerships are accelerating the development of standardized protocols that facilitate the end-of-life management of paper-based packaging.

Meanwhile, advances in digital printing and coating technologies are revolutionizing the way wrapping paper performs and engages end users. Variable data printing enables brands to personalize messaging and reduce waste generated by obsolete stock, while functional coatings deliver controlled gas permeability to extend shelf life without compromising recyclability. Emerging active packaging solutions leverage natural extracts and mineral-based additives to inhibit microbial growth directly on printed substrates, providing an added layer of safety. As automation and robotics play an increasing role in converting and finishing operations, manufacturers are achieving tighter tolerances and higher yields with reduced energy consumption.

Furthermore, regulatory frameworks such as the U.S. Food Safety Modernization Act and the EU Single-Use Plastics Directive have compelled swift reformulation of barrier solutions to meet tightening migration thresholds while reducing reliance on single-use polymers. This regulatory impetus has accelerated adoption cycles, driving converters to adopt novel water-based coatings, enzymatic sealants, and compatibility testing protocols that align with global safety and sustainability benchmarks. As a result, packaging strategies are evolving to integrate compliance, performance, and environmental metrics from design through disposal.

Together, these transformative forces are redefining the boundaries of what wrapping paper can achieve. By marrying high-performance attributes with ambitious sustainability targets, innovators are charting a path toward a resilient packaging ecosystem that aligns with global climate goals

Assessing the Far-Reaching Impacts of 2025 United States Tariff Adjustments on Import Dynamics and Cost Structures Within the Food Wrapping Paper Market

The implementation of revised tariff schedules in early 2025 introduced notable duties on a range of imported wrapping substrates, including composite films and coated foils. These policy changes, aimed at fostering domestic manufacturing resilience and correcting trade imbalances, have reshaped the cost calculus for brand owners and converters alike. The elevated import levies have prompted immediate cost pass-through pressures, compelling procurement teams to reevaluate existing supply agreements and adjust costing models in real time.

In response to the tariff environment, manufacturers have accelerated the development of nearshore production hubs within North America, reducing exposure to cross-border duties while enhancing logistical agility. Capital investments in domestic extrusion and lamination capacity have intensified, with several players expanding their footprints in adjacent regional markets. This strategic pivot not only mitigates tariff-related cost premiums but also reduces lead times, enabling more responsive inventory management in the face of volatile demand patterns.

However, adapting to these new trade conditions has introduced complexities related to regulatory compliance and customs administration. Firms are investing in enhanced data analytics platforms to optimize tariff classifications and leverage preferential trade agreements where applicable. As a result, the interplay between trade policy and operational strategy has become a critical determinant of competitive positioning.

To mitigate tariff disruptions, many companies are actively exploring alternative trade frameworks, including leveraging provisions under the USMCA and engaging with prospective Pacific Rim agreements. Through comprehensive cost-benefit analyses, executives are evaluating the relative advantages of nearshoring production versus maintaining diversified import channels, ensuring that strategic sourcing decisions reflect both cost efficiency and geopolitical risk management imperatives.

Deriving Actionable Market Intelligence from In-Depth Segmentation Analyses Based on Material Types Packaging Formats Applications and End User Verticals

When examining food wrapping paper through the lens of material type, the market reveals a spectrum of performance characteristics tailored to diverse product needs. Composite materials, encompassing both paper-film and paper-foil hybrids, deliver enhanced barrier protection by combining fibrous substrates with polymeric or metallic layers. Pure films, such as polyester, polyethylene, and polypropylene variants, offer flexibility and moisture resistance, making them ideal for high-speed packaging lines. Foil options, whether laminated or plain, impart superior oxygen barriers and temperature stability, while traditional paper grades-coated or uncoated-remain favored for applications where printability and recyclability are paramount. Each of these material categories presents trade-offs between barrier attributes, environmental footprint, and cost, underscoring the importance of aligning selection with specific preservation requirements.

Beyond substrate composition, packaging format exerts a substantial influence on operational efficiency and consumer convenience. Die-cut and gusseted bag designs excel in bakery and snack segments by facilitating easy loading and premium presentation, whereas flexible pouches satisfy portion control and resealability demands across retail and service channels. Rolls in standard and mini formats support continuous feed into wrapping stations and manual counters alike, delivering adaptability to varying throughput levels. Meanwhile, cut sheets cater to bespoke wrapping tasks, enabling artisanal branding applications where tactile engagement drives perceived quality.

In recognizing the interplay between distinct segmentation dimensions, successful strategies often emerge from tailored combinations of material type and packaging format for targeted applications. For instance, deploying coated paper in pouch form for deli items combines print quality with grease resistance, while integrating laminated foil on individual rolls serves temperature-sensitive confectioneries. Such cross-segment alignments unlock new value propositions by addressing the nuanced demands of diverse end-user verticals through purpose-built packaging assemblies.

Finally, understanding application and end-user dynamics deepens strategic insights. Food retail channels, spanning bakery, deli, and fresh produce operations, prioritize visual appeal and freshness indicators, whereas food service outlets-ranging from full-service establishments to institutional kitchens and quick-service restaurants-demand robust heat-seal and grease-resistant properties. Industrial applications, including meat packing and confectionery production, necessitate stringent barrier compliance and traceable material provenance. End users across food processing facilities, hotels, quick-service chains, and household kitchens weigh factors such as safety certification, ease of handling, and alignment with corporate sustainability commitments when selecting wrapping solutions. These multi-dimensional segmentation perspectives enable targeted product development and differentiated positioning in a highly competitive landscape.

This comprehensive research report categorizes the Food Wrapping Paper market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Packaging Format

- Application

- End User

Discerning Regional Nuances Shaping Demand Dynamics for Food Wrapping Paper Across the Americas Europe Middle East Africa and Asia-Pacific Territories

In the Americas, robust retail and foodservice infrastructure underpins stable demand for advanced wrapping solutions, with North American markets exhibiting particular interest in recyclable and compostable options. The prevalence of large-format commercial bakeries and deli chains drives requirements for high-volume roll stock, while artisanal producers increasingly seek customizable sheets that reinforce brand storytelling at the point of purchase. Cultural preference for fresh produce and ready-to-eat meals has also fueled innovation in breathable barrier constructions, addressing the need for extended shelf life without sacrificing visual clarity.

Across Europe, Middle East, and Africa, regulatory stringency and diverse end-user preferences create a complex mosaic of requirements. Western European nations lead in mandating post-consumer recycled content and strict migration testing, steering industry focus toward certified sustainable fibers and non-toxic barrier coatings. In contrast, emerging markets in the Middle East and North Africa prioritize affordability and temperature resilience, prompting suppliers to develop value-engineered foils and laminated papers capable of withstanding higher ambient conditions. Eastern European and Sub-Saharan African segments are witnessing gradual uptake of modern packaging methods, driven by expanding retail networks and shifting consumer expectations around food safety and convenience.

In Asia-Pacific territories, rapid urbanization and the expansion of domestic food processing hubs are creating fertile ground for innovation. Countries in East and Southeast Asia are at the forefront of integrating smart packaging technologies, embedding freshness indicators and QR-enabled traceability into wrapping media. Concurrently, South Asian markets present significant growth potential for cost-effective kraft and uncoated paper solutions, reflecting a balance between economic considerations and basic preservation needs. Australia and New Zealand exhibit a mature preference for premium coated papers, supported by stringent compliance regimes and evolving consumer demand for ethically sourced materials. This regional tapestry underscores the need for adaptive strategies that align material innovation with local market drivers.

This comprehensive research report examines key regions that drive the evolution of the Food Wrapping Paper market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Competitive Positioning and Strategic Imperatives of Leading Entities Driving Innovation Sustainability and Growth in the Food Wrapping Paper Sector

The competitive arena of food wrapping paper is characterized by a dynamic interplay between legacy packaging giants and agility-oriented newcomers. Larger incumbents leverage integrated value chains and global manufacturing footprint to deliver consistent quality across composite, film, foil, and paper segments. Strategic investments in research centers have accelerated the development of bio-based coatings and advanced barrier layers, enabling these players to meet rising sustainability benchmarks while preserving performance benchmarks. Collaborative ventures with material science partners have further diversified product portfolios, facilitating entry into niche applications such as active antimicrobial wraps and heat-sealable compostable films.

Conversely, mid-tier specialists and regional converters continue to carve differentiated positions by focusing on speed to market and highly tailored service offerings. These firms often excel at co-developing customized printing solutions and agile prototyping, supporting brand owners with limited runs and seasonal promotions. By harnessing digital dipping and precision die-cutting capabilities, they deliver on-demand labeling and limited-edition design initiatives without incurring the inventory risks traditionally associated with large-scale print runs. This flexibility has proven especially valuable in responding to sudden shifts in consumer preferences and promotional calendars.

Global leaders are also setting ambitious science-based targets to shrink carbon footprints within their operations and for raw material suppliers alike. They are piloting digital twin models of converting lines to optimize throughput, minimize downtime, and reduce energy usage, further enhancing their sustainability credentials while improving overall equipment effectiveness.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food Wrapping Paper market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ahlstrom-Munksjö Oyj

- Amcor plc

- BillerudKorsnäs AB

- Constantia Flexibles Group GmbH

- Delfort Group AG

- DS Smith Plc

- Georgia-Pacific LLC

- Graphic Packaging Holding Company

- Huhtamaki Oyj

- International Paper Company

- Mitsubishi Paper Mills Limited

- Mondi plc

- Nippon Paper Industries Co Ltd

- Oji Holdings Corp

- Pudumjee Paper Products Ltd

- Reynolds Group Holdings Limited

- S C Johnson & Son Inc

- Sappi Limited

- Seaman Paper Co

- Smurfit Kappa Group plc

- Sonoco Products Company

- The Clorox Company

- Twin Rivers Paper Company

- WestRock Company

Identifying High-Impact Strategic Initiatives for Industry Leaders to Capitalize on Emerging Trends and Strengthen Competitive Advantage in Food Wrapping Paper

To thrive amid shifting consumer demands and regulatory landscapes, industry leaders should prioritize the integration of sustainable feedstocks into existing production lines. By establishing clear roadmaps for transitioning from virgin polymers to certified recycled or bio-based inputs, firms can differentiate their offerings while preempting tighter environmental mandates. Cross-functional teams tasked with evaluating lifecycle impacts will be essential to balance cost, performance, and end-of-life considerations effectively.

Parallel emphasis on digital transformation will yield tangible gains in efficiency and responsiveness. Deploying advanced analytics platforms to monitor supply chain performance, trace material provenance, and forecast raw material availability will empower decision-makers with actionable insights. Furthermore, embedding digital printing capabilities within converting operations can reduce lead times, minimize overproduction, and enable dynamic customization that resonates with value-conscious consumers.

Strategic alliances with emerging fiber and coating innovators offer another avenue for accelerating access to breakthrough technologies. Joint development agreements and minority stake investments foster knowledge exchange and de-risk R&D initiatives, enabling incumbents to trial novel barrier treatments or enzymatic coatings at scale. Finally, proactive engagement with policymakers and industry associations can help shape pragmatic regulatory frameworks that balance sustainability objectives with commercial viability, ensuring that new standards drive innovation rather than stifle it.

Moreover, integrating predictive maintenance systems on high-speed converting equipment can preempt unscheduled outages and extend machine lifecycles, while harnessing consumer insights derived from social listening platforms enables more resonant packaging aesthetics and on-pack messaging that aligns with evolving purchaser motivations.

Unpacking the Rigorous Multi-Stage Research Framework Employed to Ensure Comprehensive Insights and Unbiased Analysis in the Food Wrapping Paper Study

This study was underpinned by a sequential research methodology that combined secondary intelligence gathering with primary insights to ensure depth and accuracy. Secondary exploration involved the systematic review of peer-reviewed journals, industry white papers, and regulatory filings to capture emerging material science advancements and policy shifts. This foundational step enabled the mapping of value chains, identification of key performance metrics, and contextualization of sustainability goals within global packaging mandates.

Building on this groundwork, primary research was conducted through in-depth interviews with executives across material suppliers, converters, brand manufacturers, and retail stakeholders. Structured discussions were supplemented by targeted surveys capturing quantitative perceptions on barrier preferences, cost sensitivities, and innovation priorities. These inputs were qualitatively triangulated with facility-level site visits and virtual walkthroughs of printing and converting operations to validate operational capabilities against articulated requirements.

Additionally, the analytical framework incorporated a multi-criteria decision analysis model, weighting factors such as environmental footprint, barrier efficiency, and cost volatility. Data points were cross-verified through a rigorous fact-checking protocol, while expert panels reviewed interim findings to mitigate cognitive biases. Complementing traditional data sources, social media listening and real-time sentiment analysis were employed to capture consumer perceptions around sustainable packaging and freshness cues, enriching the qualitative dimensions of the study and ensuring alignment with contemporary end-user expectations.

Together, these methodical stages coalesced into an integrated perspective, offering stakeholders a robust and unbiased foundation for strategic decision-making in the food wrapping paper domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food Wrapping Paper market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food Wrapping Paper Market, by Material Type

- Food Wrapping Paper Market, by Packaging Format

- Food Wrapping Paper Market, by Application

- Food Wrapping Paper Market, by End User

- Food Wrapping Paper Market, by Region

- Food Wrapping Paper Market, by Group

- Food Wrapping Paper Market, by Country

- United States Food Wrapping Paper Market

- China Food Wrapping Paper Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Synthesizing Core Executive Takeaways to Guide Decision Makers Toward Strategic Actions and Long-Term Success in the Food Wrapping Paper Domain

At the heart of this analysis lies the imperative for packaging professionals to embrace both sustainability and performance as co-equal objectives. By prioritizing material innovation that aligns with circular economy principles, companies can anticipate regulatory evolutions while appealing to discerning consumers. Moreover, the competitive landscape demonstrates that agility in customizing solutions-through advanced printing and modular converting systems-remains a key differentiator.

Trade policies, particularly the recent adjustments to import duties, underscore the necessity of resilient and diversified sourcing strategies. Stakeholders must continue to cultivate nearshore partnerships and leverage flexible supply networks to safeguard against future geopolitical shifts. Equally, investment in trade compliance capabilities will be indispensable for maintaining cost discipline and ensuring uninterrupted production.

Looking ahead, success will be defined by the capacity to integrate digital tools across the value chain, from predictive analytics for raw material procurement to smart packaging features that enhance traceability and consumer engagement. Collaborative alliances, whether through joint R&D ventures or strategic minority investments, will accelerate access to novel substrates and active packaging technologies.

Scenario planning workshops conducted with cross-industry stakeholders underscored the value of cultivating open innovation ecosystems, where packaging developers, material scientists, and brand owners co-create novel wrapping solutions that anticipate future regulatory shifts and consumer trends. Collectively, these foundational actions will enable executives to navigate uncertainty, capitalize on growth avenues, and secure enduring competitive advantage in the dynamic food wrapping paper sector.

Engage with Ketan Rohom Associate Director Sales & Marketing to Secure Exclusive Access to the Comprehensive Food Wrapping Paper Market Research Report

To explore how these insights can propel your strategic initiatives, reach out to Ketan Rohom, Associate Director of Sales & Marketing, for a tailored discussion. He can provide an in-depth walkthrough of the report’s findings, highlight specific case studies, and outline bespoke subscription packages suited to your organization’s needs. By partnering with an expert who deeply understands the nuances of the food wrapping paper ecosystem, you will gain actionable intelligence to inform product development, sourcing decisions, and sustainability roadmaps.

Schedule a consultation to uncover how the latest segmentation, tariff impact analysis, and competitive intelligence can be harnessed to drive innovation and margin enhancement. Contacting Ketan will ensure you receive the full breadth of actionable recommendations and forward-looking perspectives required to outpace market shifts. Secure your copy of the comprehensive market research report today and position your company at the forefront of packaging excellence.

- How big is the Food Wrapping Paper Market?

- What is the Food Wrapping Paper Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?