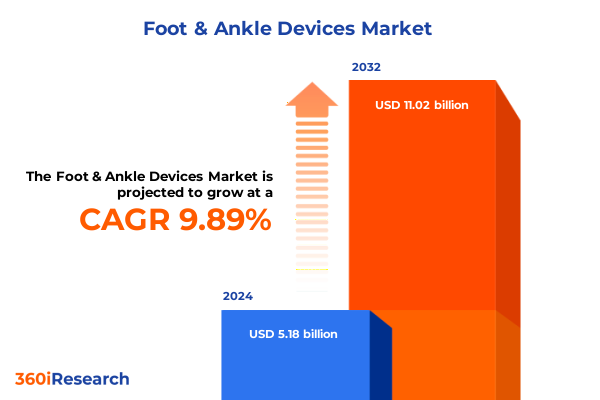

The Foot & Ankle Devices Market size was estimated at USD 5.33 billion in 2025 and expected to reach USD 5.79 billion in 2026, at a CAGR of 8.81% to reach USD 9.63 billion by 2032.

Navigating the Rapidly Evolving Foot and Ankle Devices Market Through Integrated Innovation and Strategic Adaptation for Future Resilience

As demographic and lifestyle trends converge, the foot and ankle devices sector has never been more critical to patient mobility and quality of life. The global increase in sports participation, coupled with an aging population prone to arthritis and degenerative conditions, has created a dual imperative: developing devices that support both high-impact activities and the nuanced needs of geriatric care. With over one in four adults now actively engaging in organized sports and recreational exercise, clinicians are encountering a surge in sprains, fractures, and tendon injuries requiring innovative stabilization and fixation solutions. At the same time, the prevalence of chronic foot conditions among seniors-where nearly half report persistent pain-demands implants and orthoses that balance durability with comfort to maintain independence and reduce fall risk.

Embracing Breakthrough Technologies and Collaborative Care Models to Transform Foot and Ankle Treatment Pathways for Enhanced Patient Outcomes and Operational Efficiency

The foot and ankle devices landscape is undergoing a seismic transformation driven by convergent technologies and evolving care models. Advanced imaging modalities, such as weight-bearing CT scans and dynamic MRI, are furnishing surgeons with intricate anatomical insights that underpin the rise of patient-specific surgical guides produced via additive manufacturing. These custom guides, once limited to pilot studies, are now routinely employed in complex osteotomies and fracture repairs, reducing intraoperative uncertainty and improving alignment precision. Concurrently, the emergence of smart bracing systems embedded with pressure sensors and wireless connectivity is redefining postoperative rehabilitation. These devices capture real-time gait and load distribution metrics, enabling clinicians to remotely adjust treatment protocols and accelerate recovery timelines. Moreover, the increasing integration of telehealth platforms is expanding access to specialist consultations, ensuring early intervention and enhancing patient adherence to orthotic regimens. Together, these shifts illustrate a broader progression toward value-based care, where device performance data and clinical outcomes drive collaborative agreements between manufacturers, payers, and providers to optimize both efficacy and cost efficiency.

Assessing the Far-Reaching Consequences of Renewed Trade Measures on Cost Structures and Supply Chains in the Foot and Ankle Devices Sector

The reinstatement and expansion of U.S. tariffs on imported medical devices in 2025 is introducing new cost pressures and supply chain complexities for the foot and ankle devices sector. Renewed Section 301 duties targeting Class I and II devices, including critical orthopedic instruments sourced from China, threaten to elevate component costs and heighten logistical risks for manufacturers reliant on global sourcing strategies. According to GlobalData, these measures could erode U.S. profits for leading industry players by up to $80 million next year, underscoring the need for agile supply chain planning and tariff mitigation tactics. Meanwhile, additional Section 232 levies on steel and aluminum-integral to plates, screws, and intramedullary nails-are amplifying material expenses, potentially slowing adoption of innovative fixation systems unless alternative sourcing or domestic production is secured.

Beyond China, the extension of tariffs to European and other trading partners under the same policy framework further complicates import strategies, as high-precision implants and advanced biomaterials are often manufactured outside U.S. borders. Industry analysts caution that these broad‐based measures could disrupt the timely delivery of specialized ankle fusion devices and total ankle replacement systems, leading to inventory shortages and longer lead times. In response, manufacturers are exploring diversified procurement from Southeast Asia and Mexico, while advocating for tariff exemptions on essential orthopedic goods. However, the regulatory intricacies of medical device approval hinder rapid reshoring, emphasizing the importance of strategic risk assessment and scenario planning to maintain continuity of patient care.

Uncovering Comprehensive Market Dynamics Through Detailed Product Type, Material Type, Clinical Indication, Demographic, and End User Segment Analysis to Drive Strategic Decisions

A nuanced understanding of market segmentation reveals the interplay between device innovation and targeted clinical applications. Within the product type domain, braces range from lace-up designs for mild support to rigid truss systems engineered for complex ligament reconstructions, while wraparound variants cater to dynamic rehabilitation needs. Implant solutions encompass fixation devices such as intramedullary nails used in severe tibial fractures, plates that stabilize osteotomies, and screws for metatarsal corrections. Joint replacement subcategories include partial ankle replacements aimed at preserving native motion and total ankle prostheses that restore full functionality. Orthoses offerings further diversify with ankle-foot orthoses designed for neuromuscular disorders, foot sleeves providing compression therapy, and customized insoles that address biomechanical misalignments. Prosthetic innovations span ankle prosthetic modules for limb salvage, below-knee prosthetics optimized for high-performance activities, and specialized partial foot prosthetics that enhance mobility for diabetic patients.

Beyond device typology, material composition defines performance attributes and regulatory pathways. Ceramics, with alumina and zirconia formulations, deliver wear resistance in bearing surfaces, while metals like cobalt-chrome, stainless steel, and titanium lend structural integrity to implants. Polymers, notably polyether ether ketone and ultrahigh molecular weight polyethylene, offer flexibility and biocompatibility for load-sharing applications. Clinical indications carve out distinct growth trajectories: arthritis treatments, including arthrodesis and total ankle arthroplasty, target degenerative diseases, whereas reconstructive surgeries leverage bone and soft tissue reconstruction tools for deformity corrections. Trauma fixation focuses on fracture stabilization and ligament repair technologies essential in sports medicine and accident recovery. Age group segmentation reveals divergent needs, with pediatric devices emphasizing growth-accommodating designs, adult devices balancing active lifestyles with implant longevity, and geriatric devices prioritizing comfort and fall prevention. Finally, end users-ranging from ambulatory surgical centers and orthopedic clinics to hospitals and home care services-shape demand patterns through procedural settings, reimbursement models, and patient management protocols.

This comprehensive research report categorizes the Foot & Ankle Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Device Function

- Age Group

- Clinical Indication

- End User

Evaluating Regional Market Drivers and Adoption Patterns Across the Americas, Europe Middle East Africa, and Asia Pacific in Foot and Ankle Devices

In the Americas, robust healthcare infrastructure and favorable reimbursement policies have cemented the United States as a pivotal hub for foot and ankle device adoption. The region’s expansive network of ambulatory surgical centers has accelerated the shift toward outpatient procedures, fostering demand for rapid-recovery implants and minimally invasive fixation systems. North American leadership is reinforced by a strong domestic manufacturing base and streamlined regulatory pathways, enabling swift integration of next-generation devices and supporting collaboration between payers and providers to demonstrate value at the point of care.

Across Europe, the Middle East, and Africa, innovation is driven by a well-established clinical trial ecosystem and a growing geriatric population that requires sophisticated orthotic and implant solutions. European markets exhibit high uptake of custom surgical guides and advanced biomaterials, underpinned by centralized health technology assessment frameworks that reward demonstrable clinical benefits. In the Middle East and Africa, emerging care infrastructure and rising healthcare spending are expanding access to specialized foot and ankle treatments, setting the stage for accelerated adoption of telemedicine-enabled rehabilitation and remote monitoring platforms. The region’s focus on preventive care programs is also boosting demand for supportive orthoses and smart insoles that reduce the burden of chronic foot conditions.

In Asia-Pacific, demographic transitions-marked by aging populations in Japan and China-are fueling a surge in arthritis treatment and diabetic foot care devices. Government initiatives to enhance rural healthcare delivery, combined with expanding private sector investments, are broadening the availability of advanced surgical implants and trauma fixation products. Furthermore, rising participation in sports and active hobbies among younger cohorts is increasing the incidence of musculoskeletal injuries, prompting a parallel expansion of bracing and orthotic segments. Local manufacturers are increasingly investing in 3D printing and polymer technologies to meet the divergent needs of urban and rural patient populations, driving regional innovation and competitive pricing strategies.

This comprehensive research report examines key regions that drive the evolution of the Foot & Ankle Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Insights into Strategic Moves and Innovation Portfolios of Leading Medical Device Companies Shaping the Foot and Ankle Market Landscape

Industry leaders are pursuing strategic initiatives to fortify their positions in the foot and ankle segment. Stryker’s June 2024 acquisition of Artelon, a specialist in soft tissue fixation, has augmented its ligament and tendon reconstruction offerings, enhancing its portfolio with differentiated biomaterial technology that supports biologic integration and mechanical stability. Building on this momentum, the company is investing in a dedicated metal 3D printing facility to scale production of custom implants and streamline supply chain operations, positioning itself to capitalize on the increasing demand for patient-specific solutions.

Zimmer Biomet has pursued a dual strategy of targeted acquisitions and robotics investment. Its proposed $1.1 billion purchase of Paragon 28, completed in early 2025, secured a focused foot and ankle implant line and a specialized sales channel, significantly broadening its trauma, deformity, and joint replacement capabilities. More recently, the planned acquisition of Monogram Technologies will integrate semi-autonomous surgical devices into Zimmer Biomet’s robotics arm, underscoring its commitment to advanced operative platforms that enhance precision in joint replacement and complex foot procedures.

DePuy Synthes has introduced the TriLEAP™ Lower Extremity Anatomic Plating System, delivering a comprehensive set of low-profile titanium plates and harmonized instrumentation designed for forefoot, midfoot, and hindfoot procedures. This launch strengthens its reconstructive and trauma portfolio with novel hardware options that prioritize anatomic fit and streamlined surgical workflows. Smith+Nephew’s recent rollout of adjustable tensioning technology for Achilles reconstruction and lateral ankle instability repair showcases its emphasis on intraoperative customization, allowing surgeons to refine suture tension in real time and potentially improve functional outcomes for athletic and high-demand patients.

This comprehensive research report delivers an in-depth overview of the principal market players in the Foot & Ankle Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Stryker Corporation

- Johnson & Johnson

- Arthrex, Inc.

- Smith & Nephew plc

- Zimmer Biomet Holdings, Inc.

- Integra LifeSciences Holdings Corporation

- Orthofix Medical Inc.

- Acumed LLC

- Exactech, Inc.

- Enovis Corporation

- Paragon 28, Inc.

- Össur hf.

- Treace Medical Concepts, Inc.

- restor3d, Inc.

- B. Braun Melsungen AG

- Bauerfeind AG

- Blatchford Limited

- CONMED Corporation

- Corin Group PLC

- Fillauer LLC

- Globus Medical, Inc.

- Hanger, Inc.

- Medartis AG

- MicroPort Orthopedics Inc.

- Ottobock SE & Co. KGaA

- PROTEOR SAS

- Thuasne SAS

- OrthoPediatrics Corp.

- BioSkin LLC

- Bioventus LLC

- Specialized Orthopedic Solutions Inc.

- Thrive Orthopedics

Actionable Strategic Imperatives for Industry Leaders to Capitalize on Innovation Trends and Mitigate Emerging Market Risks in Foot and Ankle Devices

Leaders in the foot and ankle devices sector should prioritize integrated digital platforms that combine clinical outcome data with remote monitoring capabilities, thereby reinforcing value-based partnerships with payers and providers. Investing in additive manufacturing capabilities will not only support the customization trend but also enable more resilient supply chains, mitigating tariff-related cost fluctuations. Collaborations with imaging and software developers can enhance procedural planning tools, driving implant accuracy and reducing operating room time. Additionally, companies should expand their presence in ambulatory surgery settings through tailored product offerings that align with outpatient workflows and reimbursement structures. In response to geopolitical uncertainties, establishing multi-regional manufacturing hubs and qualifying secondary suppliers will safeguard against supply disruptions. Finally, deeper engagement with patient advocacy groups and professional societies will accelerate adoption of novel therapies and foster data generation to substantiate clinical and economic benefits.

Employing Rigorous Data Collection, Expert Interviews, and Analytical Frameworks to Ensure Robust Foot and Ankle Market Research Integrity

This report combines exhaustive secondary research with primary engagement to ensure a robust analytical foundation. Secondary sources included peer-reviewed journals, regulatory filings, industry white papers, and proprietary databases. Primary research involved interviews with orthopedic surgeons, rehabilitation specialists, procurement executives, and healthcare payers to validate market drivers and adoption barriers. Quantitative data were triangulated through financial reports, trade statistics, and reimbursement schedules, while qualitative insights were refined via expert roundtables and advisory panels. Segmentation analyses were developed using standardized taxonomy and cross-verified against clinical procedure volumes. Regional growth assessments incorporated macroeconomic indicators, demographic projections, and healthcare infrastructure metrics. All findings were subject to rigorous peer review and quality control protocols to ensure accuracy and consistency.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Foot & Ankle Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Foot & Ankle Devices Market, by Product Type

- Foot & Ankle Devices Market, by Material Type

- Foot & Ankle Devices Market, by Device Function

- Foot & Ankle Devices Market, by Age Group

- Foot & Ankle Devices Market, by Clinical Indication

- Foot & Ankle Devices Market, by End User

- Foot & Ankle Devices Market, by Region

- Foot & Ankle Devices Market, by Group

- Foot & Ankle Devices Market, by Country

- United States Foot & Ankle Devices Market

- China Foot & Ankle Devices Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3339 ]

Synthesis of Key Market Insights Emphasizing Innovation Imperatives and Strategic Priorities in the Foot and Ankle Devices Industry Evolution

In summary, the foot and ankle devices market is entering a new era defined by personalized clinical pathways, advanced manufacturing techniques, and complex global trade dynamics. Technological breakthroughs in imaging and digital therapeutics are translating into more precise interventions and remote care models, while tariff pressures and regulatory shifts demand proactive supply chain strategies. Segmentation insights illuminate diverse opportunities across product types, materials, indications, demographics, and settings, underscoring the importance of targeted innovation and market alignment. Regional analyses highlight distinct growth vectors driven by infrastructure, reimbursement, and demographic profiles. Major industry participants are reinforcing their portfolios through strategic acquisitions, facility investments, and next-generation device launches. As the competitive landscape evolves, stakeholders who adopt data-driven collaboration, flexible manufacturing, and evidence-based value propositions will be best positioned to drive clinical excellence and sustainable growth.

Engage Directly with Ketan Rohom to Secure Comprehensive Foot and Ankle Devices Market Intelligence and Drive Informed Strategic Investments

To explore how these comprehensive insights can inform your strategic planning and position you at the forefront of innovation in the foot and ankle devices space, please contact Ketan Rohom, Associate Director of Sales & Marketing. Ketan can guide you through the report’s key highlights and ensure you have the tailored market intelligence you need to make data-driven decisions. Reach out today to secure your copy of the full market research report and unlock the competitive advantages that only this in-depth analysis can provide.

- How big is the Foot & Ankle Devices Market?

- What is the Foot & Ankle Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?