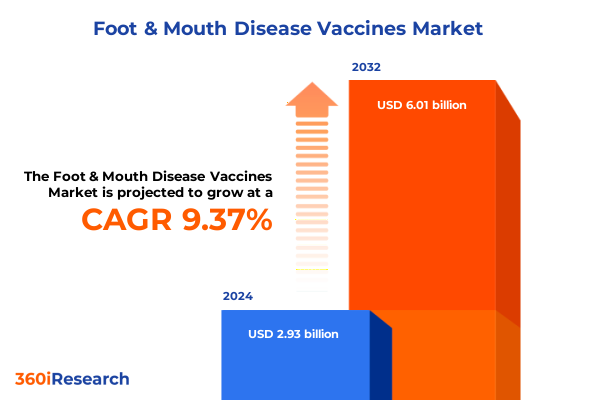

The Foot & Mouth Disease Vaccines Market size was estimated at USD 3.21 billion in 2025 and expected to reach USD 3.49 billion in 2026, at a CAGR of 9.38% to reach USD 6.01 billion by 2032.

Establishing the Critical Importance of Foot and Mouth Disease Vaccination in Safeguarding Global Livestock Health, Securing Agricultural Economies, and Preventing Disease Outbreaks

Foot and mouth disease represents one of the most significant threats to global livestock health, with far-reaching consequences that extend from farm-level economic losses to national food security challenges. Vaccination remains the cornerstone of disease control programs, enabling governments and private enterprises to curb transmission, reduce morbidity, and safeguard trade relationships by meeting stringent animal health standards. The imperative for robust immunization strategies has grown in tandem with intensifying pressures on global agricultural systems, where outbreaks can disrupt supply chains, depress commodity prices, and precipitate costly response measures.

As the veterinary vaccine sector evolves, stakeholders are placing increased emphasis on the development of formulations that deliver rapid onset of immunity, broad-spectrum protection, and enhanced stability under variable storage conditions. Concurrently, the integration of genomic surveillance and molecular epidemiology has provided unprecedented clarity on serotype distribution and viral evolution, informing tailored vaccination campaigns. In this dynamic context, a thorough understanding of vaccine platforms, policy drivers, and market segmentation is essential for stakeholders seeking to optimize resource allocation, foster innovation, and build resilient immunization programs. This executive summary distills the key trends shaping the foot and mouth disease vaccine landscape, equipping decision makers with the insights needed to navigate complexity and drive sustainable growth.

Unraveling the Recent Technological and Policy-Driven Transformations Reshaping the Global Foot and Mouth Disease Vaccine Ecosystem within Animal Health and Biosecurity Frameworks Worldwide

The landscape of foot and mouth disease vaccines is undergoing transformative shifts driven by breakthroughs in antigen design, novel adjuvant technologies, and evolving regulatory frameworks that prioritize both efficacy and safety. One prominent innovation is the advent of subunit vaccine platforms, which leverage recombinant proteins or virus-like particles to stimulate targeted immune responses without the risk of reversion to virulence. This approach contrasts with traditional inactivated vaccines, which require large-scale virus cultivation and stringent inactivation processes, and live attenuated vaccines, which carry inherent biosafety considerations despite offering robust immunity.

Moreover, the rise of polyvalent formulations capable of addressing multiple serotypes within a single dose is reshaping immunization strategies. Transitioning from monovalent preparations to bivalent, trivalent, and quadrivalent products allows veterinary practitioners to streamline vaccination schedules and enhance herd-level protection in regions with diverse viral serotype prevalence. These technical advances coincide with an era of heightened digitalization, where cold chain monitoring, data analytics, and blockchain-enabled traceability are reinforcing supply chain integrity and minimizing vaccine wastage.

At the policy level, governments are increasingly implementing public–private partnerships to support vaccine R&D, accelerate regulatory approvals, and deploy national stockpiling mechanisms. Incentivized by global health security agendas, collaborations between research institutes, animal health clinics, and pharmaceutical companies are fostering adaptive manufacturing platforms that can respond rapidly to emergent strains. Collectively, these technological and policy-driven transformations are forging a more resilient and responsive vaccine ecosystem poised to mitigate future outbreaks effectively.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Adjustments on Foot and Mouth Disease Vaccine Supply Chains and Industry Economics

In 2025, the United States introduced revised tariff measures that have significantly influenced the economics of imported foot and mouth disease vaccines and related raw materials. These heightened duties, applied across key inputs such as adjuvants, vials, and specialized reagents, have increased the landed cost of certain vaccine products, prompting manufacturers to re-evaluate supply chain configurations. In response, some stakeholders have pursued nearshoring strategies, relocating portions of bulk antigen production to domestic or allied facilities to mitigate tariff exposure and ensure continuity of supply.

Furthermore, end users including clinics, hospitals, and research institutes have reported upward pressure on procurement budgets, necessitating renegotiations of long-term offtake agreements and exploring collaborative purchasing consortia. The cascading effects have also been felt by developers of live attenuated and subunit vaccines, which often rely on international partnerships for technology licensing and contract manufacturing. As a result, several companies are accelerating the diversification of raw material sourcing to include regional suppliers in Europe, Middle East and Africa, and Asia Pacific, thereby reducing their dependence on higher-tariff jurisdictions.

These adjustments highlight the critical interplay between trade policy and vaccine accessibility. While the overarching aim of the tariff adjustments was to bolster domestic manufacturing competitiveness, it is essential for industry leaders to balance cost considerations with the imperative of maintaining robust immunization rates. Strategic initiatives that optimize supply resilience and cultivate alternative sourcing pathways will be central to sustaining vaccine affordability and upholding biosecurity objectives in the face of evolving trade dynamics.

Deriving Strategic Clarity through In-Depth Analysis of Foot and Mouth Disease Vaccine Market Segmentation across Animal Types, Formulations, and Distribution Channels

An examination of market segmentation illuminates the nuanced requirements and adoption patterns that define the foot and mouth disease vaccine landscape. When segmenting by animal type, bovine herds emerge as the predominant cohort, driven by their heightened susceptibility to severe clinical manifestations and the scale of beef and dairy operations; however, sheep and goat flocks warrant targeted strategies given their role in small ruminant agriculture and regional consumption practices. Swine populations, although less extensive, require specialized vaccine formulations that align with porcine immunogen profiles and production cycles.

Segmentation by vaccine type reveals that inactivated vaccines remain the mainstay for established immunization programs, offering a well-characterized safety and efficacy profile. At the same time, live attenuated vaccines continue to address exigent outbreak scenarios by inducing rapid, robust immunity, whereas subunit vaccines are gaining traction in research settings and regions with stringent biosafety requirements. Delving into formulation, the transition from monovalent products to polyvalent solutions-encompassing bivalent, trivalent, and quadrivalent constructs-demonstrates a clear industry shift toward broad-spectrum coverage that simplifies administration protocols and broadens herd immunity.

End users are equally diverse, spanning government-run and private clinics, specialized animal hospitals, and research institutes that focus on novel antigen discovery. The route of administration is typically through injection, which delivers consistent immunogenicity, although oral vaccines are being explored for more accessible mass vaccination campaigns. In terms of application, preventive strategies dominate, emphasizing routine herd health management, yet therapeutic vaccination is gaining visibility for rapid containment in outbreak settings. Finally, distribution channel analysis distinguishes between offline modalities-department stores, direct sales, and specialty veterinary outlets-and online platforms, including company websites and e-commerce channels, reflecting an industry increasingly embracing digital procurement to enhance reach and convenience.

This comprehensive research report categorizes the Foot & Mouth Disease Vaccines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Animal Type

- Vaccine Type

- Formulation

- End User

- Route Of Administration

- Application

- Distribution Channel

Comparative Examination of Regional Dynamics Influencing Foot and Mouth Disease Vaccine Adoption Rates in the Americas, Europe Middle East Africa, and Asia Pacific

Regional dynamics exert a profound influence on vaccine adoption, shaped by epidemiological patterns, regulatory environments, and infrastructural capabilities. In the Americas, well-established veterinary networks and robust reimbursement frameworks support extensive use of inactivated and live attenuated vaccines, particularly within large-scale bovine operations in North America and export-oriented beef production in South America. Meanwhile, private sector investment in Argentina and Brazil has spurred localized R&D, enhancing access to tailored polyvalent products optimized for regional serotype profiles.

Within Europe, Middle East and Africa, heterogeneous regulatory pathways coexist with varying degrees of public health funding, resulting in a mosaic of vaccine uptake rates. Western Europe’s advanced cold chain logistics and centralized approval authorities enable swift deployment of both innovative subunit vaccines and proven inactivated platforms. In contrast, parts of sub-Saharan Africa and the Middle East navigate resource constraints that prioritize cost-effective monovalent vaccines distributed through government channels and international aid programs. Cross-border coordination efforts through regional animal health authorities serve to harmonize outbreak response protocols and streamline vaccine registration.

The Asia Pacific region demonstrates some of the most dynamic growth opportunities, fueled by expanding livestock populations, rising consumer demand for protein, and concerted efforts to modernize veterinary infrastructure. Countries such as China, India, and Australia are investing in modular manufacturing facilities and genomic surveillance networks to rapidly identify emergent strains and adjust vaccine compositions accordingly. Additionally, digital procurement portals and partnerships with e-commerce platforms have begun to reshape how farmers access vaccine products, thereby reducing time-to-vaccination and improving overall coverage rates across diverse agricultural landscapes.

This comprehensive research report examines key regions that drive the evolution of the Foot & Mouth Disease Vaccines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Landscape and Strategic Priorities of Leading Pharmaceutical Enterprises Driving Innovation in Foot and Mouth Disease Vaccine Development

The competitive landscape of foot and mouth disease vaccines is characterized by a blend of multinational pharmaceutical leaders, specialized biotech innovators, and government-backed institutes. Merck Animal Health has sustained its position through strategic acquisitions and an extensive distribution network, while Boehringer Ingelheim leverages its global R&D capabilities to advance both live attenuated and recombinant platforms. Zoetis continues to fortify its pipeline with novel adjuvant systems aimed at enhancing mucosal immunity, partnering with academic centers to accelerate translational research. CEVA Santé Animale has distinguished itself through a focus on polyvalent formulations and regional collaborations in emerging markets, and Elanco’s investments in digital health initiatives underscore the growing importance of integrated disease management solutions.

In parallel, a number of biotechnology startups are gaining momentum by specializing in next-generation subunit vaccines and exploring novel antigen presentation methodologies such as nanoparticle scaffolds. These smaller players often engage in licensing agreements with larger manufacturers to leverage scale-up capabilities, while pursuing orphan market opportunities in regions with limited access to conventional vaccines. Public research institutes also play a pivotal role by contributing to the early-stage discovery of cross-protective epitopes and facilitating field trials that validate vaccine performance under real-world conditions.

Collectively, this ecosystem fosters a dynamic interplay between large-scale commercialization expertise and cutting-edge innovation. Industry leaders are increasingly forming consortiums and public–private partnerships to share risk, pool resources, and address unmet needs in serotype coverage and cold chain resilience. This cooperative approach is crucial for accelerating time-to-market and ensuring that vaccines remain accessible and effective in diverse epidemiological contexts.

This comprehensive research report delivers an in-depth overview of the principal market players in the Foot & Mouth Disease Vaccines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Biogénesis Bagó

- Biovet Private Ltd

- Boehringer Ingelheim International GmbH

- Botswana Vaccine Institute

- Brilliant Bio Pharma Private Limited

- Ceva Santé Animale

- China Animal Husbandry Group

- Federal Center for Animal Health

- Hester Biosciences Limited

- Indian Immunologicals Limited

- Lanzhou Biological Pharmaceutical

- Limor de Colombia SAS

- Merck & Co., Inc.

- Middle East for Vaccines Company

- Ourofino Saúde Animal

- Razi Institute

- VECOL S.A.

- Vetal Animal Health Products Inc.

- Veterinary Serum and Vaccine Institute

- Zoetis Inc.

Formulating Practical Strategic Recommendations to Enhance Market Positioning and Accelerate Adoption of Cutting-Edge Foot and Mouth Disease Vaccine Solutions

To capitalize on evolving market dynamics and reinforce immunization programs, industry leaders should pursue a multifaceted strategy that prioritizes both innovation and operational efficiency. First, investment in advanced vaccine platforms such as subunit and recombinant constructs can yield products with superior safety profiles and broader serotype coverage, thereby meeting the stringent requirements of sensitive markets and veterinary authorities. Concurrently, enhancing cold chain infrastructure through partnerships with logistics specialists will ensure product potency is maintained from manufacturing to administration.

Next, forging strategic alliances with regional research institutes and government animal health agencies can facilitate co-development agreements and streamline regulatory approvals. Such collaborations not only enable knowledge transfer and risk sharing but also support the customization of vaccine formulations to closely match local serotype distributions. By integrating genomic surveillance data and predictive modeling tools, companies can adopt an agile approach to antigen design, reducing lead times and improving outbreak responsiveness.

Furthermore, expanding digital procurement channels through dedicated e-commerce portals and direct digital engagement with end users will enhance accessibility and transparency. Complementing this with targeted educational initiatives for veterinarians and farm managers can drive informed decision-making and higher vaccination compliance rates. Ultimately, by balancing R&D intensity with strategic supply chain enhancements and stakeholder engagement, industry leaders can strengthen market positioning and deliver impactful solutions that mitigate the threat of foot and mouth disease.

Outlining Rigorous Research Methodology and Data Validation Techniques Underpinning the Comprehensive Foot and Mouth Disease Vaccine Market Analysis

This analysis draws on a rigorous research framework combining primary data collection and secondary source validation to deliver a comprehensive view of the foot and mouth disease vaccine market. Primary research included structured interviews with senior executives at veterinary clinics, animal health hospitals, and leading research institutes, along with detailed surveys of procurement managers responsible for vaccine purchasing decisions. Insights from these engagements were triangulated with manufacturer press releases, patent filings, and regulatory approval databases to ensure a holistic perspective on product pipelines and competitive strategies.

Secondary research encompassed the systematic review of peer-reviewed journals, epidemiological reports from international animal health agencies, and government policy documents addressing vaccine regulations and trade measures. Market intelligence was further enriched by analyzing genomic surveillance data that traces serotype prevalence and outbreak patterns, enabling a precise alignment of segmentation insights with real-world disease dynamics. Data integrity was upheld through cross-validation across multiple independent sources, while analytical models employed trend analysis and scenario planning to interpret the potential impact of tariff changes and technological shifts.

Limitations of the study are acknowledged, including potential variations in reporting standards across regions and the time lag associated with publishing certain epidemiological datasets. However, by leveraging a combination of real-time expert interviews and vetted secondary data, the research methodology delivers a robust, actionable foundation that underpins the strategic insights and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Foot & Mouth Disease Vaccines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Foot & Mouth Disease Vaccines Market, by Animal Type

- Foot & Mouth Disease Vaccines Market, by Vaccine Type

- Foot & Mouth Disease Vaccines Market, by Formulation

- Foot & Mouth Disease Vaccines Market, by End User

- Foot & Mouth Disease Vaccines Market, by Route Of Administration

- Foot & Mouth Disease Vaccines Market, by Application

- Foot & Mouth Disease Vaccines Market, by Distribution Channel

- Foot & Mouth Disease Vaccines Market, by Region

- Foot & Mouth Disease Vaccines Market, by Group

- Foot & Mouth Disease Vaccines Market, by Country

- United States Foot & Mouth Disease Vaccines Market

- China Foot & Mouth Disease Vaccines Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Concluding Perspectives on the Foot and Mouth Disease Vaccine Market Outlook Highlighting Critical Drivers, Challenges, and Growth Trajectories

This executive summary underscores the multifaceted nature of the foot and mouth disease vaccine landscape, shaped by rapid technological innovation, shifting trade policies, and diverse regional dynamics. The maturation of subunit and polyvalent vaccine platforms, aligned with enhanced cold chain capabilities and digital procurement channels, is redefining how stakeholders manage herd immunity and outbreak control. Simultaneously, the 2025 tariff adjustments within the United States have spotlighted the necessity of agile supply chain management and strategic nearshoring to mitigate cost pressures and ensure continuous access to critical inputs.

Differentiated market segmentation reveals that tailored strategies across bovine, small ruminant, and swine populations are vital, while a range of vaccine types-spanning inactivated, live attenuated, and subunit technologies-serves distinct epidemiological and biosafety requirements. The distribution continuum, from offline specialty stores to e-commerce platforms, highlights the ongoing digital transformation that enhances accessibility and streamlines procurement processes. Regionally, the Americas, Europe Middle East Africa, and Asia Pacific each exhibit unique drivers and barriers, reinforcing the need for localized approaches that account for regulatory frameworks and infrastructural capacities.

Looking ahead, industry leaders who embrace collaborative R&D models, invest in robust cold chain logistics, and harness real-time surveillance data will be best positioned to address emergent serotypes and evolving market demands. By synthesizing these critical drivers and challenges, stakeholders can chart a trajectory towards more resilient and effective foot and mouth disease vaccination programs that safeguard livestock health and bolster agricultural security.

Inviting Strategic Engagement to Secure Exclusive Access to the Comprehensive Foot and Mouth Disease Vaccine Market Report and Enhance Organizational Decision-Making

Engaging with this market research report offers unparalleled insight into vaccine development pipelines, competitive dynamics, and strategic opportunities within the foot and mouth disease vaccine arena. By securing a copy of this comprehensive analysis, decision makers can benchmark organizational priorities against leading industry practices, identify critical areas for investment in research and development, and cultivate resilient supply chain strategies adaptable to evolving regulatory frameworks and tariff landscapes. To obtain the full report and gain exclusive access to tailored datasets, expert commentary, and actionable recommendations, please connect with Ketan Rohom, Associate Director of Sales & Marketing, who will ensure you receive a detailed briefing that aligns with your strategic objectives and accelerates your market impact.

- How big is the Foot & Mouth Disease Vaccines Market?

- What is the Foot & Mouth Disease Vaccines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?