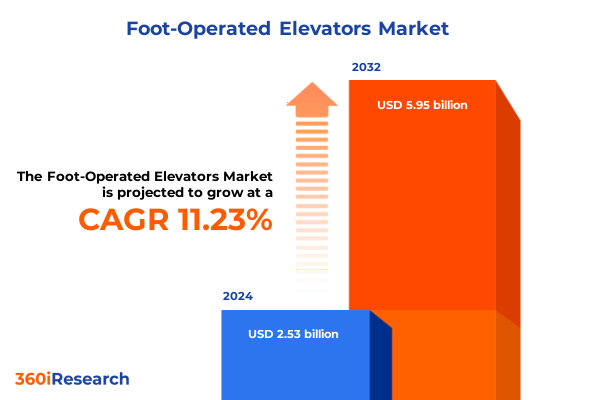

The Foot-Operated Elevators Market size was estimated at USD 2.81 billion in 2025 and expected to reach USD 3.11 billion in 2026, at a CAGR of 11.31% to reach USD 5.95 billion by 2032.

Discovering the Transformative Rise of Foot-Operated Elevators Revolutionizing Contactless Vertical Mobility in Modern Commercial and Residential Settings

The escalating demand for touch-free solutions has catalyzed a paradigm shift in vertical mobility technologies, propelling foot-operated elevators from niche curiosities to mainstream considerations in building design. As hygiene concerns and user experience expectations rise, architects, facility managers, and elevator manufacturers are converging around this novel innovation in pursuit of enhanced safety and seamless functionality. This introduction outlines the key drivers that have elevated foot-operated systems into the spotlight, while also framing the core themes explored in the subsequent sections.

Emerging from the confluence of digital controls, mechanical ingenuity, and post-pandemic risk mitigation strategies, foot-operated elevators represent both a technical and cultural response to new norms. This section sets the stage by tracing the historical context of contactless vertical transit solutions, from early mechanical prototypes to modernized designs integrating sensory automation. Through this lens, readers gain a foundational understanding of why the time is ripe for widespread adoption and what stakeholders stand to gain by embracing these innovative systems.

Identifying Key Market Drivers and Emerging Disruptions Accelerating the Adoption of Foot-Operated Elevator Technology Globally

In recent years, a constellation of market forces has converged to accelerate the adoption of foot-operated elevator technology at an unprecedented pace. Firstly, heightened awareness around public health hygiene has spurred renovation initiatives that prioritize contactless interfaces, paving the way for retrofit and modernization projects. Concurrently, advancements in sensor technology and modular design have lowered implementation barriers, enabling streamlined integration into both legacy installations and new developments. Moreover, sustainability mandates and energy efficiency regulations have bolstered interest, as many foot-operated systems leverage regenerative braking and low-power controls to align with environmental targets.

Industry partnerships and pilot programs are also reshaping the landscape, as equipment manufacturers collaborate with technology providers to refine user ergonomics and reliability. In parallel, policy frameworks in key geographies are offering incentives for contactless access systems, further stimulating investment. These transformative shifts underscore a broader evolution in how vertical mobility is perceived, moving from purely functional conveyance to an interactive, health-conscious amenity. By understanding these driving factors, stakeholders can anticipate the next wave of innovation and position themselves at the forefront of a rapidly maturing market.

Assessing the Cumulative Impact of United States Tariffs Imposed in 2025 on Foot-Operated Elevator Supply Chains and Cost Structures

The United States tariff regime of 2025, targeting a range of elevator components and subassemblies, has triggered notable reverberations throughout the foot-operated elevator supply chain. Import duties on sensor modules, specialized actuators, and precision mechanical linkages have introduced incremental cost pressures, prompting both OEMs and suppliers to reevaluate sourcing strategies. In response, some manufacturers have pursued near-shoring initiatives to mitigate exposure to imported tariffs, while others have explored component rationalization to streamline bill of materials and contain expenses.

Simultaneously, these tariff measures have accelerated innovation among domestic producers of related control hardware, generating new opportunities for localized supply partnerships. The ripple effect has also manifested in extended lead times as procurement teams navigate the complexities of duty classifications and compliance protocols. While end-users may experience marginal cost upticks in retrofit and new install projects, the evolving landscape is also fostering resilience through diversified vendor relationships and enhanced design flexibility. Ultimately, the cumulative impact of the 2025 tariff adjustments underscores the importance of strategic procurement planning and proactive risk management in safeguarding project timelines and budgets.

Unlocking Strategic Segmentation Insights to Navigate End Users, Elevator Types, Installation Modes, Capacities, Building Heights for Foot-Operated Systems

A comprehensive understanding of the foot-operated elevator market rests upon recognizing its multifaceted segmentation across end-user verticals, equipment typologies, installation pathways, capacity ranges, and building heights. From the bustling corridors of hospitals, hotels, and shopping centers to the precise demands of manufacturing facilities and warehousing operations, each commercial environment brings unique performance and compliance requirements. Infrastructure applications span airport terminals, metro stations, and railway stations, where high passenger throughput demands robust durability and rapid response. In the residential sphere, foot-operated solutions are tailored for both low-rise apartment blocks and towering mid-rise or ultra-high-rise complexes, reflecting divergent occupant profiles and service level expectations. Shopping districts and large department stores add yet another dimension, often requiring customized aesthetic finishes to harmonize with retail design motifs.

Equally critical is the diversity of elevator types, ranging from direct-acting and holeless hydraulic systems to gearless and geared traction units, as well as machine-room-less configurations featuring single-winding or double-winding rope arrangements. Vacuum-based platforms further expand the landscape, offering low-impact installations and architectural flexibility. Beyond equipment choice, end-users must weigh the merits of modernization versus new installations. Component modernization initiatives target discrete upgrades-such as installing foot-actuated sensors-while system modernization encompasses comprehensive overhauls of control logic and door operations. New builds necessitate close collaboration with architects and general contractors to integrate foot-operated mechanisms seamlessly into design and construction workflows.

Lift capacity considerations split into compact models supporting up to 500 kilograms, mid-range units handling 501 to 1000 kilograms, and heavy-duty platforms rated above 1000 kilograms. Finally, building height profiles range from low-rise structures to mid-rise developments of four to nine floors, and upward to high-rise projects encompassing 10 to 49 floors or even skyscrapers exceeding 50 stories. By navigating these interrelated dimensions, decision-makers can align product specifications with project objectives and regulatory requirements, ensuring that foot-operated solutions deliver optimal performance and user satisfaction.

This comprehensive research report categorizes the Foot-Operated Elevators market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Elevator Type

- Installation

- Lift Capacity

- Building Height

- End User

Revealing Critical Regional Dynamics Shaping Foot-Operated Elevator Adoption, Market Trajectories, and User Demand Patterns across the Americas, EMEA, and Asia-Pacific

Regional market dynamics for foot-operated elevators diverge considerably across the Americas, EMEA, and Asia-Pacific, driven by distinct regulatory frameworks, infrastructure priorities, and cultural perceptions of contactless technology. In the Americas, retrofit initiatives in North American metropolitan areas coexist with new construction demands in emerging Latin American economies. Local building codes increasingly reference accessibility and health standards, prompting property owners to incorporate foot-operated interfaces during both upgrade cycles and groundbreaking projects. Meanwhile, consolidation among regional elevator service providers is fostering bundled maintenance-plus-modernization offerings, which frequently include contactless add-ons as standard.

Across Europe, the Middle East, and Africa, stringent energy-efficiency mandates and sustainability goals have elevated the appeal of regenerative and low-power elevator architectures. Government incentives for smart building integrations further stimulate interest in foot-operated systems, particularly within public transit hubs and corporate campuses. Cultural emphasis on hygiene in densely populated cities catalyzes early adoption, while bespoke solutions emerge to address heritage preservation requirements in historic districts.

Asia-Pacific presents a complex tapestry, with ultra-high-density urban centers in East Asia driving large-scale new installations and modernization projects. In contrast, South and Southeast Asian markets are characterized by rapid high-rise residential growth, where foot-operated elevators are positioned as value-added differentiators. Local manufacturing ecosystems in China, Japan, and South Korea have scaled up production of key components, reducing lead times and enabling competitive pricing. Together, these regional profiles highlight the necessity of tailored go-to-market tactics that resonate with local regulations, cultural drivers, and infrastructure maturity levels.

This comprehensive research report examines key regions that drive the evolution of the Foot-Operated Elevators market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Market Champions Shaping the Foot-Operated Elevator Ecosystem with Cutting-Edge Solutions and Partnerships

A cadre of established elevator manufacturers and innovative newcomers is defining the competitive frontier in foot-operated technology. Legacy firms have leveraged their global service networks and R&D budgets to introduce modular sensor-actuated controls, tapping digital connectivity platforms to enable remote diagnostics, usage analytics, and over-the-air updates. At the same time, specialist engineering firms, buoyed by venture capital and private equity investment, are carving out niches by offering customizable, open-architecture solutions that emphasize interoperability with building management systems.

Strategic collaborations between elevator OEMs and automation technology providers are yielding hybrid offerings that blend mechanical actuation with AI-enabled predictive maintenance. Aftermarket suppliers are also playing a pivotal role, designing retrofit packages that integrate seamlessly with diverse lift types-ranging from holeless hydraulic piston units to gearless traction systems. In addition, partnerships with architectural firms and interior designers are ensuring that foot-operated modules can be adapted to aesthetic requirements without compromising performance.

These competitive dynamics underscore an ecosystem in which heritage brand strength intersects with agile innovation. Companies that can synchronize global production capabilities with localized customization stand to gain the largest market foothold. As alliances deepen between control system experts and elevator service networks, end-users benefit from streamlined procurement, accelerated deployment, and holistic lifecycle support for foot-operated installations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Foot-Operated Elevators market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Fujitec Co., Ltd.

- Hitachi, Ltd.

- Hyundai Elevator Co., Ltd.

- Johnson Lifts Private Limited

- Kone Corporation

- MAD Elevator Inc.

- Mitsubishi Electric Corporation

- Otis Elevator Company

- Schaefer GmbH

- Schindler Holding AG

- TK Elevator GmbH

- Toshiba Elevator and Building Systems Corporation

- Vantage Elevator Solutions

- Whitesmith Solutions 2025 Ltd

Crafting Actionable Strategies for Industry Leaders to Accelerate Adoption and Competitive Advantage in the Foot-Operated Elevator Sector

To secure a leadership position in the evolving foot-operated elevator segment, industry players must adopt a multi-pronged strategy that aligns technological innovation with market realities. First, investing in modular, interoperable controls can vastly reduce customization timelines and support a wider range of elevator types. Coupled with cloud-based analytics capabilities, this approach enables continual product refinement and the creation of value-added service offerings such as predictive maintenance and usage benchmarking.

Second, forging strategic alliances across the value chain-from component suppliers and technology integrators to architectural consultancies-will be critical for scaling deployment and capturing cross-sell opportunities. Such partnerships should prioritize knowledge transfer, joint research initiatives, and shared go-to-market frameworks that enhance speed to market. Third, proactive engagement with regulatory bodies and standards organizations can help shape codes for contactless vertical transport, ensuring that foot-operated features become recognized benchmarks for accessibility and hygiene.

Finally, targeted pilot deployments in high-visibility environments-such as healthcare campuses, corporate headquarters, and transportation hubs-can generate compelling use-cases that drive broader industry acceptance. By showcasing measurable benefits in user satisfaction, energy efficiency, and maintenance optimization, early adopters can catalyze momentum and justify incremental investments. Collectively, these recommendations provide a roadmap for companies aiming to harness the full potential of foot-operated elevator innovations.

Detailing a Robust and Transparent Research Methodology Underpinning the Analysis of Foot-Operated Elevator Market Trends and Insights

This analysis rests on a robust and transparent research methodology designed to ensure accuracy, credibility, and actionable insights. Primary data collection included structured interviews with senior executives from leading elevator manufacturing companies, technology integrators, and large end-users across key verticals, complemented by surveys capturing user preferences and operational feedback. Secondary research involved systematic reviews of regulatory documents, patent filings, industry white papers, and technical standards, providing historical context and benchmarking against global best practices.

Quantitative data underwent triangulation by cross-referencing information from financial disclosures, trade association reports, and import-export databases to validate supply chain dynamics and tariff impacts. Qualitative inputs were analyzed using thematic coding to extract recurring trends in innovation, partnership models, and adoption barriers. Regional analysis was informed by collaborations with local industry associations, ensuring that cultural, regulatory, and infrastructure nuances were accurately captured.

Finally, iterative workshops with domain experts and end-client advisory panels were conducted to stress-test preliminary findings and refine strategic recommendations. This multi-layered approach balances analytical rigor with practical relevance, equipping stakeholders with a comprehensive view of the foot-operated elevator ecosystem and its strategic imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Foot-Operated Elevators market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Foot-Operated Elevators Market, by Elevator Type

- Foot-Operated Elevators Market, by Installation

- Foot-Operated Elevators Market, by Lift Capacity

- Foot-Operated Elevators Market, by Building Height

- Foot-Operated Elevators Market, by End User

- Foot-Operated Elevators Market, by Region

- Foot-Operated Elevators Market, by Group

- Foot-Operated Elevators Market, by Country

- United States Foot-Operated Elevators Market

- China Foot-Operated Elevators Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Synthesis of Insights and Critical Conclusions Highlighting the Future Trajectory of Foot-Operated Elevators in Evolving Built Environments

Drawing together the themes explored throughout this report, it becomes clear that foot-operated elevator technology is poised to redefine contactless vertical mobility across diverse built environments. From the integration of advanced sensor arrays to the strategic recalibration prompted by 2025 tariff shifts, market participants are navigating a terrain characterized by both complexity and opportunity. The segmentation and regional analyses reveal that success hinges on tailoring product specifications and go-to-market approaches to unique user profiles, regulatory landscapes, and infrastructure characteristics.

Key competitors are leveraging their strengths in global manufacturing scale, digital connectivity, and aftermarket service networks, while agile specialists are differentiating through modular design and rapid customization. For industry leaders and new entrants alike, the imperative is clear: embrace interoperability, foster strategic partnerships, and champion proactive engagement with policy makers. By doing so, organizations can accelerate adoption, mitigate risk, and establish sustainable competitive advantage.

Ultimately, this conclusion underscores a forward trajectory in which foot-operated elevators evolve from pilot projects to integral components of smart, health-conscious buildings. As technological capabilities expand and stakeholder awareness deepens, the path ahead promises not only enhanced user experiences but also significant contributions to energy efficiency, accessibility, and operational resilience.

Take the Next Step Today Reach Out to Ketan Rohom for Exclusive Foot-Operated Elevator Research Report and Strategic Insights

For an unparalleled dive into the strategic, operational, and technological nuances of the foot-operated elevator landscape, we encourage you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. His deep expertise and understanding of stakeholder needs can guide you through the nuances of this evolving market. By engaging with Ketan, you will gain access to an in-depth, customizable research report that synthesizes market intelligence, competitive benchmarks, and practical recommendations. Whether you are evaluating supplier alliances, contemplating new product development, or refining your go-to-market strategy, this tailored analysis will empower your organization to seize emerging opportunities and navigate potential challenges with confidence. Reach out today to explore how this comprehensive research offering can accelerate your strategic decision-making and position you at the leading edge of foot-operated elevator innovation.

- How big is the Foot-Operated Elevators Market?

- What is the Foot-Operated Elevators Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?