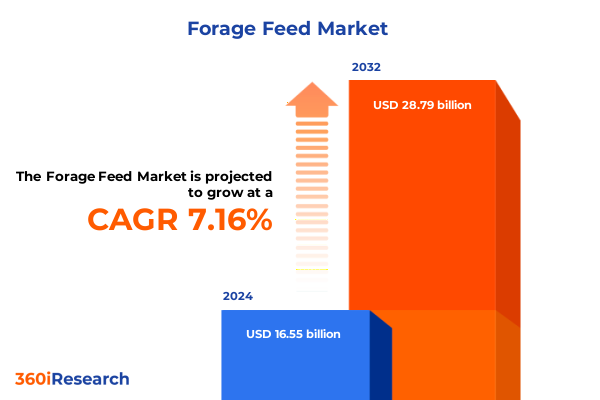

The Forage Feed Market size was estimated at USD 17.64 billion in 2025 and expected to reach USD 18.80 billion in 2026, at a CAGR of 7.24% to reach USD 28.79 billion by 2032.

A concise strategic overview of the evolving forage feed landscape connecting supply dynamics, demand drivers, and policy inflection points for decision makers

The introductory analysis frames the current global forage feed landscape by connecting structural supply factors, evolving demand drivers, and the policy inflection points that are shaping commercial and smallholder decisions today. In recent cycles the industry has been driven by higher technical yields in many producing regions alongside more volatile trade policy, which together have altered procurement pathways and raised the premium on supply‑chain intelligence. Consequently, operators ranging from seed breeders to integrated feed manufacturers are reorganizing sourcing and contracting strategies to maintain resilience and nutritional outcomes.

Transitioning from macro to operational considerations, the introduction situates forage feed as an essential input that links crop production choices to downstream animal performance and commercial viability. As pressure mounts on producers to reduce emissions, improve traceability, and control input costs, the value of high‑quality forage seeds, targeted silage practices and modular feed forms becomes more apparent. The introduction therefore establishes the report’s objective: to synthesize policy shifts, agronomic trends, and commercial strategies into a compact resource that aids decision‑makers in prioritizing investments across genetics, processing, and logistics.

How policy uncertainty, precision nutrition, and agritech innovation are jointly transforming procurement priorities, product formats, and value capture across the forage value chain

The forage feed landscape has entered a phase of transformative shifts where policy dynamics, technological adoption, and supply‑chain optimization are converging to reshape who captures value. Trade policy developments have injected new uncertainty into traditional sourcing lanes, prompting immediate tactical responses such as accelerated near‑sourcing, longer duration contracts with diversified suppliers, and incremental investments in storage and processing capacity. At the same time, producers and feed formulators are accelerating adoption of precision nutrition tools and digital traceability to preserve margin and demonstrate provenance to buyers.

Simultaneously, agronomic innovation is changing the inputs that matter. Advances in forage seed genetics and more focused silage management techniques are improving nutrient density and ensiling stability, which reduces spoilage and raises the effective yield per hectare. Digital tools are enabling more granular nutritional profiling, allowing feed formulators to shift from coarse, commodity‑level formulations toward species‑ and life‑stage specific rations. This technical evolution is driving a gradual revaluation of forage types and product formats: higher‑quality alfalfa and targeted grass mixes command differentiated roles in dairy and beef systems, while silage and pelletized formats are gaining traction for large commercial operations seeking storage efficiency and consistency.

Finally, new entrants and alternative protein suppliers are entering the feed input pool with differentiated value propositions. Insect protein, algae derivatives, and fermentation‑derived amino acids are making selective inroads where economics and regulation permit. These entrants are not yet displacing traditional forage inputs at scale, but they are exerting pressure on formulation strategies and highlighting the importance of flexible procurement frameworks that can integrate novel ingredients without compromising animal performance.

Assessment of how 2025 tariff measures and reciprocal trade responses have materially reshaped sourcing, contracting, and supply chain resilience for feed inputs

The cumulative impact of recent tariff measures and reciprocal trade responses in 2025 has reconfigured the economics and routing of many feed inputs, prompting rapid supply‑chain adaptation across producing and consuming regions. Trade actions announced and implemented in early 2025 led to a wave of reciprocal measures from major trading partners and regional blocs, and those responses have been particularly consequential for feed grains and ingredients that move at scale across borders. Market participants reacted by seeking alternative suppliers, reallocating inventories, and, where practical, shifting to deeper domestic processing and value capture to reduce exposure to cross‑border duty risk. These adjustments have been most visible in bulk commodity flows and in specialty feed additives where country‑of‑origin duties are more binding.

Moreover, retaliatory measures and counter‑tariff packages have amplified the importance of contract design and origin control. Feed buyers and processors increasingly require clearer origin documentation and contingency clauses; they are also re‑examining long‑term supply agreements to include force majeure language tied to trade policy actions. The tariff environment has accelerated conversations about regional self‑sufficiency, leading to renewed investment interest in local seed multiplication, silage handling infrastructure, and pelletization facilities to lock in feed availability and nutritional consistency regardless of external trade shocks. Such strategic moves are not purely defensive: they are designed to stabilize nutritional outcomes for livestock and to preserve margins through predictable input pathways in an environment where cross‑border costs can shift rapidly and without long lead time.

Segmented strategic implications across animal categories, product types, physical forms, and end use models that drive differentiated procurement and adoption pathways

Key segmentation insights reveal how product, animal type, form, and end‑use distinctions create materially different strategic priorities for stakeholders across the value chain. When thinking about animal type, aquaculture, cattle, and poultry each impose distinct nutritional and logistics requirements; within aquaculture the freshwater and marine subsectors demand different protein sources and particle sizes, which affects the choice of forage complements and supplemental ingredients. Product type matters because forage seeds, hay, silage, and straw are not interchangeable: forage seeds drive upstream genetics and establishment practices, hay is central to dry‑forage strategies with alfalfa, grass and timothy blends offering distinct trade‑offs in protein and fiber, and silage-whether corn or grass-delivers bulk energy and preservation advantages that influence herd feeding programs. Straw, separated into rice straw and wheat straw, remains a lower‑quality bulk fiber that often serves bedding and roughage functions rather than primary nutrition.

Form is another high‑leverage dimension: cubes, loose forage, and pellets each change handling, storage, and feed conversion dynamics. Pellets and cubes reduce waste and improve uniformity in large commercial operations, whereas loose forage retains advantages for lower‑input systems and smallholder feeding practices. End use provides a final layer of differentiation: commercial farms and smallholder farms pursue different economic and operational optimizations. Within commercial operations a split exists between corporate and independent structures that dictate investment horizons and appetite for capital‑intensive solutions like automated feeding systems and precision rationing. Among smallholder farms, community and family‑owned models have contrasting needs for cooperative storage, shared ensiling knowledge, and localized seed availability. These segmentation axes are not isolated; rather, they intersect to define practical procurement choices and technology adoption pathways. For example, corporate commercial dairy operations may prioritize high‑quality alfalfa seed and pelletized silage blends coupled with precision nutrition contracts, while family‑owned smallholders in mixed systems will favor simpler hay varieties and low‑technology silage that maximize labor flexibility and cost containment.

This comprehensive research report categorizes the Forage Feed market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Animal Type

- Form

- End Use

Comparative regional dynamics shaping supply security, processing investment, and formulation choices across the Americas, Europe Middle East and Africa, and Asia Pacific

Regional dynamics continue to exert a primary influence on supply security, input selection, and policy risk, and each macro region is converging on different strategic responses to the same global pressures. In the Americas, producers have leaned into capacity improvements in hay and silage handling and into diversified export routing as a buffer against tariff volatility; domestic agronomic performance gains have supported increased technical yields in key producing states, which creates buffer capacity but also encourages greater vertical integration to capture processing margins. This regional orientation favors investment in mechanization, seed improvement, and domestic processing assets that reduce reliance on disrupted trade lanes.

In Europe, Middle East and Africa, the policy environment and feed formulation preferences are steering emphasis toward traceability, additive regulation, and conservation agriculture. European producers place a higher premium on regulated feed additives and documented sustainability credentials, and policy attention on emissions and land use is incentivizing forage practices that support soil health and biodiversity. In parts of the Middle East and Africa, the economics of water and arable land make silage and pelletized forms attractive where storage efficiency and transport optimization are priorities. Meanwhile, Asia‑Pacific markets show heterogeneity: some markets continue to import feed ingredients at scale, while others are accelerating efforts to reduce dependence on traditional proteins through alternative sourcing, improved feed conversion ratios and targeted policy programs that support local protein substitution. Across Asia‑Pacific there is notable momentum behind formulation innovation and digitized supply chains to accommodate rapid demand growth in aquaculture and poultry sectors.

This comprehensive research report examines key regions that drive the evolution of the Forage Feed market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How incumbents, specialists, and technology integrators are reshaping competition through partnerships, vertical integration, and differentiated value propositions

Competitive and collaborative dynamics among companies are reshaping the value pyramid in forage feed. Established agribusinesses, seed breeders, and large commercial feed mills continue to dominate scale advantages in seed multiplication, bulk processing, and distribution, while specialized firms-particularly those focused on additives, fermentation technologies, and alternative proteins-are introducing modular solutions that enable formulators to improve feed efficiency and reduce reliance on single commodity inputs. This evolving ecosystem creates opportunities for mid‑sized players to act as integrators that combine seed genetics, ensiling expertise, and downstream pelletization services to offer differentiated contracts to both corporate farms and networks of smallholders.

Partnership strategies are therefore becoming a core competence. Feed manufacturers are forming sourcing alliances with regional seed houses and contracting with local processors to secure predictable quality, while technology providers supply decision‑support tools for ration optimization and traceability. Startups in alternative proteins and enzyme technologies are increasingly pursuing offtake agreements with aquaculture and premium poultry operations, providing a route to scale that does not rely solely on wholesale commodity markets. In short, a hybrid competitive landscape is emerging where scale is necessary but not sufficient, and the ability to orchestrate cross‑sector partnerships and to offer integrated value propositions-genetics, feed form, nutrition services, and logistics-is a decisive differentiator.

This comprehensive research report delivers an in-depth overview of the principal market players in the Forage Feed market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Al Dahra Agricultural Company

- Allied Seed LLC

- Alltech, Inc.

- Anderson Hay & Grain Co.

- Archer Daniels Midland Company

- Baerenberg (Barenbrug Group) B.V.

- Baileys Horse Feeds

- BASF SE

- BrettYoung Seeds Ltd.

- Cargill, Incorporated

- De Heus Animal Nutrition

- ForFarmers N.V.

- Grassland Oregon, Inc.

- J.R. Simplot Company

- Kent Nutrition Group, Inc.

- Lallemand Inc.

- Land O’Lakes, Inc.

- Lucerne Farms

- Nutreco N.V.

- NWF Agriculture plc

- Purina Animal Nutrition LLC

- Standlee Premium Products, LLC

- Triple Crown Nutrition

- Trouw Nutrition B.V.

- Wilbur‑Ellis Company LLC

Practical strategic moves leaders should prioritize to harden supply chains, optimize nutrition, and create collaborative contracting models that reduce policy exposure

Actionable recommendations for industry leaders emphasize strategic flexibility, targeted investment, and collaborative risk‑sharing to navigate the current environment. First, prioritize origin diversification and contractual resiliency by building multi‑sourced supply frameworks that limit exposure to single‑country tariff risk while securing long‑dated seed and input contracts that protect nutritional quality. Second, accelerate investments in modular processing-such as mobile pelletizers and cooperative silage bunkers-that reduce dependence on long haul logistics and enable faster response to policy disruptions. Third, mainstream precision nutrition by deploying decision‑support platforms that integrate feed form, animal type, and lifecycle stage to reduce waste and improve feed conversion; these measures deliver measurable improvements to both margin and emissions intensity.

Fourth, pursue strategic partnerships that align seed breeders, feed formulators, and large commercial buyers around quality specifications and co‑investment in seed multiplication or storage capacity. Fifth, allocate R&D budget proportional to the organization’s end‑use focus: corporate commercial operations should prioritize pellet and silage optimization and additive integration, while smallholder‑facing organizations should invest in training, low‑cost ensiling methods, and seed access programs. Finally, engage proactively with policy forums and industry associations to advocate for tariff exemptions on critical feed inputs and for clarity on additive approvals, as regulatory certainty materially reduces procurement risk and protects the integrity of animal nutrition programs.

A transparent mixed methods research approach combining secondary policy and technical literature with targeted primary interviews and scenario based supply chain testing

The research methodology underpinning this analysis combined structured secondary research with targeted primary interviews and triangulation across multiple data sources to ensure rigor and relevance. Secondary inputs included policy statements, trade press, agronomic publications and technical literature on forage cultivation, silage systems, and feed formulation; these sources were used to map observable shifts in production practices and regulatory moves. Primary research comprised interviews with industry practitioners including seed breeders, feed mill managers, commercial farm nutritionists, and regional procurement specialists to surface operational responses and contract innovations that are not yet visible in public data.

Analytical techniques included scenario‑based stress testing of supply chains under differentiated tariff actions, qualitative segmentation mapping to align product and end‑use priorities, and supply‑chain pathway analysis to identify chokepoints and investment levers. Limitations are acknowledged where rapid policy shifts can create short‑term volatility that outpaces published data; for that reason the methodology emphasizes triangulation and time‑stamped sourcing so that users can judge the currency of individual insights. To maintain transparency, key source documents and interview protocols are catalogued in an annex, and recommended follow‑up research options are provided for organizations seeking deeper regional or crop‑level validation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Forage Feed market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Forage Feed Market, by Product Type

- Forage Feed Market, by Animal Type

- Forage Feed Market, by Form

- Forage Feed Market, by End Use

- Forage Feed Market, by Region

- Forage Feed Market, by Group

- Forage Feed Market, by Country

- United States Forage Feed Market

- China Forage Feed Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

A closing synthesis emphasizing the dual forces of innovation and policy risk and the strategic priorities that determine resilience and competitive advantage

In conclusion, the forage feed landscape today is characterized by two interlocking dynamics: accelerating technical and product innovation, and heightened policy‑driven trade uncertainty. These twin pressures are forcing a reallocation of strategic emphasis toward supply‑chain resilience, precision nutrition and local processing capacity. For industry participants the imperative is clear: combine investment in agronomic quality and processing flexibility with sophisticated contractual frameworks and collaborative partnerships to navigate tariff shocks and to capture value from differentiated forage products.

Ultimately, those organizations that successfully blend genetic and agronomic improvements with modular processing and data‑driven nutrition services will be best positioned to sustain animal performance while managing costs and emissions. The current environment favors pragmatic innovators-firms that can integrate practical, low‑friction changes at scale and that can translate emerging ingredient innovations into secure, cost‑effective rations for both commercial and smallholder users.

Directly engage with a senior sales leader to secure immediate access to the full forage feed market research report and tailored enterprise licensing options

To obtain the full market research report, please contact Ketan Rohom (Associate Director, Sales & Marketing) who can guide you through tailored licensing options, enterprise access packages, and bespoke briefing services. Ketan will arrange a private walkthrough of the report’s findings and methodology, coordinate any required supplemental analyses, and set up a short executive briefing to align the research to your strategic questions. For organizations seeking custom data extracts, regional deep dives, or supply‑chain modelling support, Ketan will coordinate internal research teams and third‑party experts to scope and price those engagements. Reach out to schedule a consultation and secure immediate access to the primary dataset and executive summary deliverables so your team can convert insight into action quickly.

- How big is the Forage Feed Market?

- What is the Forage Feed Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?