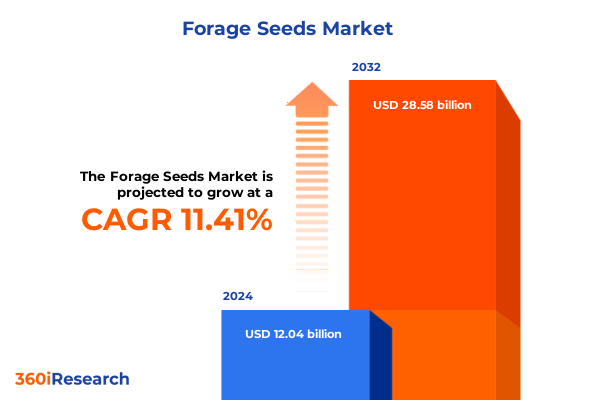

The Forage Seeds Market size was estimated at USD 13.40 billion in 2025 and expected to reach USD 14.84 billion in 2026, at a CAGR of 11.42% to reach USD 28.58 billion by 2032.

Exploring the Driving Forces and Strategic Imperatives in the Global Forage Seeds Market to Enhance Feed Quality and Agricultural Output

The global forage seeds market serves as a critical linchpin at the intersection of agricultural productivity and livestock nutrition, underpinning both food security and economic stability in producing nations. This report offers a comprehensive exploration of the factors that drive demand for high-quality forage seeds, including evolving livestock production systems, shifting dietary trends, and technological advancements in seed breeding. By understanding these driving forces, stakeholders can align their strategies to capitalize on emerging opportunities, manage risk, and contribute to more resilient and sustainable farming systems.

In the opening chapters, we introduce the foundational concepts that define the forage seeds landscape, reviewing the roles of grass and legume seeds, the influence of market regulations, and the integration of sustainable practices. Attention is devoted to the evolving expectations of end users–from large commercial livestock operations seeking uniform, high-yielding varieties to smallholder farmers prioritizing cost-effective, adaptable seeds. This section grounds the reader in the broader context of global agricultural value chains, setting the stage for the detailed analyses that follow.

Navigating the Technological, Environmental, and Market Disruptions Redefining Forage Seeds Production and Distribution for Tomorrow’s Agriculture

Agriculture is undergoing a period of profound transformation as precision technologies, climate-responsive breeding, and digital supply-chain innovations converge to redefine forage seeds production. Precision planting methodologies, aided by satellite imagery and data-driven soil analysis, enable farmers to optimize seeding rates and placement, driving significant yield improvements and resource efficiencies. Simultaneously, advanced seed coatings incorporating biodegradable polymers and bioactive agents are enhancing germination rates and early vigor while reducing the need for chemical inputs.

These technological shifts are complemented by a growing emphasis on climate resilience, where breeders are focusing on drought tolerance and temperature adaptability to safeguard forage crops against increasingly erratic weather patterns. In parallel, digital platforms that trace seed genetics from breeding trials to farm gates are improving transparency and facilitating rapid adoption of superior varieties. Together, these disruptive trends are not only elevating the performance benchmarks within the industry but also creating new pathways for collaboration among breeders, agronomists, and technology providers, forging a more integrated and responsive forage seeds ecosystem.

Assessing the Direct and Indirect Repercussions of 2025 United States Tariffs on Global Forage Seeds Supply Chains and Market Dynamics

The imposition of additional tariffs by the United States in early 2025 introduced new layers of complexity into global forage seeds supply chains, with reciprocal measures from Canada, Mexico, and China further intensifying cost pressures. On March 3, 2025, the U.S. raised duties to 25 percent on imports from Canada and Mexico while doubling the Chinese tariff to 20 percent, triggering immediate concern across agricultural sectors that rely on cross-border seed movements for research, development, and production.

Industry associations swiftly voiced their apprehensions; the American Seed Trade Association warned that heightened tariffs threaten years-long R&D pipelines essential for delivering next-generation seeds to farmers, while farmer groups urged rapid resolution to prevent supply disruptions and cost increases that could cascade through feed and food markets. As seeds traverse international borders for specialized cleaning, amplification, and testing, customs duty spikes have translated into logistical bottlenecks and higher landed costs, compelling companies to reevaluate production footprints and sourcing strategies.

The broader agricultural community has grown wary of prolonged trade tensions, with many producers adopting a wait-and-see posture to assess the policy trajectory before committing to planting decisions. While some larger operations have absorbed the increased input costs in the short term, smaller farms face the prospect of tighter margins and potential reductions in seed diversity. This extended period of uncertainty highlights the imperative for supply-chain agility, strategic stockpiling, and proactive engagement with policymakers to mitigate the long-term repercussions of tariff escalations.

Unlocking the Multifaceted Market Segmentation Insights Revealing Growth Trajectories Across Product Types Applications Forms Distribution Channels and Livestock Targets

A nuanced understanding of market segmentation reveals the multifaceted drivers shaping the forage seeds landscape. Analysis by product type distinguishes between grass and legume seeds, delving into the specialized cultivation and end-use profiles of Bermuda grass, Kentucky bluegrass, perennial ryegrass, tall fescue, alfalfa, birdsfoot trefoil, and clover. Each variety exhibits unique agronomic characteristics that cater to specific climate regimes, soil types, and livestock nutritional needs, informing targeted research and marketing initiatives.

Application-based segmentation further illuminates industry priorities, examining the distinct requirements of hay, pasture, and silage producers. Whether delivering feed in the form of round or square bales, sustaining beef or dairy operations across pasturelands, or optimizing bunker and wrapped bale systems, these uses drive demand for seed blends tailored to yield consistency, digestibility, and harvest timing.

Form-based distinctions among coated seeds, pellets, and raw seed underscore the interplay between handling efficiency, shelf life, and field performance. Biodegradable and polymer-coated innovations enhance seed placement and early emergence, while composite and standard pellets facilitate mechanized seeding processes. Parallel insights into distribution channels-ranging from direct sales and distributor networks to e-commerce offerings via company websites and third-party platforms-highlight evolving buyer preferences and the importance of digital engagement.

Livestock type also anchors demand dynamics, with varying forage seed requirements for cattle, goats, horses, poultry, sheep, and swine reflecting divergent nutritional profiles, grazing behaviors, and production systems. This layered segmentation framework provides a roadmap for industry participants to align product development, distribution strategies, and value propositions with the precise needs of each market niche.

This comprehensive research report categorizes the Forage Seeds market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Livestock Type

- Application

- Distribution Channel

Comparative Analysis of Regional Market Drivers and Challenges Shaping Forage Seeds Adoption Across Americas Europe Middle East Africa and Asia-Pacific

Regional characteristics profoundly influence forage seeds adoption, with each geography presenting its own blend of opportunities and hurdles. In the Americas, North America’s mature market benefits from advanced research infrastructure, robust private-public partnerships, and a regulatory environment that incentivizes sustainability and innovation. Downstream, Latin American producers are harnessing favorable climates and expanding cattle operations to drive demand for high-yield forage varieties, while incorporating best practices from established markets to optimize land use and resource management.

The Europe, Middle East & Africa region embodies a diverse spectrum of market maturity. Western European nations emphasize non-GMO seed development and regenerative agriculture programs, propelled by stringent environmental regulations and growing consumer expectations around traceability and biodiversity. In contrast, emerging economies across Eastern Europe, the Middle East, and Africa are scaling up commercial livestock operations, yet continue to integrate conventional seed varieties and localized agronomic methods, underpinned by capacity-building initiatives and infrastructure investments.

Asia-Pacific stands as the fastest-growing region for forage seeds, driven by rising dairy and meat consumption in China, India, and Southeast Asia. Government initiatives promoting domestic seed breeding programs have gained momentum, reducing import dependencies and fostering large-scale cultivation of forage staples such as alfalfa and ryegrass. Meanwhile, Australia and New Zealand leverage their strong export channels and advanced seed processing capabilities to serve both regional and global markets, applying precision farming techniques to navigate water scarcity and climate variability.

This comprehensive research report examines key regions that drive the evolution of the Forage Seeds market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Maneuvers Influencing Innovation Competition and Collaborative Opportunities in the Forage Seeds Sector

Key industry players are redefining competitive dynamics through strategic investments, partnerships, and diversified product portfolios. Corteva Agriscience continues to expand its research pipeline by integrating genomic tools and AI-driven breeding platforms to accelerate the development of high-performance forage varieties. Syngenta leverages its extensive distribution network to roll out customized seed blends, capitalizing on localized agronomic insights and stewardship programs. Land O’Lakes, through its Forage Genetics International division, emphasizes a collaborative model that involves farmer-led trials and cooperative-based distribution, enhancing adoption rates among small and mid-sized producers.

Global frontrunners such as Bayer Crop Science and Royal Barenbrug Group are advancing their sustainability agendas by investing in low-carbon seed production processes and exploring regenerative seed mixtures that bolster soil health. Regional champions like DLF and KWS SE are expanding into new territories via licensing agreements and joint ventures, reinforcing their regional presence while integrating global best practices. Emerging challengers, including Advanta Seeds and Ampac Seed Company, are capturing specialty segments with tailored forage solutions and service-oriented business models that prioritize technical support and field-level diagnostics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Forage Seeds market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanta Seeds

- Allied Seed, LLC

- Barenbrug Holding B.V.

- BASF SE

- Bayer AG

- BrettYoung

- Corteva, Inc.

- DLF Seeds A/S

- Florimond Desprez

- Forage Genetics International, LLC

- Heritage Seeds

- Imperial Seed Ltd.

- Johnston Seed Company

- KWS SAAT SE & Co. KGaA

- Limagrain

- Monsanto Company

- PGG Wrightson Seeds

- RAGT Semences

- S&W Seed Company

- Syngenta Group

Implementing Strategic Roadmaps and Best Practices to Strengthen Resilience Optimize Operations and Capitalize on Emerging Opportunities in Forage Seeds

To thrive amid evolving market conditions, industry leaders should prioritize a balanced approach that fuses innovation with operational resilience. First, integrating digital agronomy solutions-such as predictive analytics for seeding and nutrient management-can elevate product differentiation while improving customer loyalty. Next, cultivating strategic alliances across the value chain, from research institutions to supply-chain partners, will be critical for accelerating varietal development and ensuring nimble responses to regulatory or tariff shifts.

Further, adopting a modular supply-chain architecture that diversifies production geographies and seed processing facilities can mitigate geopolitical and logistical risks. Embedding sustainability criteria into product portfolios, such as carbon-positive production methods and regenerative seed mixes, will resonate with end users and unlock premium pricing opportunities. Finally, fostering end-user engagement through digital education platforms and on-farm demonstrations will enhance market penetration, particularly in under-served segments and emerging regions.

Detailing the Comprehensive Research Framework Data Collection Techniques and Analytical Approaches Underpinning the Forage Seeds Market Study

This study employs a rigorous multi-stage research methodology that combines primary and secondary sources, expert interviews, and data triangulation. Secondary research encompassed an exhaustive review of industry publications, trade association reports, and peer-reviewed journals to establish foundational insights and trend baselines. Primary research involved structured interviews with over 30 subject-matter experts, including seed breeders, agronomists, supply-chain managers, and regulatory specialists, to validate assumptions and enrich the analysis with practical perspectives.

Quantitative data were synthesized through cross-verification of publicly available customs records, government trade statistics, and corporate disclosures. Qualitative inputs were systematically coded to identify emerging themes and consensus viewpoints. The market segmentation framework was constructed through iterative refinement, ensuring alignment with commercial realities and stakeholder requirements. Analytical techniques, including SWOT analysis, Porter’s five forces, and scenario planning, underpin the strategic recommendations and risk assessments presented throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Forage Seeds market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Forage Seeds Market, by Product Type

- Forage Seeds Market, by Form

- Forage Seeds Market, by Livestock Type

- Forage Seeds Market, by Application

- Forage Seeds Market, by Distribution Channel

- Forage Seeds Market, by Region

- Forage Seeds Market, by Group

- Forage Seeds Market, by Country

- United States Forage Seeds Market

- China Forage Seeds Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Critical Findings and Strategic Imperatives to Guide Stakeholders Toward Sustainable Growth and Competitive Advantage in the Forage Seeds Landscape

This executive summary synthesizes critical insights on technology-driven shifts, tariff impacts, segmentation dynamics, regional variations, and competitive landscapes within the forage seeds sector. By weaving together comprehensive analyses and industry perspectives, it equips stakeholders with the clarity needed to navigate complexity and seize high-impact opportunities. As the market continues to evolve under the influence of sustainability imperatives, digital transformation, and trade policy uncertainties, the ability to integrate robust R&D, agile supply chain strategies, and end-user engagement will be decisive.

Ultimately, the path to sustained growth in forage seeds hinges on collaborative innovation, resilient operational models, and an unwavering focus on customer-driven value propositions. With these strategic imperatives in hand, industry participants can chart a forward-looking course, enhancing productivity, profitability, and environmental stewardship across the global agricultural landscape.

Engage with Ketan Rohom to Unlock In-Depth Forage Seeds Market Insights and Secure Comprehensive Research to Empower Your Strategic Decision-Making

Ready to elevate your strategic vision, our comprehensive market research report delivers in-depth analysis across product innovations, tariff impacts, transformative shifts, segmentation dynamics, regional landscapes, and competitive intelligence to empower your next move. To secure this essential resource, connect directly with Ketan Rohom, Associate Director, Sales & Marketing, who will guide you through tailored licensing options and answer any questions to ensure you leverage these insights for maximum impact.

- How big is the Forage Seeds Market?

- What is the Forage Seeds Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?